-

Posts

5793 -

Joined

-

Last visited

-

Days Won

1

Content Type

Profiles

Forums

Store

Downloads

Recruiting - 2020

2019-2020 Football Season

Football

Entertainment

Sports

News and Business

Cloak Room

Transfer Portal

Recruiting

Events

Posts posted by TexasEd

-

-

- Popular Post

Sending surplus or obsolete equipment made in the USA to Ukraine to defend democracy, stop ethnic cleansing and a enemy foreign invasion with no US troops is Bad

Sending US troops and money to ethnically cleanse Gaza and rebuild it as a resort community with taxpayer money that gets us into a 50 year conflict with Oligarchs reaping all the benefit is good.

-

2

2

-

1

1

-

6

6

-

2

2

-

- Popular Post

- Popular Post

-

2

2

-

8

8

-

My daughter got CAP. I'm a very proud/happy dad. She's considering it. She didn't want to go to UTSA for a year because she just wanted to jump in where she will be for 4 years.

What have been other experiences with CAP? Can they get a roommate that is also CAP so they can support each other and be friends when they get to Austin?

She applied to the school of Nursing. I heard it is very competitive. Is there a path to Nursing from CAP? I saw this on the nursing.utexas page as required. Does this mean that the 24 hours have to be from the sophomore year at Austin? I know it says preferred but I'm trying to read between the lines.

-

24 credit hours (it is preferred that these are done in residence at UT).

- Courses taken pass/fail, by UT Extension, UT Correspondence, or credit by exam do not satisfy these eligibility requirements.

She is also accepted at Arkansas, Texas State and several backup schools and she may get financial assistance and get to play soccer at Austin College in Sherman. So she has some solid options.

-

6

6

-

2

2

-

24 credit hours (it is preferred that these are done in residence at UT).

-

I love that “STOLLEN” makes a comeback.

need a bingo card for covefe, indicated, et al

-

3

3

-

1

1

-

-

On 2/4/2025 at 4:24 PM, 52-80 said:

iShares TLT is by far the most popular. Only 15bps of expense fees. Vanguard VGLT is most similar (~25 year avg maturity of holdings) and 4bps fees…but at this points the fees are chicken scratch. TLH targets 10-20y treasuries. I dont think in this context most people are thinking of stuff with shorter maturity.

What about investment grade corporate bonds? What is the risk tradeoff there?

-

22 hours ago, InkaUtexas said:

Walking through HEB today. Old codger in his chair is pissed there is no ice cream. He is wearing a MAGA hat.

Yep I said, supply chain and all that.

"dammit, just get ready to pay more for groceries" he says, tossing in some hungry man beef with glue whatever into his cart.

I could not help myself. "Yep, thanks Trump." I got the glare. I loved it.

Oh, and later on saw him walking out to his car. No handicap. Just fat as fuck and lazy.

2:1 he gets a disability check. Parlay bet if his check gets cut by Elmo.

-

2

2

-

-

- Popular Post

On 2/5/2025 at 9:18 AM, Nivek said:Not allowed in the curriculum. We need to teach about donkey dicks and their big loads (Ezekiel 23:20)

On 2/5/2025 at 9:27 AM, Brisketexan said:Actually, the text reflects that the dicks are like those of donkeys, but the loads are like those of horses. Get it right, scripture is important.

On 2/5/2025 at 9:30 AM, Pato del Muerto said:And it’s the literal word of god, to be taken literally.

On 2/5/2025 at 9:33 AM, Hank Kingsley said:I try to jack a jack every time I encounter one. A pious life is hard, but not as hard as that goddamn donkey dick.

It was lost in translation centuries ago but the original text specified "muledick".

-

2

2

-

3

3

-

9

9

-

12 hours ago, DixonHur said:

The ones I've seen don't seem particularly wealthy

Or inclined to invest in anything but physical silver and gold under their mattress.

It's a chicken and egg problem, really.

-

The time to have created this type of fund was when Social Security was created to take the contributions and invest them responsibly instead of a slush fund for deficit spending. Could have invested in T-bills to create the same arrangement but with a formalized debt instrument.

Pessimist me is going with the grift motive to put cronies in charge and have them invest in things like golf courses and NYC real estate that is underwater at inflated prices to buy out the owners so they can pay off their foreign loans or to realize the paper "profits" of assets like Bitcoin.

