sheeeit

-

Posts

761 -

Joined

-

Last visited

Content Type

Profiles

Forums

Store

Downloads

Recruiting - 2020

2019-2020 Football Season

Football

Entertainment

Sports

News and Business

Cloak Room

Transfer Portal

Recruiting

Events

Posts posted by sheeeit

-

-

2 minutes ago, elfenix said:

i'm totally sure there aren't any laws against straw purchases of firearms and/or handing a minor a rifle unsupervised and/or driving him to a riot and letting him run around by himself, nevermind the rifle.

Can't believe I am going to type this but you actually make a good point. There seems to be a little grey area on whether or not he could legally own the gun but I agree that if the straw purchase was illegal then that guy should be prosecuted. I also actually agree on the mom. Kids do stupid shit all the time. IF, she knew he was going to get a gun when she drove him to the riot, I think she could be prosecuted as well.

-

1

1

-

-

23 hours ago, Lobo said:

Holy shit. I’m not a practicing attorney but my only ‘A’ in law school was CrimPro.

Also Lobo:

"It was more a commentary on all the hours I’ve spent in courtrooms from law school until now,"

Just messing with you.

-

14 hours ago, Bevo said:

I'm at a loss here. Vote? Let the city burn like Seattle? I'm still hoping that the law finds an answer to riots. I don't think the guys who were shot are an answer to any of our problems in America.

There were people there "helping" (rendering aid, boarding up buildings, cleaning graffiti etc) that were not armed. None of them got brutally attacked. KR most certainly injected himself into the mayhem, which he had the legal right to do, but, IMO, the potential for a bad outcome due to people bringing weapons to the scene was greater then the help they could realistically provide. Just my opinion.

I am not saying he did anything wrong legally and I understand the argument that some people at the scene felt the need to be armed.

The reality is that Rosenbaum was hell bent on attacking/killing some individual that night who was there to help dispel the rioting and looting and arson. I think KR just happened to be the first one that passed by Rosenbaum when he was laying in wait. Could have been any of the armed folks.

It was still a bad idea to be there with an AR. Obviously the police/national guard/whoever should have been out in full force to handle the situation but they were not for whatever reason. Better to let a business burn than risk dying.

-

1

1

-

-

42 minutes ago, washparkhorn said:

So again, the crux of the case is whether loses his right to claim self-defense because he intended to provoke an attack against himself by unlawfully carrying the weapon with the intent of then using that attack as an excuse to use deadly force against his attackers.

Based on the facts I have seen, that's a stretch for any jury given the kid looks and acts like an incel, has a shitty parent/s, and has loser dead-end friends. He doesn't appear bright, he presents as lost, and his friends look like an anchor.

Frankly this looks like LARPing or Cosplay gone amuck.

Just my opinion but I do not think KR went to the riots with the intent on shooting anyone. He is a kid. Him popping off on the video is pretty typical macho talk- heck people in the CR threaten to kill someone or wish death on someone daily.

I certainly agree that him actually going to the riots with a gun was a stupid thing to do and certainly makes his comments look worse in hindsight. He should not be heralded for his actions. I hope his case is an example for those like him of what not to do. There were many ways he could have helped that didn't require him bringing an AR. I genuinely think he went there to help and was certainly a bit naive as to what might happen but nothing presented as evidence makes him look like some sociopath on a hunt to kill people. As mentioned, there is not a single bit of evidence shown in the trial that he was being confrontational or acting crazed in any way.

As to washpark's comments above, It seems people continue to gloss over pretty important aspects of the law here. The self defense statutes have been posted a few times. Even in a best case scenario for the prosecution that somehow KR gave up his defense of self defense by the simple fact of showing up with an AR, the next part of the statute says (paraphrasing) the self defense protection is immediately reinstated if the person attempts to remove themselves from the situation. It is on video and acknowledged by one of the detectives that when Rosenbaum hid and then confronted KR that KR ran away while loudly proclaiming "friendly, friendly". He absolutely tried to remove himself from the situation. So his self defense claims were absolutely valid legally.

The disturbing thing to me is that the prosecution obviously knew before the trial as did the judge and the defense attorneys. The case should never have been brought. I hope this does not give rise to more KR types that put themselves in bad situations.

I will also add that there is a LOT of criticism of those that are acting like KR is to be commended. Yet, especially in the CR, no one has any criticism whatsoever for all of the national pundits (including actual members of congress on up to POTUS) that mischaracterized the case from the beginning. It is hard for folks not to push back.

-

3

3

-

-

45 minutes ago, 52-80 said:

im behind on the stream

Scene: KR... who had a fire extinguisher...who testified and was video'd running around with a fire extinguisher.

Questioning:

DA: "So you decided you needed to run [towards the Duramax] because of the fire on the Duramax?"

KR: "Yes"

DA: "Why? what was so urgent""

KR: "because.... it was on fire??"

