ryskey

-

Posts

237 -

Joined

-

Last visited

Content Type

Profiles

Forums

Store

Downloads

Recruiting - 2020

2019-2020 Football Season

Football

Entertainment

Sports

News and Business

Cloak Room

Transfer Portal

Recruiting

Events

Posts posted by ryskey

-

-

I for one prefer hamate sashimi. Cooking a fish that tasty is a shame

-

Remaining SEC Series

Georgia RPI #1

at Kentucky #51

Auburn #14

A&M #100

at Arkansas #3

Florida #25

at OU #9

Non-Con

Texas St #128

Houston Christian #79

UTRGV #16

at Texas St #128

Prairie View A&M #297

Lamar #55

Q1 games remaining: 19

Q2: 0

Q3: 7

Q4: 1

Other than A&M, all remaining SEC games are against current Q1 competition. And UTRGV a sneaky #16.

Will be doing pretty well going 12-9 for remaining SEC games, 5-1 in non conf (one of UTRGV, Lamar, or Houston Christian in a UTSA redux). Would make a regular season record of 40-13.

-

3

3

-

-

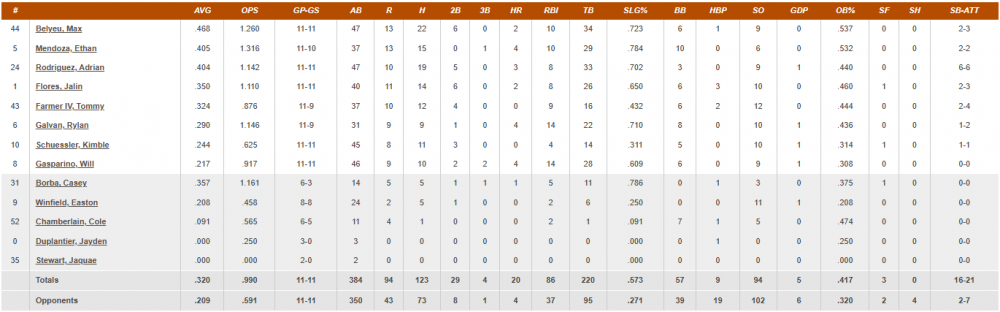

Stat oddities. Pretty meaningless this early but always interesting to look.

Doubling up competition on SLG. .271 would be 294 out of 299 teams if our competition were its own team.

Averaging 5 XBH per game and giving up only 1. Don't think I've ever seen a .217 BA / .609 SLG kind of line (Gasparino).

Stolen base margin... damn.

Schuessler the only starter not pulling his weight at the plate, but seems partly (mostly?) bad luck. Move just 3 of his liners a couple feet, and he's at .310 BA / .450 SLG / .825 OPS with double the RBI.

-

1

1

-

-

All the light oil the US is producing is worth a lot less if we can't blend it with heavy crude from Canada and Venezuela. Sooo... tariff Canada's heavy crude, cancel license for Venezuelan crude. Good strategy.

