Everything posted by ryskey

-

Texas vs Texas State- 8pm on LHN

Weird First 8 minutes and last 11 minutes UT 53 - Tx St 12 Middle 21 minutes Tx St 46 - UT 24

-

2023 All-Big 12 Awards/Honors

Good question. Who was our last FB-ish player to get meaningful snaps? Will Matthews? The king of fullback dives on 2nd and 1.

-

2023 All-Big 12 Awards/Honors

Ah yes, 32 personnel with 3 running backs lined up in the wishbone, a nightmare to defend, unless it's by the innovative 5-3-5 defense. Unstoppable force meets immovable object.

-

THE College Football Playoff Rankings Thread [MICH,WASH,TEX,ALA]

Hell ya, that's "give me north" in spanish, sort of. I don't know what that means except maybe that OU sucks.

-

2023 bank failures

I did. That's why I said this: Do you know? Because all of the analysis I saw that happened earlier this year suggested there were enough long-dated maturities for some impairment to collateral coverage, and terms are generous, but there's no systemic risk. Was that analysis wrong? Maybe it was. I wouldn't want to loan against a basket of treasuries at that valuation, and neither would any normal credit underwriter, but this isn't anything we didn't know 8 months ago. This is exactly what the lender of last resort is supposed to be doing. Confirmed the BTFP is loaned at prevailing rates (so the Fed, err... we are not losing money on the rate spread), and assets are marked to market. So the impairment in coverage or loan to value only matters in 2 situations: 1. The Fed sells the debt - this isn't going to happen 2. A significant number of banks can't service or refinance the debt. If that happens, equity of the banks go to zero, and assets are liquidated to pay back lenders. Regarding the recent uptick in BTFP loans, if I were at a bank and I could borrow money at above-market terms, I would. Ok, so let's see how regional banks are doing. This issue is known and quantifiable, so it should be priced into regional bank stocks. This is an ETF for regional banks, supposedly the most at-risk. Correction back in March during the first of the bank runs, and flat since. Looks like permanent re-rate of the group due to higher risk, which is probably fair. But still plenty of equity value sitting behind the debt.

-

2023 bank failures

Doesn't the BTFP loan at prevailing rates? So I don't think the Fed is losing money on the rate spread, depends on the accounting and if the collateral value is marked to market. Maybe I'm wrong. Anyway, the whole thing was intended to mitigate panic and bank runs by injecting liquidity in the midst of unrealized paper MTM losses. Every month that goes by, those paper losses fall as maturity approaches. Banks with a bunch of 2% coupon treasuries with long-dated maturities are still in some trouble, but I'm not sure how prevalent those are. Or the treasuries reach maturity, which is a liquidity event - either buy more treasuries at prevailing rates with those proceeds, pay back BTFP, or keep as cash on the balance sheet.

-

THE College Football Playoff Rankings Thread [MICH,WASH,TEX,ALA]

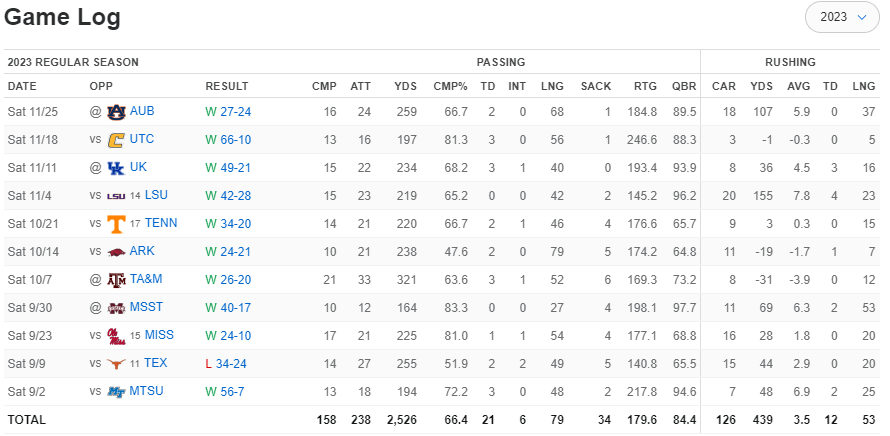

Yes, and his QBR, which includes rushing stats, is even more consistent (he went off against LSU). Using ESPN's Defensive Efficiency Rankings, Milroe's QBR against: Top quartile defenses (UT, TAMU, Auburn, Tenn, Ole Miss) = 72.5, which is very good considering the level of competition, and only 2 points lower than Ewers' total QBR on the season. Milroe's worst QBR of 65.5 came against Texas, which not coincidentally has the best defense he's faced all season. 65.5 is solid. Defenses ranked 25th thru 50th percentiles (Kentucky, Miss St, Ark) = 85.5 Bottom half (MTSU, LSU, Chattanooga) = 93.0 To put that in context, in the game MIlroe was benched, Alabama QBs combined for QBR around 13, which is horrendous. USF has the 118th ranked defensive efficiency per ESPN. He's a good QB who was slightly less good against the best defenses he faced.

