-

Posts

15669 -

Joined

-

Last visited

-

Days Won

2

Trey3216 last won the day on May 4 2020

Trey3216 had the most liked content!

Reputation

15841 Surly 1%Recent Profile Visitors

-

I put the one pictured above in a foil catering pan with a lid, in the vacuum seal with about 2 gallons of water in it, in the oven for about 2 hours at 200. Then I poured the water out and cranked the oven to 300 for 30 minutes to let it “re-bark”. Turned out great. Basically a modified sous vide

-

Several good friends of mine, 2 guys that work in restoration for Balfour, and a retired firefighter started a foundation called Midnight Hope Foundation. They set families up with hotel rooms and H‑E‑B/Wally World Gift cards to help them get off their feet after a house fire, flood, etc. they mainly serve McLennan/Hill/Bell county areas, but are making a huge push for Kerr County right now. All donations will be directly to purchase gift cards for H‑E‑B and Wally World and put directly into hands of those in need Wednesday/Thursday this week. just another outlet to help in any way. But a good cause and good foundation as well. https://midnighthope.com/?fbclid=IwQ0xDSwLZRvVleHRuA2FlbQIxMAABHiW4R3naWcOxuJsZvGrPNiWiCVMKoZI6_2d0Ye13OG246vS6_q747cppgYOE_aem_YDuZ28r-XT9QDxO_oIL7MQ

-

I’ve known he and his extended family for years. Absolutely gut wrenching. Also had one of my fraternity brothers’ daughters at Mystic. Thank God she made it. I’ve been sick to my stomach thinking about it.

-

-

lol. That’s rich

-

Damn, nearly 7 months on an entry for this thread…. making one today for next weekend. Smoking a 12#’r at 300 that I will rest, then vacuum pack, and re-heat via the hot water in cooler method. Ain’t got time or energy to cook this shit next weekend when it’s 100 outside. will add more pics later…. Pic 1 almost done trimming pic 2 seasoned with SPG pic 3 about to wrap in butcher paper

-

Almost had a Cristiano Ronaldo meme at my house this morning. My 4 year knocked a cup of apple juice over and made a big mess. Wife walks in and says “Who made this big mess on the floor”. Sweet daughter says “The juice did it” Wife says “What did you say?!? The what did it?!” I’m on the floor in the other room laughing my ass off

-

Brian Wilson dies and Israel decides to Bomb Iran...can't be a coincidence.

-

Eventually, the massive short position is going to be completely unwound. I hate where we’re at, but I know the explosion is going to make Krakatoa blush. May need to look at a HELOC.

-

O capitan

-

Exactly. We’re not openly trying to kill your players’ families. Whoop!

-

Episode 10, with stretches of 2 and 3 minutes or longer with zero dialogue (other than the rando guards/troopers' comments) and Kleya just cutting through like a knife through Franklin brisket, is absolutely perfect filmmaking, and added to the immense tension. Phenomenal.

-

I mean, there’s no chance Luthen survives. 0% and Kleya may be at a 10%

-

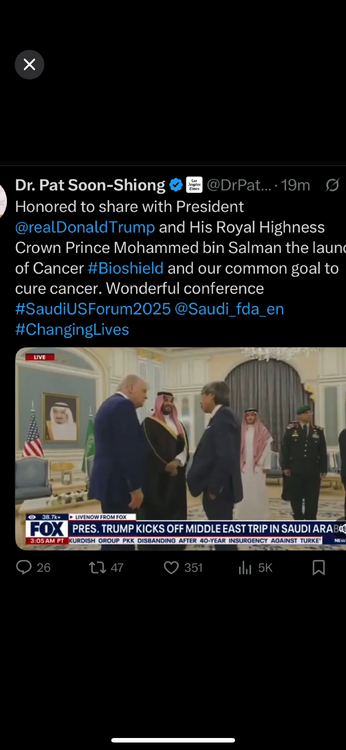

I’m hoping Trump, MBS, and our resident Korean John Denver make a deal that sends IBRX to the stratosphere. maybe MBS takes it private for $100bn. “Thank God I’m a cancer doc!”

Football ... Basketball ... Baseball ... Other Sports ... Futbol ... 🤫995🤫 ... Gambling ... Movies & TV ... Music ... Hobbies ... Lulz ... Food & Travel ... Daily Texan ... Business and Markets ... Cloak Room ... Help ... For Sale ... Board Discussion ... Subscribe!... Donate!... COOKIE MONSTER!