-

3

3

-

2

2

-

-

40 minutes ago, 52-80 said:

I stick some of my work-sponsored retirement accounts in aggressive stock/bond funds or age-based funds (which use same general formula), because theyre a bit clunky to manage actively.

Thats been a good blend because the smaller bond component sucked during last few years due to interest rates climbing from off the floor.

My IRA is semi-actively traded and ive been slowly rebalancing away from stock index and into long duration bonds. My gut feeling is equities are too heated and rates will roll over and the long bonds will outperform.(Actively traded account is anything goes…)

No telling what I will do nearer to retirement, whether ill skew the entire portfolio heavy towards bond/yield. The market environment and my personal risk tolerance might look completely different by then.

This is something I need to do as well. I'm pretty heavy stocks, and those are pretty heavy on the large cap names everyone is in (Amazon, Apple, NVDIA, Google, etc.) plus some big name financials. Over the last 3-6 months I've tried to diversify that some with more mining, energy, industrials and have gone to a larger cash position mixed between money markets, CD, etc but need to do more Bond but it's been a long time since I've been in the bond game.

Which funds are people looking at for low fees and good returns? Are there other vehicles people are looking at? Most of these assets are in IRA or Roth accounts so I don't pay taxes on them now, just need to continue growth.

-

So Elon is getting his tentacles into our personal identity information, federal payment and disbursement systems, assets and tax information, disability and health information, got some agencies to already adopt xitter as their official government communications channel, shut down the servers (is he trying to move where they’re hosted?) and shut down public facing web sites with policies and regulatory information.

Nothing to see here.

-

3

3

-

2

2

-

-

3 hours ago, InkaUtexas said:

The isolationism this is going to create will lead to 100 years of solitude.

Furk, Are we Aggy?

-

1

1

-

1

1

-

4

4

-

-

-

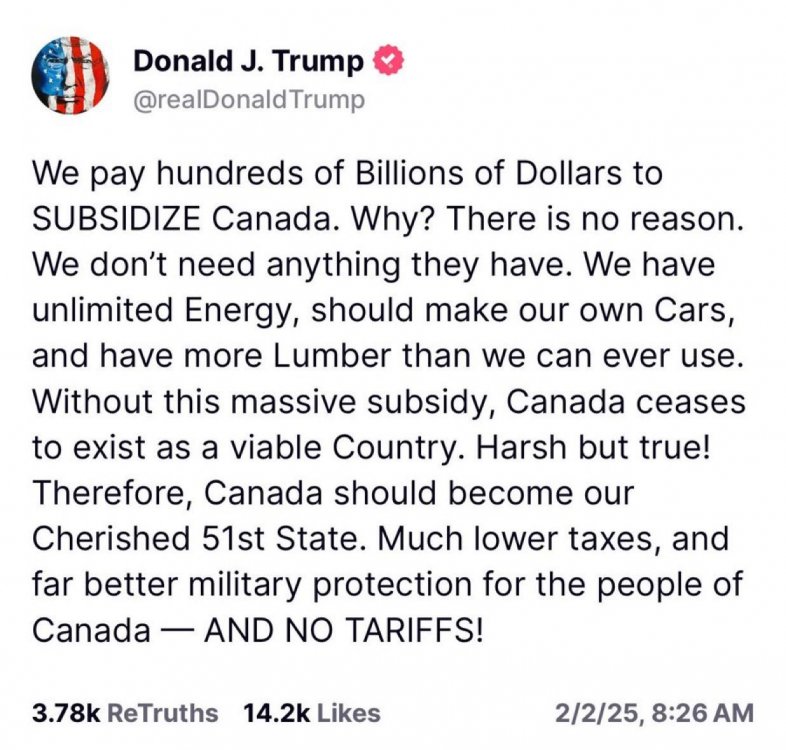

Apparently the demands on Canada were posted today, Become 51st state.

Doesn’t seem reasonable.

-

1

1

-

-

On 1/30/2025 at 7:12 PM, Txzen said:

As always, Blancolirio is a great source of information.

Wow lots of great information but none of the common sense conclusions proposed in the press conferences.

-

1

1

-

-

9 minutes ago, Okie State said:

I've actually met more than one person who thinks HIV can only be contracted by gay people. Mind bottling.

