-

Posts

915 -

Joined

-

Last visited

Content Type

Profiles

Forums

Store

Downloads

Recruiting - 2020

2019-2020 Football Season

Football

Entertainment

Sports

News and Business

Cloak Room

Transfer Portal

Recruiting

Events

Posts posted by Rusty Shackelford

-

-

but it's my life.

So, what's the deal with ALT, looks like a good entry if it still is a good investment. I mean stonk

-

1

1

-

-

On 6/30/2020 at 6:14 PM, Rusty Shackelford said:

Gold hit $1,800, looks like ATH will be set in 2020.

Well, that happened pretty fast.

-

Only an upper-atmosphere nuclear explosion is capable of generating a long range EMP that could effectively cripple most of the country. Smaller scale non-nuclear weaponry would be restricted to battlefields and local theaters of hot conflict. Somebody educate me if this is not the case.

I don't see this as being anything other than a fancy name for a nuclear attack. Therefore, due to MAD, it has as much a chance of happening as a more conventional nuclear exchange. If we see ballistic missiles headed our way, we won't bother to wait and see if these warheads are meant to turn our cities to rubble or just fry a bunch of circuit boards.

That’s my understanding as well, didn’t read the longcat OP. I’m gonna stick with this assumption until someone drops some facts to the contrary. -

1 hour ago, bernorange said:

Well it's Schiff, so Fed dumb and doom on horizon. (Just a guess)

I thought he might have had something new to say.

-

I have nothing to add other than I listened to Peter Schiff’s latest interview on Rogan this weekend and I feel more down than ever now.

Cliffs please. Down on what? -

Tesla (NASDAQ: TSLA) reported Q2 EPS of $0.50, $0.61 better than the analyst estimate of ($0.11). Revenue for the quarter came in at $6.35 billion versus the consensus estimate of $5.23 billion.

This volatile market is a Trader's Paradise. Get your free alerts by 7:30am EST daily Read More

- $535M increase in our cash and cash equivalents in Q2 to $8.6B

- Operating cash flow less capex (free cash flow) $418M in Q2

- $327M GAAP operating income; 5.4% operating margin in Q2 $104M GAAP net income; $451M non-GAAP net income (ex-SBC) in Q2 Four quarters of sequential profitability

- Next US Gigafactory site selected; preparations underway

- Increased Model S range to 402 miles (EPA)

- Model Y and China-made Model 3 production rates continue to increase

-

13 hours ago, Continental Op said:

pffffffft everyone on Surly is a 1%er and has no time for your fractional share bullshit.

I guess I should have quoted the surly 1%er that hoped AMZN would split, when I posted that.

-

Don't most brokers have fractional shares now?

-

27 minutes ago, closetohumping said:

Hey Steve Jobs worked from his mamas garage.

Good point, AAPL is a legendary stonk, so UAVS should soon join that status

-

2

2

-

-

Weak ass pussies panic selling UAVS, loading up with the discount

Not saying you won’t make some gainz from this stonk, but I remember when it popped a few months ago someone posted the streetview of the company headquarters.

For the lulz: https://goo.gl/maps/XUVf6Vdt9eLNPett9

-

1

1

-

-

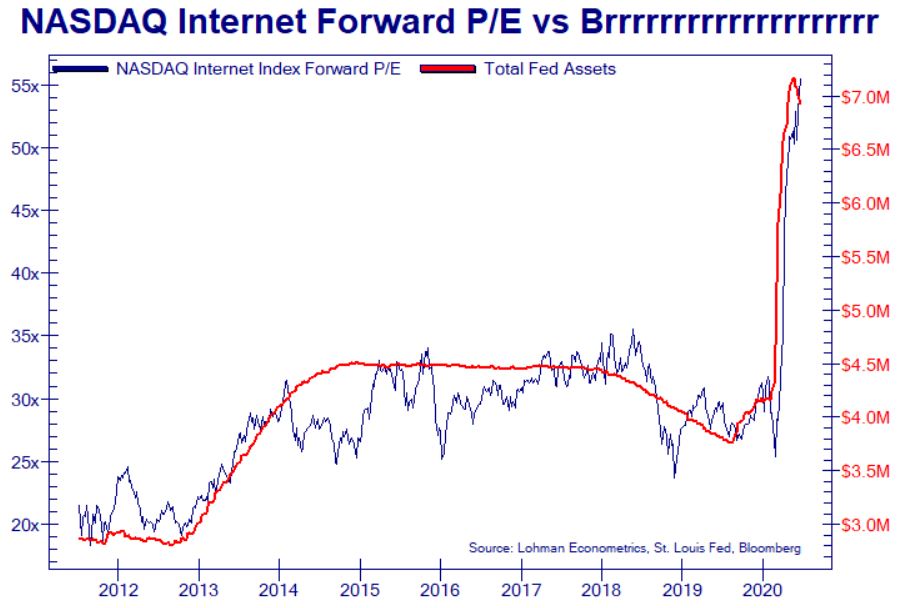

Fed to continue brrrrrrrr, even if inflation rides above 2% target rate

https://www.bloomberg.com/opinion/articles/2020-07-17/the-fed-is-setting-the-stage-for-a-major-policy-change?utm_source=url_link

waiting to see who gets triggered this time.

waiting to see who gets triggered this time.

