SoCalHorn

-

Posts

52 -

Joined

-

Last visited

Content Type

Profiles

Forums

Store

Downloads

Recruiting - 2020

2019-2020 Football Season

Football

Entertainment

Sports

News and Business

Cloak Room

Transfer Portal

Recruiting

Events

Posts posted by SoCalHorn

-

-

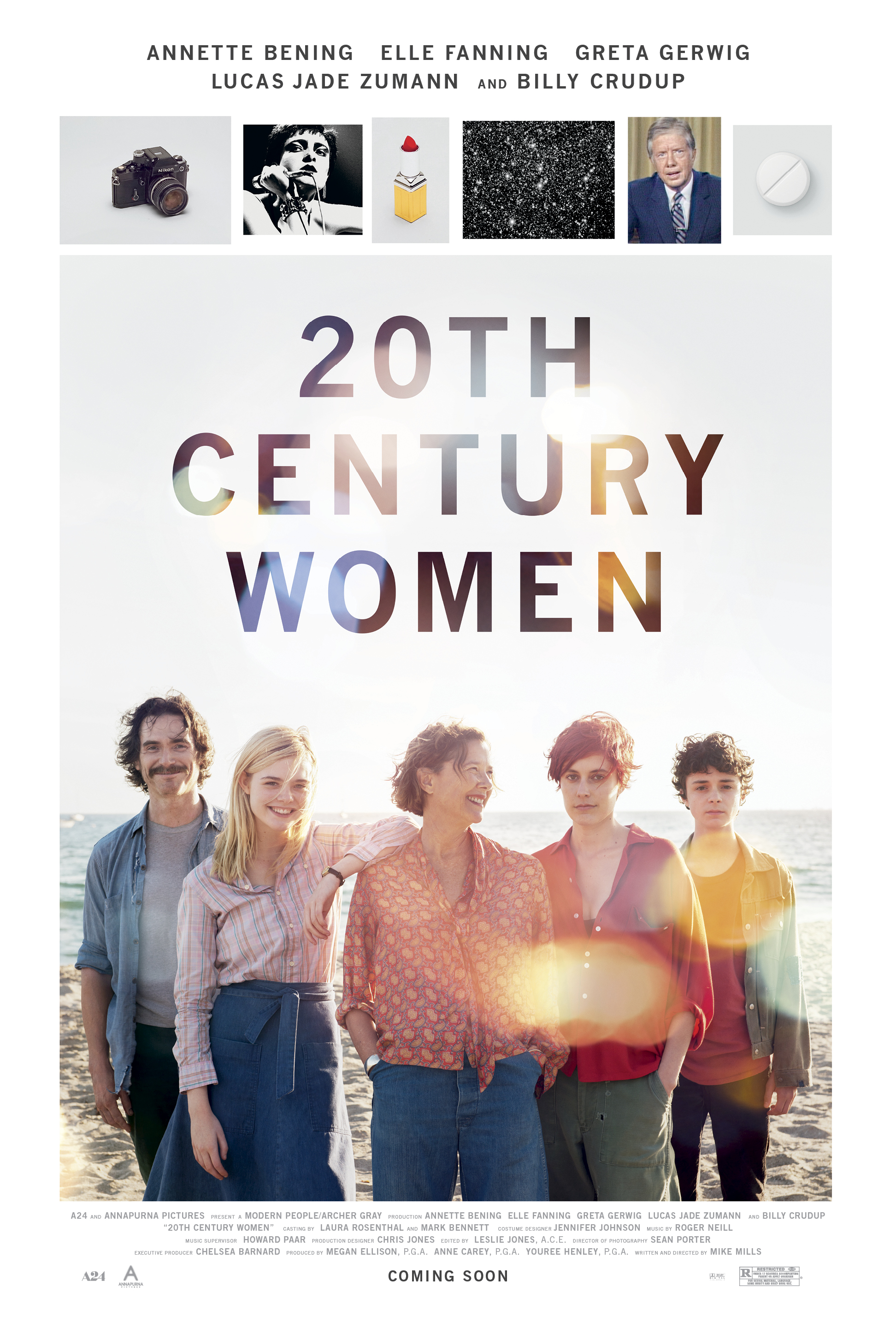

Wife choose the below. For a feminist movie, entertaining and made her want to have female empowerment sex (eg on on) afterwards

-

1

1

-

-

They like to be asked if they are jungle or city Asian

-

Does this count?

not sure why but picked this up.

