Reagan1k

-

Posts

2306 -

Joined

-

Last visited

Content Type

Profiles

Forums

Store

Downloads

Recruiting - 2020

2019-2020 Football Season

Football

Entertainment

Sports

News and Business

Cloak Room

Transfer Portal

Recruiting

Events

Posts posted by Reagan1k

-

-

44 minutes ago, Handcruser said:

There is some PMC and S&B around that same price on ammoseek. S&B is great stuff. PMC is very good too. I’d go that route.

Agree on S&B Add Prvi Partizan to that list. I've bought a ton of it...usually through SG. I'm normally too slow for ammoseek and it can get cumbersome (for me).

On management hunts with guests shooting doe and hogs, I normally hand them a box of S&B or PPU .243 or .270 if they're shooting my rifles.

I'd probably describe both as A- ammo at C+ ammo prices. Both fill military and LE contracts around the world and have a LONG history.

Quality stuff and discount prices.

-

2

2

-

1

1

-

-

12 minutes ago, fattyflattie said:

Yes but I believe you must own at least one model 70 .270. Everything after that is just lagniappe.

I didn't want to start evangelizing, but we share that common passion I believe.

-

1

1

-

-

20 hours ago, Handcruser said:

I knew it was reloads. Knew it.

Both nice guns. What is your gun budget sans glass? Why 270 (just curious)?Doesn't it say somewhere in the Old Testament (Leviticus 6.8) that every man shall own at least one .270?

-

1

1

-

2

2

-

-

-

2 hours ago, Celery Man said:

any of y'all been burned? this doesn't feel like a stonks question since i've held it for 16 years

Often, it's not so much the risk of being completely burned as it is the opportunity cost of better market returns with diversification.

A family member is a good case study I try and always remember.

She held T as her sole equity position prior to the break-up and then held the collective basket of entities for +50 years until her death - hanging on to that step-up in basis for dear life.

Had the taxes been paid at any point and the balance simply invested in the S&P 500, the value would have been 10x at her death.

She let a fear of taking gains and paying taxes dictate the investment decision instead of being just one facet of the decision.

Would I invest X% of my assets in this today is the question everyone wakes up to, whether they realize it or not.

If I wouldn't buy it today, why do I still own it is an interesting question to ask about any portfolio holding.

-

3 hours ago, Lat22 said:

Nah. That's just a Collectors Firearms price. They're ridiculous on everything.

If only my Model 70s could be sold for what Collectors puts on theirs........

-

1

1

-

-

- Popular Post

- Popular Post

We're everywhere!

Last weekend I had to participate / co-chair a rather larger event that included an open bar.

Before things kicked off it was still quiet and I went to the bar and ordered a Topo Chico with lime. When the bartender gave me the drink, he commented that I watched him make the drink like someone who wanted to make sure he got it right.

I told him I didn't drink at all and that everyone was happier for it. He laughed, stuck out his hand and said "I'm T.J. and I've got 10 years."

We talked some about our time and stories, and he took extra care to make sure he was the only bartender who made my drinks as the evening progressed. At the end of the night I gave him a healthy tip on the side, he came out and hugged me and told me to keep doing the deal.

CSB - I know. It's happened to all of us and has happened to me before, but I believe it to be important to stop and recognize it for what it is.....and it ain't a coincidence or accident.

-

7

7

-

6

6

-

That's a good one to discuss with your sponsor who probably sees it from an objective perspective.

Could easily be the EX just stirring up shit. Most teens won't even look up from their phones long enough to realize a parent slipped out for an hour and a half to get to a meeting and back.

If you're intentional about the time you do spend with them, I'd venture to make a SWAG that it isn't a real issue.

I'd go sit down with your sponsor and then maybe sit down with the kids individually and talk it out. Find the truth for each one and adjust if needed from there.

It's always a balancing act that ebbs and flows, but as you said....the reality is that without the program there is no dad in the picture at all.

-

3

3

-

4

4

-

-

On 2/16/2024 at 2:06 PM, CHIEF said:

My dad worked for Santa Fe Railroad when I was a little kid. GM would ship car parts in these thin veneer wooden shipping crates. He wanted me to start hunting with him when I was about 5-6 years old. He found three post oaks that were growing in a triangle and nailed three 2x6s about 30 feet up. He took two of the shipping crates, took an end off of each one and fastened them together on top of the three 2x6s, and threw in a bus seat. He nailed 2x4 steps to one of the trees to get in it. So, it was open top and exposed to the elements and was still referred to as "the Taj Mahal" of the lease.

