Wulaw Horn

-

Posts

20423 -

Joined

-

Last visited

-

Days Won

2

Content Type

Profiles

Forums

Store

Downloads

Recruiting - 2020

2019-2020 Football Season

Football

Entertainment

Sports

News and Business

Cloak Room

Transfer Portal

Recruiting

Events

Posts posted by Wulaw Horn

-

-

7 hours ago, Celery Man said:

Ah ok - thanks for your help. Done this precisely once before (with Phil helping out) and am fairly stupid in this area (potentially others as well). I think I didn't quite understand exactly what you meant by contingency either (the contingency being on their end), so that is good to go understand better.

To verify my understanding of how things work - probably the right approach is to, once I have my ducks a bit better in a row, go through the preapproval stuff with all of them simultaneously in order to shop amongst the offers but not have the credit check dings affect them?

I wouldn’t get prequalified with all 4 of them- what a waste. I’d get prequalified by one of them - get my credit score and deal parameters, and ask the other three for their pricing. Tell them your credit score. They shouldn’t need a full application and credit pull to tell you what the cost to do your loan will be in general terms.

-

1

1

-

-

5 hours ago, aggie08 said:

A coach can only do a good job when he has really good players and is competing for the Finals. Got it.

I was a great soccer coach in high school when I had a high D1 player on the team and we went to the playoffs. When she graduated and I had a bunch of scrubs I forgot how to coach completely and we finished bottom of the district. Overnight I went from good coach to bad.

-

42 minutes ago, Trey3216 said:

This is what it was. Seems it was the Big XII rules that cancelled the game. A Baylor trainer is the one who tested positive, and they were the trainer that works specifically with OL, DL, and LB’s, meaning all of those kids would have to quarantine since they contact traced to that trainer. Never mind that they have been tested all week and are negative.

they fell below the conference threshold for competitively fielding a team, even though the players haven’t tested positive. Unreal

Thanks for the explanation. Can we go ahead and ducking fix this? Before conference play?

-

1

1

-

1

1

-

-

Christian Laettner was far and away the best college player of my lifetime (born in 78) and it's really not close. I fully expect he will be the last great player in college basketball history and if I live to be 100 I won't see him supplanted as the greatest college player of my lifetime.

All that said- I would assume Walton was a better college player than him since everyone stayed 4 years, he basically didn't lose, level of competition was much higher (relative to the time with no early defections- post glory road Texas Western etc) and that seems to be the general consensus of every single person who watched them both play.-

1

1

-

-

1 hour ago, Don Johnson said:

This new narrative is funny. The Big 10 didn't wait on jack shit. They cancelled their season on August 11. There is one conference that didn't overreact and cancel early, yet also didn't damn the torpedo's and play Labor Day weekend like everyone thought they would. They waited a few weeks see how the NFL and other conferences would do before starting. But no one can give them credit for that, because they are the redneck villains. But we can act like the Big 10's plan was soooo smart.

His twitter profile picture makes me want to split his head open with a sand wedge.

-

4 minutes ago, Tuco said:

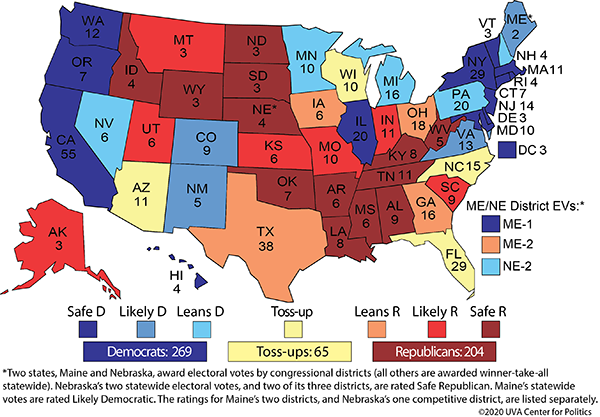

Did you think he was saying Ohio would remain undecided in the final tally?

No of course not. But coloring a map in in different colors is serious fucking business man, ok? You don't just go off making half cocked decisions like- I'm going to color PA in for the GOP and leave Ohio as a toss up- that either side could plausibly win.

-

1

1

-

-

32 minutes ago, SydneyCarton said:

So you should just have stuck to the original, and per you obvious, premise that PA went pink and OH went red? This is a weird fucking thing for you to be pedantic about. The guy fucking played with the map to make it that way and you're pissed he didn't flip Ohio too?

Yes. There is no world in which PA is a pink state and Ohio is a toss up. It's non sensical. It's a moo point. Like what a cow says. I like my maps to have some overall logical consistency with how the world works and not a bizarre mash up of random electoral vote totals to try to get to a point. OH is a state with a red tilt of like 5. PA is a state with a blue tilt of 3. They are located next to each other so there's not some weird thing where you could have a candidate appeal to some odd regionally diverse candidate.

So, when you make a map that has PA being won by a republican there is NO FUCKING WAY you should have neighboring Ohio as a toss up, b/c such a universe doesn't exist.

-

5 hours ago, jkates said:

I love Framber.

I miss our bats.

Yeah man, it's something. They all (other than Yordan, Tucker and Brantley) caught a case of the suck at the same time, and then Yordan got hurt. Nobody on the team over 900 ops. Almost nobody over 800. Nobody on any leaderboards other than Tucker probably.

I haven't watched us much and I've watched everyone else for a total of about 5 minutes- is offense down all over the place, or is this an us thing?

-

57 minutes ago, BehoId, The Underminer! said:

The premise is that Trump wins all the gold (toss up) states. So in that map he wins PA and OH.

I’m aware. But the fact that this is listed as a toss up but PA is pink implies there is a world where PA goes for trump while Ohio goes for Biden. Such a thing will not happen.

