-

Posts

1566 -

Joined

-

Last visited

Content Type

Profiles

Forums

Store

Downloads

Recruiting - 2020

2019-2020 Football Season

Football

Entertainment

Sports

News and Business

Cloak Room

Transfer Portal

Recruiting

Events

Everything posted by UTGrad98

-

2024 Presidential Election Thread - Let's keep the party going.

UTGrad98 replied to bolverk's topic in Cloak Room

I wonder if she'll say the D word -

For as long as I can remember, I assumed the "smart" people always waited to take their social security at 67 or 70. Basically to wait as long as you can before starting to take it. That only suckers and the poors took social security at age 62. So many articles I have read over the years say as much. But now Im starting to question that. So first let's look at the break even age, not factoring in reinvesting the money. Generally, the break even age is in between age 80 and 81. Here is an excerpt from an article showing that: https://money.usnews.com/money/retirement/social-security/articles/how-to-calculate-your-social-security-break-even-age Calculating Your Social Security Break-Even Age You can find your break-even age by doing some calculations based on your age and benefit. If you wait to claim Social Security benefits until after your full retirement age, your full retirement age benefit would increase by approximately 8% per year for each year that you delay claiming (up to age 70). If you decide to claim early, you can expect to receive less than the full benefit amount. By claiming at age 62, for instance, the reduction will be about 30%. Perhaps your full retirement age is 67, at which time you qualify for a benefit of $2,000 a month. You decide to wait until age 68 to apply for benefits. This will increase your benefit by approximately 8%, which comes to $160 more ($2,000 x 0.08) each month, or $1,920 more each year ($160 x 12). By starting at age 67, you’ll have an annual benefit of $24,000 every year (not counting cost of living adjustments). If you start at age 68, you’ll have an annual benefit of about $25,920. “In general, the break-even point using different claiming ages is approximately age 80 or 81,” said Drew Parker, founder of The Complete Retirement Planner in the Seattle area, in an email. If you claim at age 67 with a benefit of $24,000 a year, you’ll have $336,000 by age 80 (after 14 years). If you claim at age 68 for $25,920, you’ll receive $336,000 by age 80 and 10 months (12.97 years). Note that these calculations are all estimated, as “the Social Security Administration calculates a reduced or increased benefit using your claiming age and the number of months before or after your full retirement age to determine a specific benefit,” Parker said. Say your full retirement age is 67, and you decide to take benefits at age 62. Your monthly benefit at full retirement age is $2,000, and it will be reduced by approximately 30%. You will receive $600 less each month (2,000 x 0.30), which means each check will be $1,400 ($2,000 - $600). You’ll receive $16,800 a year. By the time you reach age 81, you’ll receive $336,000 (20 years). These estimated calculations are available at The Complete Retirement Planner using its free Social Security calculator, or with more detailed information using the planning tool. Other factors I see here are family history, the persons current health, and the average life expectancy. Here is the most recent data on life expectancy in the US once you reach age 65. https://www.statista.com/statistics/266657/us-life-expectancy-for-men-aat-the-age-of-65-years-since-1960/ The life expectancy for men aged 65 years in the U.S. has gradually increased since the 1960s. Now men in the United States aged 65 can expect to live 17 more years on average. Women aged 65 years can expect to live around 19.7 more years on average. So the big take away here is how healthy are you and what does your family longevity history look like. Just going by the data, taking social security at 62 vs 67 vs 70 breaks even right around the life expectancy of a man once he reaches age 65 ( 82 years old). Now though let's say you actually wont need your social security and can just reinvest it. Now that break even number goes even higher. Here is an example of someone taking their social security at 66 vs 70 but reinvesting it at a 5% return. https://www.cbsnews.com/news/should-you-start-social-security-early-and-invest-your-benefit/ For my situation, there is a good chance my wife and I wont "need" all of our social security and so reinvesting it is a possibility for us. Im curious what others are doing as Im not as sure as I was when to start taking my social security.

-

I'm going to neg you and I'm going to neg you as hard as I can. You have 1 day.