This has to be a bit right?

-

Taxes

in Cloak Room

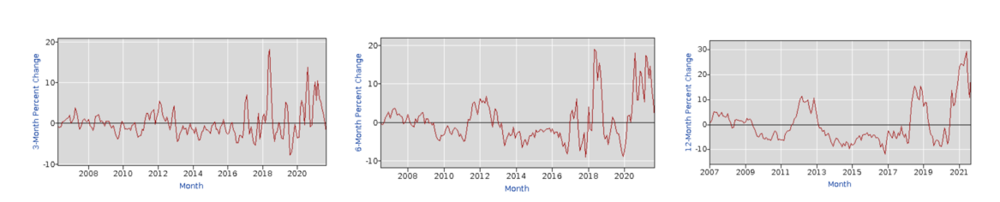

31 minutes ago, Blotto said:Or you could just simply admit you were wrong, and you don't know how to interpret the chart you used to "prove" that prices for laundry equipment had fallen since trump's tariffs. I don't have to fall back on a lame excuse of "I don't know why the charts change. Their methodology is weird. I tried to understand it. I think it is mixing different things." The reason I don't have to do that is because I simply interpret the chart by what it claims to show " 3 month % change" and then all the charts make sense. In that context, this chart also makes sense

Laundry equipment costs more, not less as you claimed . That was also the finding of this article which you completely ignore as cherry picked data . The basis of that article was a paper published in the American Economic Review, which also provides their data set (https://www.aeaweb.org/articles?id=10.1257/aer.20190611). But you would rather use a poorly interperted chart with discrepencies you can't explain "I don't know why the charts change.... but heres some random pricing I found on google"

You're full of shit. We know it. You know it. But like all loyal trumptards, you believe if you simply never admit that you're wrong, you won't ever actually be wrong.

I was really hoping you were different. But you appear to be just as stupid as the rest.

Did you even read the paper you linked to? I am strongly guessing that you did not. I did. The methodology that they used to determine the cost of the tariffs was based on sales analysis between 2013 and 2018. Exclusively. They did not use any data from 2019 or 2020. They say that right in the paper. That paper is completely worthless in this discussion.

All of this is in the paper you so proudly linked to. The paper relied on data from a group called GAP Intelligence and they send in people to retail stores in 22 different markets to get weekly pricing on washing machines. They found a spike in pricing in mid July 2018 and they stopped reporting in late 2018. Interestingly, they talk about the tariff on steel that went into effect in March of 2018 as contributing to the price increase. This corresponds exactly with the data I provided (that you and everyone else ignored) on steel prices that went up initially for about 6 months in 2018 and then went way down in 2019. So they have exactly zero data on washing machine prices from late 2018 going forward. Zero.

As I said from the beginning, there was a small spike in prices immediately after the tariffs went into effect. This is noted in the paper you linked. I never argued any differently. What I agued is that prices went down after the initial spike to levels that were below the prices at the time of the tariffs. And they did.

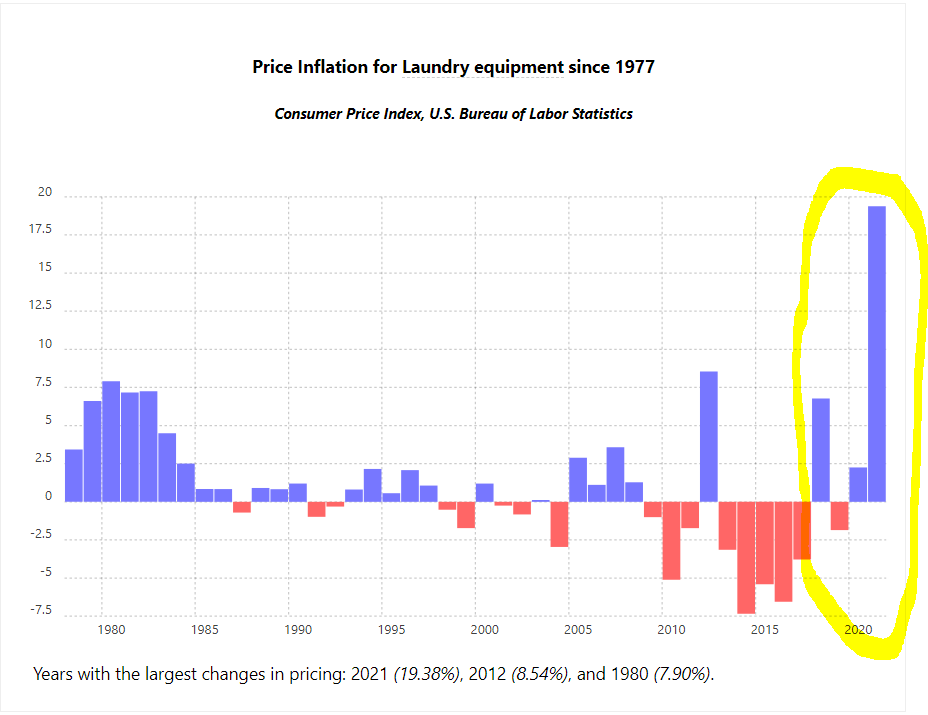

Here is a BLS/CPI graph from 2017 to 2018 and then from 2018 to 2019 for laundry equipment. This is a different graph from before and is not a 3 month/6 month/12 month graph but appears to be straight pricing.