-

-

13 minutes ago, RPM said:

You don't have enough posts or rep.

Thanks

-

Why can’t I post in CR? Yes, I know this is basically asking why can’t I just eat shit.

-

On 5/15/2019 at 11:51 AM, Damor said:

I can't find the post to give rep, but someone recommended Hernan Diaz's In the Distance.

Just finished it this morning -- that was a fantastic read, one of the best books I've read in a while, and thanks to this thread, I've read a lot of good ones lately. I really do appreciate all the great recommendations in here.

Up next, going on a WWI tangent with Goodbye to All That, then rereading All Quiet on the Western Front.

This was really good. I liked the amazon review, like a cormac McCarthy novel but good!

-

Parents live in that area. Fulshear cops will give you a ticket for going 1 mph over the speed limit.

-

- Popular Post

- Popular Post

Do any of you fucks complaining about CDC remember Steve Patterson?

-

10

10

-

Just now, Xian said:

I have so much longhorn ptsd

1234

-

ERPs were invented to revolutionary in the 80s. Unfortunately, most companies did not implement until 2000s when we were on the cusp of cloud

-

4 hours ago, William_Cannon said:

Define cheapish or your budget?Below 400?

-

Nate and his banker hire posted some bs about rumors should be ignored and good vibes would prevail on LinkedIn shortly after the raid happen.

Dude way over pays so I assumed something was fishy when I met him during a fund raising process.

-

Lotta titties in the show

-

23 hours ago, ChiTownDoc said:

Not really arguing with you. Putting money into play is about as important as actually winning with that money. Not sure I’m seeing a big disconnect with what we both are saying.

-

Nashville has a more dynamic economy. People call it Austin in the 80s

-

Trudy sucks now. Was ok only while I was in college due to their drinks.

El patio never been despite living in Austin 10+ years because everyone said is was meh. Always surprised it lasted this long

-

-

Any recs on cheaper end for 50ish inch just to watch Netflix and amazon prime? Looks like the roku TVs would be best

-

-

12 hours ago, ChiTownDoc said:

I’m not saying it’s a good bet. I’m saying when you have pressure to make deals and a lot of this is an auction process, even good banks overpay/make bad deals.

And as for as your cousin Assadullah (lol), they raise that money to be PE money. They can’t take their investor money and go throw it in securities. It’s not an option.

After we did our sale I gave X dollars to PE funds. Most of it is still parked. So I’m pressuring GS to find a fund that can put my money to work. I guarantee you they can’t take that parked money and decide to do whatever the fuck they want with it.

Not to derail the thread but your view of SoftBank isn’t completely accurate. They do have a shit ton of capital to deploy but not like IB as they raised outside money mostly from the Middle East to create a fund just to do Venturing investing.

Softbank’s view is that most markets are winner take all so their game plan is to create a moat by effectively giving startups almost unlimited funding. As a result, valuation matters less.

The wework ipo debacle only matters to them as it is making it awkward / hard for them to raise their second fund.

-

Just now, HornsOverIthaca said:

We required more interceptions.

Id take a few fucking incompletes

-

Thought it was dumb play calling but fucking worked.

-

I’m so erect

News stories that remind you of Surly

in Lulz

Posted

Not sure here or the shart thread

Florida woman killed in port-a-potty explosion

https://wnyt.com/news/florida-woman-killed-in-port-a-potty-explosion/5510789/