All Activity

- Past hour

-

1976 Wings Over America Tour. Lakewood Church, Houston.

-

Need tips for (relatively) painless vehicle registration facilities in the Austin area. I'll happily pay a convenience fee at a title shop, etc. if it cuts down the insane tax office wait times. Central/north is better than others, but I am willing to learn. Registration has not expired, insurance and ID are in hand, and passing emissions inspection is current.

-

The Leopards Eating Faces and Unlubed Dildo of Consequences Thread

Chopper replied to Horn Dog's topic in Cloak Room

-

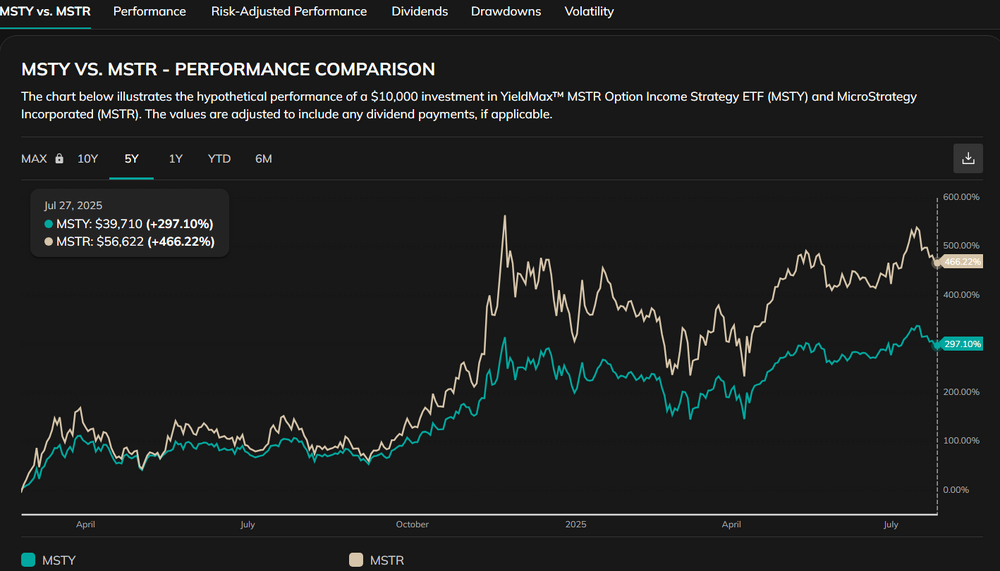

Stupid question time on the concept of these option income ETFs. While I'm nominally familiar with MSTY, I haven't really done a deep dive but what am I missing? It appears to me that you would be better off just investing in MSTR, or at least that has been the case since the inception of MSTY... While the chart above doesn't specifically indicate whether it is showing MSTY dividend reinvestment, I believe it does as I found a separate charting tool that specifically claims to factor in dividend reinvestment, and it provides very similar returns for $10K invested starting 2/22/24. I understand that one major difference between the two investments is the monthly income generation that MSTY provides and MSTR does not (assuming you dont take profits by selling some). But it seems a strategy of holding MSTR and selling after a year would provide far better returns, especially when you consider that you will be paying tax on your MSTY dividend payouts according to your tax rate, rather than lower long-term capital gains rate on MSTR if you hold a year. I spot checked a couple of other ETFs (TSLY/TSLA, NVDY/NVDA) and in both cases the underlying outperformed the ETF fairly significantly. Is the theory that these option income ETFs will out perform the underlying stock in periods of down years? Here's the sites I used to generate the returns https://portfolioslab.com/tools/stock-comparison/MSTY/MSTR https://totalrealreturns.com/s/MSTY,MSTR

-

Texas Football 2025 Fall Camp - Kicking the Sonofabitch In

Texasrocks replied to closetojumping's topic in Football

Worrying about DT going into the season and then having a couple guys turn into monsters is now a tradition. Ojomo was undersized and Coburn had some... conditioning concerns. Then they went off. Murphy was expected to be a stud, but Sweat tried to eat himself to death. They were the two best DTs in football. Collins was a good third guy who hadn't played up to his potential and Broughton was a decent rotation guy. Then they made a jump. I don't know who, but 2-4 guys will start playing out of their minds. -

