-

Posts

1447 -

Joined

-

Last visited

Content Type

Profiles

Forums

Store

Downloads

Recruiting - 2020

2019-2020 Football Season

Football

Entertainment

Sports

News and Business

Cloak Room

Transfer Portal

Recruiting

Events

Posts posted by RCRanger03

-

-

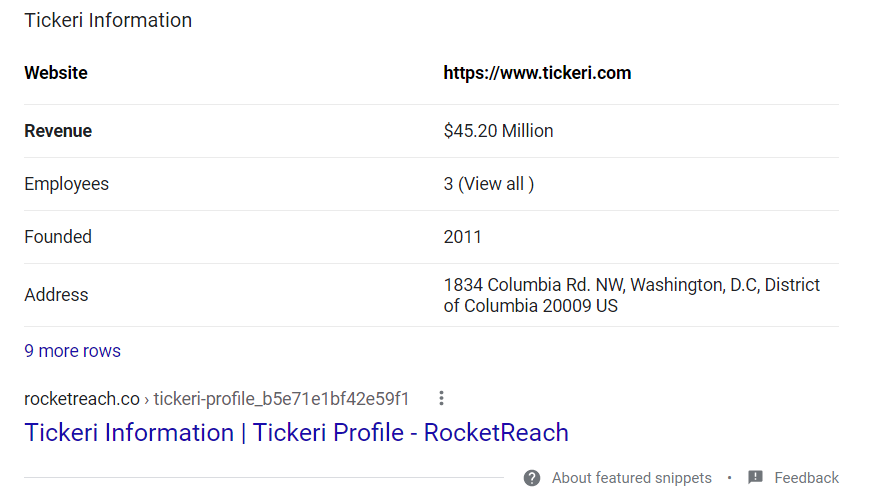

I'm going to do more detail on TSNP this weekend, but I'm very interested in this Tickeri acquisition. There are some wildly different revenue numbers flying around that color how awesome this would be.

The first google search pullout says $45.2M in Rev

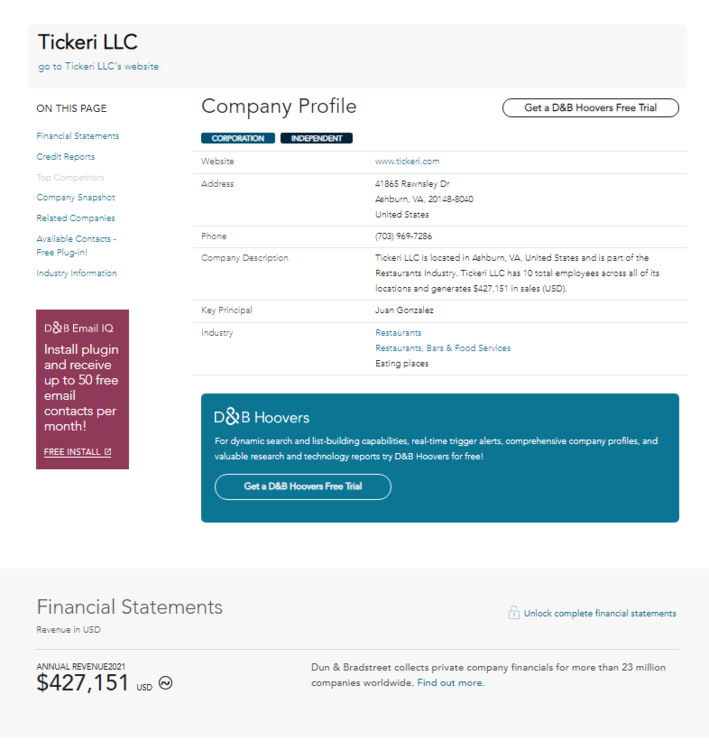

https://www.zoominfo.com/c/tickericom-llc/346458111 has 2 different numbers on the same damn page. One says 16M total, the other says 15 - 16M per Q except for Q1 2020 (totaling 48M in 2020).D&B Hoover says $427k in Revs so far in 2021 which is a whole magnitude lower, than all the others

-

Whatever keeps it as accessible as possible to yall, but away from the SEO bots.

