-

Posts

1223 -

Joined

-

Last visited

Content Type

Profiles

Forums

Store

Downloads

Recruiting - 2020

2019-2020 Football Season

Football

Entertainment

Sports

News and Business

Cloak Room

Transfer Portal

Recruiting

Events

Everything posted by PTINS

-

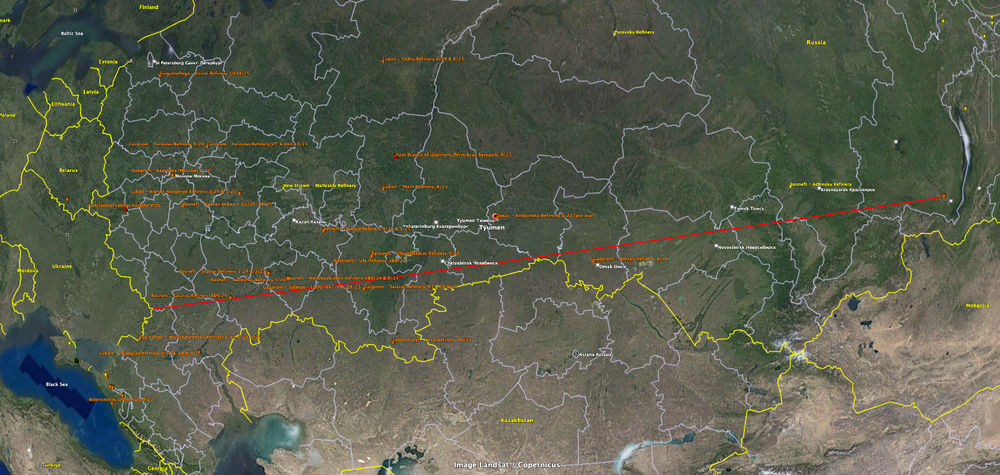

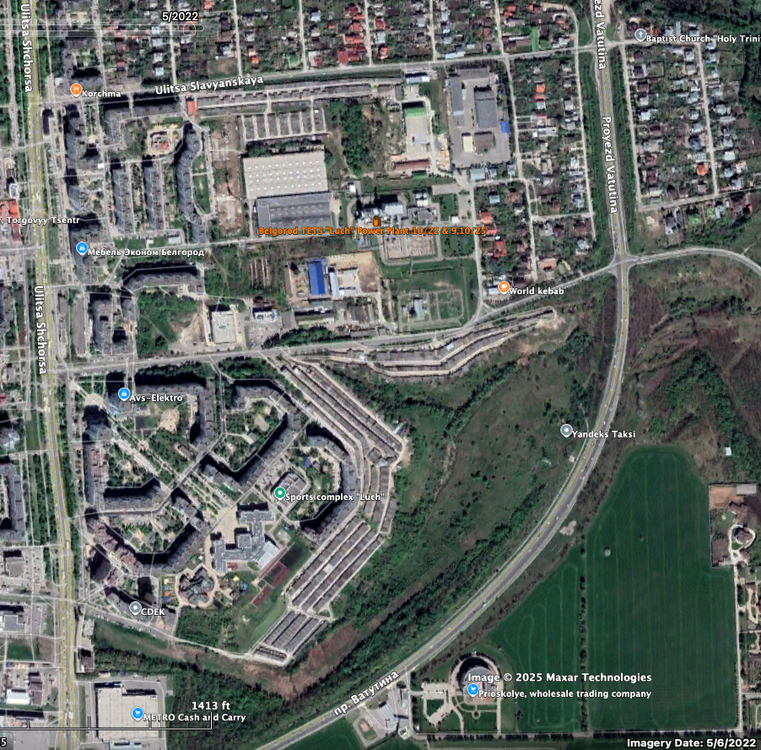

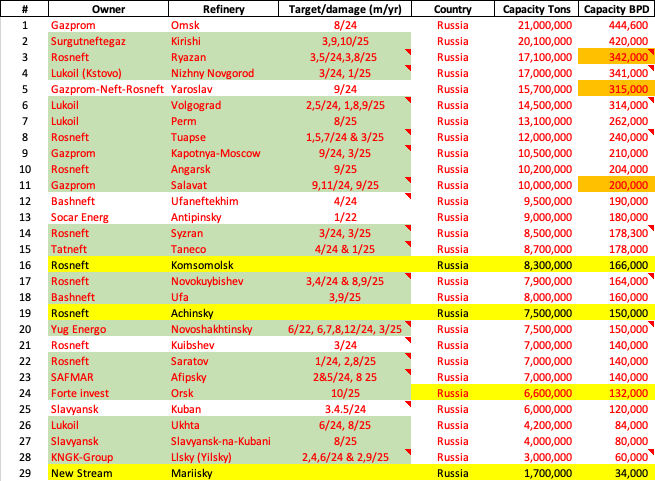

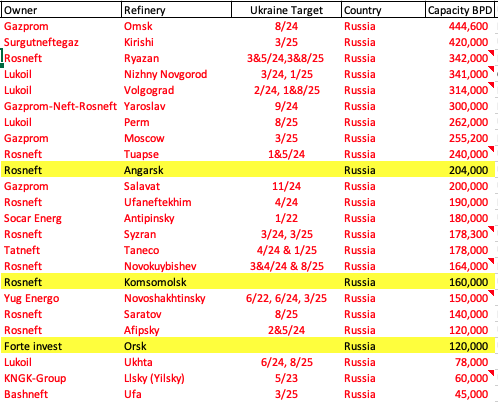

Why does Russia call them "Thermal Power Plants"? Do they also generate electricity by freezing things? I must of missed forgot most of those lectures. I remember as you approach Absolute Zero, theoretically the coldest possible temperature, molecular motion essentially stops and a system reaches its lowest energy state. Kind of how I felt after watching the Florida game. The Klintsy Power Plant is actually in Bryansk Oblast, not Belgorod Oblast. Bryansk is adjacent to Ukraine and Belarus, further to the northwest. The Belgorod "Luch substation" includes a smallish gas fired power plant, along with the necessary electrical switchgear to connect to the grid. This would be the definition of a surgical strike in the middle of the city. Somebody had good intel to know the places where to hit them that would black-out the whole city, or they got lucky. Belgorod is kind of the logistics hub of the wagon wheel for Russia fucking around with Kharkiv and supplying Luhansk and Donetsk. The more damage Ukraine causes in Belgorod, the better. Thanks! Atomheartbevo, you get the Gold Star. My earlier posts were not 100% accurate. The Socar Antipinsky Refinery near Tyumen, actually had in accident in January 2022, before Russia invaded Ukraine. As it was prewar, is was a big "who cares?" It is the icon on the screenshot below, about halfway of the red line. Shit happens fast around here. That's a bad ass paint job on the helmet. The tanks in yellow in the post above are what is burning now. Nausea, Headaches and Coughing: Locals Complain Amid Crimean Oil Refinery Fire Caused By Ukrainian Strike A major fire at an oil refinery [terminal/depot] n Russian-annexed Crimea has sparked complaints from local residents, raising concerns over safety and environmental impact. Kyiv's forces reported a “successful strike” on an offshore oil terminal near the Black Sea port town of Feodosia on Monday, sparking a fire that prompted local authorities to evacuate over 1,100 people. But while local officials claimed that “no harmful substances were detected in repeated air samples,” residents continue to complain about air quality. “Nausea, headaches, coughing in the morning — was that all just a dream? Only the rain helped us today,” Irina Kapeka, a resident of Feodosia, posted on Thursday in the local VKontakte group Podslushano Feodosia, referring to the authorities' assurances that the air was safe to breathe. Another woman, Inna Radchenko, commented on VKontakte: “It’s strange they [the authorities] haven’t declared this air to be beneficial.” The town has implemented a municipal-level state of emergency. As of Wednesday, traffic around the oil depot was restricted, with vehicles being diverted to alternate routes, the state-run RIA Novosti news agency said. I'm glad I played Risk. Russia is fucking Huge?Screenshot of Russian refineries, 21 