Everything posted by ImNotMarkinson

-

Cam Newton: most racist place I’ve seen

yeah, quite the mystery

-

Nerdsplaining Movie Plot Holes

that's interesting. you think boggs from shawshank was a rat too?

-

Post a pic that makes you lol

boss's

-

Shane Gillis

i hope someone has some crisis of conscience over this and ends up doing something interesting with it. maybe spoof the censorship rules by doing a whole set like Norm's roast of Bob Saget being ultra G rated puns and other weak stuff. or maybe make fun of Saudi government by pretending it is someone else they are talking about: "don't you hate it when they dismember journalists in . . . uh . . . england?"

-

Shane Gillis

I sorta feel different about the Saudi thing. US was big on exporting its culture through Hollywood for the last 100 years. I think its good for us as a country to do this.

-

Michigan Church Burning/Shooting - 1 Dead

Sorry about this and I hope you don't feel targeted. I doubt we will ever know why he did this. There is no result to "hope" for, as far as uncovering a motivation. My only suggestion is that anyone telling you why they think he did this is likely telling you what they want to convince others is his motivation, for whatever their own purposes.

-

Texas Rangers 2025-2026 Offseason

Kumar on opening day roster?

-

It's Fat Bear Week!

risky click of the day

-

Charlie Kirk Assassinated [Shooter in custody]

i just watched it and now it is at 9,900,001. so it definitely registers.

-

Random thoughts that don't warrant a thread

all the tylenol talk right now gives me tired head. we have brain worms on one side arguing X. we have half wits on the other side arguing Y. it's very clear that 99% of the voices out there talking about this have an IQ of 85 and no medical training. it's just a waterfall of false analogies, intentionally misrepresenting positions, statistical illiteracy, 'brave' stances, whatever else performative politics, none of which has anything to do with the merits of anything. as i type this beef, it seems like i'm just describing the world we live in for everything. but this particular topic the arguments and evidence people are relying on seem so facially dumb that it feels worse than the typical topic now.

-

Русский корабль - иди нахуй

load up those transports NOW. ship those weapons before he changes his mind.

-

Gotdammit I Just Got Scammed

true story: local school got scammed out of about half a million dollars. dude up in the DFW area buys a lambo with it or something. feds catch him. female school superintendent has to go the trial to testify because his defense is it was it wasn't fraud, it was payment for sexual favors.

-

401k question

Didn't really pay attention to my 401k investment. it was automatically invested in something called "Fidelity Freedom Index 2045." Start looking at it last year. Here's how it compares to the S&P 500. Year Fidelity Freedom Index 2045* S&P 500 Total Return Difference (Fid vs S&P) 2020 +16.42 % +18.40 % Macrotrends+4SlickCharts+4SlickCharts+4 Fid −1.98 pp 2021 +15.95 % +28.71 % SlickCharts+2Macrotrends+2 Fid −12.76 pp 2022 −18.24 % −18.11 % SlickCharts+2Macrotrends+2 Fid −0.13 pp 2023 +19.90 % +26.29 % SlickCharts+2Macrotrends+2 Fid −6.39 pp 2024 +14.16 % +25.02 % SlickCharts+2Macrotrends+2 Fid −10.86 pp I talk to the Fidelity and say "what the fuck is this thing? it's worse than just getting something that tracks the S&P by a mile?" have to listen to some idiot tell me how sophisticated it is. i politely nod and immediately go mid-year last year to change my investments. i can invest in stuff that just tracks the S&P500. Start putting everything into that. Investment YTD Return as of Aug 13, 2025 Fidelity Freedom Index 2045 ~ +15.63 % StatMuse+1 S&P 500 (Total Return)** ~ +9.9 % AP News FUCK! GODDAMMIT

-

Dumb Question Amnesty Thread

there are deep cuts and shallow cuts. in the latter, they basically don't shave topsoil off. it's all organic matter. quick growth of the grass starting with left-behind root structure/runners, lots of fertilizer, lime means constant regrowth so there is plenty of new organic material to decompose and make new soil to replace what little is lost. constant cover means that wind doesn't get to erode it either. for stuff with deep cuts, they have the exact problem you are saying. you can't keep regrowing there. it's for projects when you need to bring in the soil because you are planting on something that sucks. but you're strip mining the farm.

-

2025 Texas Volleyball - Locked and Reloaded

i like that they picked the most boring photo to promote it too.

