Football ...

Basketball ...

Baseball ...

Other Sports ...

Futbol ...

🤫995🤫 ...

Gambling ...

Movies & TV ...

Music ...

Hobbies ...

Lulz ...

Food & Travel

...

Daily Texan ...

Business & Markets ...

Cloak Room ...

Help ...

For Sale ...

Board Discussion ...

Advertise...

Tailgate Donations

-

Posts

1223 -

Joined

-

Last visited

Content Type

Profiles

Forums

Store

Downloads

Recruiting - 2020

2019-2020 Football Season

Football

Entertainment

Sports

News and Business

Cloak Room

Transfer Portal

Recruiting

Events

Everything posted by PTINS

-

That is a sad graphic. Texas is ~ 25th percentile in "Yards before contact" and ~ 27th percentile in "Yards after contact". Over all, Texas is one of the 10 worst non-QB rushing teams in the country. Only 3 SEC teams in the top quartile of either speaks well of SEC defenses, I think. Both UTSA & Texas State punching above their weight.

-

Glide path similar to a rock. The guys lucky it cleared the window,

-

That is a complex question. "Phasing out" is a price sensitive term, and human nature generally means anybody will do anything for the right price. Putting the LNG "sanctions" aside, at the end of the day, a spot cargo of Russian LNG will be cheaper than others, simply because the transit time from Russia is less than the US Gulf Coast, or the Middle East, or Australia. The capacity of the two Nordsteam Pipelines was ~ 10 BCF/day, which is ~ 4-5 world class LNG Plants. That is a big hole to fill. Russia's total LNG capacity is ~ 5 BCD, some of which was earmarked for Europe. Some of these came on line recently, in the Arctic and St. Petersburg, and how much they can actually produce is kind of a mystery. It is new enough, and given the challenges of the arctic, and Russia business in general, demonstrating reliability is a prerequisite for longer term contracts. In many cases, the companies/countries that need the LNG are also owners in the liquefaction/export facilities, so they take their ownership share of the LNG in-kind, rather than depending on third party sells. LNG is a very different animal than oil or refined products. In some cases, though there is a point to point "contract" for the LNG, that contract is in limbo until the ship docks at the destination. In times past, it was commonplace to have a ship change direction in transit and go to another destination, without any significant contract repercussions. While on the high seas, it is fair game for the highest bidder. Even within the local gas market, that information is closely guarded, because a huge influx of gas moves the market. US LNG costs will become more expensive, because the underlying demand for natural gas will increase. In the early 2000's, gas was expensive, so the US started building LNG import terminals. The Chenier Plant at Sabine Pass started as an import terminal in 2008. We received LNG imports into Louisiana ~ 2010 (I think we received 4 cargo's), and in 2012, Chenier received a FERC permit to building export facilities. The combination of horizontal drilling and hydraulic fracturing of shale, unlocked the gas resources, and all bets changed. Biden's election in 2020 changed the narrative, and Russia's Invasion and Nordstream's explosion spiked gas prices, for a bit. The Donald, and new reality of the US stepping in to fill the European void from losing Russian gas is not an issue from a resource/capacity perspective. The price of the LNG is the first big question. Domestic gas prices have doubled in the past few months. Cheap oil stops the drilling in the Permian, which is primarily based on oil economics. Appalachia is all gas, much higher near term gas potential than the Permian, but moving gas south to the Gulf Coast is limited by pipeline capacity. Sending US LNG gas to Europe while increasing domestic gas prices is going to leave a mark. The Eastern US is already seeing increased gas bills because of administrative and infrastructure costs. Layering in higher commodity prices will not be well received. And, as we all appreciate, the whims of a new administration in DC, is hard to predict.

-

Critical infrastructure is not designed to be war proof. A single drone with a grenade is a scary thought. Yes, I understand and support Ukraines targeting of Russian O&G export infrastructure to cripple the war machine. But longer term, removing 10% of the world oil production, and the closest source of natural gas to Europe, is going to have longer term effects, on everyone. The coupling of war reparations and lifting of sanctions is going to be a thorny issue that will take time.

-

"Overnight on 4–5 December, Ukrainian long-range drones reportedly struck the gas terminal at Russia’s Temryuk port on the Sea of Azov, just across the Kerch Strait from occupied Crimea. Russian regional authorities themselves confirmed a UAV attack and subsequent fire that damaged port infrastructure, while videos from the scene show large fuel fires and secondary detonations. Open-source analysis indicates the blaze centered on a gas terminal used for liquefied petroleum gas (LPG), with OSINT accounts suggesting that a nearby Gazprom-linked oil terminal may also have been within the target area. Temryuk is a key logistics hub handling LPG, oil products, and petrochemicals—commodities that help fuel Russia’s war machine and sustain its occupation of Ukrainian territory." The Temryuk NGL Terminal is ~ 50 miles from the Kerch Strait, on the Sea of Asov. Liquefied Petroleum Gas (LPG) is a commercial term, either the purity Natural Gas Liquid (NGL) products, or some combination of them. The terminal receives NGL's via rail, has ~ 100,000 bbl (4.5 MM gallons) of NGL storage on site, and loads the LPG tankers. More evidence of Ukraine's approach to systematically "degrade" the Russian Oil & Gas Infrastructure. Good for them in choosing a location that is relatively remote, though it has a smallish footprint. The orientation of the storage tanks, or bullets, are pointed towards each other, rather than away. Not the ideal orientation, but changing that would point the tanks at the rail rack and tanker loading/unloading berth. Either way, it's a juicy target.

-

Putin Signs Law Raising Russia’s Value-Added Tax to 22% "President Vladimir Putin on Friday signed a major tax overhaul that will raise Russia’s value-added tax to 22% from 20% next year, a move aimed at closing the fiscal gap created by soaring military expenditures and falling oil and gas revenues amid Western sanctions. More small businesses will also be swept into the tax system under additional changes. The annual revenue threshold for companies required to pay VAT will drop from 60 million rubles ($732,000) to 10 million rubles ($122,000). Businesses have indicated in surveys that they plan to pass the tax hike directly onto consumers, who have already been strained in recent years by surging inflation linked to war spending. Economists, including those at the Financial Ministry, have said they anticipate a modest rise in inflation as the VAT hike takes effect starting next year. VAT is one of the government’s most important revenue sources, generating 11.5 trillion rubles ($148 billion) from January through October, or more than 38% of total federal revenue. Under the changes, select food products, medicines and children’s goods will continue to be taxed at a reduced 10% rate. But certain milk-based products made with milk-fat substitutes, such as processed cheeses and spreads, will now be taxed at the full 22% rate. Russia last raised VAT in 2019, when it increased the rate to 20% from 18%." I have no understanding of Russia economics and their income and taxes, but dropping the threshold for taxing small business' from $732,000 to $122,000 seems like that puts a lot of mom & pop type business under an onerous burden, much worse than whey have seen the past 3 years. Selling gold reserves and crippling small business' already struggling while cutting basic services to the general populace does not seem like a recipe for success. I have seen a lot of stories that virtually every sector of the Russian economy has been affected to the point that workers are not getting paid, are being furloughed and have no reason to work because of non-existent supply chains. There were rumors that unpaid shipbuilding workers may have sabotaged a new ice breaker/tug boat in St. Petersburg that was critical for moving large ships through the frozen water of the Baltic. The Russian economy ...

