You would enjoy the paper. It is thorough. It’s only 28 pages. The remaining 19 pages are citations to data and prior studies. It’s an easy read.

To your point, it’s not a political discussion, so your preference for direct transfers to employers is not part of the issues studied. It is merely compiled data and analysis with policy recommendations when this tool is used in the future. Here is the abstract:

The Paycheck Protection Program (PPP) provided small businesses with roughly $800 billion dollars in uncollateralized, low-interest loans during the pandemic, almost all of which will be forgiven.

With 93 percent of small businesses ultimately receiving one or more loans, the PPP nearly saturated its market in just two months.

We estimate that the program cumulatively preserved between 2 and 3 million job-years of employment over 14 months at a cost of $170K to $257K per job-year retained. These estimates imply that only 23 to 34 percent of PPP dollars went directly to workers who would otherwise have lost jobs; the balance flowed to business owners and shareholders, including creditors and suppliers of PPP-receiving firms.

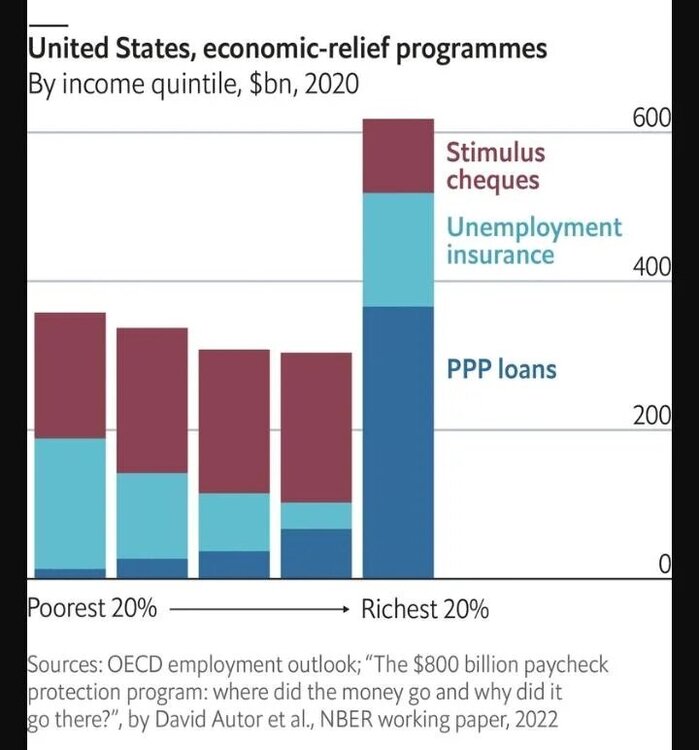

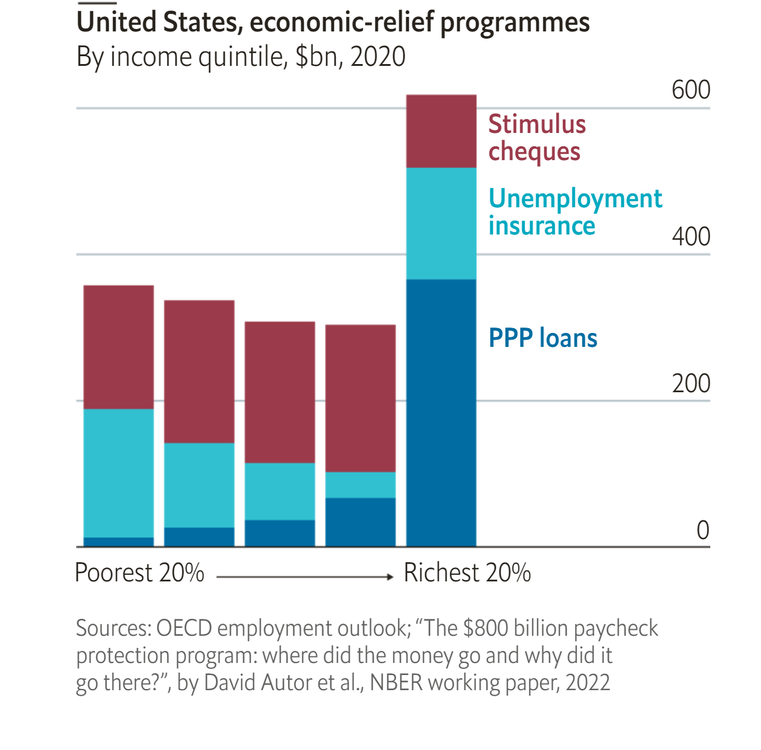

Program incidence was highly regressive, with about three-quarters of PPP funds accruing to the top quintile of households.

This compares unfavorably to the other two major pandemic aid programs, enhanced UI benefits and Economic Impact Payments (i.e. stimulus checks).

PPP’s breakneck scale-up, its high cost per job saved, and its regressive incidence have a common origin: PPP was essentially untargeted because the United States lacked the administrative infrastructure to do otherwise.

The more targeted pandemic business aid programs deployed by other high-income countries exemplify what is feasible with better administrative systems. Building similar capacity in the U.S. would enable greatly improved targeting of either employment subsidies or business liquidity when the next pandemic or other large-scale economic emergency occurs, as it surely will.

PPP was far less effective and much more costly than the UI in saving jobs. PPP transfer payments to businesses came at a cost of $258,000 per job. That’s ridiculous.

As for prosecutions, here is the data from the DOJ. I hope you are right about catching all the bad actors.

https://www.justice.gov/criminal-fraud/cares-act-fraud

For those who received PPP loans and bemoan all the Commies and Socialists, may they remove the planks from their eyes. That is not directed at you Doc.