have been hit (orange) and 3 have not been hit (yellow), yet. The red line is 2,700 miles, about the distance from Los Angeles to New York, or from Ukraine to the Rosneft Angarsk Refinery, north of central Mongolia. My guess is Ukraine smuggled troops and drones into eastern Russia and attacked from there, their "Doolittle '30 seconds over Tokyo' Raid." There was a story on the Kerch Bridge attack after it happened; Ukraine routing a truck with fake manifests, full of explosives, through multiple countries, timed to be on the bridge at the same time as a Unit Train of oil tank cars, and boom! The combination of Ukraine targeting and hitting specific process towers within the refinery, and the lack of Russian air defences proximate to the refineries, my guess is it would not take that many drones and missiles to cripple the motor fuel capabilities. I mean this in the nicest possible way, but Ukraine has flipped the switch ... destroying the invaders capacity to make war. The Blue and Yellow in kind of symbolic, don't you think? Ukraine has been very deliberate, and systematic in their approach to attacking refineries the past few months. I really enjoy seeing smart people thinking, and analyzing, and extrapolating outcomes, before they do something. Ukraine's ingenuity has been pegging the meter for a long time.

-

Kudo's to this guy for trying to keep track of all this. Most of the first hand information is suspect, and trying to compile it and process the information and boil it down into something useful is difficult at best. Even then, that summary would probably only get you a C+ or a B-. The screenshot tells you all you need to know. "Chicks dig the long ball big fires." Not unlike the Japanese carriers on fire at Midway, and we know how that turned out. Ukraine's systematic targeting of Russian refining capacity is mind boggling. The refining capacity of the 3rd largest oil producer in the world is on life support, and Russia is now importing refined products for the first time in 20+ years. Of Russia's 28 largest refineries (over 50,000 bbl/day) , Ukraine has hit 20 of them in 2025, and all but the 3 refineries in far eastern Russia have been hit since 2022/ The recent strikes targeted the specific refining towers that are the most critical pieces of equipment, and it appears they have destroyed those targets, in a way that those units would not be repaired or replaced for at least a year, if not longer. The blast from the initial explosion, and the resulting fire and heat would melt most of the wiring and cables, and the measurement, instrumentation and control equipment necessary to operate the facility. They probably couldn't get replacement parts, and don't have the money for the newer and better equipment, if anybody would sell it to them (they would). Replacing the Chevron's refinery in California would probably take 2+ years, without the impacts from sanctions on critical equipment. There are multiple layers of skilled labor required for the many tasks required, and most of the Russian skilled labor Russia had are probably dead, or gone. My summary below. Everything in red damaged in the last 3 years, the green damaged in 2025. The yellow are the 3 undamaged refineries. The 4th undamaged refinery (Orsk) just got hit this week.