-

I reposted @Brisketexan 's summary of Kasparov's comments from February 2023 for convenience. After reading those comments again, and remembering what I heard, I count that short time listening to Garry Kasparov speak as maybe the most enlightening hour of my not so young life. I felt that way at the time, and still do. The sad reality is we are almost 3 years down the road, and here we are. The former arsenal of democracy; now we have our hands extended, not to lift those that need a hand, but to pull them out of the way so we can make a few bucks off of what they have.

-

That plane doesn't look like it has moved since February 2002, the latest version on Google Earth. Perhaps the laser weapons it carried destroyed the plane ... from the inside.

-

Nitrogen Tetroxide is made from ammonia and Oxygen. Ammonia is made from Hydrogen (natural gas) and Nitrogen (air). Chemically, it is not that difficult. You need natural gas and air. However, it is highly toxic; Concentrations of 25-50 parts per million (ppm) cause irritation of the eyes and nose while 50-100 ppm can cause pulmonary edema and death. Ukraine had been on a search & destroy mission for Chem Plants & factories making and using rocket fuels, propellants and explosives. Here is a list of Ukraine targets, most in the last few months. I expect a number of them made or processed Nitrogen Tetroxide. Sverdlov Plant, Dzerzhinsk 10/24 Smolensk Aviation Plant 1/25 Belorechensk Chem Plant 9/25 Azot Branch of Uralchem, Perm Krai, Berezniki 6,7,9/25 Sverdlov Ammunition Plant 10/25 Avangard Chemical Plant, Sterlitamak 10/25 Rostec Elastic Gunpowder Plant, 10/25 Scientific & Test Center, Rocket & Space Industry 10/25 Bryansk Chemical Plant (explosives) 10/25 Tatarstan Chemical Plant 10/25 Plastmass Explosives Plant, Kopeysk 10/25 Sterlitamak Petrochemical Plant 11/25 Stavrolen Zavod Chemical Plant 11/25

-

Agree 100%. The USSR, and Russia, could never develop and monetize what they have always had. They don't want what they have, they only want what you have. "The only option is for Russia to leave." FIFY "We got a chance to wipe out Germany. Russia. Just wipe it clean off the map. Knock everything down, every city, every castle, all the bridges, all the roads. Everything. Don't leave two stones standing together. Just wipe the slate clean. Turn Germany Russia into a prairie, then ship over a few buffalo and let them start from scratch. Now, what do you think of that, colonel?" - Battle of the Bulge, Major Wolenski to Lieutenant Colonel Kiley.

-

You are correct sir. Frozen ground is hard to dig in, and pipelines are usually laid below the freeze depth, sometimes with the top of the pipe more than 12 feet below grade. However, large underground pipelines, when they rupture, tend to self-excavate, and when they burn, they turn the dirt into glass.

-

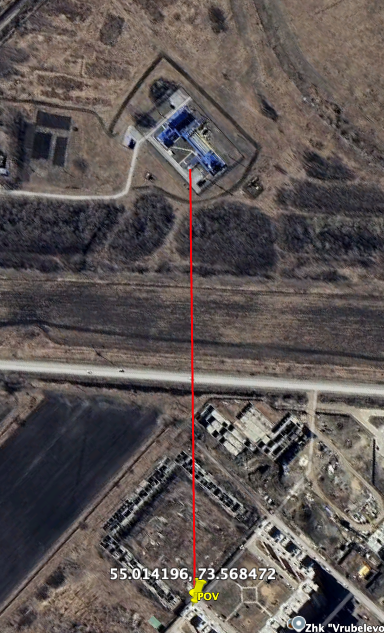

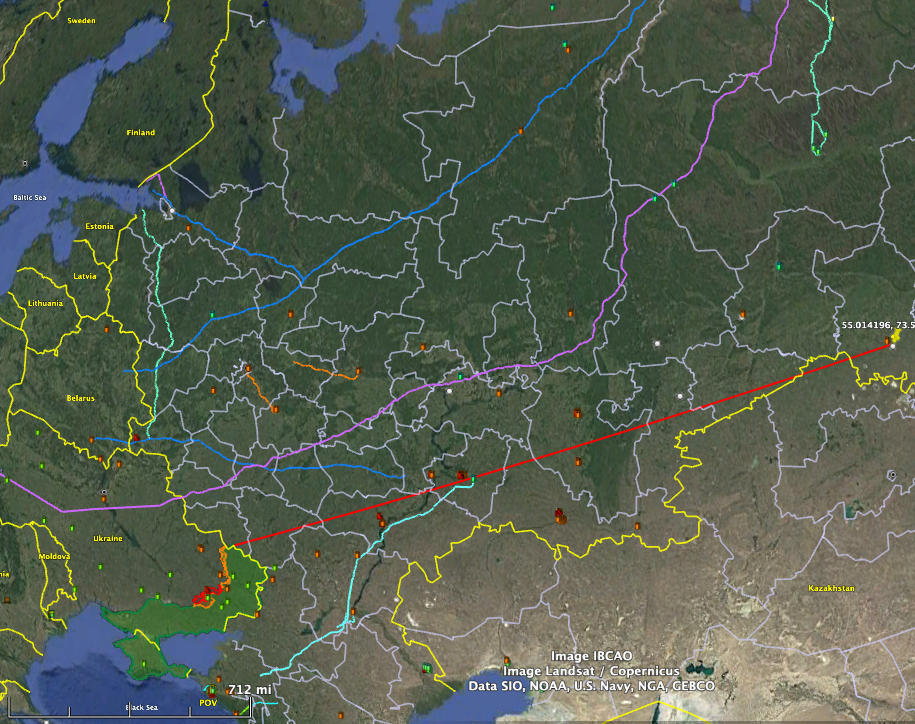

This fire is ~ 15 miles east of the Gazprom-Omsk Refinery, the largest in Russia (445,000 BPD), ~ 1,500 miles from Ukraine, and 1,800 miles from the eastern Russia-Mongolia-China border. I still wonder why they located such a large refinery complex in the middle of nowhere. The surface facility is only ~ 1.25 acres, and the footprint and layout is not consistent with anything else I have posted about here. The only thing noteworthy from the picture is the blue roofs, indicative of oil & gas (government) facilities. (When I see blue roofs on smaller building, I immediately think of corruption and someone with their hands in the states pockets.) If I was asked about targeting this facility, I would ask, "What else have you got?" It is so small, it is hard to tell what is here. It is also not obvious that this is along a major pipeline corridor (i'm not aware of any long haul pipeline within 300 miles). I would think, the pipelines from the refinery would go west. However, the size and sound of the fire, and the 2nd and 3rd blasts suggests that multiple, large diameter pipelines may have ruptured. Possibilities include missile strike, sabotage, or just an accident. Anything that big is important. More to follow.

