All Activity

- Past hour

-

Quinn "La Joya" Ewers - The Man The Myth The Mullet

markstanco replied to Coach pop a bitch's topic in Football

QE called Shedeur after the draft. Probably, maybe. -

Pakistan PM confirmed but not Indians yet.

-

Yes, other than that!

-

-

Conclave 2025: All of the Smoke, None of the Brisket

Armybrat replied to GopherRock's topic in Daily Texan

*yanquis. -

Elon Musk: Nazi traitor piece of shit [Confirmed]

MissingInAction replied to MaybeACoordinator's topic in Daily Texan

God damn it! I'm in a lot of the tailgate pics and this is surprisingly accurate. -

I remember $.99 gas and dyed diesel being around $0.49. Definitely remember glass Gatorade with the metal lids. The safety poppers were loud.

-

Negative Recruiting Your Own School: The aggy Screenshot Megathread

Mrs Whiggins replied to texifornia's topic in 🤫$9.95🤫

Someone going to tell ChubbsPeterson that his posting and arguing about a lost baseball game on a message board is....emotional? It's okay to admit it, Chubbs. -

Well, lookit his username.

-

Everything ok at home, Gil?

-

Quinn "La Joya" Ewers - The Man The Myth The Mullet

markstanco replied to Coach pop a bitch's topic in Football

This has been posted up thread a few times, but honestly not enough. Continue. -

I'm not sure why that would be surprising. The Rafale is a good 4th generation fighter with a nice EW suite, but it isn't stealth. Chinese PL 15s, which are one of top bvr air-to-air missiles around, aren't going to have any problem taking one down if given the opportunity.

-

Because the world is a zero sum game to him.

-

Negative Recruiting Your Own School: The aggy Screenshot Megathread

EastTexan replied to texifornia's topic in 🤫$9.95🤫

That's how we get our lectricity/said aggy -

Mike Malone and Calvin Booth might never get another job if the Nuggets pull this off.