-

Join Bluesky The open social network. MAKS 25 👀🇺🇦 🦅💥 Uralkhim Azot. A local resident claims to have seen 5 UAVs flying, 3 of which hit the factory, 1 was shot down, and another allegedly hit a house. "Their are a number of potash mines in the area (general term for potassium compounds), used for fertilizers, many household products, fuels and explosives, including potassium nitrate. While modern explosives use other compounds, potassium nitrate is a key component in classic black powder, fireworks, and solid rocket propellants. The Azot Branch of Uralchem is the only Russian producer of higher aliphatic amines, sodium nitrate, and crystalline sodium nitrite. The main products of Azot are ammonium nitrate, ammonia aqueous solution, ammonia water, urea, nitric acid, and nitrite/nitrate salts." Ammonium nitrate was used in the Oklahoma City bombing. Ukraine is targeting the refineries, pipelines, and related O&G facilities that generate revenue and fuel their economy, and cars and trucks. The strike on the plant making electrical connectors and products and this strike on the Azot specialty chemical plant is pretty muy bueno. Ukraine is not only blowing up the finished weapons, they are blowing up the primary components on the weapons.

-

Texas Football 2025 - Seven Win Steve Rides Again

PTINS replied to closetojumping's topic in Football

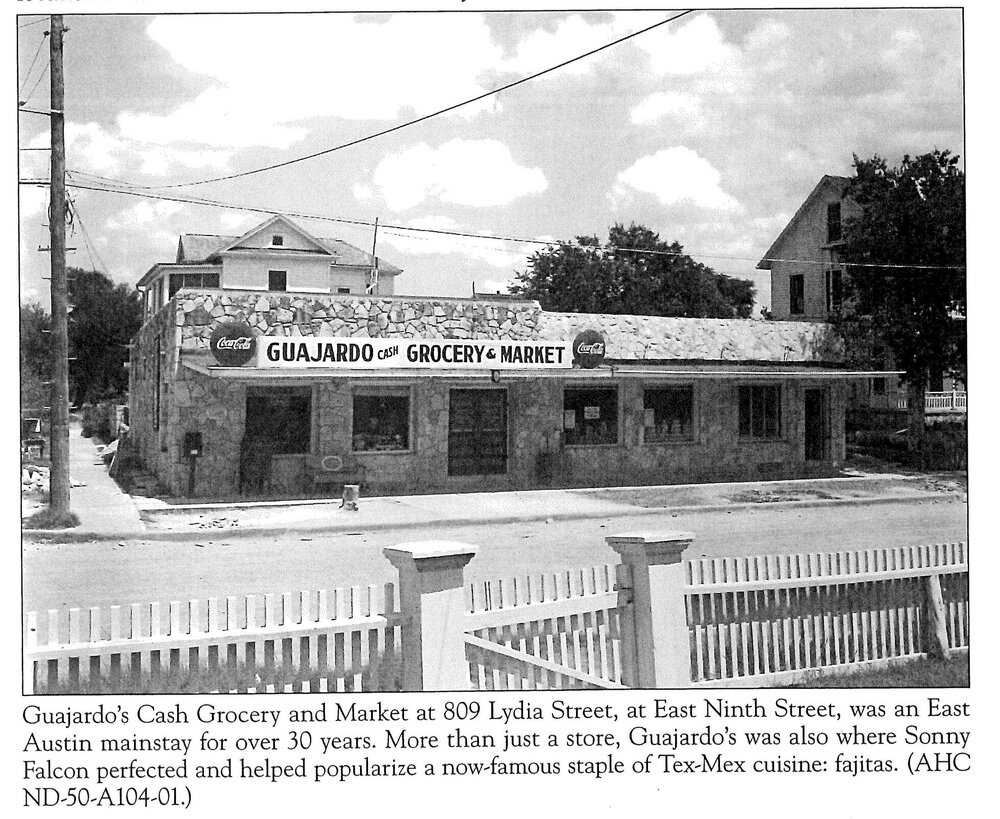

Late to the party, and nowhere else to post this. There used to be listing in the Austin phone book in the 70's for "Henador Titzoff", which actually was the number for a Sorority House. Henador Titzoff = He gnawed her tits off. "... brought fajita's to central Texas?" I beg to differ. My dad's family was from Manor, raised crops and animals, brought fresh food to the Guajardo store in Austin, Paw-paw had a bar at 3rd & Congress, El Galindo (chips) was dad's uncle. Austin food; Schlotzky's - "There is no substitute-skys" Shakey's Pizza, before Mr. Gattis, Bergstrom AFB Bowling Alley hamburgers, Del Valle schools (subsidized by BAFB), fresh cinnamon rolls in the morning, The Jet Drive-in, Saigon egg rolls on the Drag, Cisco's breakfast, The Stallion, T-Bones & Peach Cobbler at Texas Tumbleweed on 2222, Coupland Inn used to have all-you-can-eat-BBQ, Casita Jorge's margaritas before a game, The Bucket $.15/beers, Armadillo nachos, Les Amis. -