It tracks exactly as the paper you provided said it would. Prices started to go up in March of 2018 in exact accordance with the tariffs on washing machines and steel.

Now here is that exact same graph from 2018 to 2019. As you can see, the prices started dropping at almost the exact same time as steel prices started dropping and by the end of 2019 the cost was below the cost at the beginning of 2018. Just exactly as I said.

Now I was WRONG in one respect. The prices started going back up again when Covid came along in mid 2020. I am not sure how I can google prices for these machines in 2021 and get the same price as they were selling for in 2018 but I am done with it. But there is absolutely no debate that prices for washing machines declined for 2 straight years after the initial spike in July of 2018 until July of 2020 and that the price in July of 2020 was lower than the prices just before the tariffs.

-

Taxes

in Cloak Room

1 hour ago, immamac said:I'm saying if you take a loan out on an asset that has an unrealized gain, the money that is leveraged by that unrealized gain should be taxed as ordinary income upon the funding of that loan.

borrowing all the way up to 100% of your cost basis should not be taxed at all, regardless of that was a loan to begin with or not. (Cash out refi to your cost basis on a house should be allowed without tax implications, tax out refi above tapping into equity built without paying cash down should be)

Same thing with Stocks/financial instruments.

If you own stock, or are granted stock you should be able to leverage (margin trade, or collateralize) up to your cost basis without having tax implications. If you have an unrealized gain and use that gain for leverage/collateralized lending/margin you should pay those taxes upon funding of that instrument.

Stock options when executed immediately become unrealized gain (usually, thats why people execute them for their "lower" strike price). If you turn around and get a loan against your millions in stock now you should absolutely pay taxes against that instead of just interest.

RSU or Stock Grants already have a taxable event when they are issued. A lot of people instead of selling stock to pay the taxes that are due collateralize the stock and just pay interest so they can realize gains to pay their original taxes on the cost basis. It's completely fucking bonkers.

1031 exchanges should also have a maximium deferral period or maximum multiplier for deferring original cost basis (10/20/30 years or death)

Interesting. I think I understand your point. I buy 1M shares of Apple at $100/share. I have bought the stock with income that has already been taxed and my basis is $100M. Apple goes to $150/share so the value of my holding is now $150M. So I can borrow up to $100M with no tax implication. But if I borrow $120M I will have to pay ordinary income taxes (obviously at the top rate of 37%) on the $20M that is above my basis or $7.4M in income taxes. Pretty sure that would stop the practice.

This may make some sense as a tool to tax the super wealthy but for everyday people this would have serious implications. And, as I mentioned above, this tactic is really just delaying taxation not evading it. I could make a pretty good argument that borrowing against those stocks and then that money going back into the economy is much better than an amount 37% lower going to the govt.

So If I bought a house in Austin in 2010 for $150K with a $100K mortgage and I have made some improvements to it and there has been a lot of appreciation and now that house is worth $500K. I decide I want to refinance and get some cash out so I do a loan for $300K. This happens every single day. Under your plan I have a new mortgage for $300K and I have to pay income taxes on $150K (the amount of my new loan over my basis) which would be in the range of $45K. So I would now have $200K more in long term debt and I get $155K in new cash. Before the transaction I had $400K in net worth and after the transaction I would have $355K in net worth. Who would ever do this? Its a plan I suppose but it would absolutely kill the home mortgage industry and stall the economy.

I start a new business venture with little or no start up money. 5 years in I have a decent little company but need cash to really grow. I go to the bank for a business loan. This happens every single day. Under this approach, I have to pay income taxes on the amount of my loan as my basis in the business is zero. So a 30% up front cost to borrow money (income taxes on the loan) plus the interest to grow my business. No one would ever do this.

"Stock options when executed immediately become unrealized gain (usually, thats why people execute them for their "lower" strike price). If you turn around and get a loan against your millions in stock now you should absolutely pay taxes against that instead of just interest. "

I don't follow. If Musk has an option to buy 1000 shares in Tesla at $50/ share that is his strike price. So if the stock is currently trading at $100/share when he exercises his options he pays ordinary income tax on $50,000, the spread between $50 and $100, even though he received no cash and his basis remains at $50/share for capital gains purposes. So when he does eventually sell the shares he will get hit with another 20% tax on those same shares at whatever the value of the stock is over $50/share. Why does it matter if he sells stock or borrows against it? The govt is still getting the income tax from the exercised option. The govt misses out on capital gains taxes from selling his shares if he went that option but they are going to get it eventually and, in the meantime, some banker made some money which goes back into the economy.

