Everything posted by boilerhorn

-

Transfer Cycle 2025-2026 - Pining For IOLs Who Can Fog A Mirror

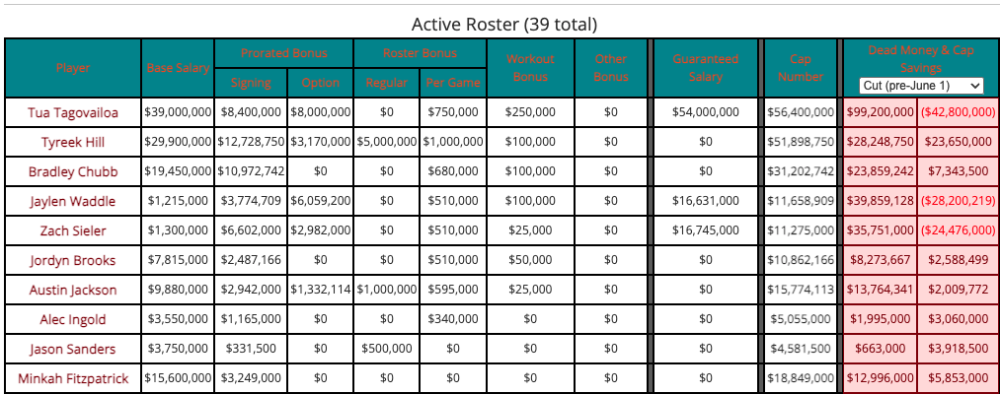

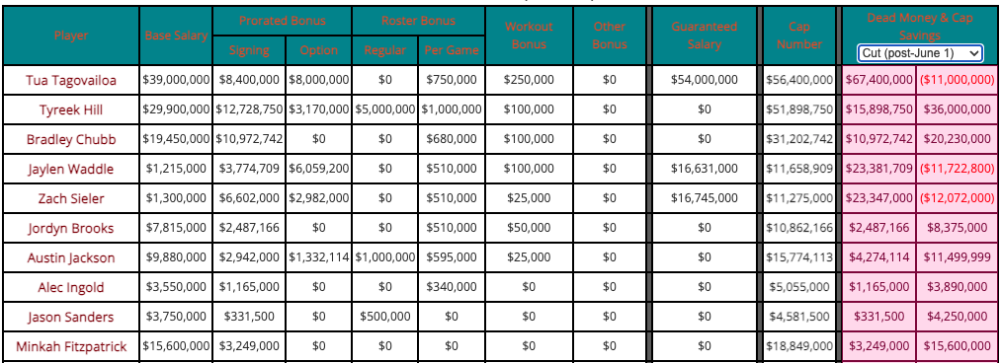

Seems like neither he nor his representatives understand the ramifications of signing a contract.

-

Transfer Cycle 2025-2026 - Pining For IOLs Who Can Fog A Mirror

-

Transfer Cycle 2025-2026 - Pining For IOLs Who Can Fog A Mirror

Kiffin:

-

Transfer Cycle 2025-2026 - Pining For IOLs Who Can Fog A Mirror

-

2026 Celebrity Death Watch Pool

Shoot. Just rewatched that Live Aid performance. There was enough shitty playing to go around. Plant was missing notes. Page was high as a kite and all over the place. Collins def needed at least one rehearsal. I guess Phil's mistake - talking about it again (??) Edit to add - 1985 Cher was top-notch.

-

Transfer Cycle 2025-2026 - Pining For IOLs Who Can Fog A Mirror

Larry Ellison to the rescue. Or - we sent Derek Warehime to the Guarnera household to seal the deal.

-

Parker Livingstone

- Transfer Cycle 2025-2026 - Pining For IOLs Who Can Fog A Mirror

"I think it’s most likely they end up at the same school, but I wouldn’t rule out a split." Where can I send my $9.95 for that riveting analysis?- Quinn "La Joya" Ewers - The Man The Myth The Mullet, Now Starting for the Miami Dolphins

- Transfer TE Michael Masunas

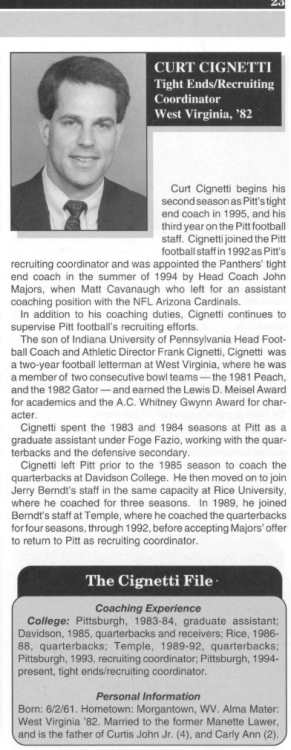

Curt Cignetti was TE coach and recruiting coordinator at Pitt in 1995. I contend he invented the notion of pairing a blocking TE w/ a catching TE. j/k https://documenting.pitt.edu/islandora/object/pitt%3A31735062136191/viewer#page/24/mode/2up- Transfer Cycle 2025-2026 - Pining For IOLs Who Can Fog A Mirror

From the linked article: At the same time, the Red Raiders can now use transfer quarterback Brendan Sorsby as a selling point, while playing with Aggie QB Marcel Reed and star wide receiver Mario Craver will be equally enticing. I don't see USC as a legitimate threat, and Texas will still be in the running regardless. Not one mention of Manning; smh; after all, it is "aggieswire"- Transfer Cycle 2025-2026 - Pining For IOLs Who Can Fog A Mirror