He would shit a rubber turkey if he saw my hunting set up today (Fridge, TV, a/c, solar electricity).

CHIEF

For a few years, we hunted from the cab of an old Ford truck that had broken down and been left for dead. The steering wheel and windshield had been taken out and we just used the bench seat- all the cushion was gone, plywood cut to cover the seat frame and we sat on pillows. Called it the Park-N-Shoot.

-

2

2

-

1

1

-

2

2

-

-

13 hours ago, Armybrat said:

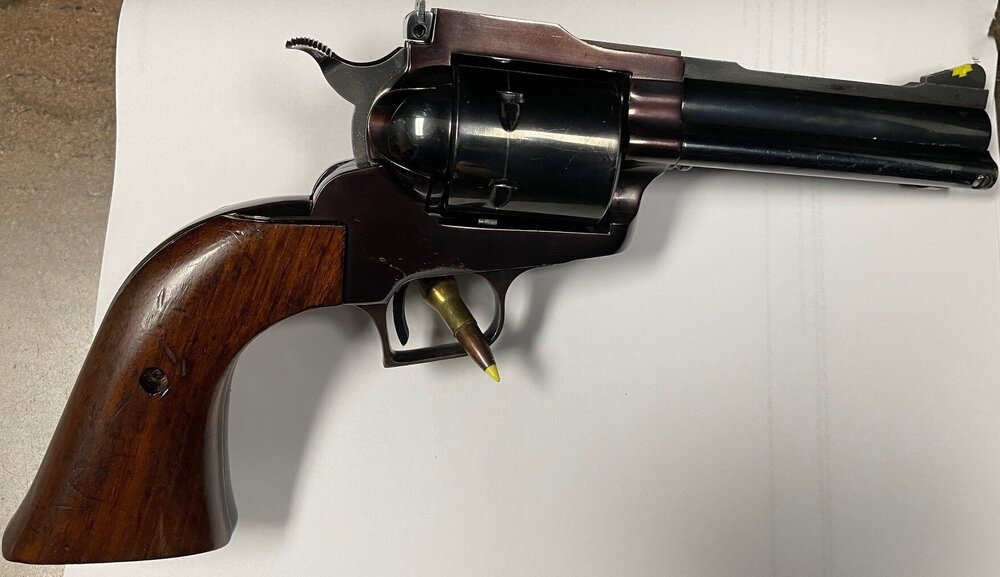

GOAT miniature guns - pretty cool:

I’ve been looking at those to tinker with when on the phone. Looks cool!

-

1 hour ago, Skipper said:

Just curious - what is a scenario where life insurance as an "investment" actually makes sense? I had always heard pretty much a ripoff in all but very specific circumstances but never understood what those circumstances would be.

For me personally - with no dog in the fight.....I firmly believe in the power of properly funded permanent insurance when the need is there. But, I would never call it an investment and don't consider it as such. It also has no benefit and may even be detrimental to most.

It's a funding vehicle for certain situations and a flexible asset I can use to my advantage - but again...it isn't an investment for me and in my mind.

I'm a business owner and have seen how it works, how it works for me and what it did for my predecessors over my 35 year tenure and the company's 80 year life. It's a fantastic tool for me to use in planning and funding certain obligations....both professionally and personally. It is also a horrible tool for one of my shop guys to buy when he's barely able to even fund his 401(k) to grab my matching dollars.

I control an ESOP, and I must plan for buying out certain employees at their death or in retirement - whichever comes first. I fund that obligation with permanent life insurance. If they retire prior to them dying, I use the cash in the policy (that protected me from the liability of them dying early) to pay them off via a loan and I have negligible cost to access those funds. When they die, I recoup all of my premiums, their buyout, and then some. All the while I was protected from an unfunded obligation in their early years for pennies on the dollar. My working capital was protected.

I have a close friend with a handicapped daughter. He peels off a fraction of his estate annually and funds a permanent policy that will take care of her at his death, without disinheriting her siblings. He spends 1-2 percent of his estate anually on those premiums. His estate and the other children will get that spend back at his death (with a multiplier) and his disabled daughter will have perpetual care.

It's an asset class and not an investment in my mind.

Two things can be true at the same time.

-

4

4

-

1

1

-

-

1 hour ago, Trey3216 said:

1) You'll always have it. You could calculatingly spend your assets down because when you die, your family will replenish assets with LI cash.

2) It doesn't factor into assets for children applying to college on FAFSA.

