-

Posts

112 -

Joined

-

Last visited

Content Type

Profiles

Forums

Store

Downloads

Recruiting - 2020

2019-2020 Football Season

Football

Entertainment

Sports

News and Business

Cloak Room

Transfer Portal

Recruiting

Events

Posts posted by Cum Rocket

-

-

-

9 hours ago, Captainant said:

You'll have to ask the latest reincanation of comrade GRUhorn, @Cum Rocket if you'd like to know "wtf is wrong with you, bitcoiners?"

Don’t know why this has got your goat right now, but the known benefits of large flexible loads to electric grids have been discussed here before.

47 minutes ago, FartingMonk said:I am really curious at how fast the next energy revolution is going to come. I've been involved in some sort of energy my entire adult life. I recently jumped into data centers and those things are energy hungry. They now are planning to go all in on AI stuff and the limitation is going to be energy. They are pouring a lot of money to do energy. Wouldn't be surprised if Google and Facebook ended up with an energy subsidiary.

Correct. Bye bye energy transition.

-

3

3

-

-

6 hours ago, Captainant said:

Problem is, that "mining community" exists just to suck up free corporate welfare bucks from our regulatory captured state

https://www.texasmonthly.com/news-politics/texas-crypto-miners-lawsuit/

It's just ridiculous how much free shit we're giving away just to attract a bunch of migrated chinese BTC mining operations

Cry harder for me

How often does the federal Govt reverse course and admit it was wrong when litigation is brought against them? I don’t know for certain but my guess would be almost never.

That column you posted was a joke.

-

Womp womp.

Still, with the large bitcoin community in Austin and the larger mining community across the state, it would seem to be a natural fit.

-

-

-

2 hours ago, Nice Guy Eddie said:

what's with bitcoin's price not going up today? Something broken?

-

-

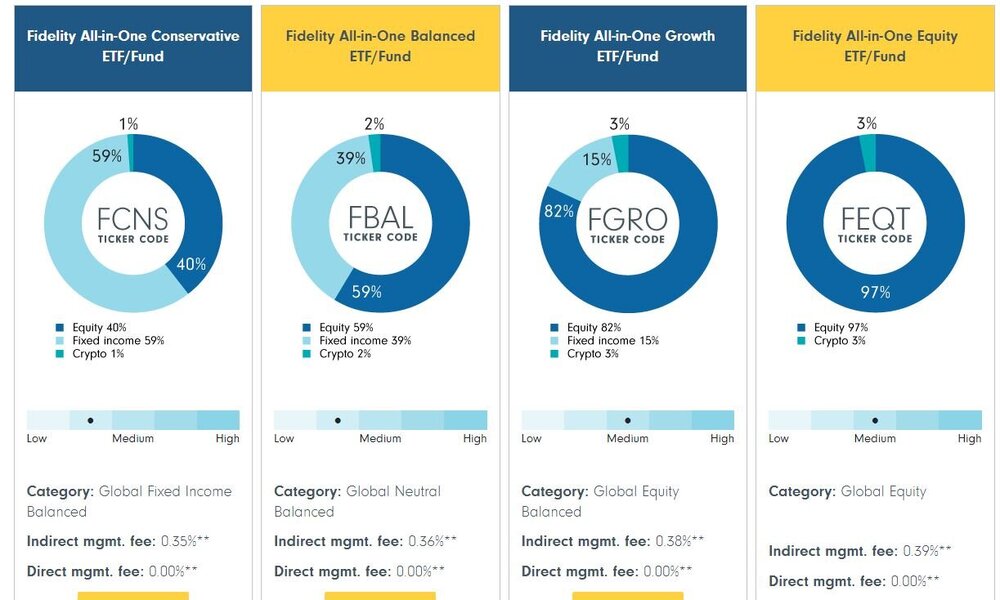

On 2/28/2024 at 7:33 AM, Nice Guy Eddie said:

for what it's worth, I saw the following on crypto youtube today. SIAP.

Fidelity in Canada is packaging their crypto ETFs within their other ETFs.

As these scenarios start to become more and more common, especially with retirement plans, this is when you have an automatic flow of funds popping into the market every payday. I imagine crypto in 401ks is still looking like 2026 or 27.

As an aside, when Canada shows "Global", they mainly mean the US.

Another one.

-

A good day to be Michael Saylor. Microstrategy up 20%. This guy will end up looking like a genius and one of the richest men on the planet. All because he “got it” and had big enough balls to go all in with large amounts of money.

6 minutes ago, Captainant said:So just to be clear: it's your contention that as long as people don't know about a fraud, there's no fraud happening and it's all totally legal and totally cool?

This is a good heuristic I like to use online.

If someone starts a comment or question with So…, 99% of the time that person is wrong. Either they're imagining something you said, or trying to insert words into your mouth.

I only commented on it being a hit by CZ. Made no comment on SBF’s fraud or the nature of fraud itself.