Discord is nice sometimes because of the rapid fire nature, there's faster reaction time to new like PFMS today. I'm in a few stock discords that help out in that sense. -

I'll be doing DD one pagers on Sunday of all the new stonks I've gotten in since my departures from SNVP, PFMS, and XMET (mostly) and any halfway decent subpenny I can find (going to be tough since today's SEC action shows they're going after non-reports). It's going to be important not to tip folks who google search my username or the ticker name so is there a surly discord I could cop a corner in to post the DD?

Also for those that got caught in PFMS R/S I feel bad, I'm also planning on doing an exit strategy for yall. PM me your share counts and cost basis.

8 minutes ago, nycHorn said:[mention]RCRanger03 [/mention] RC, what’s your feeling on RXMD? I know you like the guy that wrote up the Reddit DD piece. Is this a stock you’d continue to accumulate on dips?

I bought more today in the ROTH. Medium to Long Term Play like ALPP was in the summer. Will have more to say this weekend

-

4

4

-

1

1

-

-

7 hours ago, PenelopeWitherspoon said:

I tripped the FINRA daytrading rules today. Oops.

90 days or do you have sufficient capital?

-

3 minutes ago, Gourmand said:

@RCRanger03 what ticker is it showing under in your TDA account?

Still all numbers, I didn't try to trade on it today, but I was able to watch the trading on Lvl2 and Time and Sales.

-

1

1

-

-

Satisfied with this call. I think there may be some dippage off it not being the app release (although seems like it's close), but I'd probably try to buy in my ROTH if that happened. Long term faith restored, glad I held (probably couldn't have sold anyways)