-

Taxes

in Cloak Room

1 hour ago, Blotto said:So its your contention that after annual price inflation of what appears to be roughly +6.5% , -2.5%, + 2.5%, +19% that prices are over all lower? I still think your chart shows exactly what I stated, its only relative to the price 3 months before. Otherwise how could changing the duration parameter to 6 or 12 months lead to these results:

absolute prices are either lower than in 2017 or they are not. the trend should be "negative" (below 0) in all 3 cases, no? On the other hand, if you just assume that what is being plotted is the price relative to the variable time frame defined in the data query (3 months, 6 months or 12 months), it all makes sense and would be consistent with the overall CPS inflation chart I posted twice earlier. please explain why 6 month and 12 month charts show diff results, I'm here to learn.

I appreciate the normal response. I don't know why the charts change. Their methodology is weird. I tried to understand it. I think it is mixing different things. Prices jump around a lot.

As you correctly said, the proof should be in the actual prices.

It is really hard to find data to show this but here goes.

https://www.reviewed.com/laundry/content/electrolux-efls617siw-washing-machine-review

This is a link to a review from November 2018 for an Electrolux washing machine. The MSRP was $1,099 and they talk of a "sale" price of $900.

This is essentially the exact same machine. Same size and all of the bells and whistles on the one reviewed from 2018 but they change model numbers every year or so. Cost is $809.

https://www.reviewed.com/laundry/content/samsung-wv60m9900aw-flexwash-washing-machine-review

This is a Samsung from October 2018 for $1,799 sales price from Best Buy.

Same washer priced today for $1,709. This is after 3 years of consistent 40%-50% tariffs.

Those above are more top of the line so I checked the more basic models. I was also curious if domestic manufacturers increased their prices as a result of the tariffs.

Kenmore 25132 from May of 2018 $569.

Kenmore 25132 from today $529

I don't know what to tell you. I have no angle here. I just looked at the charts and then did some actual intel. Bottom line is that when looking at washing machines from 2018, the prices in all categories (china manufactured/US manufactured/high end/low end) are lower today.

Steel prices reacted similarly. The steel tariffs started in March 2018 at 25% and were extended to Europe in June 2018.

https://www.unarcorack.com/steel-average/

The price for US steel in March of 2018 was $43 and in June of 2018 was $45. By all accounts, the price of US steel should have gone up immediately and stayed up. However, the results were different. 1 year later in June of 2019 the price was $26. Prices stayed low. The last price for 2019 was $29. In June of 2020, a full 2 years after the tariffs were imposed, the price for steel was $25. The point is that the tariffs were not "passed on" to US consumers after the tariffs. Prices went down considerably.

Steel prices are surging now all over the world due to covid forcing factories to shut down but that doesn't have anything to do with US tariffs.

-

Taxes

in Cloak Room

15 minutes ago, jimmyjazz said:LMFAO.

a) how do you know it wasn't related to the tariffs?

b) a "spike" implies a near-instantaneous jump in price. In fact, your chart shows price climbing steadily from the implementation tariffs to mid-2018. It's far more likely to be related to tariffs than some coincidence.

c) the farther we move in time from the economic event (tariffs), the less likely subsequent price swings are due to the event.

Negged.