-

Markets still falling like whoa

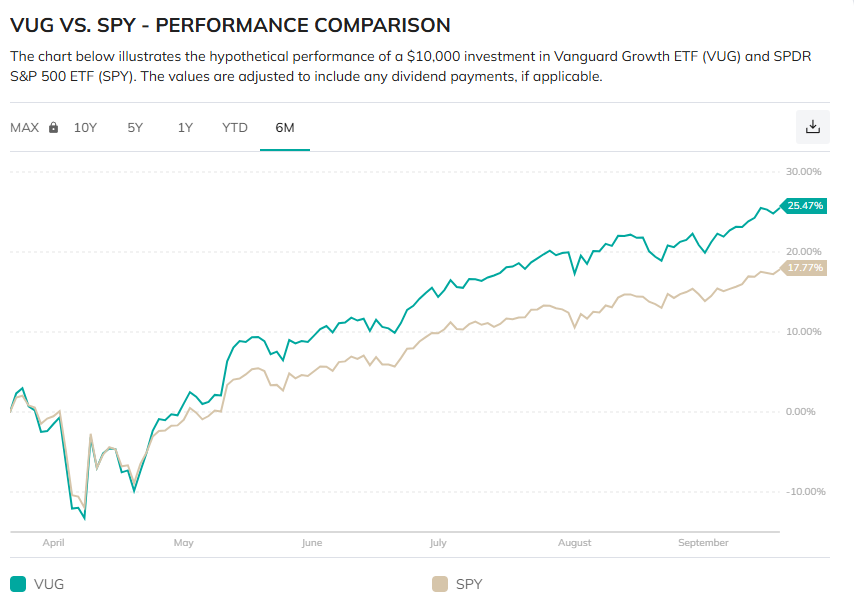

My VUG vs. SPY (life in an oligarchy) theory continues to hold water. So much wealth is piled at the very very top. "I wish I woulda" talk is the lamest in stocks, but I left a lot on the table by only moving about 10% of my SPY to VUG. If I had the courage of my convictions I would have done 50%.

-

Aggy President resigns…

- Charlie Kirk Assassinated [Shooter in custody]

the unstated premise is "have you not read the regulation that overruled the constitution?"- 2025 Texas Volleyball - Locked and Reloaded

damn, pitt. you scary. you can lose stafford and still be a top 4?- Charlie Kirk Assassinated [Shooter in custody]

accidentally accurate- Markets still falling like whoa

the tariff analysis i saw was that the US companies were bearing 2/3rds of the increase, the foreign manufacturer 1/6 and the consumer 1/6 (i.e., inflation).- Charlie Kirk Assassinated [Shooter in custody]

i don't know if there is any conclusion to it. it's not like i have any doubt about the dude's guilt. the argument that the texts aren't real is pretty compelling to me though. so rarely does evidence look exactly like something from a self-incrimination-by-numbers kit. it is just weird. HI SWEETIE WHAT ARE YOU DOING? DEAR LOVE, NOTHING. JUSTSTANDING NEXT TO A NOTARY DISCUSSING MY VIOLATION OF THE AGGRAVATED MURDER STATUTE UNDER UTAH LAW- Charlie Kirk Assassinated [Shooter in custody]

if it means anything, i love you.- 2025 Texas Volleyball - Locked and Reloaded

Spears getting this good this quickly is bad news for the rest of the country.- Charlie Kirk Assassinated [Shooter in custody]