The fact remains that if he had made it through to the next bull market, the fiat value of all his tokens would've been able to paper over his fuck ups. Would he then have learned his lesson and straightened things up? I guess we'll never know.

-

49 minutes ago, Captainant said:

It wasn't a "hit" from CZ - FTX was operating a fraudulent business with a $6,800,000,000 hole in their books and stole billions of dollars of customer funds. He shined a light on it, but he's not the person who made them steal money to make a bunch of terrible longshot bets.

And lulz GRUhorn, is that you?? Must be building up your post count before you post some more russian propaganda in the Ukraine War thread, eh?

The Ftx financial situation wasn't public knowledge until CZ brought it to light with a tweet. Then the run on Ftx started and it was game over.

Love these Dave Portnoy Bitcoin cope clips.

-

1

1

-

-

21 minutes ago, BeardIP said:

I appreciate your consistency.

CaptainAntifa is the perfect mid curve crypto hater.

24 minutes ago, BeardIP said:BTC is a scam! Saw this coming a mile away

This is their energy.

25 minutes ago, BeardIP said:

25 minutes ago, BeardIP said:Also, here is a hot sports opinion-- SBF, while still being an unethical and fraudulent liar, was actually right and had he been able to juggle the balls in the air better (and had better timing) he'd still be getting Times magazine covers for being a crypto billionaire and leader versus having his vegan diet and facing 100+ years in the clink being the topic of discussion.

That was an expertly executed hit by CZ from Binance.

-

2

2

-

-

A handful of small sovereigns are known miners. The next big shoe to drop in mining world will be when Saudi Arabia or Russia announce that they've been mining Bitcoin.

-

This is a good point. Every bit of Fud comes from middle of curve. It's only gotten in the way of people benefiting.

-

Just now, B00M said:

they weren’t even talking to you so this isn’t suspicious AT ALLI am not creative or funny enough to come up with this thread. But I am happy to take credit for it.

-

43 minutes ago, PvilleStang said:

Did you forget to log out of one sock and log into the other?

43 minutes ago, Trey3216 said:Looks like someone forgot they logged into their Joseph Stang acct after posting from their other other other other sock acct.

lol no. You can ask Joseph Stang what he thinks about bitcoin. I'm assuming he has an opinion.

-

47 minutes ago, JosephStang said:

How the fuck would I know which you fall into, Jay? I've been lied to for 7 years, every interaction is controlled, and every time I push for a 10th amendment resolution, Andrew Tate pops up on my feed confirming to me people are leveraging my work to keep me fucked while they make bank. Which army are you in? You tell me.

I think it's good that you're finally sticking up for yourself.

Jay needs to show his cards. I know for a fact he spent years working on the inside of the Vatican. He's seen the Chronovisor himself.

-

1

1

-

1

1

-

-

This is interesting to me for a couple reasons.

1) it shows unique ability of lightning to transport value via micropayments quickly. If AI really is to become ubiquitous and Bitcoin via lightning network is integrated then that would be a clear example of a medium of exchange.

2) if adoption and integration of lightning is substantial it will test the viability of current tax code. Currently if you pay for something with Bitcoin it’s supposed to be a taxable event. But if AI models are constantly routing an untold number of payments, that rule is obviously unenforceable and obsolete.

-

Just now, Snake Diggity said:

Thanks for the reply. Hard to have faith in a currency whose governance is consistently and proudly described as “messy”.

The faith in it comes from knowing it's difficult to change. Bitcoin's monetary policy and code is not subject to the whims of politicians, developers etc. 21 million is 21 million.

If you don't see the value in that then perhaps Bitcoin isn't for you, but if you want to take the value of your savings out of the hands of politicians and big banks then maybe it is.

2 minutes ago, Snake Diggity said:I also don’t understand how saying the nodes/users act as gatekeepers prevents large scale owners from exerting influence; the owners are the users, right?

Holding coins does not require running a node. I'd be surprised if blackrock runs a single one. Their coins are held at coinbase that runs nodes, but nodes are distributed all over the globe. Hell, I set one up on a raspberry Pi at home just for shits.

7 minutes ago, Nice Guy Eddie said:I thought the concept of a 51% attack was that a group representing 51% of the miners could push changes into the network, not secretly, and the other bitcoin users couldn't stop it. Obviously the disagreeing users/miners could create their version of bitcoin.

A 51% attack would allow an entity to change transactions on the ledger which would hurt credibility of the currency, but it doesn't allow changes to the code or system backing it.

-

1

1

-

-

27 minutes ago, Snake Diggity said:

Can you elaborate on that last point? I’m very interested to understand why someone owning a large percentage of a finite asset doesn’t give them control over how it is used.

Sure. So this gets a little into how consensus is derived and how changes are made to the network.