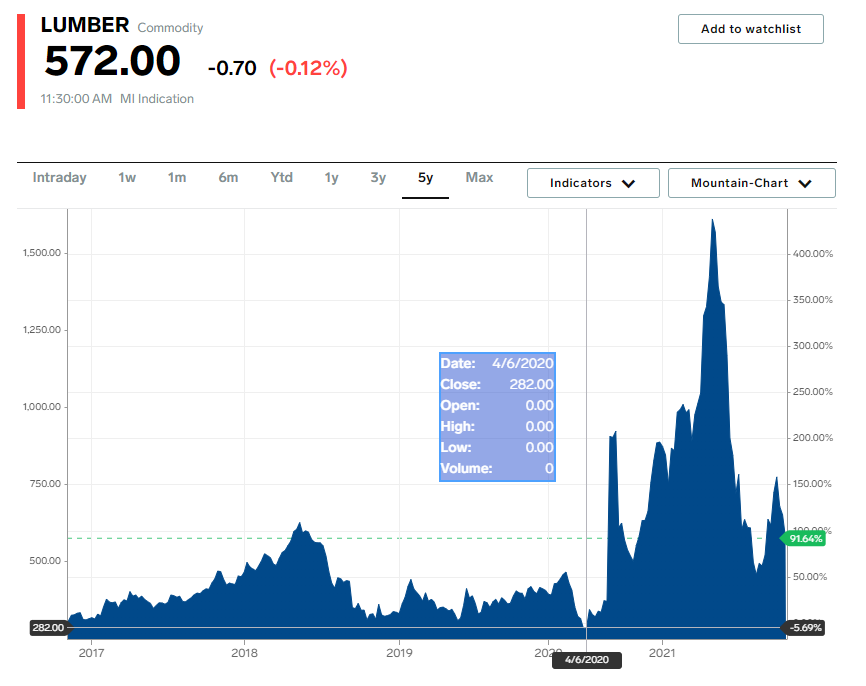

https://www.connerindustries.com/2018-perfect-storm-high-lumber-prices/

I hate responding to idiots. You couldn't be more wrong or more uninformed on the industry.

Plus, when the tariffs were imposed on lumber why didn't the price of lumber go up immediately? Based on your logic, the price for lumber should have jumped 20% in the months after the tariffs were put in place. They didn't. In fact, for the next 5 months prices actually dropped. Apparently the Canadian and Mexican lumber companies do not know how to raise prices. Further, how is it possible that if tariffs always increase prices and that cost always gets passed onto the consumer that the price for lumber 18 months after the tariffs were put in place was over 30% lower than the price was before the tariffs?

Maybe, like I keep saying, the long term effects of tariffs are hard to quantify and, in many cases as I have shown, the net result is actually lower prices for US consumers. I know that is hard for you to understand but the numbers don't lie.

-

1

1

-

-

Taxes

in Cloak Room

12 minutes ago, Blotto said:Well when I replied, I had no idea what I was looking at as there was no context other than "3 month percent change", which doesnt imply "They use a baseline price and then track the percentage that prices are higher or lower than the baseline". Now you have a link, but it doesnt work. so I still dont know what it shows. but I suspect you're still full of shit, because this chart, also from the BLS would not mesh with your claims.

Jesus. I don't know how to do a link any different. Try this https://data.bls.gov/search/query/results?cx=013738036195919377644%3A6ih0hfrgl50&q=laundry+equipment

Then click on laundry. Your chart above does not show what you think it does in relation to what we are talking about. The BLS CPI clearly shows that the consumer price for laundry equipment was much lower one year after the tariffs were put in place and well before we had ever heard of Covid. It further shows that as of today 11/2/2021 the average consumer price for laundry equipment is LESS than it was the day the tariffs were enacted.

-

1

1

-

-

Taxes

in Cloak Room

14 minutes ago, Captainant said:You're cherrypicking your data to pick out a local minima that is an outlier in the dataset. I am suggesting that the lumber tarrifs imposed materially increased lumber prices up until the pandemic

LOL. Based on what? This is becoming bizzaro world. The tariffs were imposed around May or so of 2017 at a rate of 20%-24% and the price of lumber at the time was about 385. There was a spike in 2018 (not related to the tariffs) but from late 2018 up until the time that Canadian lumber mills cut production due to Covid which was March 2020 the price of lumber was fairly constant and under the price of 385 for more of the time than above. You make statements that have no basis in reality. How can you make a statement that tariffs imposed in May of 2017 "materially increased lumber prices up until the pandemic" when there were 18 months between that time from September 2018 until March 2020 where the average prices were actually lower than May of 2017.

And a funny thing happened in 2018 when prices spiked due to increased demand. The 4 biggest lumber companies in the US all opened new mills and spent half a billion dollars doing it. Again, just like I said above, lots of things happen as a result of tariffs.

-

2

2

-

-

Taxes

in Cloak Room

1 minute ago, Blotto said:speaking of cherry picked data, your chart (with no citation) does not even show price, just rate of change of price. So if an item starts at $100, experiences a price change of 18% it is now $118. If the price then falls 5%, the price is now $112. When the spikes are larger on the increase side, prices go up. i shouldn't have to explain that, but I'm not sure you even understand what that graph illustrates. God I hope you're not an econ grad with logic like that.

Meanwhile I provided a much more detailed look at actual prices, with an explanation of the mechanics behind those price movements which you fail to address. If you're going to claim that prices went down, provide data which verifies that (your chart does not).

How do you consider this a much more detailed look at pricing? Your quoted says prices went up, initially, as a result of tariffs. No one disputed that. But then they went down.

I added a link to my post. I posted directly from the BLS CPI for laundry equipment. Do you know how the CPI works? It is not at all what you posted above. They use a baseline price and then track the percentage that prices are higher or lower than the baseline. Look at the graph. Even accounting for Covid the consumer price index, as of today, is lower than it was before the tariffs were imposed. The tariffs are still on and the price, even after massive surges due to covid shutdowns and supply chain issues is already below the price from pre tariff days.

-

Taxes

in Cloak Room

15 minutes ago, Beau Vine said:Is this for real?

How about you point out what is incorrect?

