Wulaw Horn

-

Posts

18359 -

Joined

-

Last visited

-

Days Won

2

Content Type

Profiles

Forums

Store

Downloads

Recruiting - 2020

2019-2020 Football Season

Football

Entertainment

Sports

News and Business

Cloak Room

Transfer Portal

Recruiting

Events

Posts posted by Wulaw Horn

-

-

Well, we didn’t need to play shit defense behind the kid.

not against this lineup. -

No sweat seems weird to me.

-

1 hour ago, tx 3 putt said:

you never know, but I love he’s a local kid. Can he play first ??Does he own a glove?

-

1 hour ago, UTPhil2006 said:

Isn’t that what you wanted?

It’s sort of funny in an absurdist kind of way.

id like a range between 4 and 6 throughout the course of a year or two (or bussiness cycle). That seems healthy.-

2

2

-

-

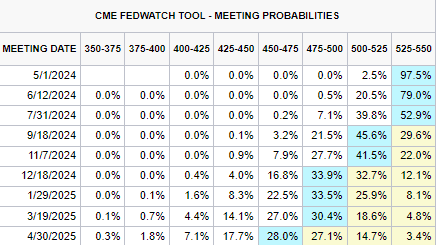

The update this morning was grim

down 53 bips.

Star pattern has broken.

all support levels are broken.

No rate cuts coming until maybe September at the earliest.

look out below! -

5 minutes ago, Chuckie Finster said:

No idea if he's gonna be any good, but I can confidently say there aren't many 18 year olds built like this.

That was their 11th round draft pick. That means they like him. Those are the guys they think are first and second round talent that are tough signs.

-

1

1

-

-

Down 40 in the mbs market to start the day. Yeeeeee Haaaaaaaaaw.

retail sales came in hot. Or maybe it’s the shooting war between Iran and Israel. -

10 minutes ago, tx 3 putt said:

Astros Hitters by wRC+ (>20 PA)

1. Jose Altuve (217)

2. Yordan Alvarez (190)

3. Kyle Tucker (156)

4. Yainer Díaz (146)

5. Jeremy Peña (139)

6. Jake Meyers (114)

7. Jon Singleton (103)

8. Alex Bregman (89)

9. Chas McCormick (87)

10. Mauricio Dubón (76)

11. José Abreu (3)Abreu misses maldy. Maldy made him look good.

Maldy’s slashing 069/100/103Dusty baker should be horsewhipped for the shit he subjected us to last year.

-

1

1

-

-

50 minutes ago, Storm the Field said:

So tempting to call him up right here, right now, but I wince when I see that K rate in AAA (22K in 54 AB).

Yes- you cannot survive in the bigs with a 35% k rate. He needs to get that down to like 25-28% to be effective at all. He’s not got crazy power or plate discipline for a big league dude.

hopefully soon. Like June 1st or July 1st we start to see that.-

1

1

-

-

We are 5-11. That sucks.

to win 90 games (which is a guarantee for playoffs and probably will win the division) we have to win at a 58% clip.

Thats a 94 win team which was our Vegas o/u. Nothing is fucked.

Get some guys healthy in the rotation and the back end of the bullpen already looks like it’s settled down and we are who we thought we were.

Might want to split the next 4 against the Braves and rangers.-

1

1

-

-

7 hours ago, Muny_Tex said:

@Wulaw (et al), any risk of these forward-seeking Refi's potentially getting derailed by short appraisals? I don't know anything about HOU market, but I would imagine there's quite a few people in CenTex that bought in past 18-24 months who are underwater-ish right now (and seemingly getting worse, depending on their 'hood + price point).

That said, true market value not always reflected in appraisals, espec when it it seems (anecdotally) like the trend overall has been to err valuations in favor of buyer/borrower; at least since prices starting exploding in Summer of '21.

On related note, as someone in the "higher for longer" camp, I tend to think the only thing that would really force the issue w.r.t significant rate cuts would be an undeniable recession with corresponding surge in unemployment. Under that scenario, I could see prices dropping quicker + further as 2nd homes, rental investors, + Airbnb'ers (of which there are many in TX) find themselves in liquidation mode. I also would imagine a lot of hopeful refinancers would be DQ'd if they no longer have the jobs/income stability to pass underwriting...which may compel those same people to sell the houses that they can no longer afford.