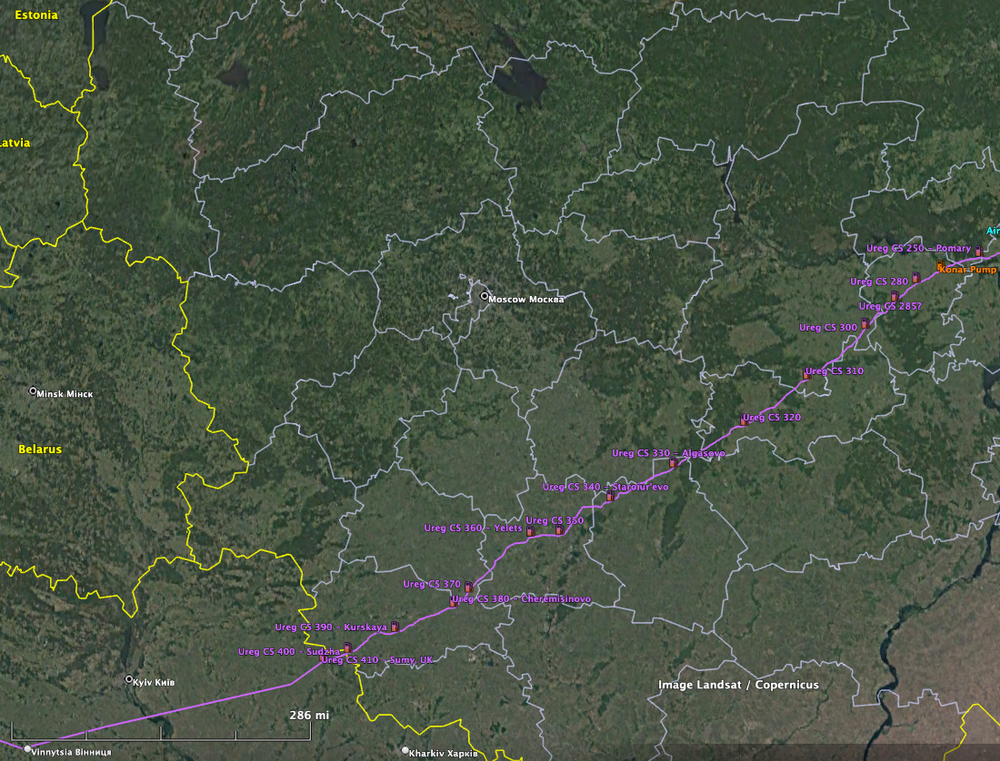

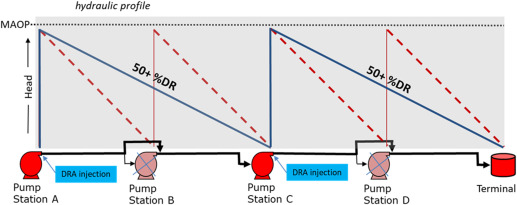

A: Ukraine took the gloves off. Similar to Refineries, what exactly Ukraine damaged is important, and very difficult to tell. Refineries >> Pipelines >> Compressor & Pump Stations >> Storage Tanks. The pipelines themselves are buried, and in the pump & compressor stations, most of the lines are buried, so it is difficult to know what was damaged without an idea what was there to begin with. Fluids move through pipes like a water hose, high pressure at one end, low pressure on the other. To fully utilize a long haul pipeline, you add booster stations along the pipeline to boost the pressures and increase the capacity. Gas is compressible, and a compressor is used to increase the pressure in the pipe. Liquids are not compressible, and a pump is used to increase the pressure in the pipeline. The functions between the two are similar in that both pipelines have friction losses (pressure drops), but the mechanics are very different. "Hydraulics" for the lay person, "Fluid Mechanics" for the enlightened ones. The Urengoy Pipeline transports gas from Siberia to Ukraine to Slovakia, some 2800 miles, with 42 compressor stations along the way. They are spaced 60-80 miles apart, depending on the topography, among other things. Blowing up the pipeline is more damaging than blowing up a single booster station. When Ukraine "invaded" Russia earlier this year (last year?), they damaged a gas measurement facility on this pipeline, which caused a bigger accounting issue than an operational one. The pipeline itself has a maximum operating pressure, and the higher the pressure, the higher the volumes moved (throughput). A single midpoint booster station (pumps or compressors) basically doubles the throughput of a pipeline, by increasing the pressure to offset the pressure drop. With the multiple booster stations on a pipeline, you end up with a "saw tooth" pressure profile along the pipeline, with each station boosting the pressure to set point, (MAOP). In the diagram below, with only Station "A" at the beginning of the pipeline, the volumes transported to the Terminal are "X". Adding a midpoint booster at Station "C" would increase the throughput to "2X". Adding Stations "B", "C" and "D" would would increase the throughput to "4X". Any capacity reduction at any one station could be minimized by changing the operating conditions at the stations before and after the affected station, with a minimal decrease in the throughput. Most of Russia's pipelines are operating at much lower volumes due to sanctions, so any longer term interruptions from any one station would be minimal. If the mainlines were also damaged at a station, that is a much different scenario. Large diameter pipeline explosions make nice pictures. A huge fireball that goes full throttle until the pipeline fuel is consumed, with the dynamic effect similar to a large jet engine on afterburner, with a 50 mile long mile tank feeding it. Urengoy Pipeline Explosion Careful, you could put an eye out if you get too close. Crazy eyes. Let me get on, and turn her loose. I can last for 8 seconds. Oh, wait.

-

GOD DAMMIT TO HELL!!!! I was typing a long response, did a quick search in the wrong window, bounced out of Surly, OH, SHIT!!! I hit the back button, and nothing was there!