8 minutes ago, Captainant said:sheeeeeit is cherrypicking and misrepresenting stats like a motherfucker (or at least mindlessly repeating whatever fox told him). Here's the actual raw data and not a trend tracker that obfuscated the data

Go figure! A lack of intellectual curiousity combined with repeating intellectually dishonest talking points.

Cloak Room in a nutshell. I have tried to be civil but you are just too fucking stupid to even know what you are showing. This is what I posted:

"We imposed 20% tariffs on Canadian lumber in April of 2017. The spot price for lumber in April 2017 was 399. In April of 2020 it was 282."

Your graph shows EXACTLY that. 3 years after we imposed tariffs on lumber the price of lumber was much lower. Shocking that in a global pandemic where production was shut down that prices increased. Are you suggesting that lumber tariffs imposed in 2017 are responsible for large price spikes as a result of a global pandemic?

-

1

1

-

-

Taxes

in Cloak Room

31 minutes ago, Blotto said:https://www.aeaweb.org/research/washing-machines-2018-tariffs-effect

Edit - are you just making bullshit up?

https://data.bls.gov/pdq/SurveyOutputServlet

That data is cherry picked. There was an initial spike in prices due to the tariffs but, as I keep saying, demand and production changed and by April of 2020 the prices were, in fact, lower than before the tariffs.

-

Taxes

in Cloak Room

16 hours ago, immamac said:This is a strong post. You absolutely should pay taxes on any leverage against unrealized gains (even margin). If it just stays purely unrealized then it should not be taxed.

Maybe you need to clarify this. Are you saying that if someone takes out a loan against an asset, that the loan proceeds should be taxed as if they were income or that the asset used to collateralize the loan should be taxed at that point?

-

Taxes

in Cloak Room

14 hours ago, Beau Vine said:?!?!?!??!?!?

No offense, but you seem to have never taken an economics class.

Huh? You seem to be under the impression that tariffs are always paid by the country imposing them and always result in higher prices. That is not true at all. I mentioned a few up thread. Look at Laundry Equipment. We hit China hard on tariffs for washing machines in 2018. The CPI for laundry equipment was down over 12% from the time of the tariff to pre covid in April of 2020.

In most cases, small tariffs are absorbed by the importing company and price increases are not realized by consumers.

-

Taxes

in Cloak Room

14 hours ago, SydneyCarton said:How the fuck are the “poor” people going to get their refund if you’re taxing everything? They saving every receipt for every purchase o which they paid a sales tax and submitting that shit to the IRS to get their max refund? Seems super realistic.

No. The tax refund is set based on income. No receipts needed.

-

1

1

-

-

Taxes

in Cloak Room

14 hours ago, Brisketexan said:This. Asking the simple question of "who, ultimately, will pay for them?" tells you that.

Import tax? Cool. The ultimate consumer (Joe and Jane America) pay that. Property tax? Everyone who resides in a property -- rent or own - ultimately pay that. Sales tax? Everyone pays that, and even with the "exempt the first $50k of income" approach, it falls heaviest on people who need to/typically spend most of their annual available cash on consumer spending (that is, most people who make under $500k or something like that). Person makes $500k, spends $400k, they get "sales taxed" on $350k, so 70% of their income. Guy with $100 million in assets uses the assets to give him $2 million in liquidity, but only spends $800k on consumption (the rest is spent on acquisitions of more assets, like real property and stock), gets taxed on $750k of his income -- 37.5% of his income. We can keep going, but the bottom line is that pretty much everything listed is a regressive tax.

Import Tax- You need to study this much more closely as tariffs do not automatically equal higher prices. There have been lots and lots of studies on this. The affect of demand is much more important as is the possible shift to domestic production.

Look at one of the big ones people griped about- steel. We put 25% tariffs on imported steel in mid 2018. The tariffs went into effect immediately. According to everyone here the cost of steel had to go up. But it didnt. It went down. The spot price of steel in June 2018 was 4578 and in April of 2020 (right before covid hit hard) the spot price was 3300.

Solar panels had a huge tariff imposed in 2018 and we were importing 80% of them. Prices were lower pre covid in 2020.

We put pretty large tariffs on China and we import more machinery and equipment from China than anywhere else by a long shot. The price of machinery and equipment had no spike in prices from 2018 to 2020. In fact, the rate of price escalation (these items have gone up every year since the 60s) was lower in that period.

We imposed 20% tariffs on Canadian lumber in April of 2017. The spot price for lumber in April 2017 was 399. In April of 2020 it was 282.

IMO, a small 2% accross the board import tax would actually lower consumer prices over time. Just like it did in the examples above.

