-

Posts

9953 -

Joined

-

Last visited

Content Type

Profiles

Forums

Store

Downloads

Recruiting - 2020

2019-2020 Football Season

Football

Entertainment

Sports

News and Business

Cloak Room

Transfer Portal

Recruiting

Events

Posts posted by washparkhorn

-

-

-

-

Self-reinforcing power structures are inherently fragile and prone to exploitation.

-

3

3

-

1

1

-

-

Meanwhile, 14 million children, women and men will begin losing Medicaid coverage at the end of the month. https://www.kff.org/medicaid/issue-brief/10-things-to-know-about-the-unwinding-of-the-medicaid-continuous-enrollment-provision/

-

1

1

-

1

1

-

1

1

-

2

2

-

-

Real men of genius . . .

-

1

1

-

-

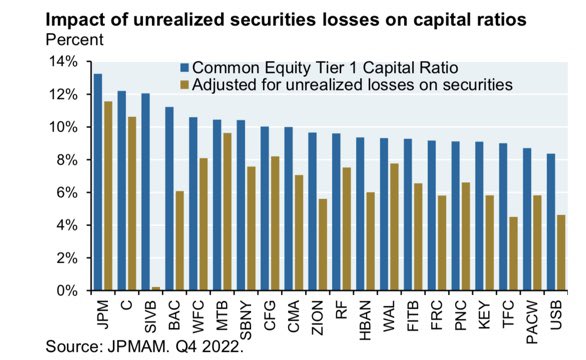

SVB was in an investment duration world of its own—

This isn’t existential risk unless someone triggers a bank run. I want to know who the short sellers are and what gasoline they were spreading and sparking. -

-

Short sellers whisper

Sparking runs through social screens

Banks tremble in fear

-

2

2

-

-

One other tidbit. The FDIC will/have asked the SVB employees to stay on as the bank is wrapped up. Typically, these employees are paid at 150% of normal pay given the need for their familiarity with the business (and the long hours).

-

Thiel deserves scrutiny of his trades after prompting the run.

Again, uninsured depositors will be made whole or close to whole. SVB had assets (poorly structured for duration risk). FDIC will make funds available for insured account holders early next week. Uninsured accounts will gain access incrementally as assets are secured. That could be early next week as well. The FDIC is not expected any tax dollars on this bank failure.

The sticky wicket for startups will access to ongoing credit. SVB understood the game and a JPMorgan-type will not.

-

2

2

-

1

1

-

-

The FDIC will ensure an orderly sale of assets and pay non-FDIC insured depositors. Once the FDIC establishes the value of SVB’s assets (this weekend) depositors will have access to funds for business needs. The FDIC knows what it is doing.

Thiel triggered this bank run. SVB officers and directors ham-handily rolled out a rescue plan that caused Thiel to panic. The bank made some shitty bets in a rising interest rate environment.

Tech prospered in the free money regime; that regime is dead. Time to break the old mindset and catch-up with the new boss. And ffs, diversify and hedge. SVB was living in a fantasy world that crashes with the New Fed.

-

4

4

-

2

2

-

-

12 minutes ago, 52-80 said:

SVB’s problem was not any wanton bad-doing.

-

2

2

-

-

-

-

Live inside SVB Bank:

-

1

1

-

1

1

-

-

-

-

-

It appears mElon is the living embodiment of the Waluigi Effect (one’s unconscious beliefs are as strong as the effort to suppress them).

-

1

1

-

-

Things go wrong quickly when the flow of Spice slows — Bene Gesserit Witch, probably.

-

-

-

Inflation characteristics following Black Swan shocks when markets are dominated by few firms:

-

1

1

-

1

1

-

-

2023 bank failures

in Daily Texan

Posted

FDIC Insured cash sweeps were available prior to the SVP bank run. Well run operations paid for this service/insurance because it limited exposure to bank runs (and paid interest).

Faux libertarians billionaires sought to nullify the adage—Fools and their money are soon parted. The older idiom—He who has the money makes the rules—always wins.