-

Posts

909 -

Joined

-

Last visited

Content Type

Profiles

Forums

Store

Downloads

Recruiting - 2020

2019-2020 Football Season

Football

Entertainment

Sports

News and Business

Cloak Room

Transfer Portal

Recruiting

Events

Posts posted by Orale

-

-

Good. If Congress were to actually act on it, I wonder if it would affect the ubiquitous alcohol advertising. Prolly not.

-

6

6

-

-

The Chilis and Twin Peaks that are across the street from each other would both likely show it.

-

-

1 hour ago, LCHorn said:

Why do you need to be a homo to be into this? My wife and I both thought Call Me By Your Name was terrific.

One doesn't need to be to appreciate it. No offense intended.

-

This comes out today. It looks intriguing and Craig is always great. It has mostly positive reviews so far. I'm a sucker for period pieces.

-

1

1

-

-

4 hours ago, Funk Doctor Spock said:

In all my years, even at school, I've only been to Pyle Field one time. Ever. I refuse to ever go back. Those people are freaks and weird af. The rest of the time in school j just watched the game when j went home for Thanksgiving. I'm so, so glad I got accepted to UT. God forbid I got rejected and have to hang my head in shame and mingle with my aggy family. *shudder*

I went the bonfire collapse year. A childhood buddy of mine was an architecture 2%er student and invited me. I was the only burnt orange in a large part of the student section. I was respectful in light of recent events. I got a lot of shit and just took it with a wan smile. Never going back there.

-

1

1

-

3

3

-

-

10 minutes ago, troph said:

how bad is the property insurance market? we have a concrete house, metal roof, there's ZERO burn to the ground risk here. tornados, nope. hurricanes not close enough. hail not really, plus willing to go to a 2% deductible. sit on top of a hill, flood risk is zero. fire risk generally in the area, sure but again concrete house it's not going anywhere in a fire. but we are having a terrible time even getting a quote. reasons - fire line, total value, total roof square footage.

premium went from $8K to $14K and no one else will quote it.

wtf?

Do you need coverage because of lender requirements? I have a commercial property that's similar, basically a concrete bunker that's fully sprinklered etc... We're selling a different property and will pay off the note on this property. Once that occurs we're only carrying liability coverage as the property coverage is for our lender. Our property coverage deductible is so high that we'd be out of pocket anyways for any damage short of a catastrophic event.

-

1 hour ago, Gatorubet said:

We are not saying folks should

-

1

1

-

2

2

-

-

15 minutes ago, Anastasis said:

Some posters here are legit like three strings away from running out corporate assassinations because their party ran another shitty candidate against Trump and lost.

Give me a fucking break. There are plenty of corporatist Democrats who are just as beholden to our broken healthcare system as the GOP. This issue transcends party. Attribute it to a single election all you want, doesn't make it so.