-

Iowa - Glorying In the Nepotism of the Ferentz Family

2023 Iowa has to be statistically one of the weirdest things ever seen in college football. This is so hideous and bizarre and I can't look away. First, let's just stand in awe of how shitty the Big 10 west is. In the 21 games between the east and west, the east outscored the west by 221, which is more than any individual team in the west actually scored all year in Big 10 competition. And that's with Michigan State (worst P5 offense in the country) diluting the east. The BEST big 10 west offense was Illinois at 24 ppg. Good defenses or bad offenses? We would normally have our question answered in bowl season with some out of conference games, but only 3 teams are bowl eligible. Ok, on to Iowa. Their average score in Big 10 competition this year was 14.6-12.1. Further, their total points scored in Big 10 competition this year would have been by far the best defensive effort (outside Iowa) in the Big 10 west. Put another way, their offense was so terrible, its output would have been the #5 best defense in the country, just behind.... Iowa's actual defense. And somehow they went 10-2. All of this breaks my brain. I don't know how to start calculating how ridiculously unlikely all this is. Maybe someone had a season like this before the forward pass?

-

Twilight In T-Town: The End of the Nick Saban Era

There's a very strong narrative that MIlroe was terrible in the beginning of the season, and is now a very good / borderline elite quarterback. And that doesn't make any sense at all. Against Texas, he made some mistakes, but showed amazing athleticism and made several good throws. Yesterday against Auburn, he made some mistakes, but showed amazing athleticism and made several good throws. Narrative should be that he's been good all season, and his performance is a function of the quality of the defense he's facing. Benching him against USF didn't make any sense. He had a solid game against a very good UT defense the previous week. I don't know what they were expecting. Milroe's QBR against ESPN Defensive Efficiency Rank: Top 25% (UT, TAMU, Auburn, Tenn, Ole Miss) = 72.5, which is very good considering the level of competition, and only 2 points lower than Ewers' total QBR on the season. Next 25% (Kentucky, Miss St, Ark) = 85.5 Bottom 50% (MTSU, LSU, Chattanooga) = 93.0 To put that in context, in the game MIlroe was benched, Alabama QBs combined for QBR around 13, which is horrendous. TUSF has the 118th ranked defensive efficiency per ESPN. A very good QB is slightly worse against good defenses. News at 11.

-

12-1 FUCK AROUND AND FIND OUT

-

T'Vondre Sweat Appreciation Thread

Having Sweat anywhere on someone's Heisman list this late in the season would have been a Surly sock material 3 months ago. Don't want to derail this, but it's refreshing to see Daniels #1 after being ignored for most of the season. Video game numbers, probably going to finish the regular season with almost 4,000 passing, over 1,100 rushing rushing, and 50 total TDs. Lamar Jackson numbers. Also up there with Murray and Burrow in terms of total offense and total TDs. But probably going to Nix because Daniels is going to get knocked for 3 losses, which would be 6-7 without him.