-

@Bevo, thanks for the post. This is newsworthy, as it relates to a Russian attack on Ukraine. I had read a similar story (the same one?) on Google. Since you posted it here, I thought I would respond. After reading the first story, something didn't sound right, so I looked a little deeper. It seems the writer merged a story on Ukraine's LNG deal with Turkey with a story on Russia attacking a Turkish LPG tanker offloading in Ukraine. He provided a quote, "Former security minister Tom Tugendhat says incident is tantamount to Russia 'attacking Nato' ." I think Mr. Tugendhat has an agenda, which unfortunately, has very little to do with what happened here. Most important, (i) This incident is nowhere close to Russia attacking NATO, "Romania’s Defense Ministry also said radar systems had tracked several aerial targets during the night but had found no incursions into Romanian airspace." (ii) Romania did not evacuate the city of Tulcea (~ 65,000 people), they evacuated two tiny villages in Tulcea County, across the river from Ukraine, 10 miles away from the city of Tulcea, "Romanian authorities ordered the evacuation of residents from the villages of Plauru and Ceatalchioi in Tulcea County." (iIi) the vessel was carrying Liquified Petroleum Gas (LPG, propane & butane), which is much different than Liquified Natural Gas (LNG, methane). They products are similar, as both are hydrocarbons, and are liquefiable at certain pressures and temperatures. But the transportation and handling of each is much different, in the size and type of the tankers and the quantities of product transported. Anyone can get a 5 gallon tank of propane refilled. LNG is stored at -260°F (-162°C) at atmospheric pressure. (iii) was a common, honest mistake. (i) and (II) are just wrong. LPG =/= LNG =/= NGL (Natural Gas Liquids)... Below is the Fox News story (ugh!!!) quoting the Associated Press, which I found to be more factual, and credible: "Russian drone strikes tanker in Ukraine’s Odesa after Zelenskyy closes US gas deal MT Orinda carrying liquefied petroleum gas was hit at Ukraine's Izmail port, engulfing vessel in flames -By Emma Bussey Fox News, Published November 17, 2025 4:42pm EST A suspected Russian drone attack in Ukraine saw a Turkish tanker hit in the Odesa region Monday, setting the vessel on fire and prompting evacuations across the Danube river in Romania. Per the Associated Press, the MT Orinda, carrying liquefied petroleum gas, was hit as it was being offloaded at Izmail port, according to Turkey’s Directorate for Maritime Affairs. All 16 crew members were evacuated. Footage from across the river in Romania, where residents were told to leave their homes, showed the ship engulfed in flames, with thick black smoke rising into the sky over the river Danube. Izmail lies on the Black Sea estuary and is one of Ukraine’s most important trade hubs. The strike came amid renewed Russian attacks targeting the Odesa region’s energy and port infrastructure. According to reports, regional military head Oleh Kiper said drones caused multiple fires and damaged several civilian vessels. Following the blast, Romanian authorities ordered the evacuation of residents from the villages of Plauru and Ceatalchioi in Tulcea County, directly across the river from Izmail. The strike came amid renewed Russian attacks targeting the Odesa region’s energy and port infrastructure. (AP) (Please note that the city of Tulcea is ~ 8 miles south of the POV in this picture.) Romania’s Defense Ministry also said radar systems had tracked several aerial targets during the night but had found no incursions into Romanian airspace. The country issued multiple alerts in recent months as Russian strikes near the border intensified. A statement from the Ministry of National Defense said the "Russian Federation’s forces attacked areas in Ukraine located in the vicinity of the river border with Romania on the night of Sunday, November 16th, to Monday, November 17th." "The Ministry of National Defense radar monitoring and surveillance systems detected and tracked targets that evolved in the Ukrainian airspace, in the proximity of Tulcea County," the statement said. "MoND notified the General Inspectorate for Emergency Situations, with regard to the establishment of alert measures for the population in the north of the county (Izmail area)." The Danube corridor has also become more important to Ukraine’s export network since Russia withdrew from the U.N.-brokered Black Sea Grain Deal in 2023. Attacks on the area also raised security concerns for NATO with the alliance reacting by expanding air-defense operations under its Eastern Sentry initiative."

-

@orange dream, much appreciated.

