-

Posts

2630 -

Joined

-

Last visited

Reputation

1827 Surly 10%Recent Profile Visitors

-

His life is hardly ruined. He either works it out with the wife or not, that's hardly a ruined life. Divorces happen all the time; he's a CEO (not his first gig either), plenty of cash, he'll land somewhere on his feet and he'll either be married or not and have a lot less in tbe bank account, but its not like divorce/cheating is life ending.

-

Epstein files update (there are no Epstein files)

jdhorn92 replied to Gil Bang's topic in Cloak Room

Easily contradicted. They had the file for 4 years under Biden. If there was anything implicating the idiot in office now, they would have used it. The "list" is a ruse, nothing to see there imo. Better approach is to get GM to talk -

Simmos, Moore, Spence, Lefau, Hill, Burke, Vasek, January and transfer DT's. Throw in maybe our best secondary in some time (really hope Derek Williams is healthy), this Defense could be special. Lance Jackson could be wildcard and of course the other young DE's who have been on campus, we may be on to something this year in terms of not a good defense, but a suffocating D.

-

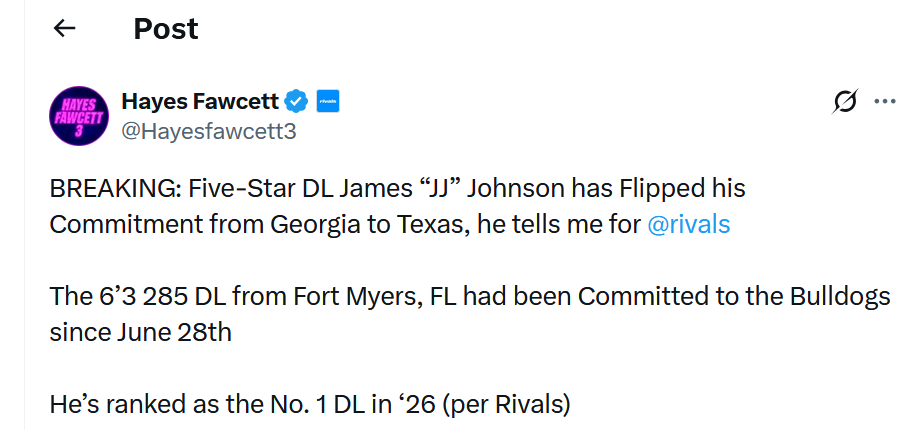

Texas Recruiting Notes 2026: Boulevard of Broken Bagmen

jdhorn92 replied to texifornia's topic in 🤫$9.95🤫

#1 DL in the Nation got to be 5 Stars. -

Texas Recruiting Notes 2026: Boulevard of Broken Bagmen

jdhorn92 replied to texifornia's topic in 🤫$9.95🤫

-

Texas Recruiting Notes 2026: Boulevard of Broken Bagmen

jdhorn92 replied to texifornia's topic in 🤫$9.95🤫

Got to be the first time ever Texas goes into Miami and snags a 5 Star DL prospect, or any 5 Star for that matter. Where was Holton Hill from? As a product of the Dallas Morning News back page recruiting lists (National in one column, then Regional and State), I would read player after player from Fort Lauderdale and Miami selecting the U, Notre Dame, FSU, etc..wondering if we could ever crack that nut. Closest we ever got to the East Coast was WR Pinkney. Nice to finally see the national push the last several years. Is this kid JJ from the HS in the news with Bridgewater? -

When factoring convenience and now eliminating the change of getting mugged, Id say the prepay is a bargain. The OP even said he checked around to make sure it was safe, it clearly was not, pre-paying and not having to jack with finding a gas station when trying to make a close flight, what a beating (no pun) that is trying to fill up when you can simply opt for the rental company to handle it. 90% of rentals are businessman, so its being expensed.

