-

Posts

915 -

Joined

-

Last visited

Content Type

Profiles

Forums

Store

Downloads

Recruiting - 2020

2019-2020 Football Season

Football

Entertainment

Sports

News and Business

Cloak Room

Transfer Portal

Recruiting

Events

Posts posted by Rusty Shackelford

-

-

Elon still going strong

-

5 hours ago, Blotto said:

Who knows with that dude. Simultaneously the biggest asset and biggest risk that TSLA has.

So, considering that 6 hours later the tweets are still up, I guess it was just Elon - high AF

-

TSLA down 10% after that tweet

-

I couldn't tell if he was high AF, or hacked. Now looks more like he was hacked.

-

9 minutes ago, Anastasis said:

LOL Elon.

He just wants TSLA at $420 again

-

1

1

-

-

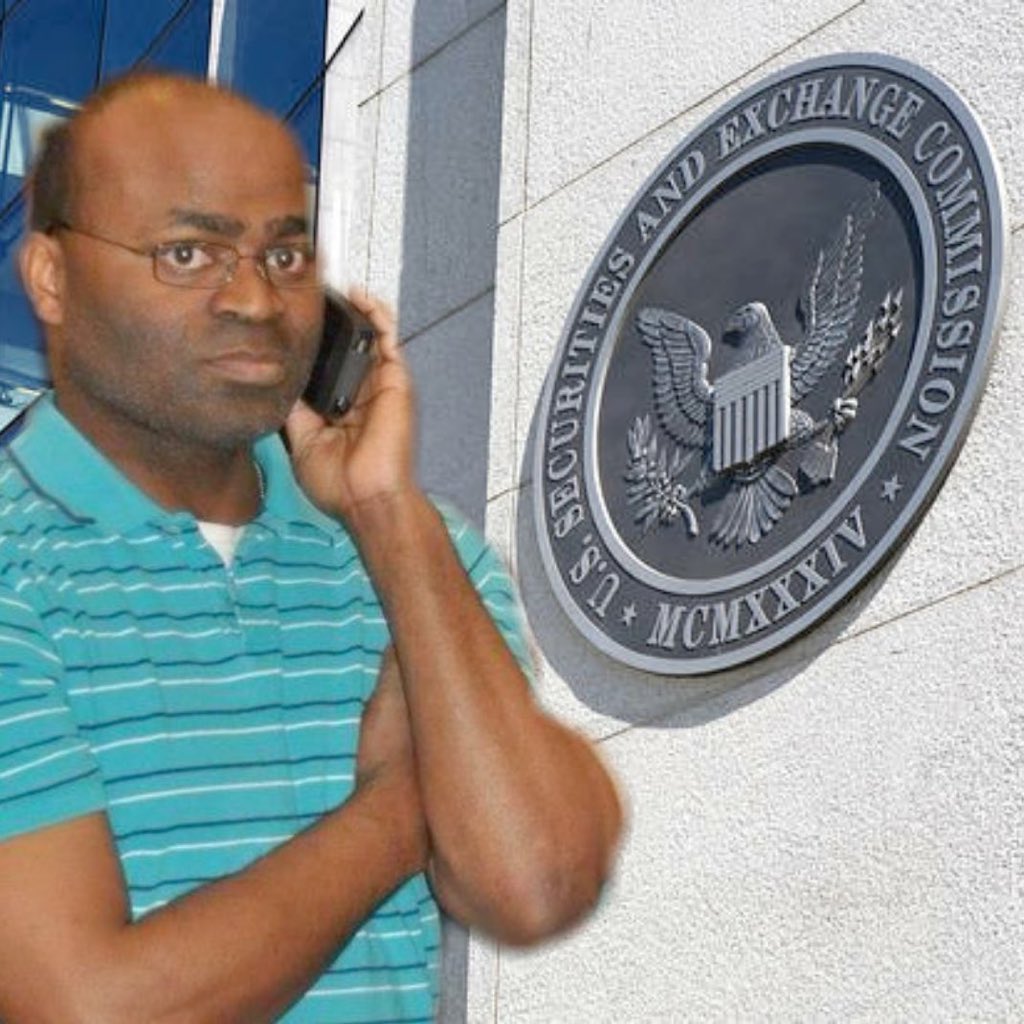

I was going to make a meme like this, but found it already posted on that twitter thread:

-

This gon be good

-

13 minutes ago, bernorange said:

Hope you aren't long pudding.

