Gatorubet

Certifiably Surly

-

Joined

-

Last visited

-

Currently

Viewing Forum: Daily Texan

Everything posted by Gatorubet

-

Could this be the craziest coaching carousel of all time?

Just like Mullen refusing to get a decent defensive coordinator, resulted us losing the Alabama after scoring 40 points, and despite everyone saying, the defense has to get better or you will be gone, Mullins pride and hard headed in this got him fired. The entire fan base was calling for Billy to get an offensive coordinator because our offense and his play calling sucked and was extremely easy for defensive coordinators to prepare for what we were doing, Billy simply refused to give up his play calling. Our defense is good enough this year if you take away the numerous 3 and outs that always leaves them gassed at the end of the game. With all the money they can make, it always amazes me how a coaches ego can ruin a good thing.

-

Русский корабль - иди нахуй

I enjoy watching military history documentaries, and I saw an interesting one comparing the Japanese zero and the Corsair. Once upon a time, Russia was the source of new technology on main battle tanks, just like Japan and it’s unprecedented zero conquered the skies for several years in the pacific. No one could match its speed and turning radius in dog fights, and the kill ratio versus existing American fighters was obscenely in favor of the Japanese. Consider the zero a microcosm of Russia’s military capabilities at the start of the war in 2022. Fast forward just two years and you have Hellcats and Corsairs in the Pacific theater destroying Japanese aviation with the same kill ratios that Japan once had: 10 to one type kill ratios in favor of American pilots. The new American fighters were 100 miles an hour faster than zeros even though they weighed twice as much, they had bulletproof canopies, heavy armor, much larger engines, and self sealing gas tanks if struck by Japanese machine gun fire. The American fighters could climb faster, dive faster, operate at a higher ceiling, absorb more punishment, and their greater armaments could destroy a zero with a single burst. The Americans could carry more ammunition, and with drop tanks could fly farther than their Japanese counterparts. American pilots destroyed so many zeros in such a surprising amount of time that the Japanese could not respond. Their rigid training and industrial manufacturing systems (requiring approval at many levels with a Navy and army that were constantly fighting politically) there was no way to produce better Japanese fighters in such a short period of time in enough numbers to compete with America. America was dumping out thousands of new pilots with 600 to 700 hours airtime using loads of ammunition to hone their skills, while Japanese pilots had barely 100 hours of training. They conserved scarce ammo to the extent that they totally lacked the skills of the prior elite pilots when they went up for the first time against experienced P-51, Corsair and Hellcat aces. And so, in just three years the fight with feared, elite, battle experienced Japanese pilots in their superior planes turned into a battle between experienced American pilots with vastly superior planes, to the point the uneven contest resulted in events like the great Marianas Turkey Shoot. Today, although Russia started out with vastly more and better equipment than Ukraine had, and a military that was universally recognized as being far better than Ukraine, in a little over three years Ukraine has mastered drone warfare and developed its own weapons like the flamingo and it’s long flight drones that are wrecking the Russian oil and gas economy. tl;dr Japan hit a tipping point when no matter their fanatical ideology and thirst for war, their inability to replace battle hardened troops and officers with leadership experience - when coupled with an inability to build significant numbers of modern weapons equal to their opponents - doomed Japan. The timeframe here seems to be playing out in the same way. Three years later, the Russian economy is incapable of sustaining this expensive large scale war. Russia is so desperate for meat for the front lines that they threw in naval and other personnel with no infantry training to be fodder for useless assaults. In that situation, Japan went to kamikaze attacks when traditional aerial combat was no longer feasible. I fear that tactical nuclear weapons might be the fallback for Russia. I think the most dangerous time is right before Russia falls and loses. like about right now. .