-

Most welcome. I was hired into a Management Development Program to find engineers that could run a company that was 100 years old, in 1975. It was all about training and development. My tangent was facilities planning and commercial development. Believe it or not, the opportunity to share information about O&G to some sweet thing you come across doesn't happen as often as you would think. When it does, don't. I learned that right out of the gate. I graduated 3 months after 3 Mile Island and at the start of Iranian Revolution, and went to work for a regulated piece of the oil industry that was in danger of making too much money. They damn sure weren't going to stop making it. Hard for a new hire to justify the 300% bump in gasoline prices while I'm buying you drinks. "You don't save the company money on your expense account, you save them money by doing a good job." Jack Issel: Exactly what is our side of the Allenville story? Max Landsberger: Were losing money hand over fist. Jack Issel: That's not true. Max Landsberger: No, but it's our side of the story. Lesson No.55: there are no truths, only stories. I did find a better line. "I've got coc..."

-

-

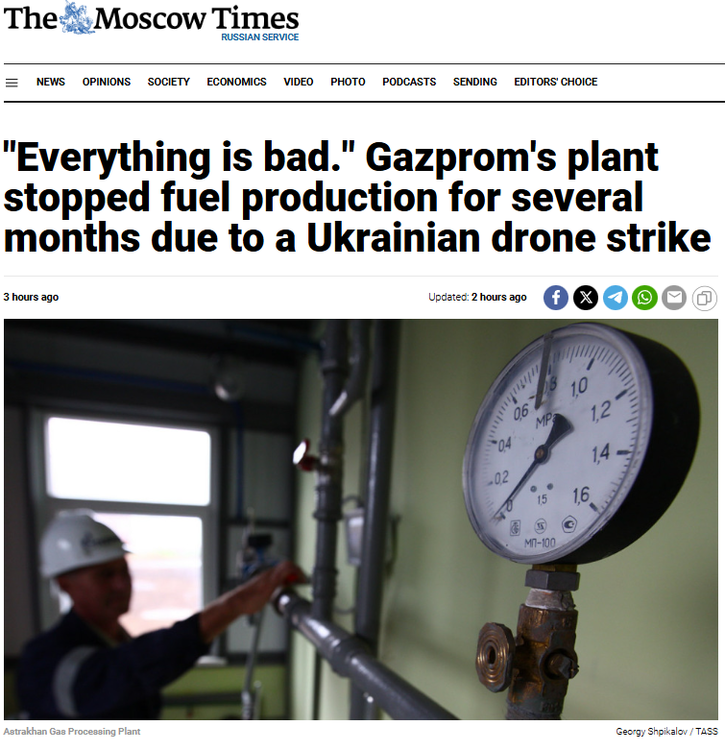

@PTINS one of those areas, this is apparently the second time in a few days so I’m guessing they have solid intel on what damage they did the first time and then did a follow-up. I preface my comments with the realization that drones and drone warfare, and Ukrainian ingenuity, are light years ahead of where they were just 3 years ago. With that said, the very recent strategic strikes on the critical nodes within the Russian Oil & Gas are far much damaging to Russia, their economy, and their ability to make war, than lighting up the random fuel depots and terminals scattered across a big ass country. On a short term basis, hitting those depots has value, as it delays Russian offensive movements in theatre, and saves Ukrainian lives. The Pump Station they hit in atomheart's quoted post was a good one to hit. First, it burns. Like always, it is hard to tell what they actually hit. It is a mainline Pump Station on a big oil pipeline, with the priorities being the pipeline itself, the pumping facilities, and the storage tanks. Tanks are not my favorites, but these are big tanks, ~240' diameter, ~ 240,000 bbl each (10,00,000 gallons). They have had 6 of them, which were probably full, ~ 1,500,000 million bbl, 60,000,000 gallons, ~ $500,000,000 in oil. If the storage is all they hit, that alone is a damn good payout. If they hit the pumps and pipeline, just more gravy on top. Yes, "I see ample evidence of a misspent youth." Opps, Sorry. (The comment my GM at Amoco said when he saw me playing pool in a bar in Eunice, Louisiana.) I see ample evidence that Ukraine has opened the file cabinets in the basements and pulled drawings of Russian Oil & Gas infrastructure (most of which was probably designed by Ukraine); Refinery process and flow diagrams, facility plot plans, pipeline alignment sheets, pump & compressor station locations, and ... Gas Processing Plants. Ukraine hit the same Astrakhan Gas Processing plant in February. (I will attach my earlier comments in a separate post.) As mentioned before, refineries have many distinct process units, including upgraded versions of similar processes that have improved over time, spread out over a 1,000+ acre footprint. It would be very difficult to knock it out 100%. Gas Processing Plants are very linear, a series of sequential processes that process natural gas into finished, usable, end use products. First the impurities are removed (oil, water, carbon dioxide, various sulfur compounds), the Natural Gas Liquids are removed from the gas stream, making the residue gas into a saleable product, and the NGLs are fractionated into 5 distinct commercial products that each have various uses, including as feedstocks to refineries and petrochemical plants, to make other finished products, including propane, gasoline and diesel. Disrupting any link in the process basically shuts down the process. The closer to the beginning, the more serious the disruption. Strike on the Astrakhan gas processing plant "The General Staff also confirmed the outcome of an earlier operation: on September 22, the Defense Forces’ long-range weapons struck the Astrakhan gas processing plant, causing damage to production areas and the suspension of part of the technological cycle. This GPP is one of the largest gas-chemical complexes in the world and a major producer of sulphur for Russia’s industrial needs." Astrakhan Gas Plant in Russia has ceased operations "Three industry sources have confirmed that the Astrakhan Gas Processing Plant, owned by energy giant Gazprom in Russia, stopped producing motor fuel after an attack by drones caused a fire on September 22, according to three sources. The fire was said to have engulfed an entire condensate unit that had a production capacity of three million metric tonnes per year. It produces diesel and gasoline. The plant near the Caspian sea, about 1,675 km [It is only ~ 700 km, 400 miles] from the Ukrainian border could only resume production within a few weeks or months. Gazprom didn't immediately respond to a comment request. Igor Babushkin said in a message sent via Telegram on Monday, that drones had targeted an industrial enterprise. He did not mention the company. As of Monday, the St Petersburg commodity exchange has ceased selling wholesale fuel parcels produced by Astrakhan. Early in February, drones also struck the plant and halted fuel production. According to industry sources, the damaged unit resumed operation at the end August. According to industry sources, in 2024 the plant will process 1.8 million tonnes of stable condensate and produce 800,000 metric tons of gasoline, 600,00 metric tons of diesel, and 300,000 metric tons of fuel oil." Reporting and Editing by Alison Williams, September 23, 2025 - source: Reuters Whatever Ukraine damaged in February, it took Russia 6 months to get the plant back online. With Ukraine's bigger and better drones and targeting accuracy, this may have been a haymaker. All it takes is a spark, or combing your hair, and ...

