Blotto

Certifiably Surly-

Posts

15016 -

Joined

Reputation

27595 Surly 1%About Blotto

Recent Profile Visitors

The recent visitors block is disabled and is not being shown to other users.

-

Was anybody watching the group coverage of Scottie's group when there was a burst of rain that started up while they were teeing off on a hole, and Lowry shanked his drive into the rough? Lowry immediately started bitching about the rain and dropped about 4 F bombs in a row which were a lot more audible than smiley's gaff. I hope we didnt lose too many delicate souls.

-

The evidence would suggest you have already considered it. Just not acted on it.

-

its not new, but they just merged with a SPAC to go public. Their financials are something like $100M in rev/$5M in profits/growing~10% year, so low margin, low growth internet retailer. The only new development is hitching their wagon to the globally respected business mind that is Donnie jr.

-

dude is on another f'n level today. Well most days.

-

-

They have raised $380M in funding as a niche software company. I wont pretend to know anything about the "apache airflow" ecosystem, but that seems like an absurd amount of money for a company with 300-400 people and their likely coding requirements. So they will find ways to spend it, and I can think of no more efficient way than to stuff your C-suite with worthless management.

-

longhorn city limits gonna get spicy next year

-

Imma longs for those idyllic internet days when we all steadfastly refused to mock infidelity, when nobody online reacted at all, and instead we prayed that everyone involved could find peace and happiness in the future.

-

so nothings going on here?

-

This shit is as old as the internet, a place you are presumably familiar with. But "whats going on here?" You alluded to it upstream, the rest of us are clueless, so help us out.

-

What the fuck did coldplay do here? Or are you saying that showing people at any public event (concerts, sporting events, etc...) should be banned? WTF? OK explain it to us. Beyond the fact that the internet is, and always has been, a medium to massacre people who fuck up by laughing at them through funny memes. What is unique about this? Even if the dude is in an open marriage, I dont think CEO's are supposed to banging their subordinates, so dont pull this shit in public if you dont want to get caught. What a strange issue to even give one fuck about.

-

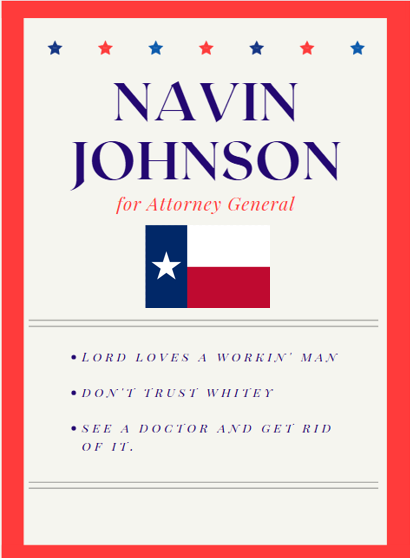

Fuckin' A Yes! Nathan Johnson for AG

Blotto replied to The Original Greaser Bob's topic in Cloak Room

I just thought it would be funny if his name was Navin Johnson instead. Because if so, it would be a crime against humanity to not build his platform on those three mighty pillars. Hell, I'd buy one of everything in the merch store. So I found an online campaign poster generator and here we are. Also, I may have been a little stoned. -

Fuckin' A Yes! Nathan Johnson for AG

Blotto replied to The Original Greaser Bob's topic in Cloak Room

- 4 replies

-

- 14

-

-

-

-

If I was on the board, I'd vote to can his ass tomorrow just for releasing that shitty excuse for an apology, or whatever it was. I wouldn't want the world to know how fucking stupid our CEO is. If they do decide to shitcan him, I wonder what clawback provisions, if any, his employment contract contains with regards to equity awards.

-

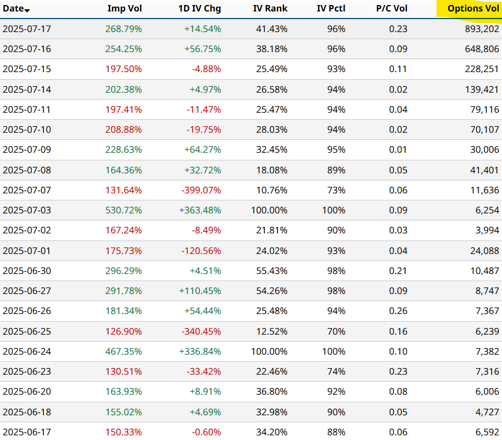

Pretty sick increase in Opendoor options volume the past week, skewed obviously towards calls. It will be interesting to watch what price levels it can hold tomorrow with a shit ton of open interest on those 7/18 contracts. ~900K volume is pretty stout for a microcap.

Football ... Basketball ... Baseball ... Other Sports ... Futbol ... 🤫995🤫 ... Gambling ... Movies & TV ... Music ... Hobbies ... Lulz ... Food & Travel ... Daily Texan ... Business and Markets ... Cloak Room ... Help ... For Sale ... Board Discussion ... Subscribe!... Donate!... COOKIE MONSTER!