-

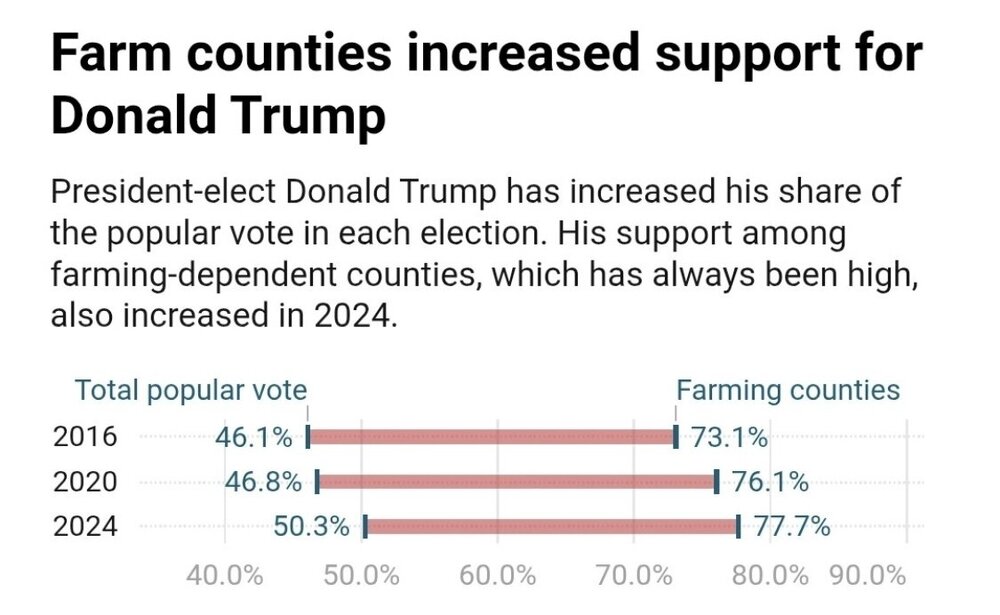

The Trump Economy

I don’t know which is worse: supporting another country financially to the tune of 20 billion so that they can drop their tariffs and sell foreign soybeans to China while leaving American soy being farmers with no China buyer to starve is bad…but worst of all they canceled Biden infrastructure projects that would’ve supplied rural farms with robust Internet service so that their wives and daughters could set up only fans accounts… it’s like a double whammy!

-

UGA- Bama 7:30 on ABC

As does FSU.

-

UGA- Bama 7:30 on ABC

Being half right is better than not being right at all, Buddy. TOUCHDOWN!!

-

UGA- Bama 7:30 on ABC

Fuck Kirby. Fuck the leg humping, butt licking, mangy, flea infested mutts. Fuck their fans. Fuck Athens. Fuck the entire state of Georgia.

-

2025 Random Games thread

and it will get uglier

-

Yogurt shop murders

Supporters of Capital Punishment will learn nothing from this case.

-

Русский корабль - иди нахуй

How could it not? After all, that thing is ancient; it will soon be 12 years old. I think that’s about how long the U.S. has had B-52s.

-

5 years in the slammer for Sarkozy

That is such bullshit. if you think impeaching Trump was purely political and not legitimate action taken against the most deserving criminal President in History, you are a moron.

-

5 years in the slammer for Sarkozy

- U.S. Beef Industry in absolute crisis

- Gotdammit I Just Got Scammed

Those poor scammers were once like you. You know, not getting any inheritance.- Trump’s America

He won’t need to steal it, he’ll win it. He’ll play a soccer match with himself the day after and declare himself the club champion again.- Trump’s America