-

2

2

-

-

AG Eagle makes me think of https://www.theeagle.com/

Surely texum aggy is involved in this scheme.

-

-

3

3

-

2

2

-

-

Almost time to start shorting some #notstonks that have bounced too much. $DIN (ihop & Applebees) has nearly tripled in the past 6 weeks, GTFOhere

-

1

1

-

-

$RICK up another 22% today

All that pent-up demand gonna explode!

-

He's talking about US shale oil not coming back. Foreign producers will be able to meet future demand when it rises.

He may be wrong, but I don't think it's too far fetched at this point

-

21 minutes ago, LABEVO said:

Virtual Fed goes brrrrrrrrrrrrrrrrrrrr

Virtual rate cut forces Nintendo gamers into riskier assets

https://www.ft.com/content/68f96d24-02f0-42fd-b132-aba0acba777f

-

1

1

-

-

-

1

1

-

-

$RICK stonked +15% since my post yesterday.

Too bad I didn't actually buy

-

1

1

-

-

Pimp Rule #1: Never fall in LUV with ya hoe

-

Not feeling the LUV

-

Just waiting for govs to relax the social distancing, but a natural candidate for a "pump n dump" Rick's Cabaret, $RICK

Think we might even see a "blow off top" in the future?

-

You see, there are equities, and then there are stonks. TSLA is the latter.

-

1

1

-

-

On 4/25/2020 at 12:12 PM, Storm the Field said:

Another 64 rigs down. Total rig count now stands at 465 (378 oil/85 gas), down 525 since the same week last year. That's the 2nd lowest amount of gas rigs recorded since Baker Hughes started keeping track in July 1987.

Have pretty steadily dropped 60-70 rigs each week since the price crash during the 2nd week of March. At this rate, we should bottom out ~250 by Memorial Day. That would blow out the previous record of 404 on heading into Memorial Day 2016.

No doubt, but rigs will probably drop faster than the current rate.

-

1 hour ago, Parliament said:

Would someone please translate this for me? Are brokerages afraid their clients can't cover margin calls? And what's the significance of this? With some folks on "Sell only," will it be enough to drive prices down?

TD Ameritrade told customers it would only allow closing trades in June and July U.S. crude futures contracts as well as in all U.S. crude options contracts.

“We made this decision based on the volatility and liquidity in the crude markets over the last week. This allows those markets to continue to return to their prior liquidity and volatility levels,” said J.B. Mackenzie, managing director in futures and forex at TD Ameritrade.

Two other brokerages, London-based Marex Spectron and INTL FCStone, said they were limiting new positions being taken up after the high-volatility trading on Monday delivered big losses to holders of that contract.

https://www.reuters.com/article/us-global-oil-brokerages-idUSKCN2253P6

Industrial & Commercial Bank of China Ltd., the nation’s largest lender, suspended sales of more products that allowed retail investors to speculate on swings in commodities after many were burnt by the unprecedented crash in crude oil.

The lender will temporarily halt opening of new positions in products linked to crude oil, natural gas, and soybeans for individuals from 9 a.m. tomorrow, according to a statement on Monday. ICBC said the suspension is to protect clients’ interests due to the recent volatility in commodities.

The move comes after a product linked to oil, sold by rival Bank of China Co., lead to more than $1 billion in losses for clients after falling below zero, suggesting there’s a hidden pocket of risk in the system. Official figures show there are about 1.88 billion yuan ($265 million) in outstanding in commodity-related investment vehicles, making up less than 0.01% of China’s wealth product market.

The implosion of Bank of China’s “Crude Oil Treasure” caused an uproar among investors, who have taken to the Internet to protest the lender’s handling of the contract rollover and to demand it shoulder some of the losses. Investors in similar products offered by other banks mostly avoided that type of loss due to different designs.

Yes brokerages are CTA.

The bigger story is that The Chinese took it up the ass on WTI futures way more than domestic speculators did last week.

-

cashtag $FED

balance sheet looks strong

-

2 hours ago, Neonmoon said:

So CHK is up to 37. I realize the short squeeze implications but that seems like a high number for them.

Earnings call in 12 days going to annihilate thay?

Don't forget about the 1:200 reverse split last week. 😆

Things not going well in Venezuela

in Daily Texan

Posted

They should have looked up this guy in Soldier of Fortune magazine