3) You can utilize the cash (via loan) to yourself at anytime with no application. Pretty convenient during high interest rate environs. You could take a car loan right now for 4.8-5% from yourself rather than 8+ from the bank right now. (Had a business client loan his business $250k for equipment purchases from his life policy a few months back at 5%...bank wanted 9%...saved himself tens of thousands of dollars)

4) in the event you were to have some sort of life threatening chronic or terminal illness (cancer, dementia, etc) you can access the death benefit while you're still alive to pay for medical care rather than have to use assets

5) It can't be taken in a lawsuit. OJ has a shit ton of money because much of his estate was in life insurance.

...In reality, once you are retirement age it more or less becomes asset insurance. You protect your assets, your nest egg, via the benefits of the policy. The cash value of the policy is yours to use freely, when there's cash available.

It's not for everyone, but it can BE A PIECE OF A WELL ROUNDED STRATEGY. It is not the only strategy, nor is being completely dependant upon the market and hoping for permanently good health and timing your exit from the workforce just right.

It's a tool - nothing more nothing less. When used properly in the right situation to solve the proper problem, it is highly effective and has enormous benefits. When used in the wrong application, it's akin to trying to cut down a tree with a screwdriver.

Investing in hedge funds and fine art is ridiculous for a 20-something with a 5-figure income and 4 kids, but that doesn't mean those don't have a place for someone else.

The stigma associated with cash value life insurance is associated with certain salespeople and how/where they sell it, but that doesn't mean its a bad product.

-

1

1

-

-

I can't figure out what anyone is arguing over. Unless this is just a personality clash or a lover's quarrel, it appears that everyone is saying the same thing.

No plan has a 100% success rate regardless of any future/unknown event. A "plan" of any kind is based on assumptions and past experience.

A 4% withdrawal rate is considered to be a reasonable rate and backtests to a high probability of success (nothing is guaranteed including the full faith and credit of the Federal Government).

A 6% withdrawal rate is risky - I can't figure out who said otherwise.

Sequence of risk is dampened by any more conservative withdrawal rate and further dampened by a separate cash reserve. It moves the success rate higher for any given rate.

What's the bone of contention?

-

2

2

-

-

1 hour ago, Armybrat said:

Only made a few hundred before a trademark battle with the Grizzly semi-auto and labor costs to machine parts and hand tune one at a time ate them up.

Old employees state that the production was only in the 100's even though they have 4-digit serial numbers.

-

1

1

-

-

3 minutes ago, Armybrat said:

Freedom Arms?

Mikkenger Arms / Dallas, TX (Edmund de la Garrigue)

Model: Grizzly- 44 mag

-

1

1

-

-

2 hours ago, Armybrat said:

Can’t tell if it is a 3-screw or NM, but maybe is either a cut down 7.5” or a 4.62” fitted with the “dragoon” grip frame?

Hint - "The frame on these (grip frame and "main frame") is one-piece. There is a side plate on the left side of the gun that allows access to the internals. The side plate is held on by a screw hidden under the left grip panel. By using a one-piece frame, the guns are strong enough to handle .44 Magnum pressures while being the size of a Colt SAA."

-

1

1

-

-

-

On 2/8/2024 at 7:25 AM, Twizzler said:

This is good advice worth investigating.

Gotta check with HR first.

If it doesn't and you have any sway in the company, ask them to amend the plan.

A good 401(k) provider will have resources and people available to educate you and walk you through the steps and pitfalls.

-

2 hours ago, deft said:

Can you put an obsidian 45 on a 300blk and safely fire subs? I recognize that the performance wouldn’t be as great as with my sdn6 but it’s what I have on hand at the moment.

Check the ratings sheet for what it can handle. May only be rated for .300 subs and for certain barrel lengths.

-

Interesting info on potential pricing changes - or not - coming out of shot show.

“

Thank you for subscribing to the SGAmmo.com newsletter. If you have trouble viewing this email you can see the newsletter at this link: Ammo Deals & News From Shotshow @ SGAmmo