-

Prediction thread 2023 Week 12: Tech at Texas

Texas 69 Tech 0 420 passing yards

-

Tell Me About Texas a&m

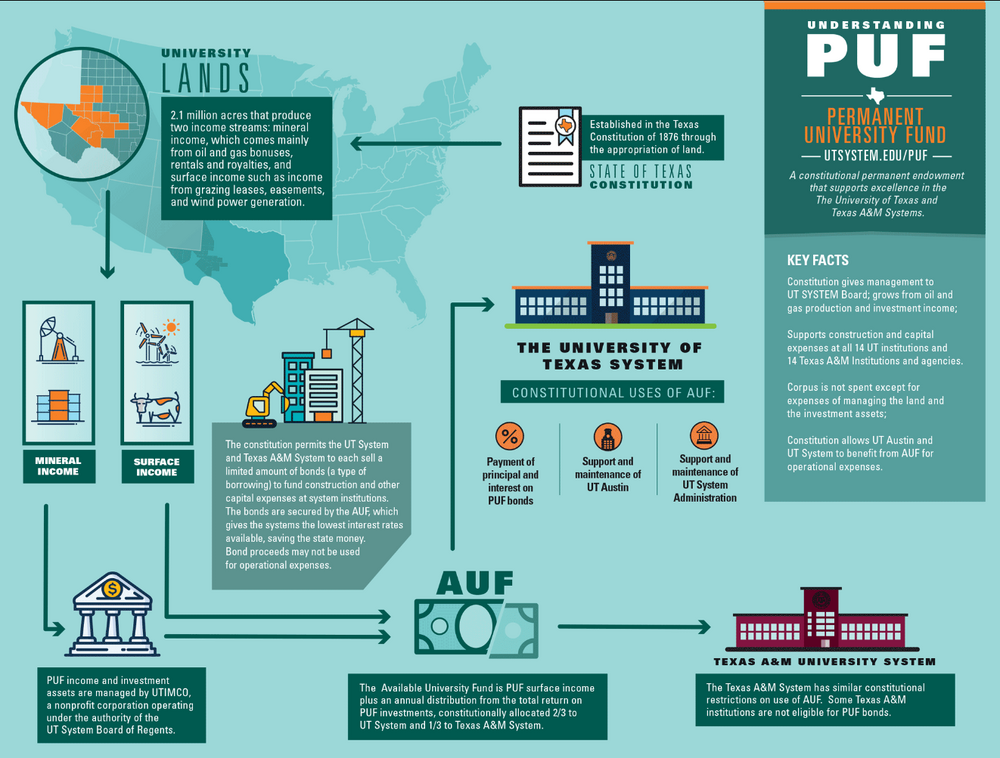

Holy shit. This is unconscionable. UT, whether implied by tradition or some express bylaw or something (do you know?), keeps these separate in part because it's borderline fraudulent. If something like this was done by a normal corporation or legal entity, its audit would come back dirty AF. Like a 501(c)3 founded to help low income kids funding the CEO's hookers and blow. If UT did anything like this (hopefully we never have?), faculty/staff would freak out and protest, and I would probably join them. So they're creating a financial instrument for this buyout and hiring the next staff with collateral from a fund with an express purpose for academic-related capital projects. So this is waaaaaaaaay more than the sticker price we're all looking at. It's an artificially low cost of capital by design for academic stuff and I don't know what kind of mental gymnastics they're going to use to justify this. The "right" way to do this (if that's even possible) would be for the athletic department to pay a higher cost of capital than a normal AUF bond, tracked by some capital account, thereby giving a nice little rate spread to the academic side and allowing them to save a little face and retain the plausible deniability of remaining as an academic institution. But I highly doubt they're going to do that. Is there some payout schedule or is this all at once? Either way, I guess it has to be financed. Bought a Ferrari on credit, wrecked it, now stuck with the note.

-

Tell Me About Texas a&m

Ok, where is the idea coming from that this buyout is going to come directly or indirectly from the AUF? There are strict requirements on uses, or maybe I'm confusing UT's requirements and oversight for PUF/AUF funds and projecting that on A&M's governance. So maybe I just answered my own question. Money is fungible and and people can rationalize all kinds of crazy things, but holy shit I can't imagine even A&M doing this.

-

Maalik Murphy unfucked Duke, works his next miracle at Oregon State

????

-

Prediction Contest Week 9- KSU @ Texas

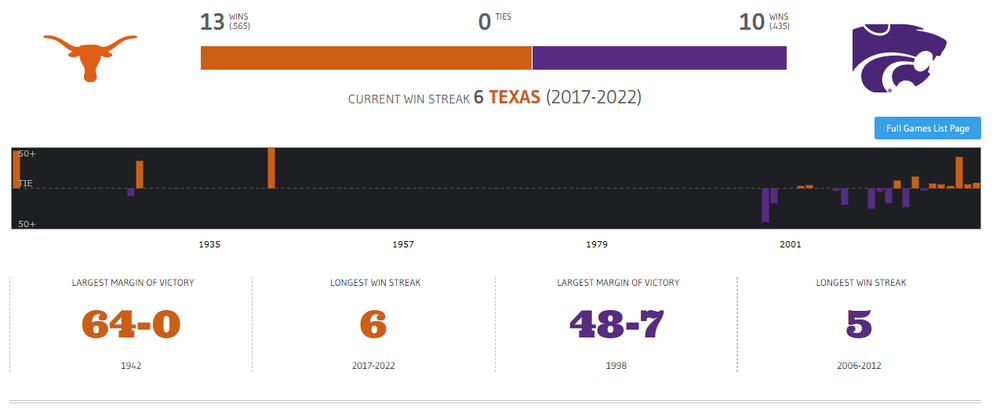

Texas 69 KSU 0 KSU 420 punting yards

-

When is the last time you wore a watch?