-

Texas Football 2025 - Seven Win Steve Rides Again

PTINS replied to closetojumping's topic in Football

We're Texas! -

Texas Recruiting Notes 2027: I remember watching his dad play

PTINS replied to BornAndRaised's topic in 🤫$9.95🤫

-

Texas Recruiting Notes 2026: Boulevard of Broken Bagmen

PTINS replied to texifornia's topic in 🤫$9.95🤫

Sunday morning I listened to part of a Youtube video with Wiltfong on it. I was doing other stuff, but he said a number of times that these Florida guys, both Texas commits and commits to other schools, were in Austin to see Texas v. Sam Houston State, when they could have stayed home and visited Florida & Miami, or the schools they were committed to. He is not a Texas pumper, but he seemed somewhat intrigued with how Texas sits in the recruiting world these days. -

FIFY Pure speculation on my part. It is like a big machine with lots of moving parts that needs constant attention, along with periodic predictive and preventative maintenance. When you start postponing, delaying and canceling the maintenance, the machine gradually starts slowing down, until it seizes up, and stops. Battle of the Bulge stuff. The more infrastructure Ukraine damages, the more critical the remaining infrastructure becomes. Refining is not something you can just throw more people at. I don't think those Russian refineries are "coming back" until the sanctions are lifted. You cannot build world class OIL & GAS facilities during a war. If the local people can't get gasoline and diesel, it won't be long until the trains can't get it, and they stop moving, which is absolutely critical in Russia. If they can't move what little they make, then what? No money, no jobs, no food, no heat and no friends. Extreme Theory? What is the worst that could happen? When Russia is facing the same existential crisis they forced upon Ukraine, then what? That is a dark hole to wonder down. TLDR Ukraine has targeted most of Russia's refineries to some degree, with the exception of those in far eastern Russian. To what degree they were damaged? No idea. Ukraines more recent attacks, where they have targeted specific process towers, tells me they are not just lobbing grenades any more, but more likely, they have access to the refineries Process Flow Diagrams and plot plans, that detail the critical process towers and equipment, and the specific locations of the equipment. Ukraine has been hitting moving targets at will, hitting a static refinery process tower that has a John Hancock like infrared signature, is easier than shooting fish in a barrel. Both Biden & Trump, and most of the EU, have had a heavy thumb on Ukraines targeting of certain Russian O&G facilities and operations, those mostly likely to impact gasoline and diesel prices at home. After 3 years of Russian fuckery, Ukraine has taken the gloves off. Oil prices have decreased from $100+ BBL to $60, because so much "sanctioned" Russian oil is still coming into the market. This reinforces the obvious; blowing shit up works a lot better than repeated hollow diplomatic threats. Refineries are more critical as they make what is needed domestically, they are also well defined choke points on crude oil production. They are literally are the fuel that drives the domestic economy, with the excess crude feeding the export market. Some of the internet threads and posts have alluded to a "product ring" around Moscow, inferring there is a series of product pipelines surrounding the Moscow region, with access to multiple refineries feeding it from different directions. As long as Moscow is happy, nobody gives a shit. More recently Ukraine has targeted everything; refining, product pipelines, pump stations and domestic oil depots (refined products), and export terminals for both products and crude exports. The cumulative effect of all of that will be more critical as time passes. Replacing the refinery process towers takes a long time. The towers themselves are custom, fit for purpose, long delivery time items. They are big, ~10-15 ft in diameter, 100+ ft tall, with a special metallurgy suitable for operating at high temperatures and pressures, in a very corrosive, and toxic environment. Cook up and smelt all the right ingredients into thick steel plates, roll the plates into cylinders, weld all the cylinders together, cut multiple openings into the cylinders, weld custom flanges and fittings into the holes, heat treat and stress relieve the finished product, load it on a special rail car and move it (without anybody finding out), erect a big ass crane, stand it up and bolt it down. Then connect all the receipt and delivery piping to the myriad of pumps, compressors, coolers, condensers, heaters, and heat exchangers, and all the valves and instrumentation and wires and cables, all of which are also special ordered equipment. And then paint it, weatherize it for winter (Real winter, not Texas winter), and insulate everything. The probability that the skilled labor required to do all these things is sitting around waiting for something to do is about 0.0%; they are probably pushing up sunflowers in Ukraine. Bottom line, reduced Russian refining is going to impact Russia immediately, and for a long time. Not just the war effort, but much more. The one thing Russia had going for it was the world needed Russia's oil production. Oil prices are down to half of what they were a few years ago. That doesn't mean we don't need Russia's oil; we just don't need it right now. It is almost funny to see Trump trying to strong arm China & India into stop buying Russian oil. Where are they supposed to get it from?

