-

Posts

915 -

Joined

-

Last visited

Content Type

Profiles

Forums

Store

Downloads

Recruiting - 2020

2019-2020 Football Season

Football

Entertainment

Sports

News and Business

Cloak Room

Transfer Portal

Recruiting

Events

Posts posted by Rusty Shackelford

-

-

On 8/21/2020 at 6:24 PM, TwiceHorn said:

It seems like after splits, even though everyone knows in their head that it's the same stock, just /2, the price crawls back toward the pre-split price a bit faster than any economic or financial information would account for.

My grandfather owned a bit of Dell stock in the late 90s. The way I remember it, Dell split 7 or 8 times while he held it, and it still went higher than what he originally paid for it.

-

Best I can do is tree-fiddy

-

1

1

-

1

1

-

-

1 hour ago, bernorange said:

Isn't El-Erian considered pretty mainstream?

btw, looks like another example of editors who write headlines that don't match the article.

-

23 minutes ago, elfenix said:

there's these things called dividends

True, but also management fees, expense ratios, trade commissions, etc that offset the dividend yield somewhat.

Anyway the point is that the dollar has lost it's purchasing power immensely, and the relative rise of gold and stocks priced in USD prove the point.

-

1

1

-

-

Regarding Lyn Alden's tweet, she's long stocks and gold (as I am) because of the devaluation of the dollar, which was done once in 1934 and then exploded since 1971 when we went off the gold standard.

-

On 8/9/2020 at 1:04 AM, elfenix said:

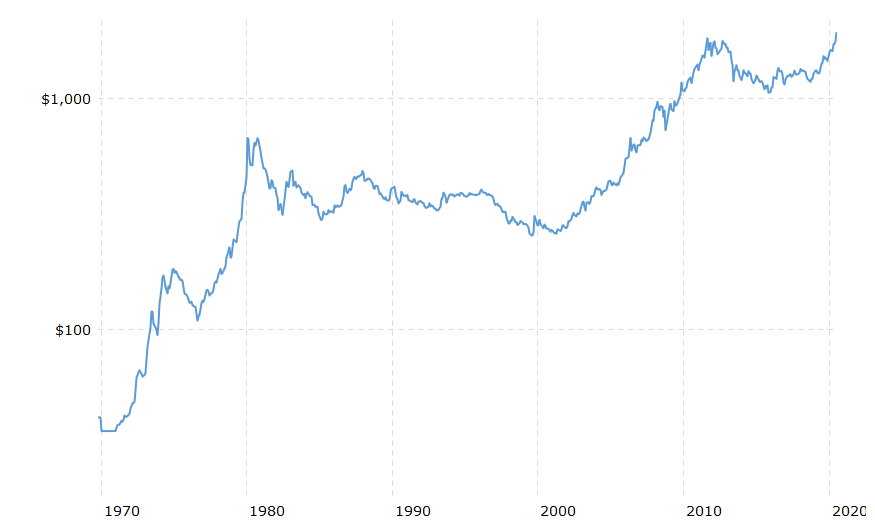

i was using the comparison invited by the twit, but ok. a $100 investment in gold in late 1971 at a price of $42.50 would today be worth $4,863.53 today. a $100 investment in the s&p 500 on january 2, 1972 (or whenever the first trading day was) would today be worth $12,189.44 cents.

That's way off, according to the data provided here

-

If you were making an honest comparison between the stock market and gold, the chart would be 1971 - present (for obvious reasons)

-

1 minute ago, ztejas said:

I mean, how did you buy it?

APMEX.com a few oz at a time, other than the first time when I learned that they reported it to the IRS.

-

Hmmm, barter or black market look better in a scenario where gold is > $10,000 / oz. We'll have bigger problems by then anyway.

-

Wouldn't you would want to claim a higher cost basis, to report it as a loss?

-

12 minutes ago, bernorange said:

If gold pops the way some outlandish predictions expect, it's going to be hard to sell an ounce or two without a Form 8300 reporting requirement. Smaller sized units carry larger premiums, but might be worth it down the road...

Good point, but how would they know your "cost basis" for the gold you sold, if you didn't have to report it when it was bought?