On the sales tax, everyone keeps ignoring all of the transactions that currently pay no sales tax. You are a lawyer. When you bill your clients there is no sales tax. Why? Insurance companies and large corporations pay the vast amount of legal bills in the US. Why shouldn't they pay a sales tax on those transactions? TMobile acquired Sprint for $26B. No sales tax. The lawyers and financial advisors and accountants made hundreds of millions in fees and none of them paid any sales tax. Why? You are so focused on nominal direct consumer spending that you miss the ocean.

Property Tax- I have no issue if you want to make this tax more progressive. Exempt the first $200K. 1/4% up to $500K. 1/2% up to $1M. 3/4% over that.

-

Taxes

in Cloak Room

6 minutes ago, landman said:So everyone's property taxes go up (or their rent if they lease), everyone pays more at the gas station, and everyone pays a federal sales tax. And everyone pays more for consumer goods because prices will go up due to the import tax.

Sounds like a plan.

7 minutes ago, Captainant said:whenever a wealthy person takes out a loan against assets with unrealized gains to extract value without paying taxes... they should pay taxes on that. This buy-borrow-die loop is only possible when you have enough capital to buy a huge asset like a business. They they borrow against the value of that company and get great rates because the underlying company is valuable - so rather than drawing a salary from the business, they "work for free" but still pull down huge liquidity. And then eventually they die, and use all the punch-outs in the estate tax code that trump made to pass those assets onto the next generation with no strings attached.

Nice 2 minute explainer video in the spoiler if you'd care to watch it

Since you took the time to write something up, it'd be rude not to reply to each point

1) a sales tax is an inherently regressive tax, and should NOT be used as a primary revenue generating source. It will adversely impact the poor and consume an even larger percentage of their wealth comparative to the ultra-wealthy.

2) More tariffs always work out great. They worked out great the last time we tried them right? Since trade wars are so easy to win and all.

3) Agree on the fuel tax increase, it hasn't changed in decades

4) We should increase taxes on investment real estate, not homesteads. If you're the owner and it's your primary residence, such a tax would again only serve to benefit the large non-residential entities that are already fucking the real estate market for individual owners.

5) Agree on a global corporate taxation structure. It's asinine to let corporations HQ'd in the US run roughshod over our government just because they can open an office in ireland or another tax haven nation.

Spending is different for nation states that it is for individuals. The government's role in spending is to stimulate the economy and to increase monetary supply. It's necessary for a healthy economy, and helps to keep the balance of power in favor of we the people, rather than they the shareholders.

You should really consider the macro effects of the policies you prefer, since they'll only contribute to keeping the poor poor, and the wealthy wealthy.

On the buy, borrow, die stuff you are talking about a tiny group of people but it really is just a tax delay and not an avoidance. Eventually those loans are going to come due. The loans don't magically disappear when they die. At some point assets will have to be sold and, as a result, income generated to pay back the loans and that income will be fully taxed. But this is just an example of how the super rich are always going to be smarter than the tax laws designed to target them.

1) Sales Tax- I think you missed the big picture and missed/ignored the part of the proposal where the lower income folks get a tax refund equal to or greater than the amount they paid. Define poor wherever you want. $50K? $75K? People under that threshold pay ZERO under this plan.

But the bigger picture is the trillions of dollars spent currently by corporate entities. If XYZ Corp racks up $5M in legal fees a year, those fees are currently deducted from XYZ's earnings which lowers their tax burden. However, under this plan that $5M in fees actually generates $100K in tax revenue. That is not, at all, making the rich richer and the poor poorer. Magnify this on every financial transaction.

2) Imports- This is not a "trade war". This is a cost to do business in the US and it applies equally to every single country that does business here. Like I said, if other countries do the same thing to us then so be it. We currently have big trade deficits so this is a win for the country. It's only 2%. Perhaps it will bring some businesses back to the US.

3)OK

4) Real Estate- I'm actually not sure what you mean by "such a tax would again only serve to benefit the large non-residential entities that are already fucking the real estate market for individual owners." If you could explain I will respond. But homesteads have to be included. Maybe exempt the first $150K. In that scenario a home worth $300K would pay a whopping $375/year.

5) OK

I really disagree with your last statement. It is a much more complex issue and will never be adequately debated on here. The Fed has many ways to stimulate the economy other than buying treasuries. Many economists agree that in the long term, the effect of those purchases are negative.

-

1 hour ago, henrygandorf said:

the whole point is that if he was technically an executive producer he wouldn't have been as involved.

Got it.

-

Taxes

in Cloak Room

Lots and lots of tax discussions and tax rates and Billionaires etc.

I am opposed to a billionaire tax scheme because history and human nature has told us that the billionaires and their tax/money support people are much, much, much smarter than congress. Once the legislation is enacted, they will simply figure out ways to avoid it. As is typical (see ACA- Obama and Dems said the exact same thing about the cost for the program being "paid" for and now even they admit the program cost trillions) we are going to pass legislation and then spend the money but the revenue is never going to be as much as predicted. As a result, the super wealthy won't actually pay for it, the rest of us will.