-

3

3

-

-

- Popular Post

- Popular Post

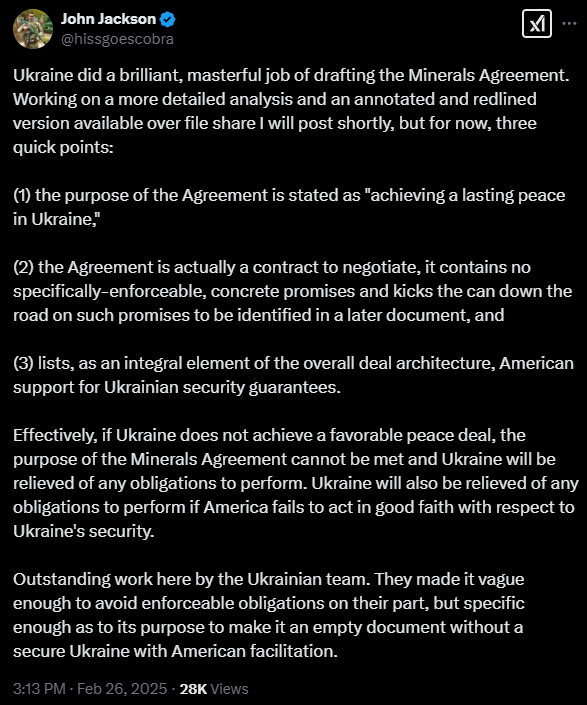

The route to get here was obnoxious and ham fisted, but Trump gets to say the US is getting paid for an easy political win, without any binding agreement from either side. Looks like status quo after a lot of hysterical yelling and fictional numbers thrown around.

-

13

13

-

4

4

-

1 hour ago, Captainant said:

Better reporting on this:

“I am not signing something that will be paid by 10 generations of Ukrainians," Zelensky said, adding that he wants a dialogue with Trump.

The initial White House proposal sought a 50% interest in Ukraine’s natural resources, including critical minerals, oil and gas, as well as critical infrastructure and ports. Zelensky said Ukraine is not ready to “split 50/50 without knowing what’s ahead.”

The Ukrainian leader also pointed out that the U.S. proposed to return future aid with an interest of 1:2. “For every U.S. dollar, Ukraine must return two. In simple terms, this is 100% of the loan,” he said.The exact details of the current proposal have been kept secret but the administration of President Donald Trump has ramped up pressure on Kyiv to sign. Ukraine has had a back and forth with its American counterparts for nearly two weeks and Kyiv will start working to conclude an agreement with the U.S. on Feb. 24, said Ruslan Stefanchuk, speaker of Ukraine's parliament.

The value and volume of Ukraine’s critical minerals are unknown with the figure hotly debated among experts as assessments are based on old Soviet-era figures. However, $350 billion worth of natural resources are located in the Russian-occupied territories, First Deputy Prime Minister and Economy Minister Yulia Svyrydenko said at the forum.A little more context:

The minister's comment comes as Kyiv and Washington negotiate a deal for Ukraine’s natural resources in return for support and security guarantees. The exact value and reserves of Ukraine’s natural resources, which include critical minerals like lithium and titanium, are only estimated and further calculations are underway.

Would be useful to see a better breakdown of the $350B number. By Western standards, "Reserves" are the value of the resource that can be profitably extracted, net of capital and operating costs. The value of "Resources" is often reported as the gross value (before capital and operating costs) of mineral deposits that have not yet been proven to be profitably extracted. So the value of Reserves is often a small fraction of the economic value of the Resources.

The reported numbers seem very hand-wavy and I suspect they're conflating Reserves and Resources. I'm not sure if anyone is doing this on purpose because this is a common mistake even among people who work in those industries. More context:

Details of the agreement have not been made public. However, the media leaked the White House’s initial proposal on Feb. 12 revealing that the U.S. is seeking a 50% interest in minerals and other natural resources like oil and gas, as well as critical infrastructure, sparking outrage in Ukraine with some officials calling the deal “colonial.”

This makes me think they're taking the total Resource value (100% of the theoretically recoverable minerals regardless of whether they're profitable to extract) and multiplying by 50%. That implies they're thinking about this as a royalty (before any costs). This would create an unbelievable economic burden on the business burdened with 100% of the costs.

Some quick math to demonstrate all this from a crude oil perspective:

1. Discovery of deposit with 10 billion barrels of oil in place - "OMG that's worth $700B at $70 per barrel"

2. It's estimated that 50%, or 5 billion barrels, of that oil can be recovered before incorporating costs and profitability. This is usually defined as Resource. Value is $350B, but this just translates to revenue over several decades.

3. Of the 50% that is recoverable, only 20% of that (or 10% of the total in-place) can be demonstrated as being profitable (revenue > capital costs, operating costs, and financing costs) to extract. Now we're at $70B of revenue for 1 billion barrels of economically recoverable resource. These are Reserves. But the value of the project, net of costs, is a fraction of the $70B.