-

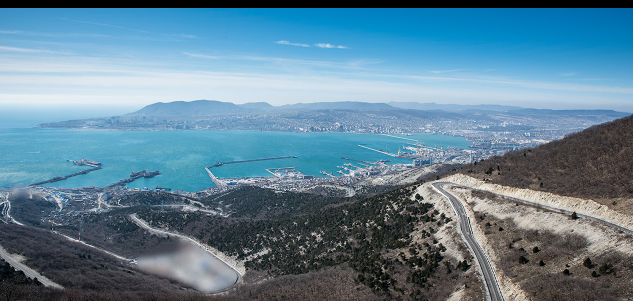

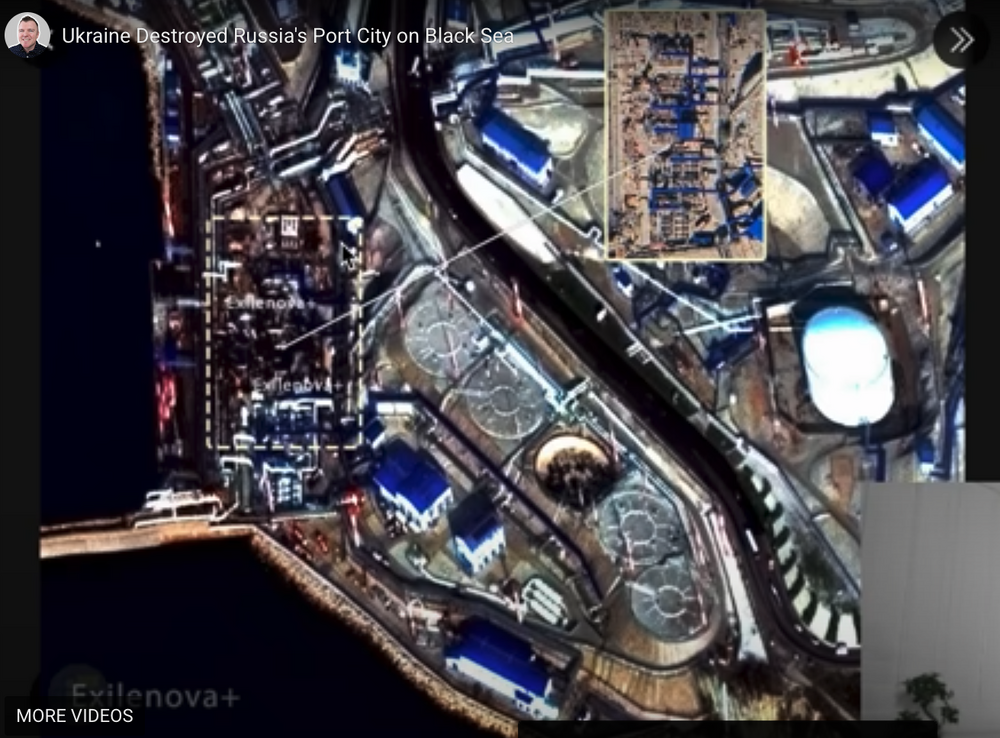

I may know a lot of things, but ... atomheartbevo, this is for you. How does one specify a poster by tagging the name in an orange capsule like you do? I really appreciate the comments from all of you, and while nothing in a message board is personal, it is the simple things in life that make you smile. With that said, this is a catch all for all things around the Novorossiysk Export Terminal. First, what a hidden jewel of a place. Like San Diego without 20 million neighbors. Just from the Google Earth photo's, the mountains and developed areas are covered with old fortresses and monuments and churches and photo ops. The harbor is ~ 75 miles from the Kerch Bridge. The Oil Export Terminal is in the left foreground, the naval base in the center w/ the crescent dyke oops, dike, and the S-300/400 location is was n the point across the harbor. The blurred area in the foreground is where the oil pipeline tunnel comes out of the mountains above the Tank Farm and Export Terminal. Like San Diego, a target rich environment. Ukraine has already attacked the Export Terminal, Navy Base, S-300/400 missile site, and a harbor buoy. Another video I saw indicated the large mushroom cloud was from the S-300/400 site, and the rocket fuel oxidizing and burning. The Tank Farm that feeds the Export Terminal is in a valley behind the 2,000' high coastal mountains, with a rail terminal that can handle oil unit trains. The tank farm pipelines go through a 2 mile long tunnel from the tank farm to the water side of the mountains. The terminal itself does not have any significant oil storage. The POV on the west shore is the point of view from some of the photos. (Please note the zig-zaggy road south of the terminal. PTINS = Porsche; There Is No Substitute!) Novorossiysk Export Terminal The terminal is similar to the one at Tuapse, with two loading jetties, one of which can handle larger tankers. The red polygon was the big fire that covered most of the pipes and manifolds that come from the Tank Farm. It is possible the one storage tank at the terminal may have also been targeted. Finally, below is screen shot from the fire damage at the terminal, with a before and after picture. It would appear this area envelopes the main loading pumps for the tankers, and all of the piping that feeds the south jetty, the one capable of accommodating the larger tankers. It also looks like the pipelines feeding the north jetty were on the edge of the fire and may have only had minimal damage. One thing of note, loading tankers is pretty straight forward, moving oil from atmospheric storage tanks into atmospheric cargo holds in the tankers. You need high volume pumps and pipelines, but not necessarily high pressure equipment. While the original equipment is specialized and fit for purpose, in a pinch, a pump is a pump, and finding a suitable, temporary replacement (water and irrigation pumps?) would not be very difficult. All the tanks and pipelines look alike, but the different tanks hold different grades of oil, sweet or sour, or heavy or light. Replacing the pipeline manifolds would be a tedious, time consuming task. Usually the pipe spools are fabricated elsewhere (in a shop or open area), with minimal welding at the site. With a lot of pipes in a congested area, the construction has to go in an orderly manner, to make sure everything fits the way it is supposed to. It looks like Russia had started to construct storage tanks at the terminal itself, but didn't get very far. This is 4 mile stretch of infrastructure made up of a series of critical nodes, that either they all work, or they don't. Let's hope they don't.

-

Getting hard data on this is damn near impossible. By definition, 80-90% of the information is coming from Russian sources. The info attributed to Reuters is being parroted by everybody else. Where did Rueter's get the info? My guess is Russia. After reading the article, and half a dozen others, I don't agree with much of what was written By my count, Ukraine has attacked half (15/30) of Russia's 30 largest refineries since Aug 2025, with ~ 76% of the capacity (~4.5 MMBpd) targeted. 13 of those targeted, mentioned specific process units were targeted and/or damaged. The video's of explosions and fires indicate there was significant damage at those facilities. Massive explosions and fires at US refineries are few and far between. The explosions and fires in Russia since August have been massive. I have not seen any factual info on the aftermath of these attacks, but I have a pretty good idea that it is anything but business as usual. Here are a few photo's of various fires at US refineries, none of which were bombed or hit by missiles: . I know Russia doesn't have to deal with unions, or OSHA, or personal injury lawyers, but any repairs would take a considerable amount of time, even without the sanctions. I would have more faith in a Russian commercial airliner than any repairs made to a Russian refinery in the past 2 years. Russia's refining capacity was ~ 6,600,000 barrels/day (6.6 MMBPD), and in 2024 had in operating rate of ~ 6 MMBPD in 2024. Russia's internal demand for petroleum products in 2024 was ~ 4 MBPD, or 67% of the refining output. In the last 2 months, Russian demand has exceeded the output. Russia reduced, and then stopped petroleum product exports in the last 2-3 months, and has been rationing gasoline and diesel since then. That is a combination of reduced refining operations, logistics, and internal demand. I'm guessing the internal demand has dropped in the last 2 years, which makes the numbers worse. But you don't stop one of the few sources of hard currency unless you have to, and Russia stopped exporting refined products. That is not indicative of a drop of 3 or 4%. And as you are all aware, refined products cost a lot more than the crude oil they are made from. They would still be running if they could.