-

5

5

-

2

2

-

1

1

-

-

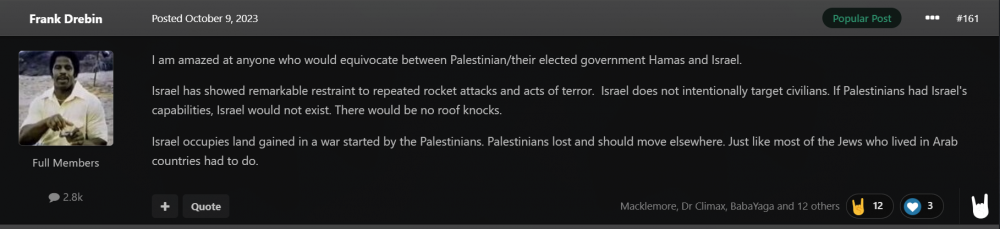

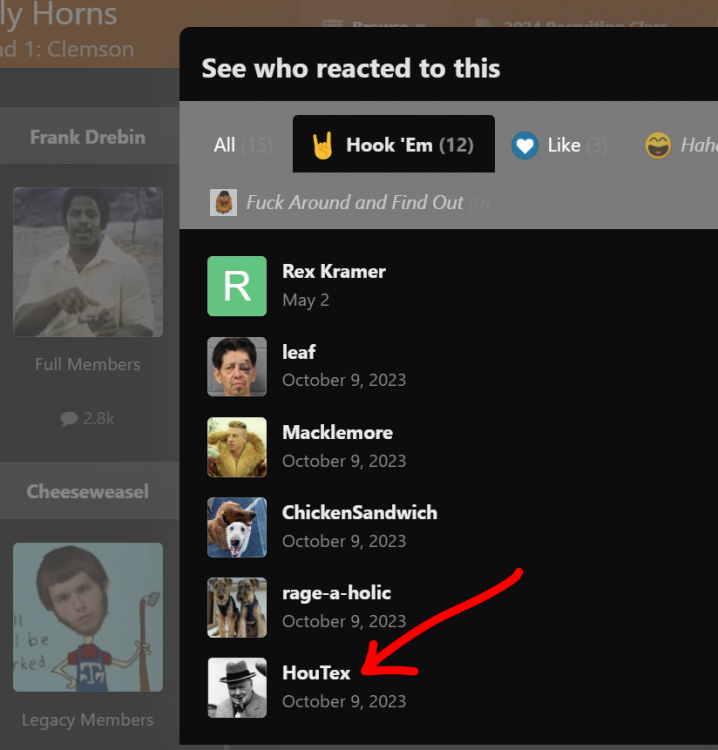

- Popular Post

1 minute ago, bolverk said:Puhleeze.

Below we have YOU, a member of the bar, liking a comment from another fellow member of the bar, applauding a call for ethnic cleansing -- a fucking war crime.

It's kind of rich that you're more concerned with a single dead executive than you are with 2 million people, ~45,000 of whom are now dead a little over a year later.

https://www.surlyhorns.com/board/topic/32512-israel-hamas-war-thread/?do=findComment&comment=5606792

-

3

3

-

1

1

-

17

17

-

1

1

-

1

1

-

15 minutes ago, Skipper said:

Got it. So first degree murder now fine and dandy as long as you agree with the political or social motivations behind the killing. Victim not alleged to have done anything illegal? Fuck him - worked for an evil corporation so he deserved it. 2 kids left without a father? Fuck them too. Pathetic.

I have no doubt we'll see some massive hypocrisy from several posters when this plays out under a different set of facts and the killing does not align with their personal political/social belief systems.

Is your argument that people whose family members needlessly die or suffer in agony because of assholes like the UHC guy should just lay back and take it? Sorry pal, that's just the system we have, nothing you can do about it. Maybe submit a letter of concern on your congressperson's website?

It seems you have no problem with corporate murder, but blanche at the thought of a citizen punishing a key player in that system. Fuck off with that pearl clutching. It's not murder if it's justified.

-

3

3

-

1

1

-

-

59 minutes ago, HouTex said:

Well done briefing by the PA governor.

Nah. What has peaceful political discourse gotten the hundreds of thousands if not millions who died before they needed to, suffered horribly, or went bankrupt because of the greed of the private healthcare industry? They should just accept their unjust fate and not fight back?

-

2

2

-

1

1

-

1

1

-

-

29 minutes ago, Rex Kramer said:

Ok

Why post on this forum if you're just going to respond like a child?

-

1

1

-

-

Does anyone know where the Mexico City Texas Exes group watches the games?

-

9 hours ago, Vegas64 said:

I agree 95% with the sentiment on these 12 pages. However in the interest of fairness and since everyone else is giving anecdotal insights, I do want to give UHC props.

I have a gentic disorder and I live in Texas. I have an aunt who has the the same one who lives in the London area. I've had Anthem, BCBSTX, Aetna and UHC.

Getting coverage of a biologic that I need 3x a year has been infinitely easier with UHC. They approved it the first time without appeal or needing to harrass my specialists with interviews and gave me the name brand. The other insurers were horrible. Constant denials and appeals and then finally approving with a biologic similiar (generic I guess?) and on a more elongated schedule, 2x a year versus the 3, than requested by my docs.

My aunt in London and dealing with the NHS?

Horror stories. Very basic care and medicine (generic, low efficacy and therapeutic relief pills versus the very expensive infusion therapies) and the wait if you are ever approved is so bad. She had to go on their version of disability because she couldn't get access in a timely way to function at even a mid-level. She's doing fine now after having had to spend a few years at the front of this disease getting it into a remission state, but there was suffering and loss, etc. from not being able to flex. I should also add she's not wealthy and very middle class and working class.

All that to say, NHS is amazing for the flu or covid or insulin. It's amazing for 90% of the healthcare population.

But if you have a rare or aggressive and specialized disease and need specialists and expensive meds (the vast, vast minority) there is no better healthcare than in the U.S.

I'm happy you received the care you needed from UHC. But you do realize your anecdotal experience is hardly a useful data point in assessing the quality of outcomes for 340 million people?

-

- Popular Post

These insurance companies effectively murder or make life a living hell for millions of people every year purely for profit. They are evil. I'm glad this asshole was killed. Perhaps more executives of shitty companies that hurt lots of people should be killed. It just might cause some companies to stop being so evil, if only for self preservation. Keyboard warrior rant over.