Capital costs: $20 per barrel

Operating costs: $10 per barrel

Financing costs: $20 per barrel X 1 billion barrels = $20B. Let's assume a 5% interest rate, which is absurdly low. The Marshall Plan was around 4%. Financed over 20 years, this is another $20B.

That leaves $20 per barrel ($70-$20-$10-$20) of profit for 1 billion barrels, or $20B spread out over 20 years.

So that $350B of Resource is only worth $20B in Reserves. And that's before any royalties are paid. If the US is demanding a 50% royalty, then this project would never get off the ground because no sane company would take those terms.

It's possible (and likely) that some of that unprofitable Resource will eventually move into the Reserves category with more exploration, better technology and/or a higher oil price, but that's not going to move the needle much.

-

1

1

-

-

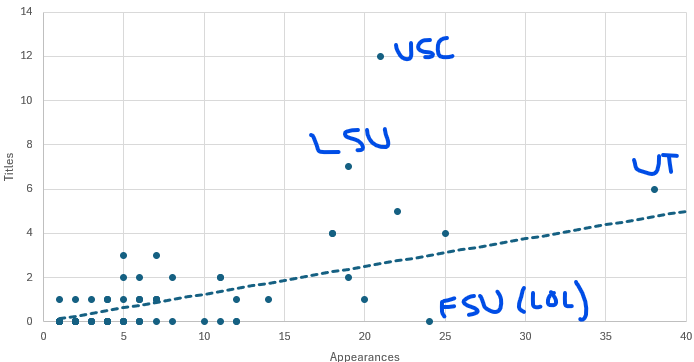

Just to beat a dead horse. Line is the predicted # of titles with all 8 teams having an equal chance of winning. UT slightly outperforming. USC is ridiculous. FSU 0 for 24.

-

2

2

-

-

- Popular Post

- Popular Post

-

-

3 minutes ago, Rimbo said:

i know what you're trying to do but please stop unless you're going to do it better than this

Cotton Bowl = Siege of Kiev (basically not even a battle, just a bloodletting)

Ohio State = Mongol Empire

Ryan Day = Genghis Khan

Jeremiah Smith = Odegei Khan

UT = Kievan Rus

Sark = IDK, whatever poor duke was in charge of Kiev. Probably got decapitated or something

Doooooooooomed

-

1

1

-

4

4

-

-

Quinn = Blake Sims, Jake Coker, Jake Fromm, or JJ McCarthy. All those QBs CFP-era QBs made the NC game and 2 of them won it, mostly with good defense. Actually Coker had Derrick Henry so that's a big reason too. Anyway, none of them were expected to be superman and put the team on their backs.

With this defense we can still win the NC with Quinn as long as he doesn't turn it over, special teams doesn't melt down, and some semblance of a running game. Give it a 20% chance we can do that 4 games in a row. I'll take it.

-

2

2

-

-

-

Doesn't happen every snap, but you can see where his brain starts to malfunction, like a program caught in an if loop. Too much thinking, his body and brain out of sync with how the play is unfolding vs how he idealizes it in his brain. It's like the instinct has been beat out of him.

I would say he should grow back his mullet, but that would take about a year. Maybe he'll grow it back in time to impress his NFL coaches with Mullet Quinn after being drafted in the 4th or 5th round.

-

Texas 69

Vandy 0

420 passing yards

-

1

1

-

-

5 hours ago, 52-80 said:

brent venables pees with his pants all the way down

9 minutes ago, Leanderman said:Brent Venables lights his own farts with a blow torch.

