-

Posts

110 -

Joined

-

Last visited

Content Type

Profiles

Forums

Store

Downloads

Recruiting - 2020

2019-2020 Football Season

Football

Entertainment

Sports

News and Business

Cloak Room

Transfer Portal

Recruiting

Events

Everything posted by Esque

-

All Encompassing Mortgage and Real Estate Thread

Esque replied to UTPhil2006's topic in 6th Street Journal

Yeah, lots of folks getting SMOKED on taxes and insurance y-o-y. Going back and looking at some u/w versus actuals is sort of hilarious. -

We started watching the new season. Perhaps our sense of humor, but this is my favorite show in years. Just lots of good gags and very dark, Russian humor.

-

All Encompassing Mortgage and Real Estate Thread

Esque replied to UTPhil2006's topic in 6th Street Journal

You have no idea. Seeing some of these deals under "rescue capital" terms and even with super attractive terms wouldn't touch them with a 10 foot pole. Some of these fools are still underwriting low 4% cap rates on deals when trying to raise capital to save deals. It's going to be a mess. -

All Encompassing Mortgage and Real Estate Thread

Esque replied to UTPhil2006's topic in 6th Street Journal

Interesting. Is pulling the lever on fees versus points due to HPML risks? So staying within that spread to APOR by adjusting fees as well? Is there a limit to these fees to remain a QM? So basically playing with two main levels - points and rate? -

All Encompassing Mortgage and Real Estate Thread

Esque replied to UTPhil2006's topic in 6th Street Journal

Curious - What's the general rate spread between say a sub-prime (<620), near-prime (620 = 660), prime (660-720) and super-prime (720+) borrower? If the national average 7.00% is for the prime borrower, does it stack up something like this? Sub-Prime: 8.00%+ Near-Prime: 7.40% Prime: 7.00% Super Prime: 6.40% - 6.60% How high are rates for some of these first time buyers using FHA with 580 credit, which I think is minimum credit score required with 3.5% down for FHA? -

All Encompassing Mortgage and Real Estate Thread

Esque replied to UTPhil2006's topic in 6th Street Journal

Yeah, really don't get what all the panic is about. We've known we're going down this road for over a year now. Nothing about this is surprising nor will it surprise me when they reach a deal at the 11th hour and kick the can down the road AGAIN instead of addressing fundamental financial issues we have. -

All Encompassing Mortgage and Real Estate Thread

Esque replied to UTPhil2006's topic in 6th Street Journal

How are you mortgage brokers competing against the homebuilders in submarkets where homebuilders are active? Looks like they're buying down rates anywhere from 1.50% - 2.00% plus other incentives. So if market today is circa 6.50% they can get down to let's say 4.50% - 4.75%. How in the world does the buyers down the street compete with that if they want to sell? Or they could potentially be screwed for years until the builder is done and out of their community? Or take a huge equity cut to get the sales price down enough to compensate for rate differential? Seems like a fubar situation. -

All Encompassing Mortgage and Real Estate Thread

Esque replied to UTPhil2006's topic in 6th Street Journal

2YT ripping this morning. 10YT should follow? -

All Encompassing Mortgage and Real Estate Thread

Esque replied to UTPhil2006's topic in 6th Street Journal

I'm not struggling to find the article, but there were some statistics released of percent of total mortgages under 3% and under 4%, which were eye catching. Given the environment, if you're locked into one of these mortgages - why would you EVER sell? Would just hire a property management company and rent it out. Free money given cost of capital. At the bare minimum wait for a few years since carrying costs is so low and you'll get solid rent in the meantime. This is one of my biggest concerns. We had so much activity in new home sales and refinancing that there's zero reason to move if you're locked into a good rate. This artificially restricts supply and encourages current owners to rent before they consider a sale. Will only sell if they absolutely have to, and even then why would you sell then buy into a market at 6.50% interest rates? The knock on your monthly payment is huge. Better off to sit still and improve your current home to make it work for a few years. -

Grapevine/Coppell/Southlake/North of DFW dining recommendations

Esque replied to BearSchlong's topic in Dallas

George's Coffee and Provisions in Old Town Coppell for coffee Ramen Hakata off E Round Grove Rd for Ramen Hard Eight BBQ in Old Town Coppell for BBQ Parma Pizza & Pasta off E Round Grove Rd for Italian Anamia's off Denton Tap for Tex-Mex Siam Thai Cuisine off MacArthur for Thai Victor's Wood Grill off Denton Tap for American Fine J Macklin's Grill off Denton Tap for American Casual Coppell Deli in Old Town Coppell for Diner food -

All Encompassing Mortgage and Real Estate Thread

Esque replied to UTPhil2006's topic in 6th Street Journal

Any thoughts on the market digesting the increased pace of QT by the Fed that began this month? Given this is primarily going to be MBS, shouldn't that further impair values by driving increased volume? Or realistically, too many moving pieces in secondary market to know how it all plays out in reality? -

All Encompassing Mortgage and Real Estate Thread

Esque replied to UTPhil2006's topic in 6th Street Journal

Mortgage rate just jumped to 6.23% today, up almost 25 bps. Crazy… Sent from my iPhone using Tapatalk -

