-

Posts

1532 -

Joined

-

Last visited

Content Type

Profiles

Forums

Store

Downloads

Recruiting - 2020

2019-2020 Football Season

Football

Entertainment

Sports

News and Business

Cloak Room

Transfer Portal

Recruiting

Events

Posts posted by UTGrad98

-

-

Spy may hit 381 tomorrow! My trailing stop losses are very helpful on days like today. So it's gonna bounce at 381 right? I'm nervous it's gonna be one of those days where it hits 381 and then the bears and bulls fight at 384 the rest of the day and we won't know until like 30 seconds before close whether we are gonna go lower or higher the next week or 6. Not sure what to do here.

-

I have a question that has been bugging me. Why would I ever allocate any money in my portfolio to bonds? It made next to nothing in the run up from 2020. And that's fine. I wasn't banking on much return. What I was expecting is a hedge against a downturn. And so far my bond fund is down 8% this year. My 401k is my hedge against my stupid self as I don't actively manage it. I'm 80/20 stocks bonds. Why the hell would anyone put money in bonds? And if they are a traditionally good investment what made these last 2 years different?

-

1

1

-

-

India blocks all wheat exports effective immediately.

https://www.cnbc.com/2022/05/14/india-blocks-all-wheat-exports-with-immediate-effect.html

-

1

1

-

1

1

-

-

2 hours ago, Storm the Field said:

You ok?

He only lost 500. That's like 2 steak sandwiches now.

-

1

1

-

3

3

-

-

Of all the days for my boss to fly in and a new study trial team to fly in...I would have taken the entire day off to stare at the markets today. God has a cruel sense of humor in my simulation. This day could be crazy.

-

I thought the inflation started last April so while the number may look better tomorrow its on top of the already 6 % inflation April 2021 had from the prior year. Is this correct?

-

-

That was the most limp dick bounce at 400. Next stop is the 380-385 range. 20% drop of spy is 384. Fibonacci retracement of 222 covid low to 480 high is around 381-382. I'll be taking a large position around there. After that is 360 and 350 for spy. My body is ready. I did exit my 400 spy position at a stop loss of 404 this morning. Don't care how others play. This is exciting for me in my own trading world.

-

I'm guessing the great resignation is probably over.

-

2

2

-

-

For some divine unknown reason I changed my limit buy from SPY 405.00 to 405.80 (52 week low) back on Monday so I just caught this rally and rode it up the last 36 hours. Put in a stop loss at 424 yesterday and it hit during my morning meeting. Crazy market. I'll keep playing these swings I guess and if I screw up and it keeps falling at least I'm invested. Next buy is 400. Then 385. I'm fine with 2-3 percent gains in this choppy market.

-

1

1

-

-

3 minutes ago, Gil Bang said:

Dewey defeats Truman!

You may be right but this is pretty damning. Apparently this type of leak is ultra rare and violates all kinds of trust in the Supreme Court

-

1

1

-

-

Unprecedented leaked document draft of ruling.

Can we call it the Bernie bros and rbg law? Reap what you sow 2016 libs

-

2

2

-

-

- Popular Post

- Popular Post

This happened to my dungeons and dragons group some time back with adhering to 5th edition rules. Fantasy worlds can be a bitch to navigate.

-

2

2

-

2

2

-

10

10

-

I could have sworn you drove a Corolla.

-

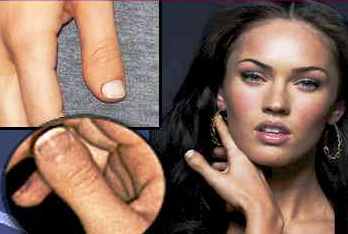

Jolie > Fox : acting

Fox > Jolie : hotness

Jolie = Fox : crazy

-

1

1

-

2

2

-

2

2

-

-

-

-

6 minutes ago, clapclapclap said:

And still no one on the inside taking him out.

-

37 minutes ago, cactusflinthead said:

The worse this war gets the more I think it's impossible he runs for president again. I mean the democrats are smart enough to play shit like this on a loop during the general election aren't they?

-

10 minutes ago, WBT said:

There was one?

They had 10's of subscribers.

-

I have an employee who is having a tough time getting along with everyone else at our workplace. He is extremely unhappy but is really bringing on himself. Anyway, if he wants to claim unemployment after giving his 2 week notice, what options does he have? He cant be off work for any considerable time and make his rent. Is this a difficult thing to get, claiming unemployment after you quit a job? What would help his case (like starting an HR case for work environment issues)? Is it next to impossible to get unemployment unless you are laid off in Texas? Or will a note from me do, as they say, and it is quite easy to get and nothing to worry about?

I do want to help the guy but its becoming a real issue with both him and most of the other employees.

-

Feels good to not even taste the koolaid so far this spring. Hopefully I can keep it up through fall practice.

-

1

1

-

1

1

-

-

1 hour ago, Trey3216 said:

It's a family effort to make sure our 5 month old has formula. My wife and I, my parents, her mom, her sister... It's an asswhipping hunting for formula. Shit keeps me up at night sometimes.

Have the nanny feed her.

-

1

1

-

-

My boy has what I would consider mid functioning autism. He is verbal and he speaks but not like you or I do. He exhibits all the classic signs of austism but my wife and I have learned to enjoy and cherish every second with him instead of worrying so damn much about everything. He is in public school and it has been a God send. He has grown leaps and bounds. We are starting to have some real hope. He will most likely need some type of assistance as an adult and that is really the only thing left that would keep me up at night if I let it. And thats OK.

You and your wife will have to make decisions on how to navigate but let me tell you not to beat yourself up too much about the choices you make or have made in the past. Lots of things have a way of working themselves out. Love the hell out of him and do the therapies and schooling type you think is best. For your son I think he will end up ok. I really do. It just may take some therapy and counseling to get him where he needs to be but he will get there. Show him a life of love and happiness at home. If his life is surrounded by that then that is his best chance to be loving and to be happy as that is what he sees most and how he associates the life around him.

-

5

5

-

1

1

-

Markets still falling like whoa

in Business and Markets

Posted

So if rates get to 6-8%, can I park some of my money in a 30 year note and receive 8% a year for 30 years? That doesnt seem right and way too easy of a decision.