News from Shotshow 2024: I just got home from 4 days in Las Vegas at the shotshow, where I met with the people from the factories we work with, factory sales people, factory directors and owners, importers, etc. The big point of discussion seemed to be shortness in supply for nitrocellulose, which is the raw material used to make gunpowder and other propellants and explosives. Based on these conversations, the issue seems to be based on 2 factors, decreased availability in the supply chain and increased demand for the manufacturing of military ordnance. Getting into the details and a little more, a huge percentage of the nitrocellulose used to make gunpowder historically came from China and Russia, however according to my conversations with industry partners, the Chinese manufacturers who historically were the biggest suppliers at over 30% of the market share are no longer willing to ship raw nitrocellulose to the USA or NATO member countries in attempt to reduce the USA & NATO's ability to supply Ukrainian forces with artillery shells, and of course Russia who historically was the 2nd biggest supplier is out of the supply chain as well. This decrease in supply in raw material has gunpowder manufacturers in the USA raising prices dramatically and cutting off many of the smaller ammo manufacturers. The 2nd part of this issue is the demand for military ordnance, like 155mm artillery shells that use huge quantities gunpowder propellants, and the gunpowder manufacturers switching production to this type of gunpowder with what supply of nitrocellulose they do get. The first reason is that they always put the US government's needs before those of the commercial market, and the second reason is that it is simply much more profitable to manufacturer military ordnance than it is small caliber ammunition, so they get a much more profitable price manufacturing powder for artillery shells. In conclusion, while most of the factories seem to have gunpowder stockpiled today, this issue is expected to catch up to them no later than the summer of 2024 and possibly within a few months, and when it does it will mean the factories will be capable of producing much less small caliber ammunition to sell to the US commercial market. If demand for ammo is low to moderate, you may not see a big change, but if demand were to go way up as it does periodically, the factories will not be able to ramp up capacity to fill that demand. In my opinion, a lot could go wrong in the commercial ammo supply chain in 2024 and it would be wise to stock up sooner than later as 2024 price increases have just started to set in on just a handful of select items so far, and availability is still good which has held prices down temporarily.

At SGAmmo, we have the best selection of high quality ammunition you will find anywhere online, and at competitive prices. If you have some spare time please take a few minutes and look over the online catalog at www.SGAmmo.comwhere you can see all the products we have to offer. We also have free shipping on any order with over $200 worth of product, making for a more straight forward transaction without expensive surprises in checkout. You can mix and match different products to get to the $200 threshold for free shipping, so feel free to take your time and shop the website for anything you might need. We also set the bar for quality packaging in the industry, and double box all case orders free of charge to make sure your purchase arrives in the best possible condition. We want you to be satisfied with a hassle-free transaction by receiving the goods ordered as pictured and described, in good condition, quickly and efficiently. Due to the current unstable market conditions, we guarantee our newsletter pricing for 48 hours from the time it was sent or while supplies last. We thank you for your support of our family owned and operated business, please stay subscribed for future SGAmmo newsletters.

Thank you, Sam Gabbert, SGAmmo Owner”

-

1

1

-

-

7 hours ago, Handcruser said:

Played with it today. I’m not a fan of

Interesting. As I mentioned, I've never shot the two H9s I have and obviously haven't shot the DD iteration.

They aren't my cup of tea visually. I guess my reason for buying originally was the Texas tie-in.

I'll be interested to shoot the DD but visually it still isn't that appealing.

What in the handling turns you off?

-

SIAP but Daniel Defense now has the H9. https://danieldefense.com/daniel-h9.html

Low bore axis, trigger, and feel of a 1911 in a striker fire is the goal.

It's DD's remake of the Hudson H9. I have two of the Hudsons in my safe - never been fired.

Interested to see the reviews of the DD version. Hudson was certainly on to something before the went poof.

Hopefully DD has their version nailed. Would be a great compromise for those who love shooting the 1911 but want the simplicity of SF.

-

1

1

-

1

1

-

-

10 hours ago, Handcruser said:

It is not against the rules. What do you have?Patiently strumming my fingers on the desk waiting for the post.

-

3 hours ago, BabaYaga said:

I don't have an ax to grind one way or the other - low fence, high fence, sedated and photoed - whatever is legal and within your moral speed bumps, rock on if that's how you want to do it. As long as the animal is treated humanely and your aren't crossing any legal barriers, fire away.

Along those lines, I've noticed recently that "free range" is being used in lieu of making the fence distinction. To avoid high fence or low fence moniker, folks (typically under high fence) will use free range.

That can be and is a very true statement under many situations, even if there is a high fence involved. Give a buck X,000 acres and that SOB can be as free-range and hard to hunt as any public land animal.

Pointed out only as a statement that is seems to me the high/low becomes a battleground for comments and judgement, while some of that gets diffused and craftily avoided with the use of "free range".

-

2

2

-

.thumb.jpg.966209e305efc41e5dea6c653261eec8.jpg)

National Pro-Palestine Protests Thread

in Daily Texan

Posted

Cart before the horse a bit there at Columbia. No plans on how they'll eat or drink. No knowledge that the school will stop you from getting your own food...but press conference to demand they don't?

Writing checks their ass can't cash at this point.