zzz

-

Posts

109 -

Joined

-

Last visited

Content Type

Profiles

Forums

Store

Downloads

Recruiting - 2020

2019-2020 Football Season

Football

Entertainment

Sports

News and Business

Cloak Room

Transfer Portal

Recruiting

Events

Posts posted by zzz

-

-

-

We were whipped in the trenches on both sides for the better part of 3 quarters. That was a bigger issue than coaching.

-

5

5

-

1

1

-

-

49 minutes ago, Huckleberry said:

I'd like to personally thank @BurntOrange&White for shitting all over this thread shortly after my last post and thereby drawing attention away from the multiple swype-based typos that made me look like the Android @SydneyCarton.

Android is weird

-

1

1

-

3

3

-

-

- Popular Post

- Popular Post

-

Can’t we just hire the Tech coach? My tech acquaintances assure me he was the brains behind the operation

-

1

1

-

3

3

-

-

-

-

-

-

Oh thank God. I've seriously got to get some work done this week

-

1

1

-

1

1

-

-

2 hours ago, DFW Horn said:

Has the skyrocket always been one of their regular 'yells' or did they add it for all of the errant Calzada throws?

-

3

3

-

-

Kill someone with $100 billion and assume their identity.

-

1

1

-

-

8 hours ago, Longhornlove said:

All Ass, no gas

More like 'our ass, so gaped'

-

Noice

-

4 hours ago, Biff Tannen said:

Fuck. I'm sorry man. I think this is the longest streak on Surly. Can you not leave?

Maybe it's a record on Surly, but I have two brothers and their families that live a few miles apart on the same power line, both have been out since the first ice storm last Thursday. Both have been eeking by with a small generator and a space heater.

-

2

2

-

-

37 minutes ago, bluto said:

Is it an actual obligation requirement if in the money or can you still reject to exercise the option?I believe you are correct. You still have the option to exercise or sell at expiry, although I've never tried that.

-

1

1

-

-

34 minutes ago, Gourmand said:

Interactive Brokers or TD Ameritrade

Just FYI, TD Ameritrade charges $6.95 per OTC trade. Interactive Brokers charges $0.005 per share for Pro platform or 1% of trade value, $0 for IBKR Lite . I have never had a trade rejected using TD Ameritrade. I don't trade OTC with my IB account due to the $0.005 per share fee.

-

1

1

-

-

34 minutes ago, Dbeasy said:

Now explain what happens when options expire. That’s a little more tricky.

Bought a call

- Expires out of the money: worthless (you lose any premium you paid).

- Expires in the money: you are obligated to buy 100 shares at the option strike price for every option you bought. You make money by selling at market to close the long position (buy low, sell high) minus the premium you paid.

Sold a call

- Expires out of the money: worthless (you keep the premium someone paid you when they bought the option).

- Expires in the money: you are obligated to sell 100 shares at the option strike price for every option you sold. What happens is your broker buys the shares at the current market price and sells them to the other party at the strike price. You eat the difference. Risk is theoretically unlimited. You keep the premium you collected.

Bought a put

- Expires out of the money: worthless (you lose any premium you paid).

- Expires in the money: you are obligated to sell 100 shares at the option strike price for every option you bought. You make money by buying at market to close the short position (sell high, buy low in this case) minus the premium you paid.

Sold a put

- Expires out of the money: worthless (you keep the premium someone paid you when they bought the option).

- Expires in the money: you are obligated to buy 100 shares at the option strike price for every option you sold. Risk is limited to the share price reaching $0. You get to keep the premium paid to you.

-

1

1

-

-

I should clarify, when you bought the option, you 'bought to open' a contract. You will simply 'sell to close' your option contract. No need to exercise the option and then sell the shares.

-

1

1

-

-

21 minutes ago, CooterBrown said:

Option dumb ass here.

Here's something basic that I don't understand.

An example:

I buy a call option for $1 premium with a strike price of $100. I pay $100 for the contract (100 shares x $1).

The stock is in the money at $105 prior to the expiration date.

How do I collect profits? Do I have to have to exercise the option contract and pay the full $10,000 (100 shares x $100) out of pocket and then sell it at $105 (or the current price) to get $500 (100 shares x $5) profit? I've watched a ton of YouTube videos on how options work but none of them ever explain how you actually collect your profit.

Just sell the option(s) back. There will be a bid/ask just like when you bought it.

-

1

1

-

-

14 minutes ago, KYHorn said:

Been following right behind AMYZF with limit orders over the last week trying to catch a dip, like a dipshit. There's a shameful trail of canceled limit orders starting at 0.89 and slowly increasing to 1.10, when I finally decided to hop on board.

Yup, I do this too, a lot unfortunately. Lately I've been putting 1/3 or 1/2 of my position at the current price so I'll be in the trade just in case it takes off and never looks back, then look to add on pullbacks. It's not perfect, but it eases the FOMO a bit.

-

1

1

-

1

1

-

-

-

On 1/29/2021 at 10:59 AM, RCRanger03 said:

Just wanted to let yall know I'm not able to come to this thread during work hours on my computer maybe for the foreseeable future

Something somebody posted flagged as a porn url and it reported me to my ITS director. Probably going to have to stay off the rest of the day except on my phone which will be very little. Hopefully they don't monitor me going forward.

Sent from my SM-G970U using Tapatalk

Ranger, try installing the Opera browser. It has a free, built-in VPN. My work blocks the best the intertron has to offer, however, I can get to all of it with this setup. I use this exclusively for browsing the Surl. I know my work can't see the traffic because I should get redirected to a page telling me I fucked up when I go someplace I shouldn't. Just remember to clear the history occasionally if you are concerned.

Since it is a free VPN, I'm sure all traffic is routed through some Chinese servers somewhere and they are logging everything, so I wouldn't go to any websites that ask for any personal info or passwords, at least that is my personal policy. The VPN is also great for questionable web searches to avoid targeted ads, just make sure the country of origin is USA or some other English speaking country, because if it is set to a foreign country, then the search results may be in that country's language.

Go here to check where your IP says you are located with the VPN on.

-

3

3

-

-

Interactive Brokers was also restricting GME by only allowing you to close positions, so you could sell if already long, but could buy if you were short. TD Ameritrade let me buy it around noon after I was finally able to merely log in to their app. Picked up 3 shares to help the cause, don't care if it goes to $0.

-

2

2

-

2024 EDGE Colin Simmons

in 🤫$9.95🤫

Posted

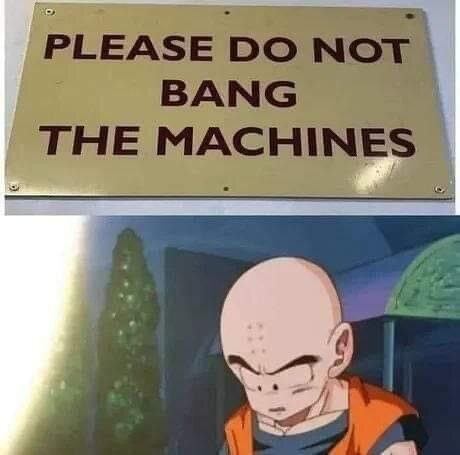

The last couple of pages of this thread are very reminiscent of a timeless classic.

https://forum.bodybuilding.com/showthread.php?t=107926751