All Encompassing Mortgage and Real Estate Thread

Esque replied to UTPhil2006's topic in 6th Street Journal

Anyone deal with the home builders? With rates up to almost 6.00% after today, expect we'll see another uptick in cancellations? -

All Encompassing Mortgage and Real Estate Thread

Esque replied to UTPhil2006's topic in 6th Street Journal

@HRSchenker I get the frustration and friction, but this is largely out of municipalities' hands. This is a matter of administrative law and has to do with the laws and rules of Texas occupation code. The power bequeathed to municipalities largely revolves around land use and which improvements can be constructed upon said land. The operational use of said improvements comes down to occupations code. What needs to be regulated is too difficult to regulate and that's the rub. Technology has enabled a unique occupation model in which the same improvement can reasonably be used for long term occupation and short term occupation interchangeably. Whereas historically there was more of a distinction between the two. I don't know what code or regulation is reasonably going to manage this without creating some administratively nightmare, which is not what we need. For example, you could use the fire department to limit all residential dwellings to a capacity of one person per bedroom to mitigate STR impact. However, you'd also be fucking over a lot of student housing, family housing, and so forth. It just doesn't make sense. Municipalities have tried, but they're grossly overstepping their authority. And have been called out on it a few times. -

All Encompassing Mortgage and Real Estate Thread

Esque replied to UTPhil2006's topic in 6th Street Journal

@Wulaw Horn What do you watch in a market like today's to see where loans are going? Obviously watching the MBS market, but any specific trades or what not? Super curious if rates pop further after a day or two more like today and get up to 6.00% soon. -

All Encompassing Mortgage and Real Estate Thread

Esque replied to UTPhil2006's topic in 6th Street Journal

Let's assume Fed announces 50 bps today and $50 - $75 Bn b/s run off on a go forward basis. Most, or at least a lot, of b/s run off is going to be MBS. So rates jump from let's say 5.35% to what? 6.50%? How bad does Fed selling (which also means stop buying) in the MBS market whack spreads? How and when does this translate to pricing in residential? Seems crazy that we're still seeing price increases. Something has to give? -

All Encompassing Mortgage and Real Estate Thread

Esque replied to UTPhil2006's topic in 6th Street Journal

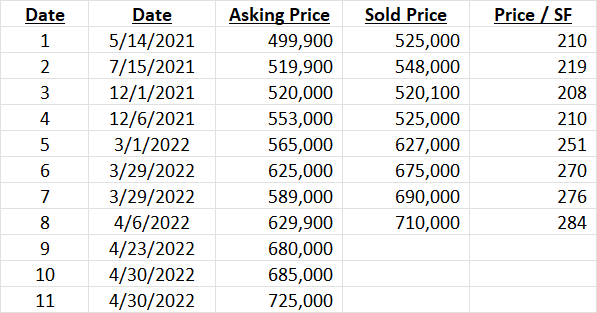

This market is just silly. Here are some metrics for a small town home development (about 125 homes) we have been keeping an eye on. These are all very vanilla, down the fairway homes from Darling Homes built in either 2013 or 2017. So they are newer (relatively speaking) and are all 2,500 sq. ft., 3/2.5 with a study. -

All Encompassing Mortgage and Real Estate Thread

Esque replied to UTPhil2006's topic in 6th Street Journal

Completely agree with this. Part of this, unfortunately, is simple economics. The home building industry has consolidated over the last several decades and thus is more of an enterprise endeavor these days. You'd still be shocked at how inefficient it is, but is is all on a relative basis in that it is more efficient than it once was. Over time, the largest home builders ("nationals", "publics") have figured out the obvious, which is incremental square feet via an office, dining room, and/or fourth bedroom is accretive to the bottom line because the fit-out of these spaces is limited, i.e. just more lumber and dry wall. So the house that used to be a 3 bedroom, 2 bathroom, 1,500 sq. ft. home is now 4 bedroom, 2 bathroom, 2,600 sq. ft. This has made the median house less affordable to the median household income. But is accretive to the home builders. Another part of this is competition on the home building side. The Global Financial Crisis wiped out a lot of the local and regional home builders who didn't have the balance sheets to weather the storm. Yes, the nationals and publics got hammered, but they had the balance sheet to weather the storm. So an even larger percentage of overall production is through a fewer number of builders who increasingly control the market, especially on the land side. Capital markets has also accelerated this trend during covid-19 as office and retail, which have been favored for capital allocators due to cheque size, are obviously much more risky and are out of favor. Thus, more capital than every is flooding into multifamily, industrial, and residential. Capital allocators are buying up houses in lots from home builders and renting them out. Thus, the number of homes available to end users is that much less and thus competition is driven up. Would guess somewhere between 1 out of 4 or 5 homes today are purchased by investors. I don't see this trend reversing anytime soon unless we completely roll back time and everyone is back in the office full time - unlikely. Without going on too much longer, let's never forget the increase on soft costs and politics of dealing with the city. This is a newer phenomenon and is getting worse and worse. But will leave that alone for now beyond stating the obvious, that is limits new supply. As a result of this, and many other considerations, you will have more and more households renting. It is just a reality. And completely agree it is bad for society. -