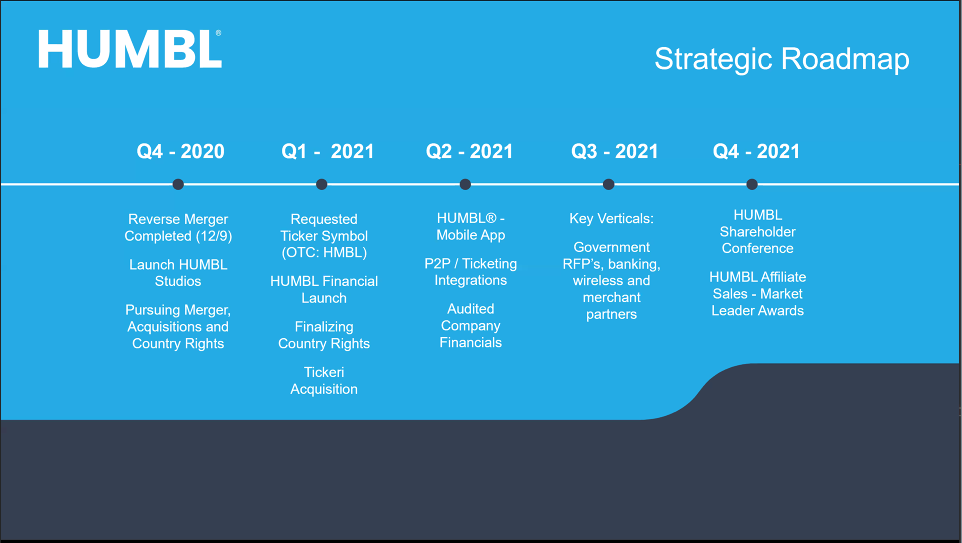

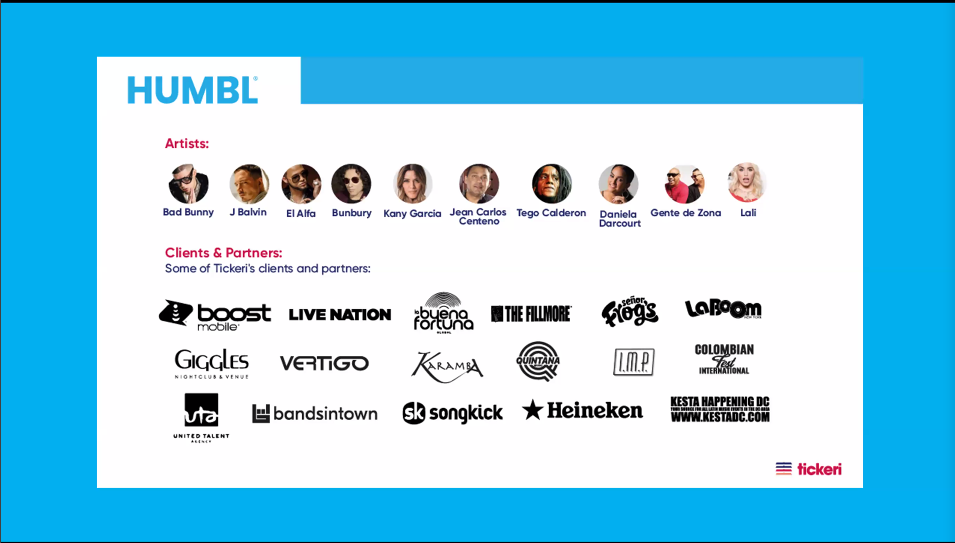

Really like the Tickeri acquisition. 20M in stock and cash will be interesting to see how that was broken up, but I agree that it's more interesting to me than the other merchant stuff they've talked about. The audited financials are going show us a lot about that and the other major holders. May like what I see, and may not, but I'm glad they're sticking to the Q2 commitment.

-

2

2

-

-

Would it be weird for me to go the shareholder conference?

At least 1 County has rights finalized! More announcements coming soon!

-

-

2 minutes ago, Hank_Hill said:

Is that just humbl merchandise?

I bet it's all the merchants in there

-

App on the borderline between Q1/Q2 but they don't want to rush it out. I agree with that decision but sounds like it's close

Repeating that it's live in the APP store doing final testing

-

-

Just said they were frustrated to kick out attempted US customers. That was me lol pretending to be from Singapore by a proxy lol

-

1

1

-

-

Humbl Financial no timeline on US release, but maybe will try to do another acquisition in this area.

-

7 - 10 days for a nano merchant whatever that is

6 figures of revs from the humbl shop so far

-

The global sports market would be a huge way to incorporate this outside of the traveler market. Very very happy with this news

-

-

-

Huge because it already has a footprint. This is for that revs question

100B market in Ticketing

-

This is the big news

-

1

1

-

-

Acquisition! of a company called 20M acquistion of Tickeri

-

Not just an alipay copy cat. Want to be adaptable to regions needs

-

1

1

-

-

-

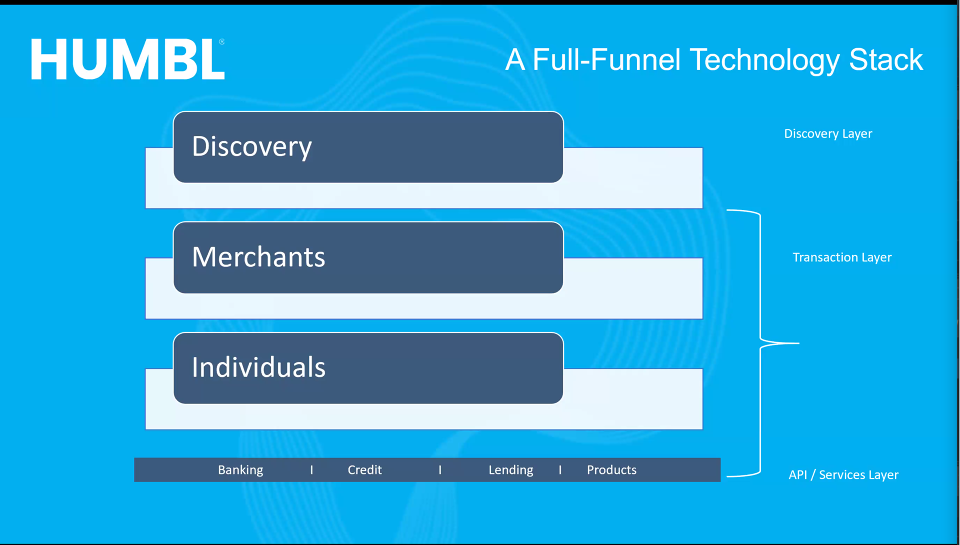

Building a smart financial grid for the global economy. So you don't have to cash out to use digital currency with a digital merchant layer

-

Q2 Release of APP is confirmed

-

1

1

-

Penny stock thread split

in 6th Street Journal

Posted

I'm signed up, will post DD in the Discord tomorrow