(2) (a) An actor commits aggravated murder if the actor intentionally or knowingly causes the death of another individual under any of the following circumstances: (i) the actor committed homicide while confined in a jail or other correctional institution; (ii) (A) the actor committed homicide incident to one act, scheme, course of conduct, or criminal episode during which two or more individuals other than the actor were killed; or (B) the actor, during commission of the homicide, attempted to kill one or more other individuals in addition to the deceased individual; (iii) the actor knowingly created a great risk of death to another individual other than the deceased individual and the actor; (iv) the actor committed homicide incident to an act, scheme, course of conduct, or criminal episode during which the actor committed or attempted to commit aggravated robbery, robbery, rape, rape of a child, object rape, object rape of a child, forcible sodomy, sodomy upon a child, forcible sexual abuse, sexual abuse of a child, aggravated sexual abuse of a child, aggravated child abuse as described in Subsection 76-5-109.2(3)(a), child torture, or aggravated sexual assault, aggravated arson, arson, aggravated burglary, burglary, aggravated kidnapping, or kidnapping, or child kidnapping; (v) the actor committed homicide incident to one act, scheme, course of conduct, or criminal episode during which the actor committed the crime of abuse or desecration of a dead human body as described in Subsection 76-5-802(2)(d); (vi) the actor committed homicide for the purpose of avoiding or preventing an arrest of the actor or another individual by a peace officer acting under color of legal authority or for the purpose of effecting the actor's or another individual's escape from lawful custody; (vii) the actor committed homicide for pecuniary gain; (viii) the actor committed, engaged, or employed another person to commit the homicide subject to an agreement or contract for remuneration or the promise of remuneration for commission of the homicide; (ix) the actor previously committed or was convicted of: (A) aggravated murder under this section; (B) attempted aggravated murder under this section; (C) murder, under Section 76-5-203; (D) attempted murder, under Section 76-5-203; or (E) an offense committed in another jurisdiction which if committed in this state would be a violation of a crime listed in this Subsection (2)(a)(ix); (x) the actor was previously convicted of: (A) aggravated assault, under Section 76-5-103; (B) mayhem, under Section 76-5-105; (C) kidnapping, under Section 76-5-301; (D) child kidnapping, under Section 76-5-301.1; (E) aggravated kidnapping, under Section 76-5-302; (F) rape, under Section 76-5-402; (G) rape of a child, under Section 76-5-402.1; (H) object rape, under Section 76-5-402.2; (I) object rape of a child, under Section 76-5-402.3; (J) forcible sodomy, under Section 76-5-403; (K) sodomy on a child, under Section 76-5-403.1; (L) aggravated sexual abuse of a child, under Section 76-5-404.3; (M) aggravated sexual assault, under Section 76-5-405; (N) aggravated arson, under Section 76-6-103; (O) aggravated burglary, under Section 76-6-203; (P) aggravated robbery, under Section 76-6-302; (Q) felony discharge of a firearm, under Section 76-11-210; or (R) an offense committed in another jurisdiction which if committed in this state would be a violation of a crime listed in this Subsection (2)(a)(x); (xi) the actor committed homicide for the purpose of: (A) preventing a witness from testifying; (B) preventing a person from providing evidence or participating in any legal proceedings or official investigation; (C) retaliating against a person for testifying, providing evidence, or participating in any legal proceedings or official investigation; or (D) disrupting or hindering any lawful governmental function or enforcement of laws; (xii) the deceased individual was a local, state, or federal public official, or a candidate for public office, and the homicide is based on, is caused by, or is related to that official position, act, capacity, or candidacy; (xiii) the deceased individual was on duty in a verified position or the homicide is based on, is caused by, or is related to the deceased individual's position, and the actor knew, or reasonably should have known, that the deceased individual holds or has held the position of: (A) a peace officer; (B) an executive officer, prosecuting officer, jailer, or prison official; (C) a firefighter, search and rescue personnel, emergency medical personnel, ambulance personnel, or any other emergency responder; (D) a judge or other court official, juror, probation officer, or parole officer; or (E) a security officer contracted to secure, guard, or otherwise protect tangible personal property, real property, or the life and well-being of human or animal life in the area of the offense; (xiv) the actor committed homicide: (A) by means of a destructive device, bomb, explosive, incendiary device, or similar device which was planted, hidden, or concealed in any place, area, dwelling, building, or structure, or was mailed or delivered; (B) by means of any weapon of mass destruction; or (C) to target a law enforcement officer; (xv) the actor committed homicide during the act of unlawfully assuming control of an aircraft, train, or other public conveyance by use of threats or force with intent to: (A) obtain any valuable consideration for the release of the public conveyance or any passenger, crew member, or any other person aboard; (B) direct the route or movement of the public conveyance; or (C) otherwise exert control over the public conveyance; (xvi) the actor committed homicide by means of the administration of a poison or of any lethal substance or of any substance administered in a lethal amount, dosage, or quantity; (xvii) the deceased individual was held or otherwise detained as a shield, hostage, or for ransom; (xviii) the actor committed homicide in an especially heinous, atrocious, cruel, or exceptionally depraved manner, any of which must be demonstrated by physical torture, serious physical abuse, or serious bodily injury of the deceased individual before death; (xix) the actor dismembers, mutilates, or disfigures the deceased individual's body, whether before or after death, in a manner demonstrating the actor's depravity of mind; or (xx) the deceased individual, at the time of the death of the deceased individual: (A) was younger than 14 years old; and (B) was not an unborn child. - Charlie Kirk Assassinated [Shooter in custody]

Football ...

Basketball ...

Baseball ...

Other Sports ...

Futbol ...

🤫995🤫 ...

Gambling ...

Movies & TV ...

Music ...

Hobbies ...

Lulz ...

Food & Travel

...

Daily Texan ...

Business & Markets ...

Cloak Room ...

Help ...

For Sale ...

Board Discussion ...

Advertise...

Tailgate Donations

Back to top