-

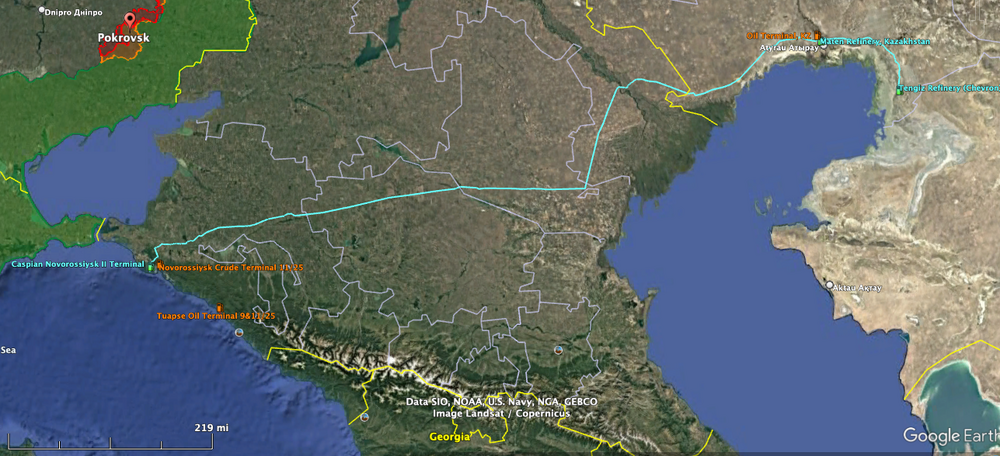

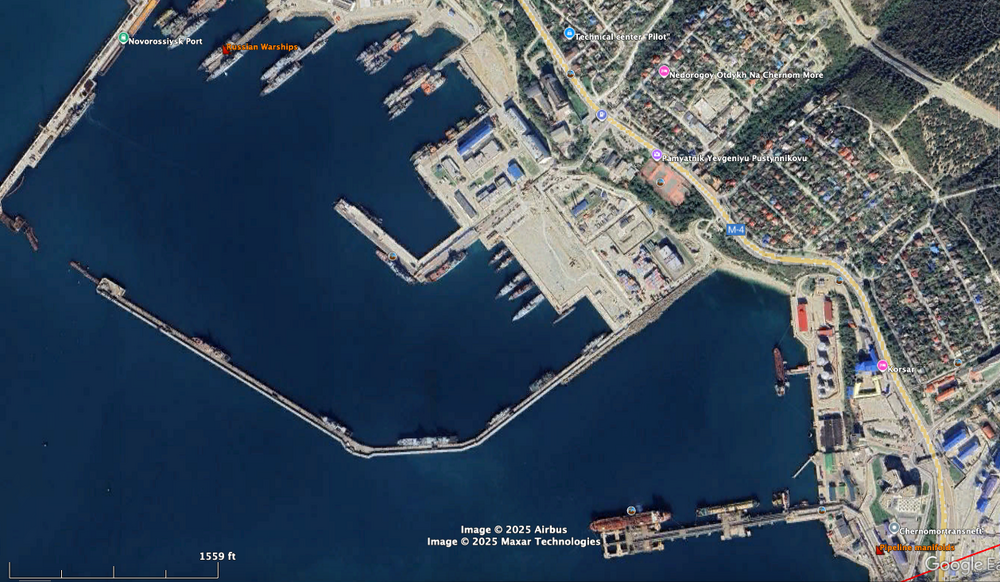

As always, thanks for your informative posts. Just a few random comments, Re: Black Sea Crude Export Terminals There are actually 3 main "Russian" export terminals on the Black Sea. Two of them have been repeatedly attacked over the past few months, Taupse & Novorossiysk, and appear to be inoperable. The 3rd, is the Caspian Consortium Novorossiysk Terminal (at the end of the Kazakhstan Caspian Pipeline), ~10 miles west of the Russian Novorossiysk Terminal. The Russian terminal has been attacked repeatedly the past 2 weeks; the Caspian terminal has not been attacked. I previously posted some details on the Taupse Terminal a few weeks ago. Novorossiysk Terminal This terminal and surrounding area has been hit numerous times, with confirmed/probable damages to tankers, loading berths, loading manifolds, pipelines, S-300/400 missile systems, and loading buoys. The red line is the POV from one of the videos showing missile strikes on the terminal, that appear to have damaged the pipeline and loading manifold systems. When you zoom in to that area, the area immediately north of the oil terminal appears to be where Russia has moved what is left of the Black Sea Fleet, from Sevastopol. The image from 10/2024 shows ~ 2 dozen warships, including 3 submarines. I think that some of these may have been hit in the past few months. For reference, you can see the red POV line in the lower right corner. Caspian Novorossiysk Terminal The Caspian Consortium is a Kazakhstan led effort to monetize their resources, including transporting over 1 million bbls/day from Kaz to Russia and the export terminal. Chevron operates some (all?) of the key facilities, along with other multinational companies, with the majority ownership being non-Russian. I expect the location of the Caspian assets, well away from the normal Russian oil infrastructure, was carefully thought out and planned. In the second photo above, you can see the size of the Caspian Tank Farm in the upper left corner, and the 10 storage tanks, each with a 1,000,000 bbl storage capacity. I have not seen anything about the Caspian Pipeline mentioned in any sanctions, or Ukraine attacks, but I would think there was a lot of discussion about this group of assets, and not attacking them. I think Kazakhstan choose their partners wisely.

-

In the 80's, I was a an engineer in a plant built in the 50's, with a project to install a new electronic distributed control system on the boilers, steam and cooling water systems, to replace the original vintage local-pneumatic system. We had drawings on almost everything, most of them brand new, neatly folded in triplicate, in the original manila folders. Even then, it was a challenge; I had the old drawings from 30 years prior, but nothing that showed any additions or modifications since then. All the prior engineers had all been Chem-E's, from Louisiana, and I'm not sure they understood mechanical drawings. We were circulating steam and water to ~ 40% of the original plant, that had been idle for ~ 15 years. The plant management and operators, all good ole boys from the bayou's and backwoods of Louisiana, had no idea what I was talking about. I do laugh when I'm posting here, knowing the way I was trained from day 1, with safety preached all day every day, and trying to apply that thought process to a populace without indoor plumbing, working in a Soviet era refinery.

-

You all have seen many pics of O&G facilities, and their maze of pipes in the pipe racks. With any fire, you shut the valves on either end, and make a decision to put the fire out, or let it burn itself out. Fire water systems are designed for smaller, localized fires; not a catastrophic explosion. There are fail safe procedures in place, starting with fire detectors and an Emergency Shut Down (ESD) system, a big red button that sends pre-programmed instructions to open and close whatever needs to be opened and closed in an emergency. They are located in the control room, around critical pieces of equipment, and around the perimeter of the process areas of the plant. Some times, it becomes a bit more complicated. Like a drone, or a big bomb exploding in the middle of a pipe rack, like the one in the picture below. Usually the ESD will isolate everything within the plant. Okay, the valves at the plant fence are closed, now what? It depends, on a lot of things. A lot of the larger pipes and block valves have motor controlled actuators that are controlled remotely, or at the valve. Once all the automatic control valves are closed, or opened, now the rest have to be done manually. Most equipment is always in service, so they only have manual isolation valves that are needed for routine maintenance. Why are the big oil companies so cheap? Why don't they automate everything? Sometimes that stuff breaks, or fails, or goes off by itself, and automatically goes to fail safe, either opened or closed. Each decision to automate is made case by case. After that, the remaining valves are closed manually. The first priority is protect personnel. Muster is preselected places, and count heads. Then, make decisions on what do do. Is the fire under control? There are drawings on every pipe in the plant. Lots of them. It is hard enough tracing a specific pipe, looking at the drawings, then the pipe, as you walk through the pipe rack. Obviously, you can't do that during a fire, and when everything is a pile of twisted steel, good luck with that. Even when everything is done right and operating okay, O&G plants are dangerous, and intimidating places. The sounds of high pressure steam and high speed turbines is not a natural sound, and they have a blend of strange smells. By design, you are putting extremely hazardous and volatile fluids at high pressure in a large steel vessel, and adding heat to it. I don't think those would be the preferred places to be in a war.