All those things could happen, sure, and a recession will definitely drive down interest rates and values both (at least almost always that’s what happens) which should make housing more important.

a couple things to note regarding value as it pertains to refinance:1) the houses with the least equity are Va and FHA loans, and refinance in those properties don’t require appraisals, merely paying on time 6 months in a row qualifies you for an appraisal-less Refiance

2) Conventional homes require merely to see 5% equity- starting point on the vast majority of homes is much higher than that

3) the best comp for a house generally is the purchase price of that house- it’s likely as you mentioned appraiser will err on the side of the borrower

4) the last time this became a systematic problem post 2008 market crash the government rolled out a program to allow this to happen- I’d expect similar here and it makes sense- if the original loan is backed by Fannie/Freddy no reason not to make a new easier to pay loan also so backed- it’s smarter than letting it default

recessions mean unemployment rate around 10 typically, right? So 2X as many people unemployed as currently I would submit that as minorities and poor are disproportionately hit by recessions, and least likely to own homes it’s unlikely that this would create a large group of homeowners wanting to refinance that cannot- especially in light of point 1 made above- but we shall see

A recession not caused by housing is generally good for housing in the above sense

-

1

1

-

-

We are 3-1 when I get to watch on TV. Was out of town for the Yankee sweep and the Royals sweep. I’m going out of town Tue-Thursday- prepare your bets accordingly.

-

1

1

-

-

3 hours ago, Wulaw Horn said:

Cy Blanco got the ball today. All is well with the world. First day of the rest of our lives.

See. Now go win again tomorrow.

-

1

1

-

-

Cy Blanco got the ball today. All is well with the world. First day of the rest of our lives.

-

-

On 4/11/2024 at 7:47 PM, Neonmoon said:

Person calls me Tuesday late asking to be pre approved fast as dream house has multiple offers. Etc. I drop everything and get it done within an hour. They got the house. CPI hits. Now they say rates are too high and went shopping and found an online lender willing to give them an 1/8 better. The aristocrats.

Some people suck. 1/8 of a point is a lousy jump off point man. I don’t blame anyone over 1/4. What sucks is they probably shopped your deal over to them and told them beat by 1/8 and we are good. Which/ cool- of you know you are going the lowest route go the lowest route and get with them from the word go, don’t go get everything sorted with you and get white glove service and then fuck you in the ass over a couple bucks. I mean, I’m sure there’s people on here that will consider what they did to be perfectly right and justifiable, but it’s a really shitty way to live and for your sake I hope they get fake cancer and die.

-

2

2

-

-

Just now, UTPhil2006 said:

The reverse jinx isn’t working

I"m not actually going for the reverse jinx. I'm just trying to condition myself to this mindset and not worry about rate at all making my life easier b/c the hope is killing me. Kill all hope and just deal with the suck and figure it will put more people out of business, get more market share and create a bigger refinance boom and more robust market when things finally break loose. Have to embrace environment instead of pining for a different one. Trying to find reason for optimism or a good step forward.

-

3 minutes ago, LCHorn said:

I wonder if Dana might be better for a rebuilding team. I think I’m stealing this from @Wulaw Horn but maybe he’s not a war-time consigliere.

That was me!

-

59 minutes ago, Neonmoon said:

This is going to be so funny when we get a 50 basis hike in July. I'm here for it baby. I'm tired of waiting expectantly- just lean into the suck. The ride will be that much more glorious on the way back down. Yeeeee haaaaaw.

-

1

1

-

-

23 minutes ago, Make em eat Taco Bell said:

it's not about 2017-2023, but 2024 where the whining so far has been justified particularly because of the 1B , bullpen, and the perma-decline of Bregs. Pitching injuries matter a lot but when 3 or 4 hitters are worthless every game, that's a major concern.

Bregs starts like shit every year and ends up a 4 WAR player. Same as it ever was.

-

1

1

-

-

12 minutes ago, Macklemore said:

I thought you’d be on the plane crashing in the mountain team like myself, @Mitch Hedberg and @cabowabo considering the foundation is crumbling with the piss poor performances by Espada and Dana and gutting of the analytics department.

Look at the lineup. They are performing 20% better than average and that’s what you’d expect for the year/ that’s really good. The sequencing will come.

we’ve got a bunch of guys that we know are good on the IL right now that should come back, and are getting good stuff from some guys that are surprising. It will be a really good staff.

I’m not worried about what everyone though would be the best back end of the pen in baseball 2 weeks ago.

it’s fine. This year. I’m nervous in the intermediate to long term because no Luhnow.

-

1

1

-

-

Burn baby burn. Started the day up 14! Now down 10 with a reprice for the worse. Let’s see how shitty we can get. Bring back 8 like we saw in October for a bit.

-

8 minutes ago, UTPhil2006 said:

At least there’s Masters coverage to flip over to when we’re down 4-0 by 1:30 today

Weather delay and late start. Will be a shitshow there.

also- yall are being silly. This is a good team w good team that has things going against them right now.

we will be fine.-

1

1

-

-

29 minutes ago, UTPhil2006 said:

Definitely location sensitive, but the lower level buyers are getting hamstrung by rates and other outside forces, whereas higher level buyers and homes, while there are fewer of them, are generally less concerned about rate and/or qualification

Also when they sell they have appreciation from their purchase and plenty for downpayment, obviously.

-

1

1

-

Houston Astros 2024 Season Thread

in Baseball

Posted

Fucking fuck.