-

13

13

-

1

1

-

1

1

-

1

1

-

9 minutes ago, victory88 said:

Anyone have a rec for homeowner's insurance? I had to quickly find a policy for this year during a closing and that premium has basically doubled for next year up to 7ish k for the year. It's a shit policy too so looking to shop around. Anyone have a broker they like? My current policy is with Mercury through goosehead.

I recently switched to Geico and it was 1/3rd the price of our prior carrier Liberty. I've never made a claim so I can't speak to the quality of the coverage.

-

8 hours ago, HiggyBaby said:

Opinions on geico for cars? Long time USAA member but moved away from them after a lot of years because rates. Found an agent who’s given me a decent deal with Progressive. But I’m still paying thru the nose with two teen drivers. On a whim I ran a quote by Geico and it was a good 50% less. Too good to be true? Any issues with them?

I just switched my parents' car from Liberty to Geico. Went from $3,000/yr to $500/yr. I've personally had Geico for 12 years on multiple cars. Only one claim for a broken window from a parking lot hit and run. Super easy process getting it fixed and paid for.

-

-

- Popular Post

- Popular Post

5 hours ago, 'stache said:I’ve been there and agree. There’s nothing intimidating about 90,000 homos swaying back and forth and singing showtunes from the late 1800s.

Um, we homos would have nothing to do with those delusional dorks thank you very much.

-

7

7

-

2

2

-

14

14

-

I reduced my sugar intake pretty dramatically a year ago after high glucose blood work, then quit alcohol in January. Went from 177 to 155 pounds this year. I've been doing a basic dumbbell workout along with pushups 3x a week along with running/walking/elliptical cardio 6 days a week. I have decent muscle tone, but I feel the gains have plateaued. Come January I want to revamp my workout to increase muscle gain.

-

1

1

-

-

Quote

Rafael Corrales, a real estate agent in Miami, recently showed houses to a young couple hoping to move from a rental into a home. They had been lured to the market after hearing that mortgage rates had come down.

But when the couple went to get approved for a home loan, they found that the borrowing costs had ticked up once again.

“They were very confused,” said Mr. Corrales, 49, an agent for Redfin. It pushed them back onto the sidelines of the housing market, and they’re now staying put in the hope that rates will fall again.

Mortgage rates fell steadily from this spring through September, as economic data slowed and as investors began to expect a steady string of interest rate cuts from the Federal Reserve. But the rate on a 30-year mortgage has reversed course and climbed sharply over the past month to 6.79 percent nationally, from about 6.1 percent at the start of October.

The move has come as a shock to some home buyers, who had waited many months for Fed officials to begin lowering borrowing costs, hoping that they would bring relief to the mortgage market.

The logic was fairly simple. When the Fed lowers its benchmark interest rates, the downward shifts tend to trickle through financial markets to lower other interest rates. While the biggest impact is on short-term rates, the effect can extend to 10-year Treasury notes, which mortgages closely track. And the Fed is, in fact, adjusting policy. Officials cut interest rates for the first time in four years in September, and they followed with a quarter-point rate cut on Thursday.

But other recent developments have helped to counteract the rate cuts.

For one thing, market-based rates like mortgages tend to move in anticipation of future Fed policy — not the policy at the moment when the cuts happen. And just how much the central bank will manage to lower rates next year is increasingly in doubt. The economy has been stronger than expected, which could argue for less aggressive Fed reductions. Donald J. Trump’s election as president only further fuels uncertainty.

Mr. Trump has proposed a cocktail of tariff increases and tax cuts that could stoke inflation, economists and investors think. As a result, White House policy could prevent Fed officials from lowering borrowing costs by as much as they otherwise might. In fact, Wall Street investors began to bet on higher inflation and fewer rate cuts as Mr. Trump’s victory came into sight. And mortgage costs also move for reasons other than the Fed outlook: Expectations for higher deficits could also help to push them up, for instance.

The upshot for home buyers is an unsatisfying one. Many economists do expect mortgage rates to fall again in the months to come, but exactly how far is murky.

Greg McBride, chief financial analyst at Bankrate, said he was expecting that “the new normal over the next couple years will be mortgage rates in the 5s and 6s.” Daryl Fairweather, chief economist at Redfin, said she thinks that rates will drop to around 6 percent over the next 12 months.

Either would be far above the sub-3 percent rates of 2021 — or even the 3 to 4 percent rates that were common in the 2010s — and higher than what some economists were projecting just a few months ago.

“I do think that with time rates will fall,” said Igor Popov, chief economist at Apartment List. “But I don’t think we’re looking at a near-term future that’s going to take us back to 3 percent mortgage rates.”

Mr. Trump promised to sharply lower interest rates — including mortgage rates — from the campaign trail. But the president has no direct control over Fed policy.