Bitcoin governance is messy and has multiple layers, but the biggest test of who actually controls the bitcoin network was the Blocksize Wars that culminated in 2017. It was a fight over whether or not to increase the bitcoin blocksize. The blocksize is the amount of data (or transactions) allowed in a block every 10 minutes. As bitcoin was becoming more popular there was concern about escalating fees and how to scale bitcoin to allow more transactions. "Big blockers" as they were called wanted to double the block size. Included in that group were almost all the big miners and exchanges, including Coinbase quite prominently.

On the other side were "small blockers" that wanted to maintain the same blocksize and pursue other ways to scale bitcoin, including something at the time called SegWit. The concern of small blockers was that increasing the blocksize would substantially increase the hardware requirements to run full nodes on the network which verify transactions and the ledger itself after miners put together blocks. Larger hardware requirements would decrease the amount of nodes run globally and hurt decentralization of the network. There's all kinds of intrigue behind this including meetings of large entities and holders to plot to force through changes they wanted. This all came to a head and that's when the UASF was performed in 2017 where full nodes all signaled the change to add SegWit and all miners and other companies fell in line.

Tl;Dr Nodes (bitcoin users and network participants) are the final gatekeepers to protocol changes.

12 minutes ago, Nice Guy Eddie said:IF Blackrock wanted to control/change bitcoin buying out the miners might be the best option, but there is limited value in that. As they approached control, it would scare off bitcoin owners and the price would plummet. To control bitcoin is to kill it.

This is incorrect. See above.

-

Interestingly, there is a way for ETFs to verify their holdings with bitcoin. Only one has done it so far. Bitwise (BITB)

Bitwise Become First To Disclose Bitcoin ETF Holdings Address (forbes.com)

They also have pledged 10% of their ETF profits for the first 10 years to bitcoin developers. So if you're looking to buy an ETF, they're probably the best candidate.

-

16 hours ago, B00M said:

@Cum Rocket how much BTC does blackrock now control thanks to their ETF? Is there a point at which you’ll be concerned about their ability to move the price?

How will their holding a large amount of BTC allow them to move the price? Their buying and selling of BTC is dependent on etf inflows and outflows, unless I'm mistaken.

I believe in the goldbug world there's long been a suspicion that somehow the GLD etf was used to "sell paper gold" and suppress the price, but I'm not sure of the mechanics of that. The difference here would be there is a known, finite amount of bitcoin. Perhaps the resident gold bug @RDCanecutter could elaborate on the GLD thing.

12 hours ago, Nice Guy Eddie said:It was bound to happen that the big players would eventually control most of bitcoin. Unless Satoshi wakes up and uses his wallet.

Holding a large amount of bitcoin doesn't give any one person or entity more control over the bitcoin network than anybody else.

-

1 hour ago, Nice Guy Eddie said:

for what it's worth, I saw the following on crypto youtube today. SIAP.

Fidelity in Canada is packaging their crypto ETFs within their other ETFs.

As these scenarios start to become more and more common, especially with retirement plans, this is when you have an automatic flow of funds popping into the market every payday. I imagine crypto in 401ks is still looking like 2026 or 27.

As an aside, when Canada shows "Global", they mainly mean the US.

Damn speculators!

What's going to be funny is, as bitcoin pumps, Microstrategy will eventually get added to S&P500, then nocoiners in index funds will become passive investors in Bitcoin.

-

1

1

-

-

6 hours ago, Snake Diggity said:

Before a BIP can make it to UASF, it has to be approved by an editor.

But also, even if you’re right, how well would UASF have worked if CVE-2018–17144 hadn’t been responsibly disclosed? There’s no indication that future bugs in the software could be guaranteed to be fixed via UASF quickly enough to avoid catastrophe, and that’s assuming they're found by good actors.

I’m not going to put myself forth as an expert on Bitcoin. Maybe you know it all. That doesn’t change the fact that the VAST majority of people “investing” in Bitcoin have no fucking clue how it works. The value of Bitcoin is overwhelmingly fueled by speculation. It’s GME.

I don't know it all. I know more than most. Despite my shitposting, I try to help educate posters here while I pass the time and cycles continue. I think over time posters have come and gone but are generally more level headed and understanding. Now, if you bring the same recycled FUD I will not let it go unaddressed.

On that note

1 hour ago, Parliament said:2) It's a baseball card, Beanie Baby, tulip bulb. Here you wanna buy and hold for a bit. Or short it. Totally nothing wrong with using it for this purpose. But let's be honest with ourselves and call it what it is.

We should be honest with ourselves.

Did beanie babies or tulips come back multiple times with even bigger bubbles?

What's the ticker of the SEC approved baseball card Etf? The one that's doing big volume.

May be worth thinking more deeply about why your comparisons are ridiculous.

Your head remains in the sand. That’s ok. You'll get it at the price you deserve.

2021 - Is inflation finally back in the conversation?

in 6th Street Journal

Posted

Has he spoken with Powell?