-

Same thing I heard from my buddy who had a kid at La Junta. Kincaid family, he said the older couselors told the boys to "get to the fucking hill". Not sure if that indicates they had more lead time. He said his boy spent 4 hours in his underwear waiting, cold until evac occurred to a church. We're on a 12 friend text thread, so we havent pressed for details beyond what he is sharing as his boy shares more. He said the older male couselors in his La Junta cabin were great and the timing tells me they at least were positioned where they had time to get to higher ground.

-

Always opt for the gas fuel option when renting a car.

-

He hit the deep throws in the 2 Bama games but was not so good in most of the other games throwing deep. His intermediate stuff however was tremendous.

-

He’s Going to California

-

Be curious to see where it goes from here. down 7% today

-

Firefighters ambushed by gunman while responding to brush fire in Idaho

jdhorn92 replied to Parliament's topic in Daily Texan

yes thats right. My cousin has seen him at gigs. He (my cousin) plays all over. The bar Idaho Pour Authority (great name for a bar) is owned by cousins best friend, at least it was as of a year ago or so and they see him in there periodically -

Firefighters ambushed by gunman while responding to brush fire in Idaho

jdhorn92 replied to Parliament's topic in Daily Texan

CSB/ My Aunt and Uncle live in Sand Point (my youngest cousin graduated HS there). They moved there from Long Beach, CA 25 years ago to retire. My Uncle was retired LAPD. Mark Furman (sp), yeah that Mark Furman also lived there for a period of time after OJ. My Uncle took a racquet ball to the arse from Furman. Maybe not so cool story. Carry on. -

Firefighters ambushed by gunman while responding to brush fire in Idaho

jdhorn92 replied to Parliament's topic in Daily Texan

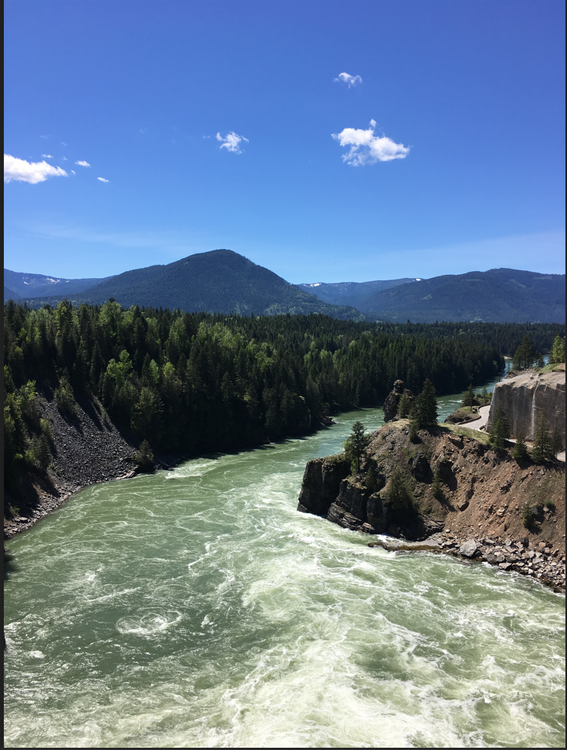

Extended family has a house in Sandpoint, about an hour north of CDA. Spend many years going there. They also own several acres in Clark, MT along the Clark Fork River. Spend many weekends with my cousins and brother camping and fishing for Pike. In all my years up there, we never had any issues or saw anything, but we werent looking for it either. I guess in and around the tourist areas of the lake and Schweitzer Mt they would likely not be as obvious. Couple times we would stay at the resort in CDA if we had a late of enough flight out of Spokane. Always enjoyed both CDA and Sandpoint. Very remote up there, its only about 60 miles south of Canadian border where we camped and fished. View from above our campsite down river a 1/5 mile, near the damn.

Football ... Basketball ... Baseball ... Other Sports ... Futbol ... 🤫995🤫 ... Gambling ... Movies & TV ... Music ... Hobbies ... Lulz ... Food & Travel ... Daily Texan ... Business and Markets ... Cloak Room ... Help ... For Sale ... Board Discussion ... Subscribe!... Donate!... COOKIE MONSTER!