-

Thanks for that info, there's more to it than I knew.

Just ordered 3 more oz

-

1

1

-

-

I believe a transaction over $10,000 is reportable to the IRS. The first time I ordered gold from APMEX they sent a copy of what they reported to the IRS. I have made sure to keep my future purchases under that amount since then.

-

The USD is our favorite weapon, which is why the rest of the world (at least those that are not allied with us) want to dethrone the dollar.

https://fee.org/articles/swift-and-the-weaponization-of-the-us-dollar/

-

2

2

-

-

My nomination for worst accent goes to Ewan McGregor’s french accent in the Beauty and the Beast remake (I only saw it once with my daughters)

-

12 hours ago, MagicSoccerSpray said:

Don't forget the Ted Danson casting. That movie was filled with jarring "friends of steve" casting choices and I think the opinion is starting to finanlly spread that, aside from the opening scene and Hanks, it was full of rehashed tropes and wasn't as good as it's reputation.

LOL it took 2 years for someone to agree with me. And FTR, I still think it's a good movie.

-

1

1

-

-

The Fed Is Planning To Send Money Directly To Americans In The Next Crisis

https://www.zerohedge.com/markets/fed-planning-send-money-directly-americans-next-crisis-

1

1

-

-

The US government assigns individuals credit scores?

-

2

2

-

-

13 hours ago, Superhero said:

It's more about selling my silver. I have a lot of silver, and even though it's fun to roll around in silver coins, a lot of silver = a lot of weight.

The gold/silver price ratio is 87:1 now. Which suggests I should be hoarding more silver. But carrying 1 oz of gold is easier than lugging around 5.5 pounds of silver.

https://seekingalpha.com/article/658611-precious-metals-are-on-sale-or-are-they

I have some physical gold and silver and also hold gold and silver ETFs, but (mainly because of the size difference) for my future PM purchases, I have settled on buying only physical gold and only ETF silver.

-

ehh, not really, but here's the regular scale if you prefer

-

Why logarithmic though?

Because of the long time scale, I would look at the stock market logarithmically too over that amount of time -

Not a fan of ADOM, but I've flipped it a few times.

I've been buying WKHS calls the past couple of days #stonks

-

-

The peaks in '80 and '11 also came after a 10+ years of mega return; and just like stonks or RE, FOMO kicked in and gold overshot.

Looks to me like we are still in year 1 of a gold bull market, not saying it will run for 10 more years, but it's a little early to call it a bubble.

-

1

1

-

cashless society

in Cloak Room

Posted

https://home.treasury.gov/news/press-releases/sm1152

G7 Finance Ministers and Central Bank Governors’ Statement on Digital Payments

October 13, 2020

WASHINGTON – The widespread adoption of digital payments has the potential to address frictions in existing payment systems by improving access to financial services, reducing inefficiencies, and lowering costs. At the same time, payment services should be appropriately supervised and regulated to address challenges and risks related to financial stability, consumer protection, privacy, taxation, cybersecurity, operational resilience, money laundering, terrorist and proliferation financing, market integrity, governance, and legal certainty, among others.

The public sector, through the provision of fiat currency and the conduct of independent monetary policy, as well as its regulatory and supervisory roles, plays an essential role in ensuring the safety and the efficiency of payment systems, financial stability, and the achievement of macroeconomic objectives. It is in this context, that a number of G7 authorities are exploring the opportunities and risks associated with central bank digital currencies (CBDCs). Confidence in the stability of domestic payment systems and the international monetary system is underpinned by credible and longstanding public sector commitments to transparency, the rule of law, and sound economic governance. We are committed to addressing existing frictions within payment systems and to fostering continual improvement.

The G7 continues to support the work of the FSB, FATF, CPMI, and other standard-setting bodies to analyze the risks associated with and determine appropriate policy responses to digital payments. In particular, the G7 underscores the importance of the G20 agenda to enhance the efficiency of cross-border payments and to address regulatory and public policy issues arising from global stablecoins and other similar arrangements. The G7 continues to maintain that no global stablecoin project should begin operation until it adequately addresses relevant legal, regulatory, and oversight requirements through appropriate design and by adhering to applicable standards.