-

"The Russian official also urged Russians to “not trust rumors” and to believe only official statements about the “repulsed attack” and “falling debris.” The city’s residents are also being advised not to believe their own eyes, as they watch the fire in Stavrolena grow more and more intense." The Stavrolen Chemical Plant was also attacked last month. It uses the Natural Gas Liquids (NGL) removed in a gas processing plant as feedstock in this plant. The Natural Gas liquids are fractionated (fractional + distillation) into 5 commercial products (ethane, propane, iso and normal butanes, and "natural gasoline." This could happen at either the gas plant or here at the chemical plant. This is a physical separation of dissimilar products, though complex, is still relatively simple. The Stavrolen Chemical Plant further processes the feedstock, using extreme heat to "crack" the molecules, and produce, ethylene and propylene, and polyethylene and polypropylene (plastics), as well as other derivatives, PVC, synthetic resins, polymers, etc. These processes include heat and catalysts to break the molecular bonds and re-combine the molecules. This is a complex linear process, where the outflow from one vessel goes to the next vessel; it either all works or none of it works. One of the 1st things I learned as a new engineer is you never want to run out of feedstock, which means this is not the kind of process you turn on and off. "If the process stops ..., well, it is hard chipping the hard plastic out of the towers." You would want any shutdown to be in a controlled manner. This is a photo of a Louisiana ethylene plant getting shut down in an uncontrolled manner. Notice the well trained employees, and contractors, getting the "fuck out of dodge". They call the NGL tanks "bullets" for a reason; when they rupture, they take off like a 10-15 ft diameter rockets. Gas processing, and the Chemical side of hydrocarbon processing, is a very mature industry in the US and Canada. They are in a handful of countries that have both the native feedstocks and the downstream processing infrastructure. The USSR could never do this. Most of their gas exports went to the soviet satellite countries, which gave them control of the people, but not the hard currency. The breakup of the Soviet Union, and Russia cozying up the the west, led to the Nordstream gas pipelines, an entry into Western Europe. Russia finally had a means to monetize their natural gas resources. Nordstream gave them a lot of hard cash, and Russia and the Oligarch's, wisely invested that cash in gas related infrastructure; production, gas processing, pipelines, chemical plants and LNG plants. They invested in the downstream integration that interfaces with the marketplace. Since then, they now have 4 or 5 world class gas processing plants, a handful of ethylene plants, and are were migrating towards world class LNG in a big way, until they invaded Ukraine. Unlike oil, the gas side of the equation is somewhat unique, a symbiotic relationship between producers and consumers, where both sides need each other, and cannot survive without the other. The gas infrastructure is prohibitively expensive, with the only players being nationalized companies, the largest public and private companies, and a relatively small group of engineering and construction companies. It requires long term contracts, and long term relationships. Russia's gas, and the Sakhalin LNG Plant on Sakhalin Island in the Pacific, brought together Exxon & Shell, and China, Japan, and S. Korea. Russia was finally monetizing their natural gas resources, and Putin FUBAR'd it up like nothing before.

-

The way Arch played the last 6 quarters is all i need to see. Going through his progressions and completing to his 3rd and 4th read, moving out of the pocket and keeping his eyes downfield, and making a couple of NFL throws so close to the sidelines, that you need super slow motion to confirm the calls. This will be the first game that Arch has had a healthy, and comfortable, starting trio of Moore, Mosely & Wingo. He should have a full compliment of receivers this game. Not having Taaffe the past 2 games was huge. If he is back, and controlling the defense, we'll be okay. Time for Texas to play their best game of the season.