-

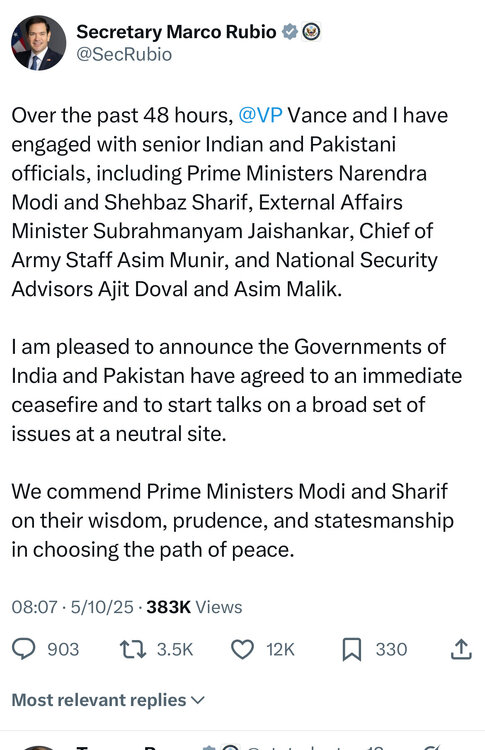

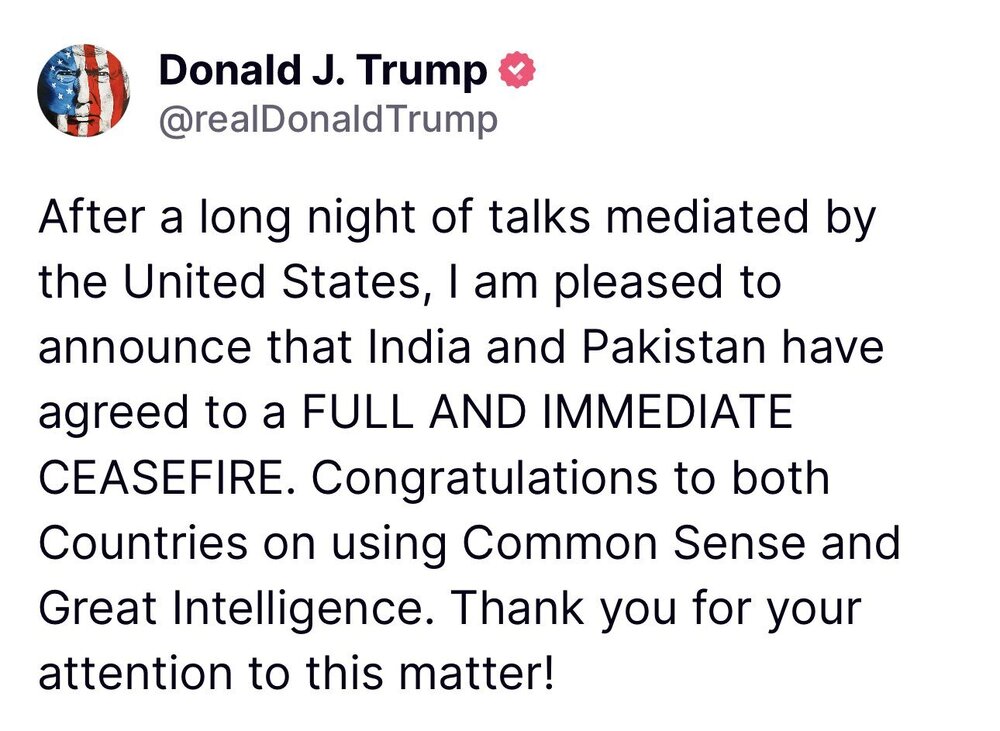

Things not going well in the world: India-Pakistan edition

immamac replied to TheFlyingBoat's topic in Cloak Room

The thank you for your attention to this matter always gets me. -

Apparently the shooter told the lost driver to leave and the driver complied so yeah, firing a weapon is astoundingly stupid.

-

Bleach Blonde Bad Built Butch Body in Congress? Oh you mean Marjorie!

speed817 replied to Pancho's topic in Cloak Room

-

He got delayed stole on twice fucking horrible showings from Galvan, Flores, Gasparino, Farmer and Ruger. Other than that we were solid.

-

Has anyone told them you may not want to nuke the country that is right fucking next to you?

-

Isn’t this the same team from last year?

-

Things not going well in the world: India-Pakistan edition

satyanash replied to TheFlyingBoat's topic in Cloak Room

-

All Encompassing Mortgage and Real Estate Thread

horn4life replied to UTPhil2006's topic in Business and Markets

Ok I stand corrected. I thought if you bought a homestead of equal or great value you could defer all the gain. I guess I wasn't contemplating exceeding the $500K cap when I actually thought about this a few years back. So the exclusion is the 121 Exclusion. According to Rocket I can use this every two years? This would be important to me, because if I were to talk the wife into making a homestead move, It would be to convert our current homestead into an income producing property, while I remodeled a new homestead. This is the scenario I am considering trying to pull off. I have a neighbor whose parents home has been vacant for a couple years. Full of Christmas hoarding crap. But she is needing to get some cash finally, and the property is in trust, and I was nervous about trying to buy the property from a trust. Mainly as I was going to give her almost nothing down, with a future balloon payment. Or interest only loan to keep my costs down by renovating. In this scenario I could convert my current homestead into a rental, thus opening the door for a future 1031 exchange. In this scenario my wife and I (filing jointly) could Sell the property (within the 2 or 5 years homestead 121 limitation) and take $500K cash out tax free, and defer any additional gain beyond that amount into a new investment property using the 1031 exchange. In essence converting the homestead residual cap gains into rental property equity, correct? HOWEVER - I thought I was limited in taking the 121 cap gain exclusion to once every 5 years? Rocket is saying once every two years?

Football ... Basketball ... Baseball ... Other Sports ... Futbol ... 🤫995🤫 ... Gambling ... Movies & TV ... Music ... Hobbies ... Lulz ... Food & Travel ... Daily Texan ... Business and Markets ... Cloak Room ... Help ... For Sale ... Board Discussion ... Subscribe!... Donate!... Advertise... COOKIE MONSTER!