-

I understand june and July were great so let's get that out of the way. What have you done for me lately. The 7 and 10 day keep getting worse and worse and now it's getting into my, fuck this bullshit, temp range. This morning is a sauna and I'm seeing mid 100s later this week with no relief in the 10 day to make me feel better. Fuck August.

-

2024 Presidential Election Thread - Let's keep the party going.

UTGrad98 replied to bolverk's topic in Cloak Room

His campaign should say he had a cold. -

-

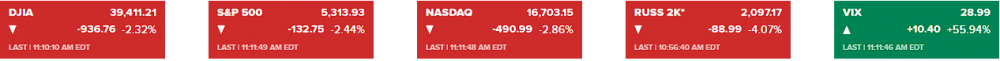

Someone please explain. What Im not understanding is how the VIX could get to 65 today and close at 38, something it hasnt done since 2020 pandemic and before that times like the dot com bust and great recession. It doesnt make any sense. Another thing that doesnt make much sense is how Japan's stock market can lose 17% in 2 days including 12% in 1 day. Is it all because of this "carry trade" and the BOJ raising rates 25 basis points? Or the fact that the Fed chose NOT to lower interest rates by a quarter point 4 days ago? Those take 9-12 months to take effect anyway. These dont seem like fear inducing catalysts to me. What am I missing here? The global markets were frothy and we are getting rid of some of that froth. Seems pretty standard. Why so much fear? Ill hang up and listen.

-

For today. It looks like we've bottomed for today

-

Yea 508 was the -10% from all.time high resistance level and I think it hit that in premarket trading. Damn premarket, always gets the cool stuff.

-

Pretty good bounce off of spy 510 so far.

-

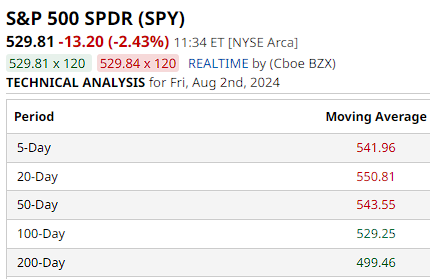

I think we bounce off the 200 day moving average. Stocks don't just fall straight down. And Japan has been following our moves from the day before the last 2 sessions.

-

200 day moving average for SPY is right at 500. Did not think we would get here so fast. If it goes below 500 and closes below 500 in the next few days, look out below. 450 and 440 are in play

-

-

Same. I looked in 2022 at my 401k and saw my bond fund was down 10%. Never been so furious in my life in terms of managing my money. You can throw a rock and you will see 60% stock 40% bond portfolio advice so I never put in the work to understand that a bond fund trades just like a stock does and can absolutely lose principal. Huge lesson. Never again. Bond funds can suck my dick.

-

Markets doing bad

-

-

-

Yea money is a good word too. People like money.

-

For those of you who like to day trade on the way down, the first truly big resistance points are 515ish for the fibonacci retracement of the 565 high and 351 low of the SPY and 508ish for the 10% correction. The initial 10% correction bounce in 2022 was one of the biggest just reviewing the notes I made. The initial 20% drop also had a big bounce back in 2022. The last 3 recessions had an average of a 41% drop. The more the merrier as far as I'm concerned as i will be trading at these levels like I always do.

-

This is just my opinion but I think the word 'stocks' or stock market is your biggest buzz word that would drive eyes and traffic and should be in the title somehow. I'm partial to 'Stocks and Business- let your nutz hang' but that's just me. You could go a step further and do something more youthful and say 'Stocks/Business/Crypto' for the young kids.

-

I think they are going to be late. Last 2 days have been blood baths with the data that has come in. Sahm rule triggered. Vix north of 20. Talk of a 50 basis point cut in Sept now. I remember an article I read 6 months or so ago which said when the fed starts cutting rates is when you should feel nervous not before. That will be especially true if they feel they are behind and have to cut 50 basis points for their first cut. It will basically be admitting a mistake.

-

Here comes.your traffic...