-

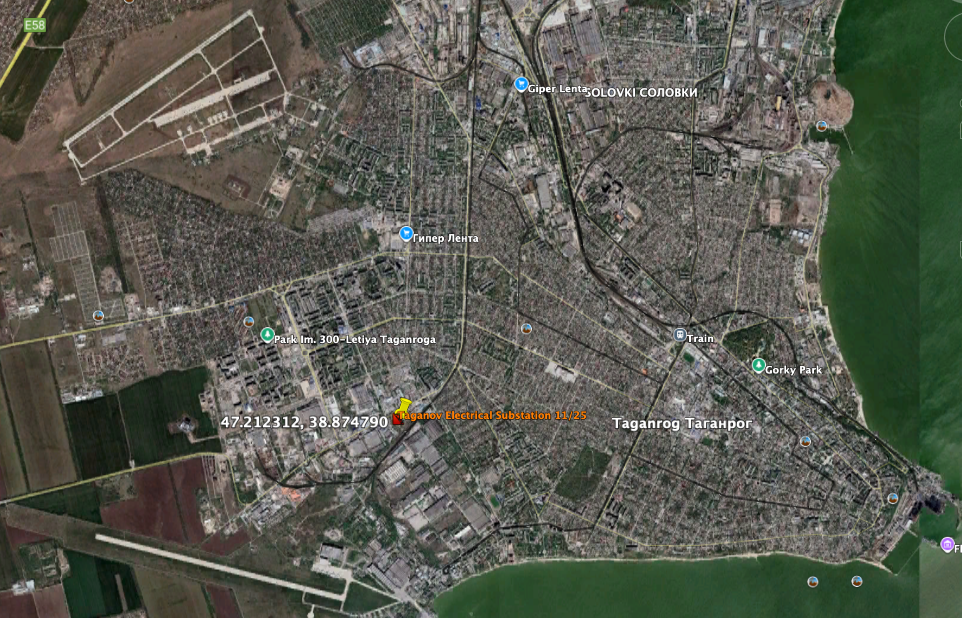

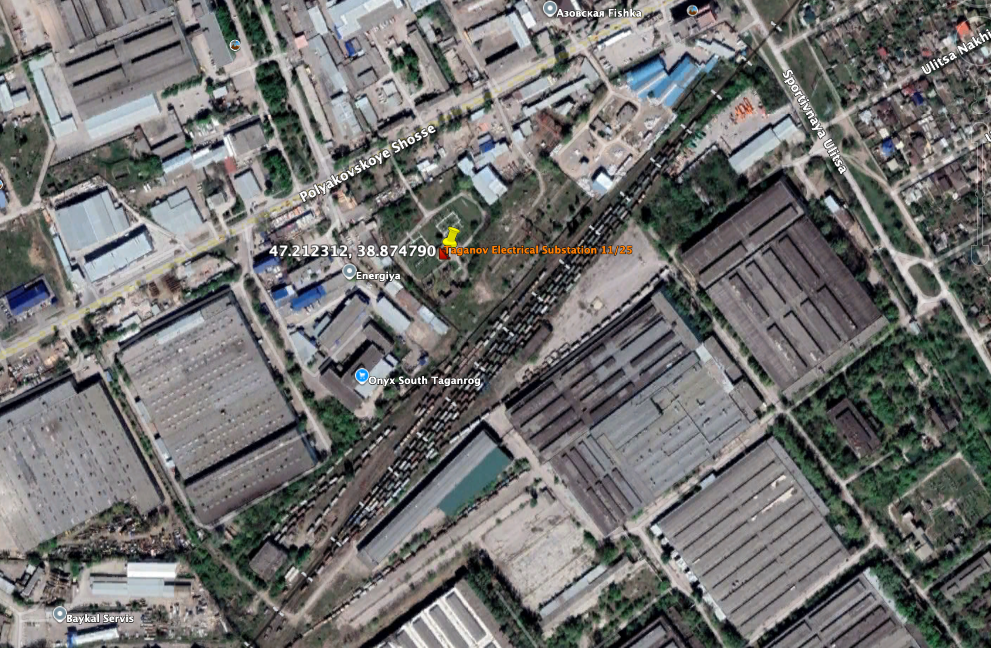

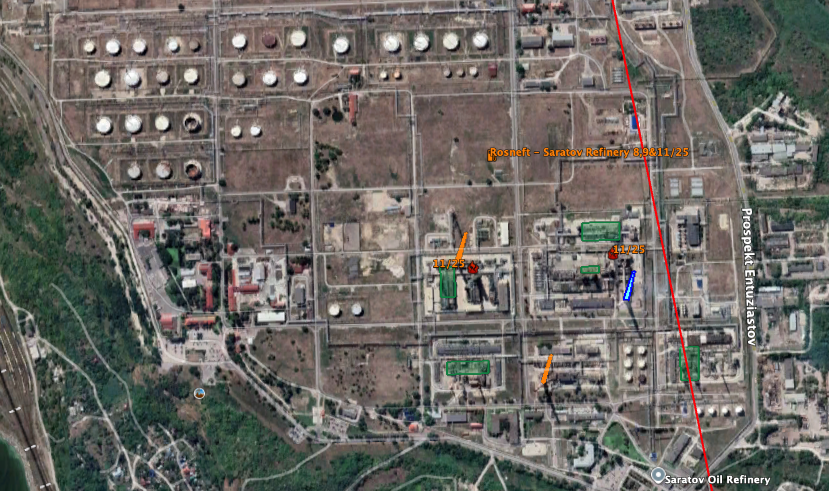

The Taganov Substation is in an industrial area, with a lot of larger buildings. The blurred area includes an airstrip, so maybe the industrial plants make aviation hardware that used to be installed here before the war. My google earth shot from 2002 shows Russian AWACS & Bear bombers on the apron in the bottom of the photo. I don't imagine they keep anything that close to Ukraine anymore. The substation has a small footprint, but if it serves a specific area, good. I imagine Ukraine has pretty good intel on this area. It is interesting the rail siding next to the substation can accommodate a large number of rail tank cars, so specialty chemicals may be involved in the manufacturing nearby, The Saratov Refinery, with the red line showing the line of sight in the OP, from bottom towards the top.The little red fires labelled "11/25" are the 2 big towers hit earlier this month. The Blue and Orange oblong objects are tall flare/exhaust stacks, and I think the Blue one is the tall flare you see in the video. I think the green polygons are choice targets (main process vessels) within the refinery, and it appears they are close/within the fires from the videos. I thought the attack 2 weeks ago took out the main process vessels. It is interesting that Ukraine would hit it again with 2 weeks. Again, indicative of good intel on what was hit before, and what needed to be hot again.

-

I saw a post here, or a post linked to a post here, that had an interview w/ Konstantin Samoilov from Inside Russia. I couldn't find it again, so I reposted it. I know others have posted Konstantin's opinions here, so I listened to this. This is a very informative podcast. It's long, 68 minutes, something good to have playing in the background while you're doing other things. But listen to, it's well worth the time, or just read the rest of this post, 2-3 minutes tops. (Re: the 2nd Interview in the post regarding Pokrovsk, I haven't listened to it yet., but I think I disagree w/ Pokrovsk importance. More later.) "Putin never planned for a long war. The invasion was meant to last a few days. Ukraine was the red line. That’s what Russian policymakers had warned the U.S. about for years. The idea was to send troops in, topple the government, draw the line, and leave. But that plan failed. Instead of a quick operation, Putin got stuck in a war he can’t win, one that has drained his military and isolated Russia from the world.” Power grids exploding. Soldiers unpaid. Cities running on generators. Putin says Russia’s economy is untouchable. Konstantin from Inside Russia says that’s a lie. He lived it, and what he describes sounds less like strength and more like survival on borrowed time. We cover: • Why Western sanctions are finally cutting off the oxygen • How oil giants like Rosneft and Lukoil are scrambling for cash • What life looks like when prices rise and supplies vanish overnight • Why Russia’s best engineers and developers are leaving faster than they can be replaced • And how one wrong move could send the entire system crashing Konstantin says Russia’s economy isn’t dying quietly. It’s bleeding out in real time, and Putin can’t stop it. 02:02 – “Moscow is not Russia,” wealth versus decay beyond the capital 03:55 – From wild 90s freedom to Putin’s tightening grip 05:47 – The social contract: stay quiet and live comfortably 07:09 – The invasion ends that contract overnight 07:20 – The economic panic as companies flee 08:30 – Competing narratives: collapse or resilience 09:17 – How Russia stumbled into a war it did not plan for 10:50 – Shock and chaos among Russian officials 12:55 – Propaganda scrambles to invent justifications 14:30 – The instant exodus of Western companies 16:30 – Ikea, Apple, McDonald’s, and the first wave of panic 17:28 – Russia forbids dollar withdrawals to stop the run 18:40 – How Putin’s “war economy” kept the system alive 19:16 – Oil prices surge, saving Russia for two years 20:22 – Who blew up Nord Stream and who benefited most 21:04 – Why the U.S. gained as Europe lost Russian gas 22:19 – Decades of cheap energy end overnight 23:28 – How Russia gave Europe’s market to America 24:11 – The self-inflicted wound that wrecked Gazprom’s future 25:25 – The economic unraveling begins 26:25 – The perfect storm of sanctions, exodus, and brain drain 28:05 – Millions leave, the professionals among them 29:10 – War spending drains the “savings account” 30:12 – Putin’s reserves are drying up 31:48 – GDP myths and fake data inside Russia 32:25 – The illusion of growth built on war production 33:44 – Military factories slow and layoffs begin 35:03 – “The party’s over,” Russia hits zero growth 35:45 – Why Putin still refuses to end the war 37:29 – The Titanic analogy: lights on, hull already flooded 40:00 – Blackouts, shortages, and the slow collapse 42:00 – Siemens leaves, turbines fail, power plants decay 43:12 – Why China cannot replace Western tech 44:40 – The lagging effect of sanctions now hitting home 45:10 – Putin escalates war as protests begin to spread 46:50 – Early sparks of unrest across Russian cities 47:55 – Prices soar, infrastructure breaks down 49:01 – Fear inside Putin’s own circle grows 50:36 – Why he cannot stop the war without losing power 52:05 – The danger of returning soldiers and shrinking spoils 52:58 – Why the “territory win” is a poisoned prize 54:30 – Putin’s miscalculation as NATO grows stronger 56:20 – Mario challenges NATO’s role and the red line argument 57:55 – Konstantin’s rebuttal: “Diplomacy, not invasion” 59:03 – The myth of NATO encirclement 01:01:46 – How Putin turned NATO from partner to enemy for politics 01:03:02 – Why he really invaded Ukraine: falling ratings and stagnation 01:05:33 – The plan for a quick regime change gone wrong 01:06:52 – “He wanted control, not blood,” but the war trapped him 01:07:29 – Mario proposes future debates with data-driven experts"