-

"According to preliminary information, the drones hit the ELOU-AVT-4 unit - the heart of the plant. It first cleans oil from water and salts, and then converts it into gasoline, diesel, kerosene, and fuel oil. A strong fire and a black column of smoke are observed on the plant's territory," the source said. The fact of damage to the refinery was also confirmed by representatives of the Bashkortostan authorities. That is the way to do it. A++ (Sorry, A+. I've been reading the recruiting pages too much) A surgical strike at the main process tower that removes the impurities and separates the crude oil into the various transportation fuels. The entire vertical column is enveloped in flames, with a single column of thick black smoke (fuel burning >> oxygen supply) rising high into the sky. The longer it burns, the hotter the oil gets, the faster it vaporizes, the easier it burns, the bigger the fire and the hotter it gets. Too hot of a fire to put out with water, you have to remove the fuel source, which means shutting off valves. The instrumentation and automated control systems, if they had any to begin with, and if they survived the initial explosion, probably melted within the first few minutes, meaning the valves would have to be closed manually. "disco inferno (Burn, baby, burn) burn that mother down (Burn, baby, burn) disco inferno, yeah (Burn, baby, burn) burn that mother down (burnin'!)"

-

They can decrease the purchases from Russia. They won't decrease the purchases entirely, at least not willingly. This comes up a lot. Worldwide Oil Production ~ 100,000,000 Barrels/day (BPD). The US, Saudi Arabia, and Russia eash produce over 10,000,000 BPD. Nobody else is anywhere close, few even produce half that amount. In a balanced market, cutting off 10+% of the supply affects 100% of the market. The US is probably the only market where people bitch about gasoline & diesel prices. Everybody else knows they import crude oil and refined products, and understands they are pawns in the market place. The US is also a pawn, but everybody in the US believes it is their birthright to always have cheap gas. Oh, and the collective mindset of the US, it what you would expect from a bunch of idiots. The US leads the world in oil production, and also leads the world in oil consumption, by a significant amount. A large portion of the "US consumption" is actually crude oil used to make refined transportation fuels that are exported and actually consumed by the importing countries. The US produced and imported oil is refined in the US, the gasoline mostly stays here, and the excess diesel is exported. With Russia as a pariah, and the US watching/endorsing Israel bombing Qatar, I would expect the Middle East-US mindset to be neutral at best, meaning the US would be in a bidding war for crude oil; Exxon, Chevron & Conoco bidding against Europe, China, India, Japan, S. Korea, etc. To replace 1,000,000 BPD of "lost" oil production would take ~ 300 new wells in the permian. Each well 10,000 feet down, another 10,000 foot "lateral, at a cost of $10,000,000/well, or $3 Billion total, with a "B". Nobody in the US is drilling based on $60 oil. Prices have to move up first. Stopping Russian exports is the first domino. Yes, any fireball on the horizon in Russia is a good thing. Mostly, it is just shut-in in place underground. Russia could earn some "good will" by paying it forward to Turkey & China and others, but producing and giving it away has a chance of future benefits, whereas the shut-in gas is worth nothing. Hitting any Russian Refinery. anywhere is good. just for the optics. But not all attacks are equal. The new Saratov Refinery attack caused a fire in the red polygon. That appears to be proximate to some manifolds and some above ground piping. Nothing that seems to be critical and out of commission for very long period. A google screen shot shows the fire location relative to the refinery footprint. IMO, hitting anything in the yellow polygons was probably a much better target than what they hit. Recently, Ukraine has targeted, and hit, specific process towers. Those are among the highest value targets in Russia, because they reduce fuel production, reduce export revenue, and are very difficult to replace, given sanctions and difficulties Russia will have in getting replacement parts, controls and instrumentation. Hitting storage tanks makes big fireballs, but 2 or 3 of the larger tanks is only ~ 1 days/ worth of production. Knocking out the main process towers means a 40% reduction in total refining capacity for ~ 6 months, or longer. Seeing Ukraine specify vessel names and numbers, and hitting them, makes my heart go pitter patter.

-

Texas Football 2025 - Seven Win Steve Rides Again

PTINS replied to closetojumping's topic in Football

Any pass play that loses 5 yard needs to be shit canned and never to be seen again. Nothing kills a drive like throwing a pass 20 yards to loose 5 yards on 1st down. Most of Sarks scripted plays to start the game are dog shit. -

Got my season passes!!! See you bright and early. Maybe just early.

-

Besides Arch’s poor mechanics and bad throws, the most disappointing thing is seeing Arch sitting on the bench by himself every time we are on defense. Why is there not a coach with him with screenshots of alignments and plays talking to him, settling him down, getting him to focus on the fundamentals, the little things that yield positive results? I know Sark is busy managing the game, but there is no reason for Arch to not be talking to somebody the whole damn game. Seeing those piss poor side arm throws all daylong was frustrating as hell. Where the fuck is his QB coach?