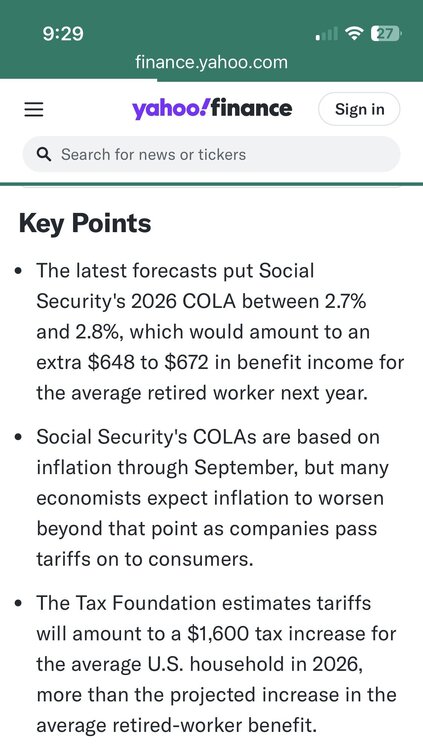

The Social Security cola won’t come anywhere near to dealing with the increased prices next year. I think it will be more like low 3s to 4. Add tariff costs to inflation and everyone on Social Security and Social Security Disability will be fucked. And this is before the big beautiful Bill kicks them off Medicaid. The Medicare part B monthly premium is increasing almost 12% as well. Throw a shrimp on the barby and a mattress in the garage, because all your parents are moving in…. Grandma and grandpa will probably have to fight your kids for the best room.- U.S. Beef Industry in absolute crisis

- U.S. Beef Industry in absolute crisis

i’m still in awe that Brat fed his family by stampeding them off cliffs waving a buffalo robe while carrying a Clovis point spear.- Русский корабль - иди нахуй

“Oh. Look Norway, those glide bombs are for your exclusive use, because only you have F-35A fighters. What? You mean Denmark and Poland have them too? And you belong to the Nordic Defense Cooperation with Denmark, Sweden Finland and Iceland? Well, for God’s sake don’t let the Poles borrow them or they’ll lose them in Russia somewhere…”- Русский корабль - иди нахуй

“Here’s a bunch of glide bombs, Norway. We’re not sure which of your neighbors you might use them on, but here’s 800 of them.”- Русский корабль - иди нахуй

- Русский корабль - иди нахуй

Not supplying gas to Asian ethnicity Eastern Russians is one thing. Moscow not having gasoline indicates a huge problem. Because if Moscow now isn’t getting gas, Siberia is sure as shit not getting any.- Русский корабль - иди нахуй

Give me one ping Vasily. One ping only…- Gotdammit I Just Got Scammed

I don’t think I’ve actually placed a phone call to my credit union for 20 years. See website and app for 99.999% of info.- The Leopards Eating Faces and Unlubed Dildo of Consequences Thread

- U.S. Beef Industry in absolute crisis

Football ...

Basketball ...

Baseball ...

Other Sports ...

Futbol ...

🤫995🤫 ...

Gambling ...

Movies & TV ...

Music ...

Hobbies ...

Lulz ...

Food & Travel

...

Daily Texan ...

Business & Markets ...

Cloak Room ...

Help ...

For Sale ...

Board Discussion ...

Advertise...

Tailgate Donations

Back to top

Account

Navigation

Search

Configure browser push notifications

Chrome (Android)

- Tap the lock icon next to the address bar.

- Tap Permissions → Notifications.

- Adjust your preference.

Chrome (Desktop)

- Click the padlock icon in the address bar.

- Select Site settings.

- Find Notifications and adjust your preference.

Safari (iOS 16.4+)

- Ensure the site is installed via Add to Home Screen.

- Open Settings App → Notifications.

- Find your app name and adjust your preference.

Safari (macOS)

- Go to Safari → Preferences.

- Click the Websites tab.

- Select Notifications in the sidebar.

- Find this website and adjust your preference.

Edge (Android)

- Tap the lock icon next to the address bar.

- Tap Permissions.

- Find Notifications and adjust your preference.

Edge (Desktop)

- Click the padlock icon in the address bar.

- Click Permissions for this site.

- Find Notifications and adjust your preference.

Firefox (Android)

- Go to Settings → Site permissions.

- Tap Notifications.

- Find this site in the list and adjust your preference.

Firefox (Desktop)

- Open Firefox Settings.

- Search for Notifications.

- Find this site in the list and adjust your preference.