All Encompassing Mortgage and Real Estate Thread

Esque replied to UTPhil2006's topic in 6th Street Journal

The Good: We finally found a home after searching for 18 months and putting in just shy of 15 offers. The Bad: The husband refused to fully execute the contract last second, stating that he just couldn't sell the house they raised their family in. The Ugly: I laughed hysterically when we got the call because our search has been such a shit show, of course this would happen. The wife cried and was upset all night. On to the next one. The great news is there were only five offers on the home, whereas prior homes have had anywhere from 25 - 50 offers. So seems to be cooling down quite a bit. I'm curious, what do you think happens to rates as Fed begins QT in the open market and floods it with the MBS they purchased over the last two years? Presumably this is already priced in? Or not necessarily? -

All Encompassing Mortgage and Real Estate Thread

Esque replied to UTPhil2006's topic in 6th Street Journal

@UTPhil2006 What are you seeing right now in terms of prime interest rates? Think near 800 credit, large down payment, conventional loan. -

All Encompassing Mortgage and Real Estate Thread

Esque replied to UTPhil2006's topic in 6th Street Journal

This is a mess of a story and hard to relay. In short, saw a house on a Friday and made an offer Saturday morning. Offers were due Saturday night. Later in the morning found out we knew two others who also made an offer on the house. In the afternoon, we began receiving calls from our respective Buyer's brokers pushing us to increase our offers. The Seller's agent was sharing other offer details and then falsifying other offers to get everyone to increase their respective offers. We all spoke in the afternoon and agreed to disclose each other's offers to each other but also agreed we weren't going to undercut each other. Found out we were second, but were not too far off. So all three declined to play the game and we just sat at our offers. Pissed the Seller's agent off and they voiced significant displeasure. Somehow even though we were the highest bids, another offer won. Buyers' agents could not explain what happened. Pretty sure Seller's agent had grown accustomed to squeezing out Buyers and was upset it didn't occur, so miss represented offers. It is all sort of a mess and Seller's agent already has a local reputation for doing similar things, so while I was frustrated and disappointed, am not surprised. Pretty sure there's some code of ethics violations on all fronts, but good luck trying to prove it or bother wasting your time on this. You just move on. -

All Encompassing Mortgage and Real Estate Thread

Esque replied to UTPhil2006's topic in 6th Street Journal

After dealing with scheming realtors the last few weeks, how has technology not made this "job" obsolete? What value do they bring to the table that substantiates their compensation? -

All Encompassing Mortgage and Real Estate Thread

Esque replied to UTPhil2006's topic in 6th Street Journal

Home prices up another 18.4% in October. Lovely. -

I can't tell if this movie was so intentionally bad, that it was actually good or if it was simply bad. The set-up was a massive middle finger to Warner Brothers. I would love to read the contracts involved on both sides that ended up in the abomination of a movie. I'm almost not even sure where to begin as far as the bad and the ugly for the movie. What in the hell happened to Agent Smith? Why did Trinity end up as a Mary Lou at the end? Neo can't fly but can now do shockwaves? The dialogue was laughably bad at moments. However, there were still some good, thought provoking moments I enjoyed. Count me in the minority, but I appreciated how they replaced Morpheus. This is likely how we will develop AI in the future, by placing programs in an open world environment in a looping scenario, until they become self aware. Also, The Analyst is a great replacement for The Architect. A malevolent blend between The Oracle and The Architect that provides accurate commentary on the polarization of humans due to emotions. The movie had some really interesting elements in it that I enjoyed, but overall the story was so bad I can't ignore it. Would have rather none of the cast returned and we could have written this off from the get go.

-

2021 - Is inflation finally back in the conversation?

Esque replied to Reagan1k's topic in 6th Street Journal

Say what you want about overall inflation. Labor inflation is real. It's been most noticeable and advertised in low- to moderate-income positions and the narrative has been this is a long overdue re-pricing exercise between capital and labor. However, I am no long convinced this is the case as we are increasingly beginning to see it creep into our professional fees. For example, discovered the big four accounting firms are materially (30% - 50%) increasing salaries to keep talent. We're being massaged by our other third party consultants (engineers, attorneys, etc.) to expect the same in 2022. I don't see how you roll any of these changes backwards. So even if you believe (I do) that price increases are being driven by short term disruptions (supply chain or otherwise), I'm not as confident these will roll back as labor will simply be making more money on a nominal basis. Granted, this will all take time to play out. Just my two cents from a boots on the ground perspective.

Football ... Basketball ... Baseball ... Other Sports ... Futbol ... 🤫995🤫 ... Gambling ... Movies & TV ... Music ... Hobbies ... Lulz ... Food & Travel ... Daily Texan ... 6th Street Journal ... Cloak Room ... Help ... For Sale ... Board Discussion ... Subscribe!... Donate!... Advertise... COOKIE MONSTER!