You mean I didn't have to be nervous about getting it from a chick it back in the 80s-90s. Fuck.

-

1

1

-

-

Lol, FAFO Karen

-

2

2

-

-

Need to rule out drones

-

11 minutes ago, bolverk said:

I'm watching a local news station on YouTube. One of their reporters on the scene came across this oxygen tank about a 1/4-mile away from the impact site (they're saying it's a large debris field).

Also, the weather guy checked the temp readings about a 1/2-mile in elevation (max height at which the plane reached), and the temp was below freezing. So, they think that ice was likely NOT a factor.

As I was typing this, they read a quote from a city council person, there are mass casualties on the ground. Reports are that it's a gruesome scene.

Edit: Also, also the plane crashed only about 30 seconds after take-off, according to what the anchors just said. The flight was heading to Springfield, MO.

Good update but you meant above freezing. I would think the pressure zones around the wings would also have an impact so not just ambient temps.

I'm still waiting to see if they rule out a drone.

-

3

3

-

-

-

It caught on fire in mid air then crashed? Someone with common sense will tell us definitively what it was but maybe a drone? Doesn't look like a Boeing plane.

-

3 hours ago, elfenix said:

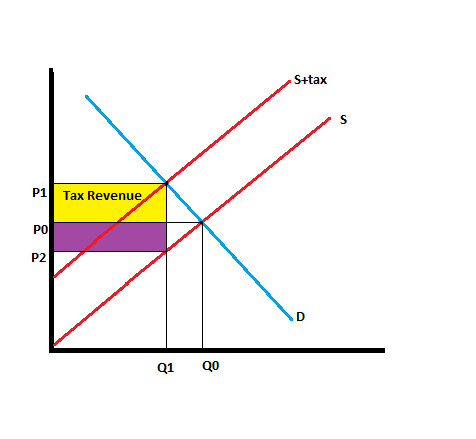

This isn't true except in very limited circumstances. Here's what happens:

in this chart the yellow portion is borne by consumers (they are paying p1), the purple portion is borne by producers (they are receiving p2), and the triangle to the right is the dead weight loss from sales that weren't made.

in this chart the yellow portion is borne by consumers (they are paying p1), the purple portion is borne by producers (they are receiving p2), and the triangle to the right is the dead weight loss from sales that weren't made.

There's no may about it. Quantity demanded is reduced except, again, in very limited circumstances.

Why, might you ask, are those circumstances limited? That's because if an increase in price (either due to supplier choice of the imposition of a tax) didn't reduce the quantity demanded, the supplier absolutely wasn't pricing as high as they could have. Now, while I'm not naive enough to think suppliers have priced their products for perfectly maximum profits, I do think most are in the ballpark.

Just think about it. If you have 100 widgets to sell, and you can sell every single one of them priced at $100, or you can sell every single one of them priced at $125, you're pricing at $125. That's the only circumstance where the entirety of a 25% tax could be passed on.

The key part that is left out here is when you have a mix of domestic (non-taxed) and foreign (taxed) suppliers that the demand goes up on the domestic sourced goods. This puts upward price pressure on the domestic goods without the tax revenue increase. The domestic goods are going to find an equilibrium price with the imports.

So your American made tires, California Avocados, US Timber are all going to go up too because those manufacturers will not be able to meet the market supply demands.

Add on top of that the tariff goes into the baseline price and then you have sales tax on top of it so you end up with 25% increase in price with another 2% sales tax (.25*.08) your 25% tarrif is really a 27% increase in consumer price.

-

5

5

-

1

1

-

-

1 hour ago, DixonHur said:

Sounds like it's time to adjust my international fund portfolio

Did this back in December.

-

1 hour ago, Incredulity said:

It’s abundantly clear what’s being demanded. I’d agree proving it’s been accomplished in 12 hours is no small task.

Making a condition proving a negative or absence of something is often a sign of a lack of critical thinking skills.

Prove to me no-one has hacked your computer system. Prove to me you didn’t intentionally put listeria in the Bluebell. Prove to me that his actions are not out of ignorance but malice.

-

2

2

-

Kyle Rittenhouse 2.0

in Cloak Room

Posted

Surly mathematicians, would you describe Kyle's path from fat nobody to celeb du jour back to bearded fat slob selling pew pews as regression towards the mean?