-

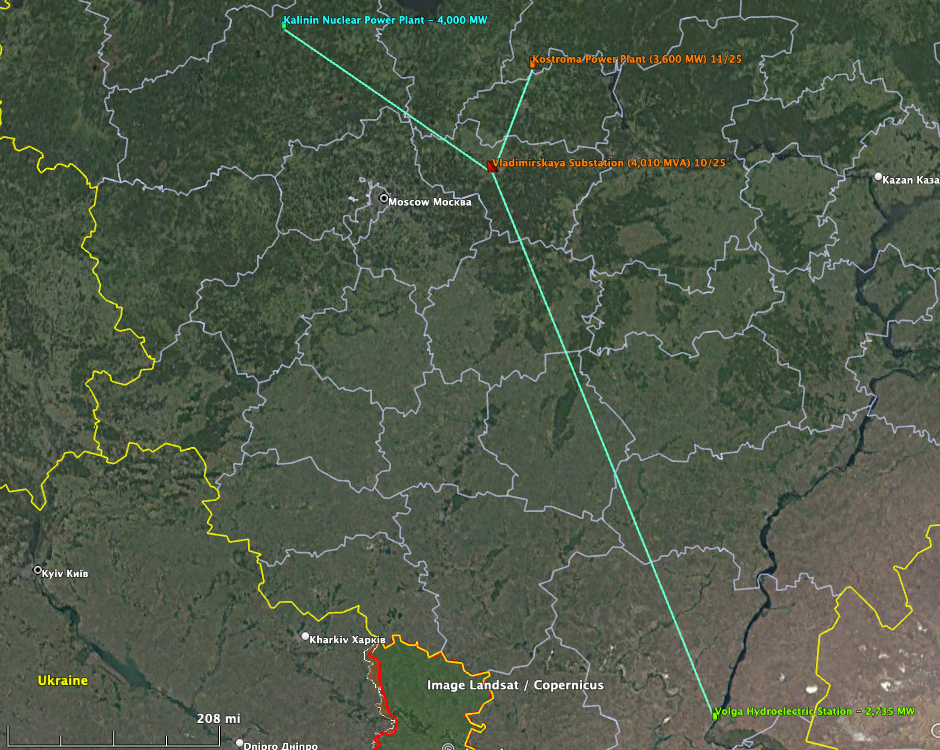

This is kind of a big deal. With the new information posted, I was finally able to find the Vladimirskaya Substation on a map. (The connecting lines shown are representations only.) "Strike drones targeted an energy infrastructure facility near the Russian city of Vladimir overnight between November 4 and 5. The strike hit the Vladimirskaya high-voltage substation (750 kV) in the settlement of Energetik, near Vladimir." The statement above in incorrect. "The Vladimirskaya substation is one of the region’s major energy facilities. Its installed capacity is about 4,010 MVA. The substation is a key hub, with numerous 110–750 kV power transmission lines branching out from it, serving the regional power grid. Its stable operation is critical to the reliability and balance of Russia’s power system. It was the second time in a week that Ukrainian drones had hit the facility and set it on fire. Aside from scattered light anti-aircraft fire at the target, the Ukrainian drones seemed to have made their way to the target unimpeded. The Vladimirskaya substation is a key energy facility transferring electricity from the Volga Hydroelectric Power Plant, the Kostroma Power Plant (natural gas-fired), and the Kalinin Nuclear Power Plant to the cities of Vladimir and Ivanovo and their collective regional populations of at least 750,000 residents, as well as serving as a major electricity source for the greater Moscow power grid." I think it is fair to say this is probably the most important electrical substation in Russia, with the main service area being Moscow. This is the second attack in the last month on this Vladimirskaya substation, located ~ 100 miles from Moscow, with the 3 main plants feeding the substation totaling over 10,000 MW of capacity, diversified between Nuclear, Hydroelectric and Natural Gas: Volga Hydroelectric Power Plant 2,735 MW Kostroma (Natural Gas) Power Plant 3,720 MW , targeted this week Kalinin Nuclear Power Plant 4,000 MW For reference the 2 Texas Nukes total 5,000 MW (The South Texas Plant capacity is 2,700 MW, and the Comanche Peak Plant has a capacity of 2,300 MW). Texas just approved the first 765 kV power lines in Texas in April 2025. Anybody surprised that the ERCOT managed power grid in Texas is inferior to Russia's? Sorry, Cheap shot. Everything in Russia is a life support system for Moscow.

-

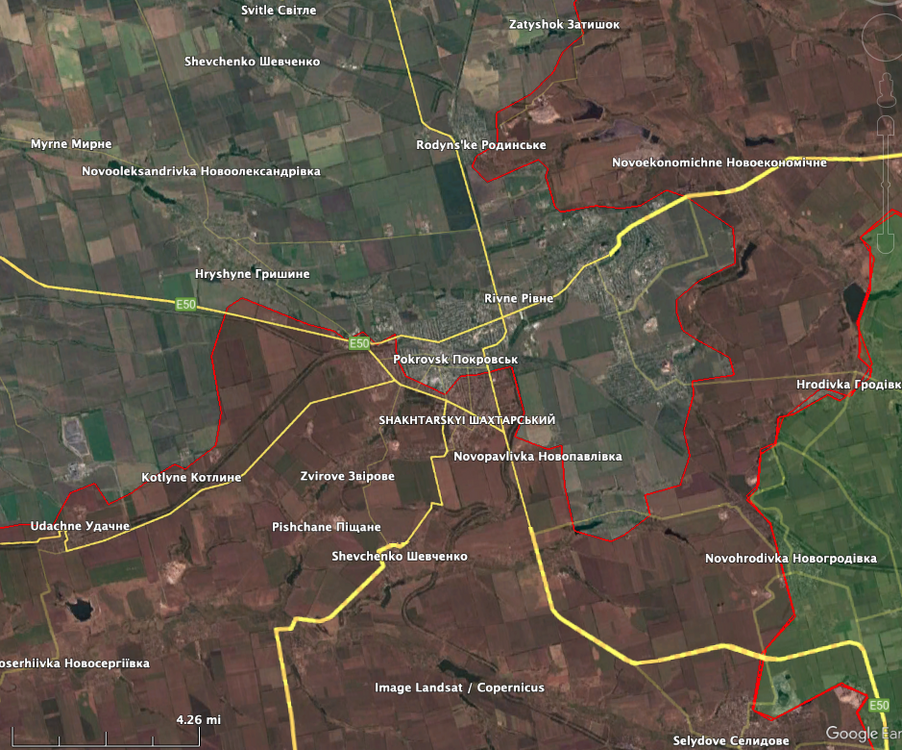

I updated my map of the Pokrovsk area. It is in a flat open area, with no significant geographical features (Rivers and hill tops.) Bakhmut had a number of river valleys and well defined "higher ground" areas, which allowed both sides to look down into the city, and inflict damage on the other. While Russia has made significant gains in the general area in 2025, they have only gained ~ 2 miles in the area immediately west of Pokovsk. In Povrovsk, there is still ~ 5 mile gap between the Russian forces, which is basically a bunch of open fields. Not the best area to do sneak and peek, or move quantities of troops and equipment, but Russia's gonna Russia, meat assaults across open grounds hoping Ukraine runs out of bullets.

Football ... Basketball ... Baseball ... Other Sports ... Futbol ... 🤫995🤫 ... Gambling ... Movies & TV ... Music ... Hobbies ... Lulz ... Food & Travel ... Daily Texan ... Business and Markets ... Cloak Room ... Help ... For Sale ... Board Discussion ... Subscribe!... Donate!... COOKIE MONSTER!