-

Do you FIRE? Financial Independence, Retire Early

UTGrad98 replied to UTGrad98's topic in Business and Markets

I'm a pharmacist so in regards to finding part time work it's much easier for me due to how my profession is. The only other type of profession I have a handle on is finance which is what my wife does and she says she will consult part time once she is ready. When I read about others who transition into part time work not in their field of study, they look for something that has part time benefits and low stress. One insurance option for us if neither can find work with benefits is ACA. We are a family of 3 with my wife and i both 49 years old and if you look at the ACA subsidy chart, we need to make less than 97k a year and we will receive a subsidy on our medical insurance. I think it comes out to $600ish a month as ACA states they can't charge you more than 7.8% or something close to that of your adjusted gross income per year for insurance. That is for the silver plan. ACA also works for us because with my wife being from Mexico she can navigate their health system so we have access to that as well which drastically reduces our cost burden. -

Do you FIRE? Financial Independence, Retire Early

UTGrad98 replied to UTGrad98's topic in Business and Markets

1. I usually work Wed and Thurs each week at 8 hours/shift. Usually once a month I only work once that week. And 2 or 3 times in this past year I took 2 weeks off for various vacations. I just got back from a 10 day trip to Mexico last week. 2. I prefer not to answer what our net worth is although I will say I rarely include my home equity as I don't place as much value in that because you have to live somewhere. I will say I went part time right when the math worked out to where a 5-6% average return / dividends meant we would never have to touch our principal amount in savings/401k and that we could live off only the returns. We are now 13% higher than that minimal amount now and that will continue to grow for at least the next 4-5 years which is why I think I wanted too long to do this. -

Do you FIRE? Financial Independence, Retire Early

UTGrad98 replied to UTGrad98's topic in Business and Markets

Imma wants some more discussion on the business board so I figure Id give everyone an update on my (sort of) FIRE status since it will be 1 year on Aug 12th since I quit full time work and went down to about 6-7 shifts per month. So far, so good. In fact, I still think I work too much. I rarely if ever get bored when I am off and I just feel so much less stressed. Sunday nights have been an absolute treat. I dont dread Mondays anymore. Sports are much more enjoyable, especially Sunday and Monday night football. Ive been working out almost daily since I stopped full time work and the video game my brother and I and best friend are creating is coming along (somewhat nicely). Financially, we increased our nest egg about 13% since August 2023. About 10% due to gains in the market and 3% in terms of money we put in. And this is with us being quite conservative in our stock/MM allocation. In fact, I am starting to believe I waited 1 or 2 years too long to make this move. Issues that I have overcome have been 1. not saving/putting nearly the same amount of money in Vanguard as I used to. I save a fraction of what I did BUT I have allowed myself to spend more on wants and other more frivolous things like a nice $1k gaming laptop that I never would have bought before. That was a mental hurdle I had to jump over. And 2. my wife getting used to me being home more. At first she kept questioning when I would go back to full time, but now she actually is put off when I go in to work because of all the stuff I do when Im home to help her out (groceries, taking/picking up up our kid from school, cleaning, general errands etc). I keep telling her she needs to go part time as well but she isnt there yet. She is getting closer however. All she needs is a job that makes her 25k a year as that is her yearly part of our household expenses. She absolutely can consult part time but whatever. I dont push too hard. My next change will be working less than I do now ( going down to 1 shift a week) while still increasing our nest egg each year, albeit much more gradual, The mental hurdle here is I will begin to actually take out a small amount of funds yearly. So far I have estimated that once I go down to 1 shift weekly, I will need to take about 7-8k a year to supplement. That is going to be a tough one for me and it is still most likely 2 years away before I make that move. All in all, no regrets what so ever. Well, I know now I waited too long to do this so that is my only regret. I hope some of you jump in soon. The water is nice and warm. Life is too short not to.- 526 replies

-

- 15

-

-

Football ... Basketball ... Baseball ... Other Sports ... Futbol ... 🤫995🤫 ... Gambling ... Movies & TV ... Music ... Hobbies ... Lulz ... Food & Travel ... Daily Texan ... Business and Markets ... Cloak Room ... Help ... For Sale ... Board Discussion ... Subscribe!... Donate!... COOKIE MONSTER!