-

Posts

9,845 -

Joined

-

Last visited

Content Type

Profiles

Forums

Store

Downloads

Recruiting - 2020

2019-2020 Football Season

Football

Entertainment

Sports

News and Business

Cloak Room

Transfer Portal

Recruiting

Events

Posts posted by washparkhorn

-

-

-

-

- Popular Post

- Popular Post

-

1 hour ago, B00M said:

Is falling oil the biggest driver of official inflation rates falling?

Services inflation is the sticky wicket as we go forward. Goods inflation has peaked or will peak shortly. Services inflation remains elevated — and is reflective of rising wages according to JPowell.

Monetary, not fiscal (politics), decisions are driving policy.

-

2

2

-

-

I believe this will be the first engineered recession in modern history. There is no playbook to follow, only theories of how the animal spirits will react. “Demand destruction via unemployment” is the play called by the Fed. In a consumer driven economy like the US (roughly ⅔ of GDP is consumer spending), the Federal Reserve is meddling with the primal economic forces of nature.

-

BOJ bends the knee.

“Tighter BoJ policy would remove one of the last global anchors that’s helped to keep borrowing costs at low levels more broadly,” Deutsche Bank analysts told clients, noting the BoJ move had come as markets were “already reeling” from the European Central Bank and Federal Reserve’s hawkishness last week.

Many economists now expect the BOJ to raise interest rates next year, joining the Fed, the ECB and others after a decade of extraordinary stimulus.

-

-

- Popular Post

25 minutes ago, smuggs said:thick, sweaty cock

Hell of a drug for many social conservatives. The science backs it up:

The authors investigated the role of homosexual arousal in exclusively heterosexual men who admitted negative affect toward homosexual individuals. Participants consisted of a group of homophobic men (n = 35) and a group of nonhomophobic men (n = 29); they were assigned to groups on the basis of their scores on the Index of Homophobia (W. W. Hudson & W. A. Ricketts, 1980). The men were exposed to sexually explicit erotic stimuli consisting of heterosexual, male homosexual, and lesbian videotapes, and changes in penile circumference were monitored. They also completed an Aggression Questionnaire (A. H. Buss & M. Perry, 1992). Both groups exhibited increases in penile circumference to the heterosexual and female homosexual videos. Only the homophobic men showed an increase in penile erection to male homosexual stimuli. The groups did not differ in aggression. Homophobia is apparently associated with homosexual arousal that the homophobic individual is either unaware of or denies.

-

5

5

-

2

2

-

4

4

-

2 hours ago, FirstTimeCaller said:

This is some BS -- even if it's trying to pain a positive outlook with the "more than ample" prospective returns.

It makes it sound like 2009-2021 were just a walk in the park for investors, no one had any worries, and things were chill. If you bought and held during that time, you did very well. But it wasn't always easy. But it was also a time that saw a big 2018 drawdown, a practically overnight 35% drop with Covid, lots of fear and uncertainty following the 2008/09 crash, and a bull market that seemingly nobody really trusted.

Was it a great time to invest? Absolutely. But to make it sound like it was paradise where everything was perfect and no one had worries is silly.

From 2009 - 2021 the Fed pumped up the equity bubble. Anyone who “followed the Fed” and brrrt during that time had an easy time. Contrarians were crushed over and over again.

Those days are over, until the Fed restores the Greenspan Put (which will happen, because the Fed will not allow international capital to to suffer). Same as it ever was, until it’s not.

-

2

2

-

-

- Popular Post

-

-

Nicely done! Hook ‘em!

-

1

1

-

-

5 hours ago, B00M said:

Prospective returns

Relative entry point.

-

The world’s biggest money managers are set to unload up to $100 billion of stocks in the final few weeks of the year, adding to a selloff that’s snowballed since Jerome Powell’s unequivocal message that policymakers will press on with aggressive tightening at the risk of job cuts and a recession.

Notwithstanding their losses this week, equities gained over the quarter, driving up their value relative to other asset classes and forcing managers with strict allocation mandates to sell them to meet targets. Bonds are the likely beneficiaries of sales by sovereign wealth, pension and balanced mutual funds looking to replenish their fixed-income holdings, according to JPMorgan Chase & Co. and StoneX Financial Inc.

-

-

-

-

-

- Popular Post

- Popular Post

-

3 minutes ago, B00M said:

what am I missing?

Some have a longer time horizon and see value at these levels. I agree with your conclusions. The Fed is using the “laws” of the Phillips Curve as a crude sledgehammer to crush inflation. They see unemployment as the simplest method of achieving demand destruction. Recession does not worry them.

The Fed promised pain—and intends to deliver. Services inflation remains sticky. I see another leg down; capitulation isn’t here yet.

-

2

2

-

-

- Popular Post

- Popular Post

-

The arrest warrant gives his attorneys plenty of space to mount a defense. And If she is recanting (as some have reported), he may see the charges dropped.

As for his job, that’s a PR/political/marketing issue. It doesn’t look good for him. The fact he went to her bedroom after she acted as the initial aggressor was a mistake in judgment that may be fatal for his career at Texas.

-

-

- Popular Post

- Popular Post

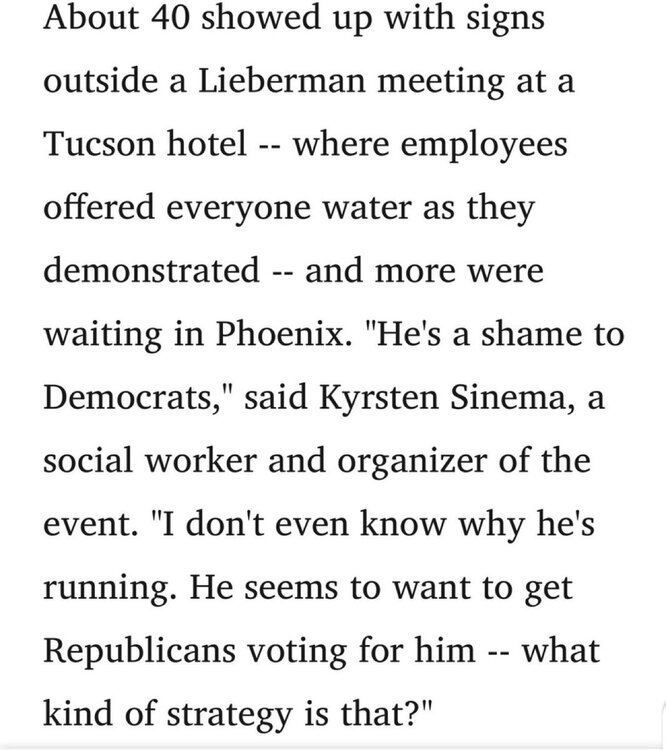

Comic Relief: Satirical Tweets and Memes

in Cloak Room

Posted