Cam played HS ball ~30 miles SE of Auburn, in Phenix City. Landing at Auburn is not that far out of the question. He did flip from Aggy to Auburn after Jimbo was fired. He had 4 visits: Auburn, LSU, Aggy, Clemson. For an NIL era signing, it certainly looks like a list of bag-toting teams, though.- Transfer Cycle 2025-2026 - Pining For IOLs Who Can Fog A Mirror

If an edge can drop back in pass coverage, perhaps he can be moved to WR. 4-dimensional thinking?- Transfer Cycle 2025-2026 - Pining For IOLs Who Can Fog A Mirror

- Transfer Cycle 2025-2026 - Pining For IOLs Who Can Fog A Mirror

22% of his total rushing yards came in 1 game - against Colorado. Colorado was #133 of 134 in run defense.- Transfer Cycle 2025-2026 - Pining For IOLs Who Can Fog A Mirror

For consistency's sake, Sark is dropping the ball by retaining the ball-dropping WR coach.- NFL Black Monday, 2026

- NFL Week 18_ 2 pseudo playoff games and the NFC#1 Seed up for grabs

I am a Steelers fan, too, and said, "blow it up if they lose this game." Looks like that is not happening. It was hilarious that Tirico and that shit-heel Collinsworth were talking about Tyler Loop... Paraphrased: "They traveled the country looking for a kicker and concluded that Loop was made of the right stuff." Miss. I guffawed. Houston needs to call the play that got Flowers and Likely loose multiple times around 10x against the Steelers.- $9.95 worth every penny

Additional confirmation that Nahlin is a chode. No surprise. "I regret nothing" about calling out a fan favorite former player is quite the position to take. What a twit.- Avatar: Fire and Ash

So not historically accurate? Crap.- Transfer Cycle 2025-2026 - Pining For IOLs Who Can Fog A Mirror

Gibson to Purdue would be fine with me. He's better than all the spares they have at RB right now. We have Connor Stroh to thank for that. Given Texas does not play Kentucky next year and Purdue does not play Northwestern, I'd kind of prefer Stroh go to one of our competitors. At least we'd know where to send Kanu - on every play.- Transfer Cycle 2025-2026 - Pining For IOLs Who Can Fog A Mirror

Purdue has won zero games in the big10 in the past two years. It is safe to say that a full roster reboot would be reasonable. They were a bit more competitive this year under Barry Odom than last year under Ryan Walters. In 2024/2025, Purdue lost the following starters to the portal: TE Max Klare -> tOSU S Dillon Thieneman -> Oregon (All American) DT Cole Brevard -> Texas OL DJ Wingfield -> USC OL Mahamme Moussa -> Louisville DE Will Heldt -> Clemson DT Jeffrey M'ba -> SMU DB Nyland Green -> ASU P Keelan Crimmins -> Illinios Not saying the above is a murderers row, but having Klare, Thieneman, and Brevard likely results in 1-2 additional wins. With the cut-paste above, I was surprised to see that someone pays for Purdue's rivals site. Edited to add: Purdue had 54 new transfers-in this year. Most in NCAA. I suspect we'll see serious turnover again this year. To my knowledge there is no giant money-whipper behind the scenes and legit NIL opportunities in West Lafayette are modest at best. If Purdue becomes competitive again, some opportunities will surface in Indy...- 2026 Rose Bowl - Indiana vs. Alabama

Purdue is the land grant university, yes. Engineering, Agriculture, Pharmacy, etc. IU has neither engineering nor Ag. Edited to add - from 1865-1869, Purdue was called “Indiana Agricultural College.” Around that time, the state considered adding an agriculture school to Indiana University or Butler to make one of them the land grant university.- 2026 Rose Bowl - Indiana vs. Alabama

My niece goes to IU. My brother is trying to keep her grounded during this run. As Purdue grads, we have seen our fair share of “this team is going to do it! This year is the year” Mostly in basketball, but there was a decade of recent “great” Purdue football under Joe Tiller. The vitriol between Purdue and Indiana is lower key than OU or Aggy for Texas. It exists, but you don’t have IU or Purdue guys flexing at parties, etc. or whooping (or whatever) at weddings, funerals, or church events. That said, we do have the following: What do Purdue and Indiana students have in common? They all applied to Purdue. And What do Indiana grads say to Purdue grads? “Would you like to biggie size that?” I’d love to see IU win it all.- Quinn "La Joya" Ewers - The Man The Myth The Mullet, Now Starting for the Miami Dolphins

I will confess that I was one who suggested that Manning might need a small break. His body language was off, he was missing open receivers, etc. Plus, Caldwell looked relatively sharp in spot duty. That said, it was a foolish idea - and even more so with the benefit of hindsight. Arch needed to work through his issues ON the field; Sark cleaned up his playcalling; Stroh got benched; etc... - Transfer Cycle 2025-2026 - Pining For IOLs Who Can Fog A Mirror

Football ...

Basketball ...

Baseball ...

Other Sports ...

Futbol ...

🤫995🤫 ...

Gambling ...

Movies & TV ...

Music ...

Hobbies ...

Lulz ...

Food & Travel

...

Daily Texan ...

Business & Markets ...

Cloak Room ...

Help ...

For Sale ...

Board Discussion ...

Advertise...

Tailgate Donations

Back to top