Wait now I think I like him

-

1

1

-

-

- Popular Post

- Popular Post

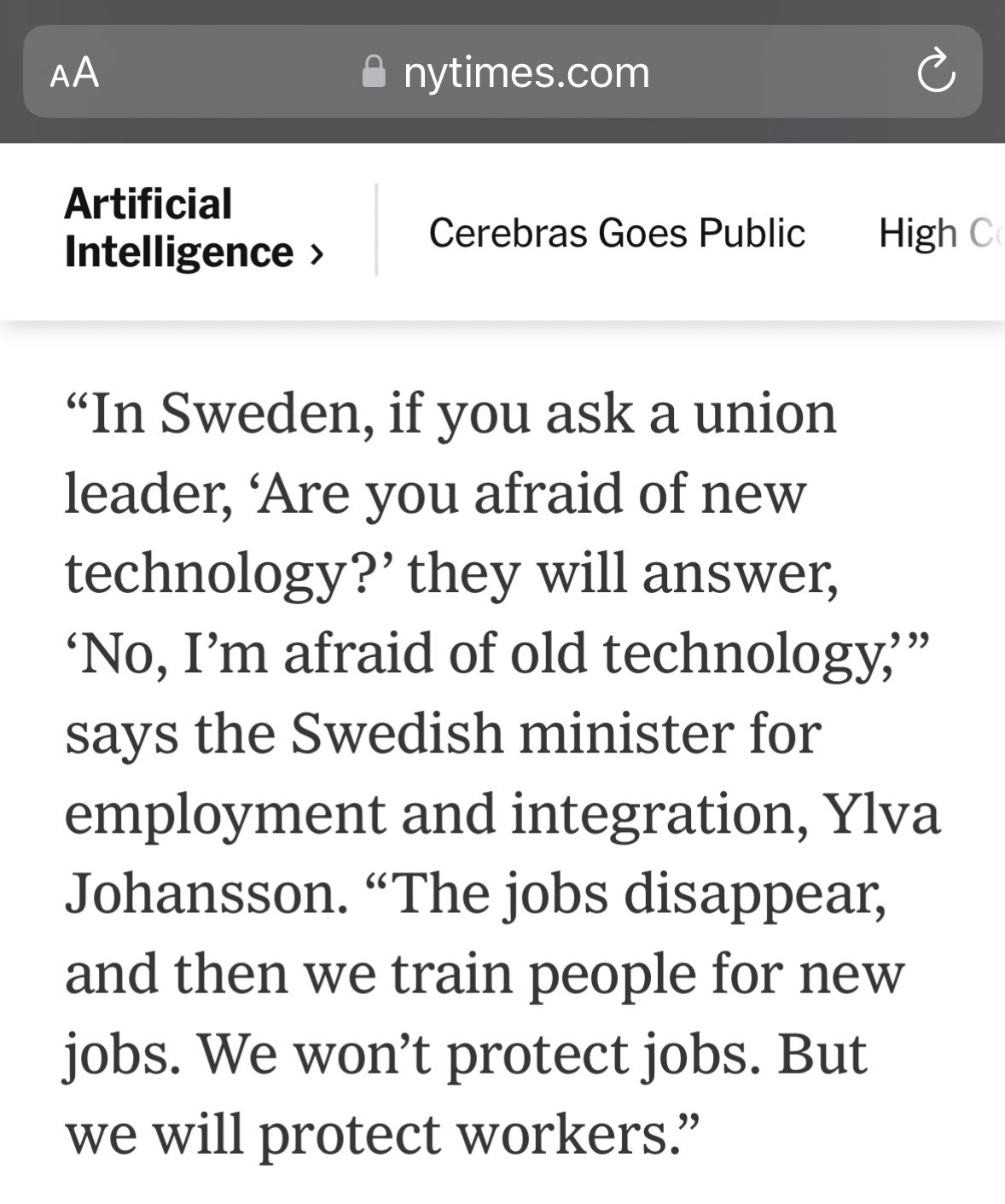

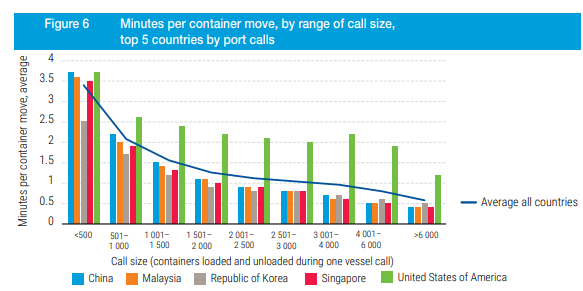

Western Europe's port performance in general outpaces America's. So this doesn't have to be a contentious ideological divide between Management and Labor. The difference there appears to be a healthier and more collaborative, non-zero sum (or negative sum) approach between government, corporations, and labor.