Texas Football 2025 Fall Camp - Kicking the Sonofabitch In

immamac replied to closetojumping's topic in Football

His frame can handle it. -

-

Texas Football 2025 Fall Camp - Kicking the Sonofabitch In

The Ace of Aces replied to closetojumping's topic in Football

Washington went from 218 to 260? That’s a ton of extra weight - even if all muscle. -

Non-Texas weather. The all-encompassing thread

Al_4_ISU replied to Parliament's topic in Daily Texan

Derechos are maybe the most terrifying wind storm. The one in central Iowa in 2020 just laid a path of waste that would make a tornado blush, in terms of total damage dollars. Yesterday could have definitely been worse. -

Epstein files update (there are no Epstein files)

Gatorubet replied to Gil Bang's topic in Cloak Room

-

You guys aren't thinking about the funny nicknames The Nuge has lined up for Republicans when he switches parties. and thats a major blindspot for you guys

-

Elon Musk: Nazi traitor piece of shit [Confirmed]

InkaUtexas replied to MaybeACoordinator's topic in Daily Texan

She will get a cybertruck. -

Epstein files update (there are no Epstein files)

Al Bundy's Napoleon Hand replied to Gil Bang's topic in Cloak Room

"These were irreplaceable 16 year-old girls working in my spa. It was like he was stealing my girlfriend." -

https://www.politico.eu/article/winners-losers-eu-von-der-leyen-us-donald-trump-trade-deal-tariffs/ Not sure how paywall-y this is. I think politico only requires you to provide a valid email to continue reading their stuff. It is a very good comprehensive article that goes into detail on the various trade sectors/components coming into play. It underscores that Trump‘s roostering around about a completed deal is typically false bullshit, with many details to be determined, and goals set that are impossible to meet. Add that there are numerous details still to be figured out regarding all of the new exceptions to the 15% tariff. If the goal was to supply certainty and allow people to get the supply chains back up and operating, that fails. Like a dog. Someone needs to tell me how going from a 1.5% tariff on EU goods generally - to a 15% across-the-board tariffs (with a whole bunch of carve outs and still to be figured outs) will not involve at least some measure of inflation due to the increased cost of EU goods subject to the 15% tariff. Europe ain’t gonna eat that. Someone is also going to have to explain why everybody around the globe rightfully hating on the United States for spring, that’s Trump‘s whim, tariffs B.S. is not going to result in at least some European businesses deciding to purchase goods and services from anyone but the USA if they can get away with it. The EU can establish a tariff rate, but the EU can’t force it’s private businesses to want to buy from America. It’s like Trump saying “tariffs for you, but not for me” is going to make them rush lovingly into our arms and try to increase imports from the US. Mind bottling.

-

The rebates were all part of the plan. Thank you, Mr. President!

-

More like a misfire sale.

-

Texas Football 2025 Fall Camp - Kicking the Sonofabitch In

SydneyCarton replied to closetojumping's topic in Football

The freshman All-American DT from Syracuse wasn't recruited just for depth, eh? -

when i first started picking individual stocks i bumped into a couple that 10x'd within a few months. some alternative energy stuff. i congratulated myself on my genius, held, and watched them turn into dust. since then, i've been index-only for 95% of my portfolio and random stuff just for my amusement for the remaining 5%, none of which has done anything interesting.

-

Epstein files update (there are no Epstein files)

wildcat09 replied to Gil Bang's topic in Cloak Room

Oh my god. -

Football ... Basketball ... Baseball ... Other Sports ... Futbol ... 🤫995🤫 ... Gambling ... Movies & TV ... Music ... Hobbies ... Lulz ... Food & Travel ... Daily Texan ... Business and Markets ... Cloak Room ... Help ... For Sale ... Board Discussion ... Subscribe!... Donate!... COOKIE MONSTER!