-

your own contribution seemed a bit pejorative.

So sorry -

Isn’t that what they said?

-

I never know how to play these biotech stocks, so thinking about going with ARKG, any thoughts?

-

And extra inflation as a stated policy from the Fed

https://www.bloomberg.com/amp/opinion/articles/2020-07-17/the-fed-is-setting-the-stage-for-a-major-policy-change?__twitter_impression=true

Faced now with the prospect of another prolonged period of low inflation, Fed officials are signaling they will place less emphasis on Phillips curve estimates when setting policy. Fed Governor Lael Brainard said this week that “with inflation exhibiting low sensitivity to labor market tightness, policy should not preemptively withdraw support based on a historically steeper Phillips curve that is not currently in evidence.”

No longer are estimates of longer-run unemployment taken as almost certainly indicating the economy is at full employment. Instead, Brainard said the Fed should focus on achieving “employment outcomes with the kind of breadth and depth that were only achieved late in the previous recovery.” The Fed is going to try to run the economy hot to push down unemployment.

By de-emphasizing the Philips curve, the Fed loses its primary inflation forecasting tool. Instead of an inflation forecast, the Fed will rely on actual inflation outcomes to determine the appropriate time to change policy. Brainard pointed out that “research suggests that refraining from liftoff until inflation reaches 2% could lead to some modest temporary overshooting, which would help offset the previous underperformance.”

Think about what she is saying. Traditionally, the Fed attempts to reach the inflation target from below, effectively using the unemployment rate to forecast inflation and then moderating growth such that projected inflation doesn’t exceed its target. Brainard is saying the Fed should not tighten policy until actual inflation reaches 2%. Policy lags — the time between the Fed’s actions and the resulting economic outcomes — mean inflation will subsequently rise above 2%. The Fed would thus overshoot the inflation target and then return to the target from above.

Federal Reserve Bank of Philadelphia President Patrick Harker goes even further in a Wall Street Journal interview, saying “I don’t see any need to act any time soon until we see substantial movement in inflation to our 2% target and ideally overshooting a bit.” Expect to see more Fed speakers also saying they want inflation at or above 2% before they tighten policy. Also expect to see something along these lines codified at in a policy statement.-

1

1

-

-

1 minute ago, Trey3216 said:

Election run up volatility

Valid point, though strange to see it drop off in November.

-

19 hours ago, Trey3216 said:

Just bought 50 VXX $35 strike weeklies for .78. Also bought 10 for next Friday at 1.60.

Probably doesn't matter much if you're playing weeklies, but have you looked at the term structure lately?

Looks like the market is betting on things going to shit in October (Q3 earnings for the banks perhaps?)

-

5 minutes ago, Wally Fairway said:

good point

Immediately, I go and check out VXX and the options strings. Because #stonklife and what could go wrong.The "correct" way to play VXX options is a straddle, right? So you don't care if it goes up or down, just that it goes???

I believe a straddle would be more expensive, but you would have access to gains on the down side.

-

9 minutes ago, Anastasis said:

Last time Trey mentioned VXX options, I took a flier on a small call position. That was Feb 20 or so. You know the rest of that story.

52 minutes ago, Trey3216 said:Yep, which in turn will turn up the heat on the market as a whole.

I am going to start buying VXX calls every week. 10% out of the money to start.

I'm no expert, but I've played around with call backspreads on VXX before. You only lose if VXX trades flat, which is extremely rare.

-

2

2

-

-

52 minutes ago, Eastwood said:

As soon as unemployment and PPP funds dry up, they might get hit real hard.

Yep, from that first link Capt posted:

QuoteJPMorgan executives said this recession is abnormal because of the high level of stimulus support from the government, which has helped raise Americans' personal income."May and June are really the easy months in terms of what this recovery will look like," Piepszak said on a call with reporters. The real damage, she said, would become evident in the coming months. -

-

The Fed started tapering a few weeks ago. We'll have to wait and see if the printer gets booted up in time to prevent another crash.

-

18 hours ago, RCRanger03 said:

LOL I must have mistyped, no I took my $3.5K initial investment up to his $35K initial investment in those 4 months (without pulling any of my ALPP)

No whales here

I can believe that. My Stonk account YTD went 21k > 36k > 9k > 62k (today)

-

5 hours ago, RCRanger03 said:

I started at 10% of that initial investment, but I'm around that now... if one of my shell plays pops I'll get there.

Work has been killing my stonklife lately. Turns out when you're training new hires flipping over to ToS is frowned upon

You went from $3,500 to almost $1,000,000? How long did that take?

Our monetary system is insane

in Cloak Room

Posted