-

10

10

-

1

1

-

The total ban on automation is insane. He's complaining that his workers had to work through COVID. Yes, many others did too. Do you know what allows workers to work remotely? Automation.

The issue with wages not keeping up with dividends/earnings/management compensation is impossible to quantify since most port companies in the US are either

1. Private so impossible to tell what their financials look like.

2. Large multinational companies in which a small percentage of the total revenue comes from US ports. So it's impossible to determine profitability of US ports there unless there's some disaggregation in the financial statements. A read of port performance (several rankings and metrics here https://portalcip.org/documents/port-indicators-and-statistics/ ) indicates the US is middling at best compared to other OECD countries, and American ports lagging way behind other countries after grouping by size and throughput.

An attempt to solve all of this could involve RSUs, stock grants or stock options for ILA workers. Let them own part of the company that pays them. Align interests, let workers participate in record dividends and stock performance if they exist. But we are probably past the point where that would solve anything. The combative nature here indicates poor management decisions probably have at least some of the blame here.

But back to the ban on automation. Port inefficiencies contribute to inflation and decreased exports, both of which we can all hopefully agree are bad. This is a race to the bottom where a large group of people have a financial incentive to be inefficient and negatively impact the rest of the country.

The other countries do a lot more exports, while the US is more weighted to imports, so I don't know how that may effect the numbers above.

-

7

7

-

-

Texas 69

UTSA 0

Ewers/Arch 280/140, which adds up to..... 420

This might be the only game that these numbers actually have a chance of working

-

Texas 69

CSU 0

420 WR Yards

-

2

2

-

1

1

-

-

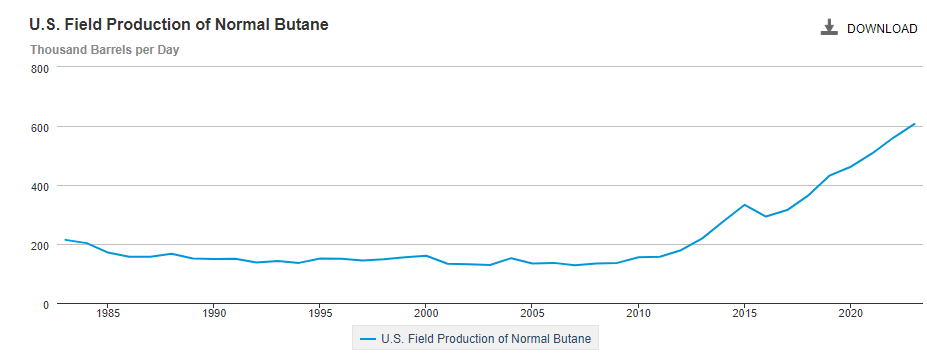

Here's another way to look at it. This is n-butane (c4) production. It's quadrupled in the last 15 years.