However, I do agree that the wealthy could/should pay more in taxes but it has to be enacted in a way that they can not evade it. You absolutely have to consider how any new taxes are actually going to be collected. Congress does not care. They pick an entity (in this case the super wealthy) who are a tiny fraction of the population and who the vast majority of the population don't feel sorry for at all (meaning they can pick on the super wealthy and not have any political blowback- its too fucking easy) and claim that group is going to pay for the new spending (it is "paid" for) when they absolutely know in their hearts that it won't work.

I would keep the current tax rates where they are. For certain the corporate rate and possibly raise the top rate to 40% on income over $2M.

My solution is really simple and really easy to implement.

1) National Sales Tax with Tax Rebates- I would enact a 2% federal sales tax with zero exemptions. Hard to get exact figures but our GDP is around $20T so 2% would raise about $400B. The arguments that this would be a regressive tax have some validity so you can easily set an income level of say $50K and every filer at that limit or under gets a direct tax refund on their taxes of 2% of their income. This would affect about 75 million tax payers. If we assume an average refund for all 75 million of $700 (I used $35,000 as the average amount spent annually and 2% of $35,000 is $700) which is about $50B so the net is about $350B.

Lots of hand wringing about the extremely rare group of people that borrow against their portfolios and the Bezos and Musks etc. They can not avoid this. Those people spend a lot.

2) Import Tax of 2%- Our imports total about $2.5T annually. This raises another $50B. There should be a cost to importers to access our free marketplace. If countries put a 2% import tax on us then so be it.

3) Fuel Tax- The US uses around 170B gallons of fuel (gas, diesel, aviation etc) annually. A $.50 fuel tax would raise $85B. It would also have the effect of weaning the country off of gas.

4) Real Estate- The combined value of US real estate (residential and commercial) is around $50T. A federal 1/4% tax would raise $125B.

5) Foreign Corporate Tax- I would leave the corporate rate exactly where it is right now at 21%. Our tax rate for our businesses has to be competitive with the market in a global economy. I would enact a plan where US multinational companies can realize and repatriate all of their profits back to the US for the exact same rate they are legally paying in whatever country they happen to be doing business in. If Microsoft earns $100M in Ireland and Ireland's tax rate is 12% then Microsoft can bring those profits back to the US for 12%. It is estimated US companies pay about $400B in foreign taxes annually.

The infrastructure to collect these taxes already exists and is in use.

The total from these 5 items is a little over $1T annually.

Lastly, the only way this makes sense in the long run is if spending is kept in check. Currently our taxes are approximately 32% or so of our GDP. I would freeze these taxes at current rates. I would then mandate that total government spending can not exceed 35% of GDP. If you want/need more money then you have to grow the economy to get it. So there is a % deficit on existing tax revenue. With a $20T GDP that means a shortfall of $600B. My plan raises an extra $1T so there would be a surplus of $400B which should be used to pay down the debt. Even a modest $400B pay down would have a massive impact on the value of the dollar globally.

If we get into a war or have a Covid issue or a bank collapse, then the govt would have to raise the percentages on the 5 items above to pay for it.

-

26 minutes ago, henrygandorf said:

it was not your quote, it was from some article but in the body of your post. just thought it was a little counterproductive that an "expert" brought in to share his opinion would confuse something pretty important to the situation.

Understood and agreed. Although in the case against AB, I don't think it matters if he was technically a producer or executive producer as he was, obviously, very involved and on the set.

-

15 hours ago, Willfully Horn said:

Top tax rate in the golden era of the 1950s was 95%. Pay your tax.

This is not specifically responding to you, Willfully Horn, but all of the people clamoring over the super high tax rates of the 50s and 60s. This will never go over well here but what Reagan did was lower the high end tax rates while simultaneously getting rid of lots of tax deductions available only to the wealthy.

https://checkyourfact.com/2019/01/09/fact-check-90-percent-taxes-eisenhower-1950s/

The reality is that the top 1% of earners in the 1950s, where the top federal income tax rate never went below 70%) paid an effective tax rate of 16.9%. Much lower than we have today.

I think I'll start a new thread on a way to increase revenue for the govt.

-

1

1

-

1

1

-

-

21 hours ago, Al Bundy's Napoleon Hand said:

Well nobody died and they both plead guilty to lesser charges. The fact that they became famous is amusing I suppose. I think they are whackos.

-

1

1

-

Kyle Rittenhouse

in Cloak Room

Posted

Back to the surly we love. Calling out a poster for trolling and being lazy by trolling and being lazy.

https://www.foxnews.com/media/usa-today-correction-fact-check-biden-watch

""Corrections & Clarifications: This story was updated Sept. 2 to note that Biden checked his watch multiple times at the dignified transfer event, including during the ceremony itself," the correction read at the top of the report on Thursday"