And analysts across Wall Street projected that Mr. Trump’s campaign promises would risk keeping interest rates at least slightly higher than they otherwise would be. In fact, the yield on 10-year Treasury bonds jumped 0.2 percentage points on Wednesday, the biggest move in more than two years.

Some economists think that with the election now over and at least that source of uncertainty fading, rates will slowly come down next year.

“Rates have gone up in the past two weeks, but I think it’s mostly because of volatility leading up to the election,” Ms. Fairweather said.

But with mortgage rates poised to stay much higher than they were as recently as 2021, the housing market may remain stuck.

Many owners who locked in super-low mortgage rates at the height of the pandemic are unwilling to sell and walk away from their comparatively lower monthly payments. That, in turn, limits how many starter homes are for sale — which means that even with weaker demand from buyers, prices have continued to rise.

The lock-in effect “restricts mobility, results in people not living in homes they would prefer, inflates prices and exacerbates economic inequality,” researchers at the Federal Housing Finance Agency wrote in a recent paper. They estimated that more than 1.7 million home sales had been forgone over the past two years.

Michael Kosch, who lives in Grosse Pointe Shores, Mich., a suburb of Detroit, has a mortgage rate of about 1.9 percent, locked in during the depths of the pandemic. The house he and his wife bought in 2020 does not meet all of their needs: The couple and their young daughter could use an extra bedroom, a bigger garage and an upstairs laundry. But when they started scoping out nearby homes this summer, they flinched at the rates.

“Even if mortgage rates come down into the 5 percent range, you just can’t give it up,” Mr. Kosch said, referring to his pandemic-era deal. They opted to fix up their home instead.

And if the combination of hefty prices and high borrowing costs persists, it is likely to keep affordability historically poor.

It is not clear that White House policy will do much help in the years to come. Mr. Trump has suggested slashing regulations, which housing economists have said could help somewhat.

But he has also blamed immigrants for pushing up housing costs, even though economists point out that their impact is probably limited, and that they also help to expand the housing supply as a central part of the construction work force.

And while Mr. Trump at one point promised that he would bring mortgage rates “back down to, we think, 3 percent, maybe even lower than that,” he cannot force the independent Fed to lower rates or buy bonds to make that happen.

High rates and high prices are posing a problem for people like Scott Grillo, a renter in Rochester, N.Y., who has been looking to buy his first home but who has been held back by costs. He has been waiting for the 30-year mortgage rate to dip below 5 percent before making the leap.

“I’m looking for the perfect moment, which doesn’t always happen, but I’m crossing my fingers,” Mr. Grillo said.

Mr. Corrales, the Redfin agent in Miami, is also watching, as many prospective buyers make similar choices. He said some had been waiting for the election, eager to see what might come next.

“Both sides of the table are waiting for rates to be sub-6,” Mr. Corrales said.

But rates now seem unlikely to decline to the levels that Mr. Grillo and Mr. Corrales are looking for quickly — if at all.

“The housing market distortions that we’ve seen are maybe becoming even more entrenched, or at least persisting longer than people had initially thought,” said Lu Liu, an assistant professor of finance at the Wharton School at the University of Pennsylvania. “That’s certainly something that the new administration will have to deal with.”

-

1

1

-

-

3 hours ago, thrillhammer said:

you could stop with this list, but i'll add la fogata, el mirador, la fonda on main, mi tierra's.

I feel like the last few times I've gone to La Fonda, the food quality was way below what it was when I was growing up. They used to have the fajitas, for example, come out nice and charred on the searing hot skillet. The most recent time I ordered it, it came out on a plate and the fajias looked so sad. I haven't been back since.

-

Rosarios. Sol Luna. Mirasol. Los Barrios. Guajillos.

-

3

3

-

1

1

-

The Surly Road Cycling Thread

in Hobbies

Posted

I'm doing a ride from Lisbon to Porto this coming week (using a good quality rental touring bike) and am finalizing a route. I'm fit but not a highly experienced cyclist like many of you. So I'm looking for a route that has relatively low elevation changes, low traffic, and nice scenery.

My question is which app do you like for planning routes. I have Strava, Komoot, and Google Map. While the routes they provide aren't wildly different, there are some differences. Komoot seems to suggest busier roads than Strava and Google when I do random spot looks using google map. I also don't like that Komoot doesn't seem to show the road numbers like Google and Strava which is a pain when comparing routes between the different apps. Anyways, I'm sure whichever route I end up with will be fine, but any suggestions are appreciated.

I plan to do multiple longer backpacking trips this year, so I'm using this relatively short trip to test out apps, new equipment, etc.