-

1 minute ago, jimmyjazz said:

Yeah, that has nothing to do with what I saying, but thanks for the input.

I wasn't calling you a bedwetter btw, I was using your post as a jump off point for everyone on here who is concerned about all sorts of things in this election being possible harbingers of doom for team blue. I understand what you are saying. What I'm saying is that you are wrong. People want to be a part of a greater story, and people want to be on the winning team. Hearing massive amounts of people are voting in this election and they are doing it to oust Trump is going to raise support for Biden not lower it. It will be a positive feedback loop where results feed on themselves.

We've seen this story already in 2018. It was a skull fucking. Since then we've got 200k dead and a tanked economy to add to the list of things people bitch about in regards to Trump, along with a general sense that America is turning into a tire fire. Those are all data points that work strongly against him.

It's become like Bill in Sinton posting about maintaining focusness against UTEP b/c once upon a time they were tied with UT after a quarter and a half 48 years ago. Embrace the mudhole. That's what's coming.

Again, this is a jumping off point for general board fear and loathing. Not necessarily aimed specifically at you (other than the back half of the first paragraph).

-

43 minutes ago, jimmyjazz said:

It's that difficult for you to imagine people who might have otherwise voted decide their vote is no longer needed?

Every study I've ever seen from economists who do this shit for a living says that you want to be the front runner and people are going to band wagon along with you in greater numbers than go out determined to vote for the other guy. This is just bedwetting worries from people who aren't viewing this rationally.

-

1

1

-

-

52 minutes ago, thepop said:

I always felt that voting should be limited to the educated, but apparently that's frowned upon.

Literacy test and poll tax for the win, right? Right?

-

1 hour ago, Gap03 said:

Another high quality poll showing Biden with a steady lead. Interesting breakout here. Fucking white evangelicals ...

Suburbs Biden +16? I don't know about that. That seems a little high to me, but maybe. If that number is correct then the election isn't close it's a rout, and Texas and GA probably flipping, along with of course rust belt, AZ, NC, Florida etc.

-

-

6 minutes ago, tantric superman said:

My wife (on the attractive scale, about the median) makes a mean peach cobbler a la mode.

Out of rep. If you married one that's way hotter and way uglier then she could also be your median wife, as well as just median on a general attractiveness scale...

-

13 minutes ago, Fudge Nuggets said:

This is all kinds of wrong. Thank God you gave up on being a teacher before you could corrupt an entire generation of kids.

Explain. Those examples all perfectly fit definitioins of mean, median and mode bro. 30/5 is 6- mean

3, 5, 5,5, and 12 you drop the first two numbers and the last two and the one in the middle is median- 5.

Mode is most frequent- which definitionally fits my last sentence. What the heck are you talking about bro?

-

Who you gonna call and whatcha gonna do with that phone?

-

-

Yeah I want no part of that anywhen if I’m stuck there.

go with rolling in Jesus posse I guess. -

13 minutes ago, Pescado_Rojo said:

Nope. I'd just gotten off the crazy train with a girl that tried to throw a Weber Kettle with a load of still burning charcoal through my sliding glass patio door.

You've lived a more interesting life than I. I've only had sex with 2 different women and married to both of them (consecutively not concurrently) so I like to live vicariously through others from time to time with stories about insane women.

-

3 hours ago, crimsonlonghorn said:

Amazing how all the theater evaporates when people finally get tired of playing along. Same thing is happening with the masks. More and more people are saying, "naaaahhh".

Hook em to the first part. I've seen zero evidence of the last part. In fact, anecdotally I've seen mask usage increase over the past couple months as opposed to decrease.

-

20 minutes ago, The Dog said:

So we now have recent polls from three heavily R districts (TX-3, TX-21, and TX-31) that show Trump and Biden basically in a dead heat in those districts. TX-3 is Biden +3, TX-21 is Biden +2, and TX-31 is Trump +1. All three districts are rated as R +10 or higher by the Cook Political Report.

Very interesting. Wish there was more Texas polling so we could see how real this is.

And something other than Texas internals. But, basically if those are right Biden's probably going to win Texas. Note, I don't expect Biden to win Texas and I don't think those polls are correct- but I'm not going to dismiss them out of hand.

-

9 minutes ago, BehoId, The Underminer! said:

Sobato just moved NE2 to lean D, which would be v v cool.

Look- 269 v 269 would be really really really bad for the country. I can't even stress how much this would bum me out. In that scenario you could see NC, Florida and AZ all moving together and Trump carrying those, but that's best case scenario. Don't see him winning Wiscky. So, Trump's upside, in my mind is 259 electoral votes. I still see this as Biden at like 330 ish to trump at 200 ish. Which makes it look basically exactly like the Clinton 2 terms and the Obama 2 terms.

-

- Popular Post

- Popular Post

1 minute ago, Sbbruin said:was @Wulaw Horn at the helm of that thing?

Choo choo motherfucker!

-

12

12

-

3

3

-

1

1

All Encompassing Mortgage and Real Estate Thread

in Business and Markets

Posted

I should add (and other lenders can agree or disagree with me here is live their perspective) I dont think this is a dick move. I’d much rather a potential borrower tell me his verified credit score, purchase price, down payment and ballpark dti and ask me what I can do for him than get a prequal concurrent with 3 other lenders. That’s 5 minutes and no money from me on the phone. A prequal with a 1/4 shot is more of my and my teams time than I’d want to devote right now.

more- you could just post his quote to the board (rate, any discount points, origination charges) and we could tell you if it’s a good deal or if you should keep shopping. Then you don’t even have to call the other 3 yahoos.