Hell ya

-

Week 9, 2023: Kansas State @ Texas

- The Ontology of discussion of Deep Thoughts

If someone wore this backwards, he would be dickbutt.- Ontology of Morality

Taken to an extreme, moral relativism would tend to require extreme accountability to oneself (our "highest self" or whatever is equivalent in your belief system), otherwise it inevitably becomes a tool for justification of self interest. But the accountability to self requires some absolutes. I believe in 2, and one is arguably a corollary of the other. English does not have a word to describe the first, but at its most pure, the best description I can conjure is unfathomable grace. Agape, one of the Greek expressions of love, is probably close. Divine love for those who view this through a religious lens. This grace has unconditional reverence for all creation (including Self) without judgment or attachment. I believe all humans, regardless of culture or background or belief system, are capable of brief moments of this when they are at their best. Most of us, including me, fail 99.9999% of the time, but that is the entire point, otherwise we would not have the human experience. Why am I here? To live a human experience. I think the virtues most of us recognize are just expressions of this grace contextualized through human experience. It nearly always has to catch a ride on something familiar for us to recognize it. And then all of those virtues can be perverted when one spends too much time on the context or dogma and not the intention behind it. And that leads to the 2nd absolute, which is free will. I do not believe this exists in a vacuum, but on a continuum from a simple organism behaving according to its programming (like a bacterium), to humans, which are furthest along on that continuum. Humans possess the ability to observe ourselves and choose/evaluate/discern more than any other species. But the aforementioned failure rate (despite knowing better a lot of the time) creates evolution and infinite perspective, and it is from those infinite perspectives that destroys the universality of most (all but 2) moral judgments. I believe a community of humans living according to these 2 absolutes, with superhuman accountability to themselves, would create utopia, and that utopia would be expressed arbitrarily through whatever culture they happen to share or create. But unfortunately (or fortunately?), the practical requirements of life get in the way, so the ability to sustain an existence of unfathomable grace is.....difficult. This is my worldview based on my own biased perspective and I don't expect anyone to agree. Or, Dickbutt.- Iowa - Glorying In the Nepotism of the Ferentz Family

Is the Big 10 going to change up the divisions? Part of Iowa's absurdity is that the West is so awful. In 10 interdivision games between East and West this year, the East is 7-3 with an average score of 32-13 in favor of the East. And of course Iowa misses Ohio State and Michigan. And is there some bizarre rule where Iowa gets to avoid Ohio State most years? They've played 3 times in the last 13 years. And most of their best years in the Ferentz era, they missed both Ohio State and Michigan. Iowa's seasons in which they've finished the season ranked since 2001 (Ferentz era): 2002 - #8 - miss Ohio St 2003 - #8 - played both going 1-1, losing to Ohio St 2004 - #8 - played both going 1-1, losing to Michigan 2008 - #20 - miss both Mich and Ohio St 2009 - #7 - played both going 1-1, losing to Ohio St 2015 - #9 - miss both Mich and Ohio St 2018 - #25 - miss both Mich and Ohio St 2019 - #15 - miss Ohio St 2020 - #16 - miss both Mich and Ohio St 2021 - #23 - miss Ohio St 2023 - #24 so far - miss both Mich and Ohio St So in the last 10 years, their successful seasons are 100% correlated with missing Ohio State and 71% correlated with missing both. The formula seems to be: continue milking 2002-2004, avoid Ohio St at all costs, and finish ranked in the years you miss both Ohio St and Michigan. Even including 2002-04, he's never beaten both in the same year. Maybe that's the best they can expect.- Israel vs everyone war thread

Damn, which one? NCC-1701-D?- Quinn "La Joya" Ewers - The Man The Myth The Mullet, Now Starting for the Miami Dolphins

There's broken brain Quinn (first 3 quarters of Wyoming, first Q against OU), then there's.... normal(?) Quinn? Through 6 games, he has the highest QB rating since Colt in 2008. I had to include only QBs with more than 100 attempts in order to filter out.... Case McCoy in 2012. Hahaha This includes 2 top 10 defenses according to FPI and the toughest strength of schedule in college football. Zooming out, broken brain Quinn is so frustrating to watch, but mix in normal Quinn and he's damn good. Very little correlation between strength of the defense and his output- similar numbers against the bad defenses.- Dick Butkus RIP

The 8-year old in me is still amused by transposing syllables, turning his name into Butt Dickus. RIP- Week 6 2023 score prediction: Red River Shootout

Texas 69 OU 6.9 (rounds up to 7) Texas 420 rushing yards - The Ontology of discussion of Deep Thoughts

Football ...

Basketball ...

Baseball ...

Other Sports ...

Futbol ...

🤫995🤫 ...

Gambling ...

Movies & TV ...

Music ...

Hobbies ...

Lulz ...

Food & Travel

...

Daily Texan ...

Business & Markets ...

Cloak Room ...

Help ...

For Sale ...

Board Discussion ...

Advertise...

Tailgate Donations

Back to top