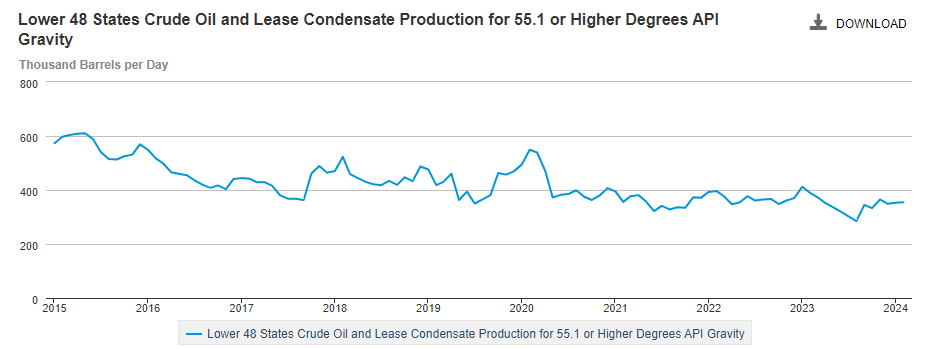

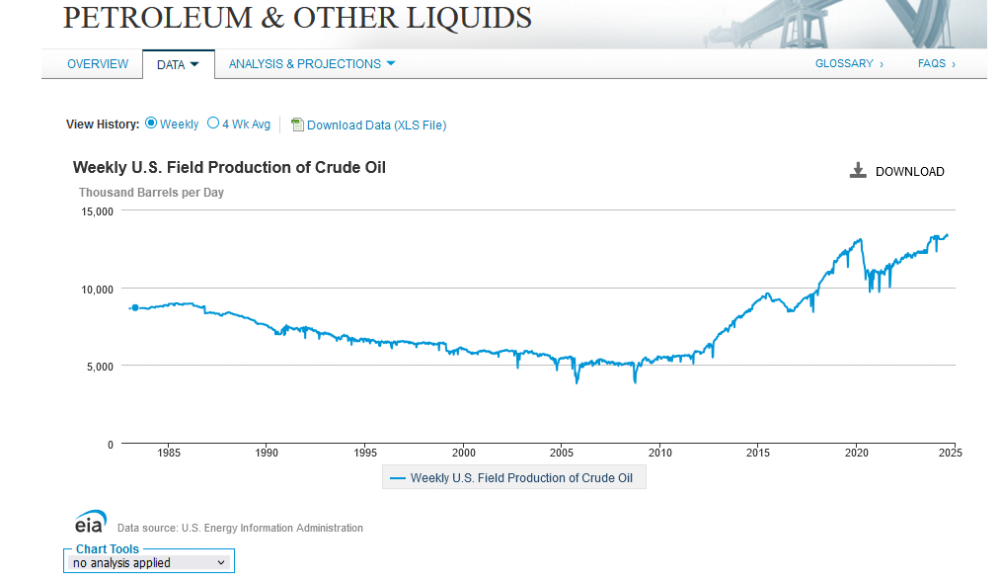

In reality, actual production of c5+, whatever you want to call it, has likely grown proportionally. It's so hard to track because of where it gets separated in the supply chain. But here's the EIA's lightest (closest to c5+) crude oil classification. Reported supply is down. The biggest reason is blending with heavier crudes to meet WTI spec of ~40 API.

-

4

4

-

1

1

-

-

On 8/15/2024 at 2:00 PM, The Royal We said:

Hmmm. So they didn't change the production calcs to start including condensate, but the EIA did make changes to their adjustment factor?

I found the original twitter thread referenced in your PDF and none of it seems nefarious or out of bounds to me, but a lot of it is admittedly over my head.