-

It is really comforting to see Ukraine transition from targeting oil storage tanks and depots to targeting the processing parts of the refineries, the large tall towers, the crackers and distillation columns. The tanks make huge fireballs and burn for days, but they are just large gas cans. You know, "chicks dig the long ball." The columns "crack" the oil, breaking down the long chain hydrocarbons into simpler fluids that are separated and further processed within the refinery. There may be 50-100 separate processing units within a world class refinery, but only a hand full of them include the towers. Destroying a pressure vessel (large propane tank) 100+ feet tall, 10+ feet in diameter, with numerous pipes going in and out, and all the associated controls and instrumentation is a much, much bigger issue. Ukraine w/ US "support" 2022-2023: Ukraine fighting a war 2024-2025: I am not a Bot. I am also not a wonk. Maybe? This is a screenshot from a file I started when Ukraine was invaded. It is from a combination of publicly available information from multiple sources, the accuracy of which is suspect, but directionally, it is pretty accurate. Ukraine has targeted every significant Russian refinery (21) except the 3 highlighted. Those 3 are way far east, 1200+ miles from Ukraine. What exactly was hit and damaged is not known. Some of these refineries (similar to Deer Park and Lake Charles) have a footprint of 1-3 square miles, 1,000+ acres. Hitting half a dozen oil storage tanks in the tank farm is much different than taking out 1 of the main process units, a mile away. A lot of the reporting in the media, is like a lot of reporting in the media. Good for public consumption, but a lot of BS. Refineries make both gasoline and diesel, AFTER the oil has been refined and separated into individual components. How much of each and the various grades is determined by further downstream processing and blending units. Ukraine is 100% doing what they need to do, fighting to continue to exist. But the ankle bone is connected to the leg bone which is connected to the knee bone... Decreasing refined products from Russia, means that Russia and all their customers will need to find alternative supplies, which are limited. Supply & Demand always works. Crude demand, and prices, will go down, and gasoline and diesel demand, and prices, will go up. Make no mistake, this is a concern that both Biden & Trump shared. It is not "price gouging" by US refiners. It is a free market at work. Both Valero (in progress) and Phillips are shutting down refineries in California this year. California is scrambling looking for outside supplies. Maybe build a new refinery? What? No pipelines from Texas? You reap what you sow.

-

2025 game Week 1, #1 Texas @ #3 Ohio State - What the Fuck is a Buckeye?

PTINS replied to Wulaw Horn's topic in Football

IMO, Their OL probably looked decent this spring and summer, when they were blocking the one good DT that was available. The OL blocking against a bunch of younger DL that was supplemented with mid-level transfers is not the same as going against a more elite and experienced DL. -

My dad was the Scoutmaster and my mother was my Den Mother. I was in the Cub Scouts; got kicked out for eating a Brownie. Just kidding! If we stayed in Florida, my brother would have earned his Eagle Scout rank. We moved to Austin in '66, he got a guitar, and rest is history. Bergstrom did not have the parental involvement that Eglin had. Too many short cycle dads were sent to Vietnam, and Austin, TX was a lot different than Valparaiso, FL.

-

Texas Football 2025 - Seven Win Steve Rides Again

PTINS replied to closetojumping's topic in Football

I don't disagree with any of your post. I only included aggy as 1 of the 4 that left the B12, blaming Texas for everything as they slithered out the door. I lived in Colorado for 3 years, when they were good. Too bad Rick Neuheisel fucked that up. He had a monster going. I bought some new Python Boots before I moved up there in the 90's. I knew what they thought about Texan's, and I didn't want to disappoint them. I was talking to a colleague one day, and he said something like, "You damn Texan's are all alike! Texas this, and Texas that! Why are you guys like that? Do they teach you that shit?" "As a matter of fact, they do. Texas History in 7th Grade." "Oh..." he replied, somewhat. surprised. "I have to be honest ... I'm jealous. Every person I've ever met from Texas is like that. I just wish I was from a place like that, where everybody had that much pride." -

Texas Football 2025 - Seven Win Steve Rides Again

PTINS replied to closetojumping's topic in Football

Conoco and Phillips are Oklahoma home grown oil companies started in the late 1800's. Jed Clampett sold his fortune to Mr. Brewster in Tulsa, the 'Oil Capital of the World." Oklahoma is similar to Texas in that there are multiple producing formations, stacked like pancakes. There are no dry holes in Oklahoma; the only question is how much produced water you have to get rid of. West Texas Intermediate looks like the oil after a 2 year oil change. The Oklahoma Sweet oil produced around Ponca City, Conoco's home, is a golden-greenish-yellow color, and looks Quaker State 10W-40 that comes out of a can. It's the second most popular thing to come out of Ponca City, Oklahoma; Candy Loving being the first. The smaller independent oil companies are the meat in potatoes in Oklahoma oil & gas production, many of which have had their fortunes since well before I moved there in the late 70's. Yes, there are plenty of trailer parks, just like any other place. But there is also an underlying wealth that is for them to know, and for you to find out about. Harold Hamm was the youngest of 13 kids born to a share cropper, didn't go to college, and started his own company at 21. He is worth ~ $18.5 Billion. Yeah, Harold didn't go to college, but I bet his kids did. Make no mistake, there is a lot of money up there.

Football ... Basketball ... Baseball ... Other Sports ... Futbol ... 🤫995🤫 ... Gambling ... Movies & TV ... Music ... Hobbies ... Lulz ... Food & Travel ... Daily Texan ... Business and Markets ... Cloak Room ... Help ... For Sale ... Board Discussion ... Subscribe!... Donate!... COOKIE MONSTER!