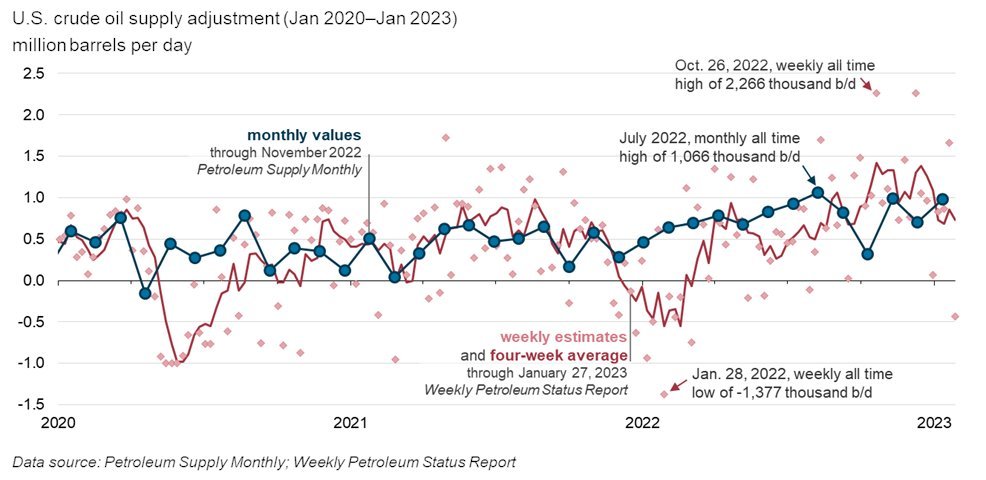

This chart from his thread shows how their adjustments have changed over time. There's a big dip in the monthly average adjustment the second half of of '22 at the same time the EIA's overall production numbers were still increasing - yea? It's a bit of a black box for me, but I don't see how you can say the EIA's daily production number is bogus because of their adjustments. What am I missing?

There's a growing trend to only report C2-C4 (ethane, propane, butane) as NGLs. C5+ (pentanes plus, natural gasoline, naphtha, whatever you want to call it) often goes in company financials and reported as crude oil. It is for the most part (usually fetches a price 85%+ of WTI), so this isn't some sneaky accounting trick.

What's making this very confusing is that the majors and some large independents own midstream and downstream infrastructure, so double counting of supply is very real.

1. Oil company (or the upstream business unit of an integrated major) reports c5+ in their crude oil production. Cool. No rules against that, and is consistent with what the liquid actually is.

2. Midstream company (or midstream business unit of an integrated major) separates the heaviest of the c5+ at the processing plant and blends it with crude oil. This gets sent down the crude oil pipeline instead of the Y-grade pipeline. Cool, this is consistent with what the upstream company is doing. But EIA's accounting of hydrocarbons often counts it again (especially if the midstream company has an incentive to do so, depends on the GPT contract), especially on these weekly EIA updates. So now we have upstream and midstream counting the same c5+ for supply purposes.

3. Y-grade (mostly c2-c4, but still enough c5+ to throw balances out of whack) gets sent to the gulf coast in dedicated pipelines, individual components go through fractionation. C5+ is then separated and blended into crude oil during downstream processing. This also gets counted as crude supply, depending on how it's separated. This is never balances, volatile hydrocarbons are unpredictable and change drastically with small changes in temperature.

4. Crude oil transportation infrastructure. The lightest ends of stabilized crude oil (this is also c5+) can still flash to vapor, then condense again with small changes in temperature. This is often removed, especially before export. More "crude oil" for the purposes of EIA's supply. Here's more confusion: even heavy crude oil contains a lot of c2-c4 that gets thrown in with propane, etc for supply purposes.

It's also worth discussing the differences between the weekly EIA estimates, which are just estimates. Best to take a 4 or 6 week rolling overage, which ends up closer to the balanced supply and disposition a few months later.

I'm still confused with all of this, and so is everyone else. The only way to do this more precisely is track the each specific hydrocarbon chain (c2-c30+) and adjust for cracking, and that's not possible. See that big jump in 2023? That's partly a result of the changes DeCarolis was talking about. I have no idea how much of that 1 million bbl/d jump is a result of double-counting, but I do know there's some.

-

5

5

-

1

1

-

-

-

lol

-

2

2

-

-

59 minutes ago, Helobious said:

Are you talking about me?

There are memes for that. Must adapt to post-literate society and only use memes.

-

1

1

-

1

1

-

Texas Baseball 2025 - Your SEC regular season champions!!

in Baseball

Posted

Remaining SEC Series

at Kentucky RPI #40

Auburn #12

A&M #58

at Arkansas #1

Florida #31

at OU #20

Non-Con

UTRGV #30

at Texas St #77

Prairie View A&M #298

Lamar #59

Q1 games remaining: 12

Q2: 5

Q3: 4

Q4: 1

Win 4 of 6 remaining SEC series to go 10-8 the rest of the way. Drop 1 more non-con. Would make the same regular season record prediction as last week of 40-13. Even though we're missing Tenn and Vandy, looks to be a top 10 SOS. Maybe not saying much, all of the SEC will end up in the top 20.